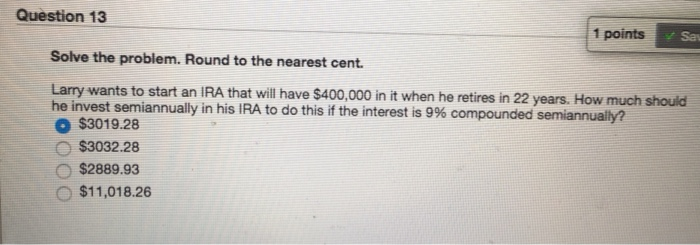

How To Start An Ira

How to start a roth ira.

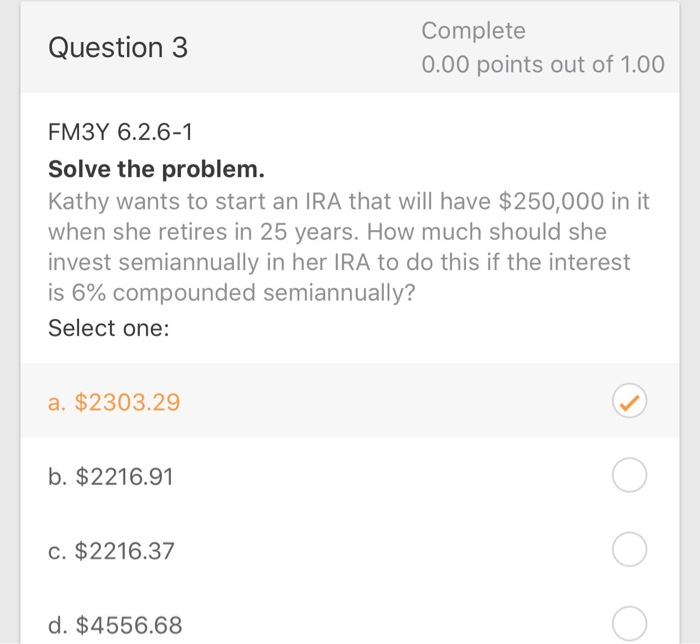

How to start an ira. Well send instructions once your ira is open. Name beneficiaries for your ira. Starting in 2020 as long as you are still working there is no age limit to be able to contribute to a traditional ira. Opening a roth ira can be as simple as visiting your banks website and filling out an online application.

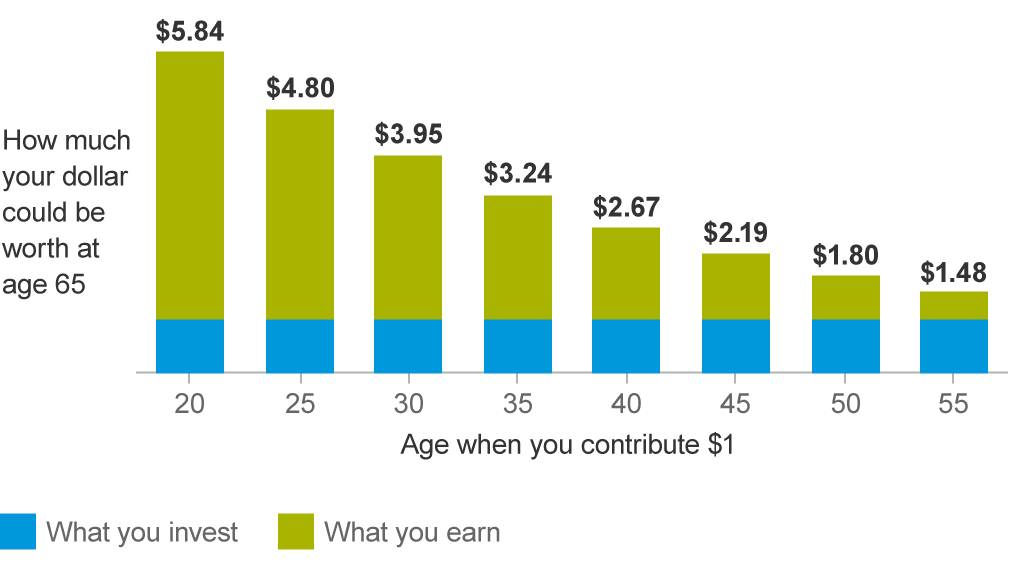

But you dont have to handle the process on your own. Most large firms also offer online access to start the account application. And if youre age 50 or older you can save up to 7000 for 2019 and 2020. If your bank doesnt offer roth ira accounts you can open one with a brokerage firm.

