How To Withdraw From 401k After Age 60

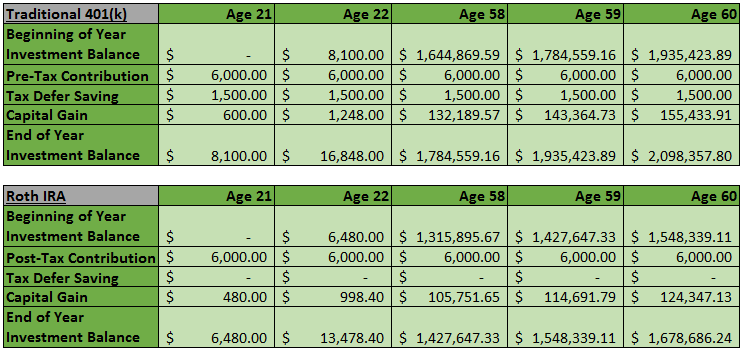

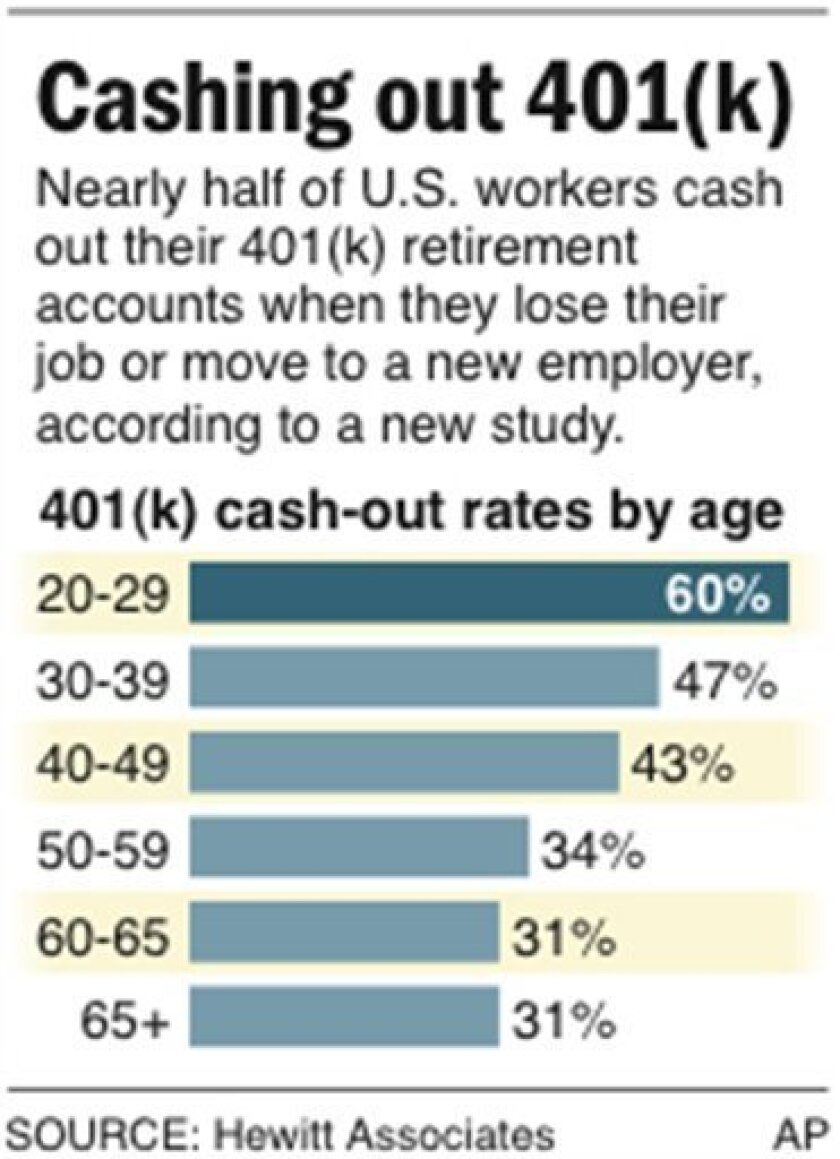

Previously if you wanted to withdraw cash from your 401k or traditional ira before age 59 and a half youd face income taxes and a 10 penalty on the amount you withdraw.

