How To Start Flipping Houses With Bad Credit

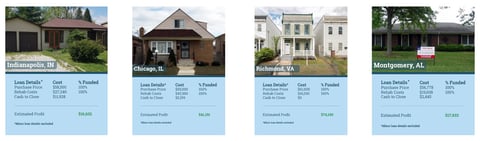

Investors use a variety of different lending options to finance house flipping.

How to start flipping houses with bad credit. Bottom line while working on improving your credit score you can start flipping houses even if you have bad credit. 7 ways to flip houses with no money and bad credit private lenders. You can finance house flipping with a home equity line of credit. More often than not private lenders will serve as an investors greatest source of funding.

6 insane tricks learning how to flip houses with no money and bad credit doesnt have to be a dream. Partnershipsa partnership refers to the process in which two people combine forces to tackle a housing project. If your credit score is too low for you to be able to secure loans for a house flipping venture you might want to take some time to improve your credit score. In their simplest form hard money lenders are lending companies that offer specialized short term.

Flipping homes with no money down and a less than stellar credit score might seem impossible but there are more options than ever for new investors. We outline them here. The first step is connecting with a local real estate agent who can connect you with lenders and help you find a property in your budget. If you have bad credit you will have problems getting financing because lenders typically require credit scores above 620 for secured loans and scores above 700 for unsecured loans.

It is attainable for those that are patient who have income and are fine to turn to a private lender. Over the past 10 years or so ive taught many people how to flip houses with no money and bad credit. This can take some time but it might be worthwhile in the long run. Private investorsa private investor is a person who is not associated with any particular bank or business willing.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/home_buyers-554992017-5b7ec6fb46e0fb002caac68d.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/young-couple-working-on-home-renovations-169267258-58ae24183df78c345b3c9a80.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/19885135/Atlanta_shutterstock_1550188286.jpg)

/young-couple-working-on-home-renovations-169267258-58ae24183df78c345b3c9a80.jpg)

/couple-standing-in-front-of-their-new-home--504224016-5ac05c1d18ba010036c17569.jpg)

/how-to-rent-an-apartment-with-bad-credit-960969-v3-5b64bafa46e0fb0025430a5e.png)

/GettyImages-595348089-56fca13e3df78c7d9eded557.jpg)