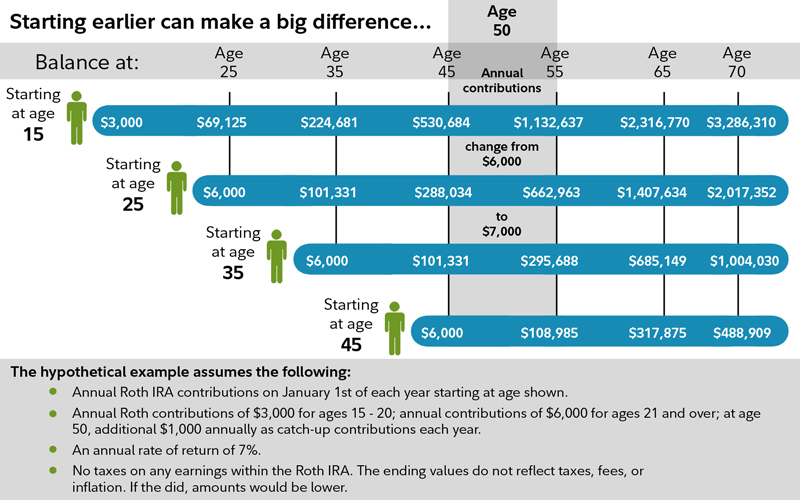

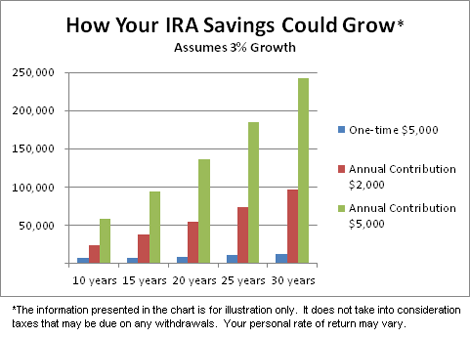

Make your first contribution consider maximizing your contributions each year up to 6000 for 2019 and 2020. You usually get a tax deduction on your contribution and. If youre just starting out as an investor theres no better way to start than with an ira. But once you start withdrawing funds the money is tax free.