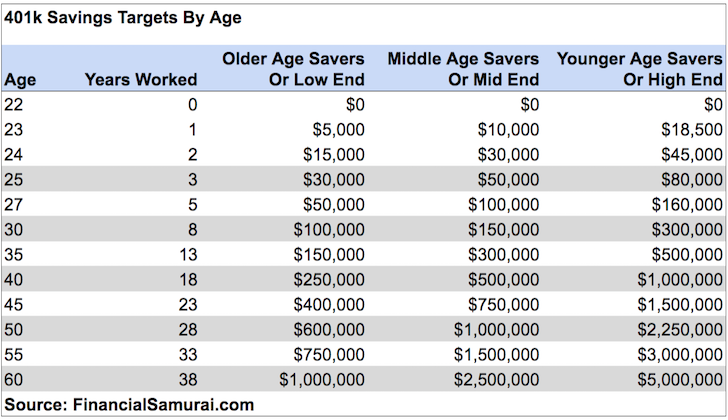

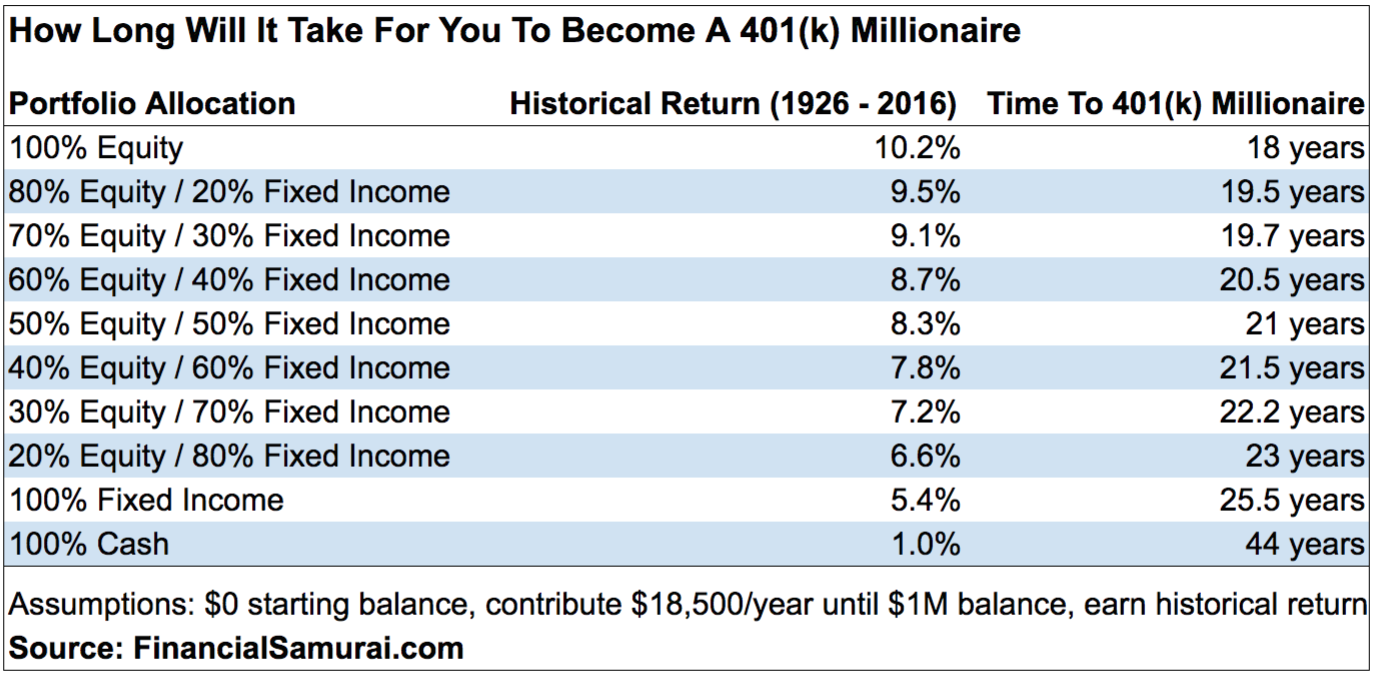

How to withdraw from 401k after age 60. The above average 60 year old should have at least 800000 in their 401k if theyve been diligently saving and investing. Age 59 12 is the earliest you can withdraw funds from an ira account and pay no early withdrawal penalty tax. And if you arent 60 yet then hang in there. After a year when you turn 58 you can retire for good and take advantage of penalty free 401k distributions from both companies.

You can now withdraw from your 401k penalty free if you wish. Required 401k distributions in 2020 no distributions are required even if youre of the age required typically required to take a withdrawal. If you are 60 years old you are at the ideal age to begin taking money out of your individual retirement account at least from a tax penalty standpoint. So if youre 60 your company cant stop you from withdrawing your money.

1 depending on your companys rules you may elect to. However just because you can get the money in your 401 k doesnt mean you have to. Many financial advisers recommend the 4 rule when evaluating how much you can take out of your retirement accounts without fear of outliving your savings. If you are retired terminated employment after reaching age 55 and still have funds in your 401k plan you can access them at age 59 12 and pay no early withdrawal penalty tax.

However the average 60 year old has closer to 150000 in his or her 401k. Once an ira account holder turns 59 12 the internal revenue service allows penalty free withdrawals in almost all cases. Under the cares act. If at age 60 you withdraw from your 401k and the taxes are removed before the money is dispersed what line should the withdrawal be reported on to avoid a double tax.

If you have rolled your 401k funds to an ira the rules are the same. Youre not required to start taking. You will receive a 1099 r for the withdrawal and enter it into the tt program.

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

/what-age-can-funds-be-withdrawn-from-401k-abd801d6dbd343309cf738f1fa2c621c.png)

/thinkstockphotos200556773001-5bfc3d8c46e0fb00511e3192.jpg)

/how_a_401k_works_after_retirement-5bfc374d46e0fb0026046f66.jpg)

/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

/hipster-senior-man-with-beard-using-laptop-and-woman-watching-992018092-e252ed97124f4ce78a78ef33f399b422.jpg)