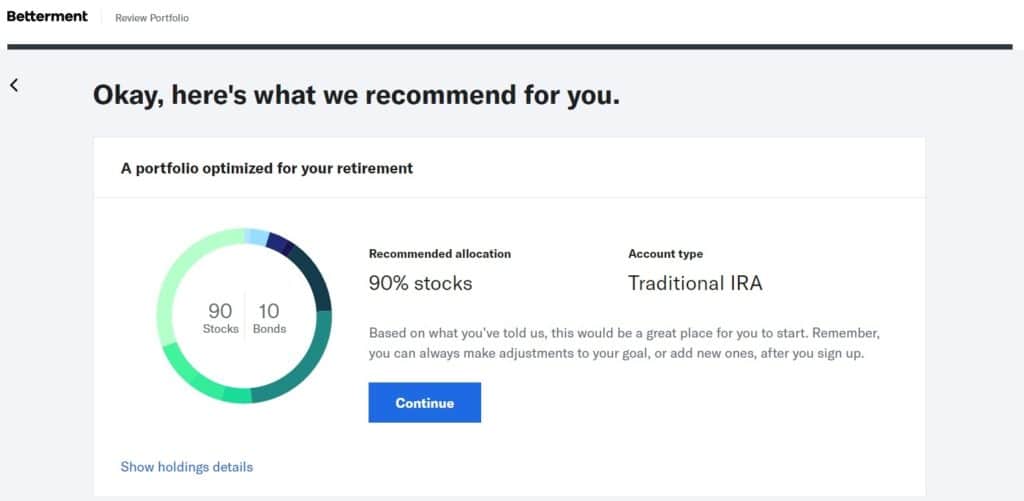

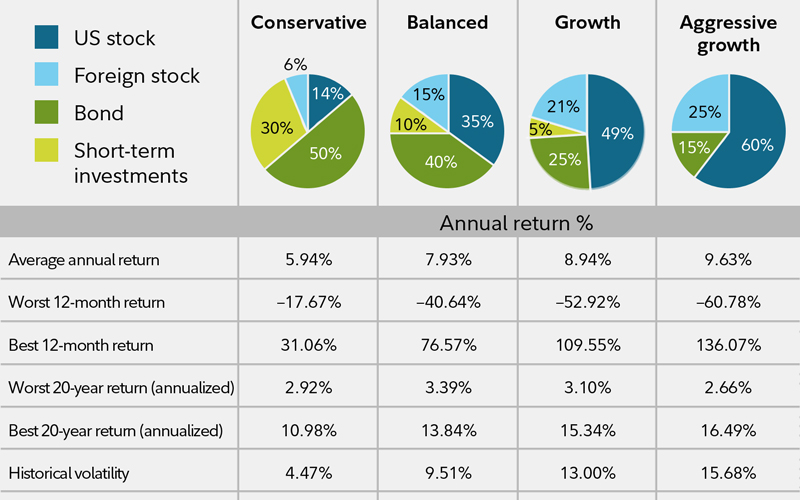

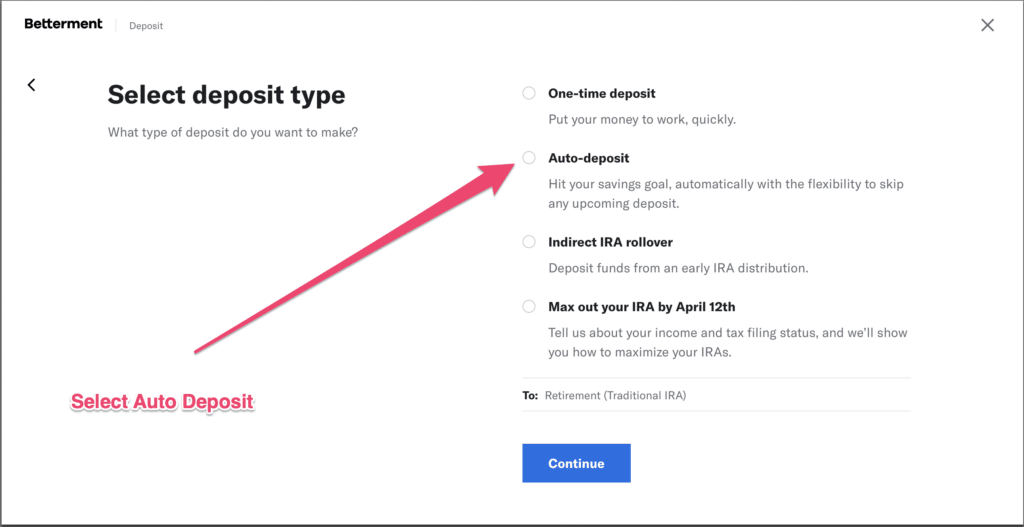

Open your ira online quickly easily. Choose a broker or other financial institution fund your account and select a few investments stocks mutual funds or etfs and put your money to work. Move money directly from your bank to your new vanguard ira electronically. In general youll head to the providers website choose the type of ira you want to open roth or traditional.

Now you know the key steps to starting an ira. Conversely traditional ira deposits are generally made with pretax dollars. Youll just need your bank account and routing numbers found on your bank checks.

.png)

/best-roth-ira-4172142_FINAL3-3da06bb428754decb45f909cbfc7f8e4.png)

:max_bytes(150000):strip_icc()/GettyImages-1032712376-cd38099375c64894819e6ff53c12bcef.jpg)

/what-to-do-if-you-contributed-too-much-to-your-roth-ira-49102ec9ed7948d2863c9ea0e7581dce.png)

/saving-for-retirement-with-a-late-start-38e3bb030ef242649b53f1ad16826b10.png)