How To Start A Roth Ira Account

See how different types of iras work and how to get an ira started.

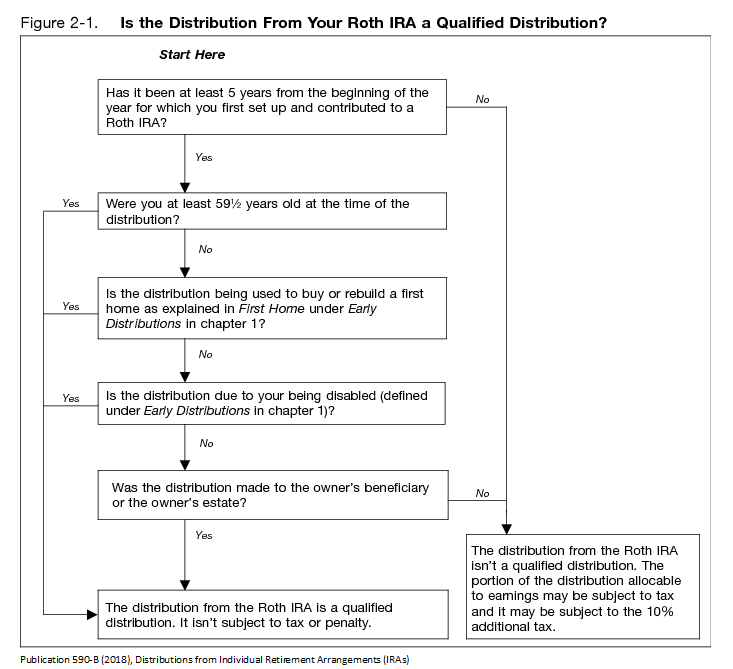

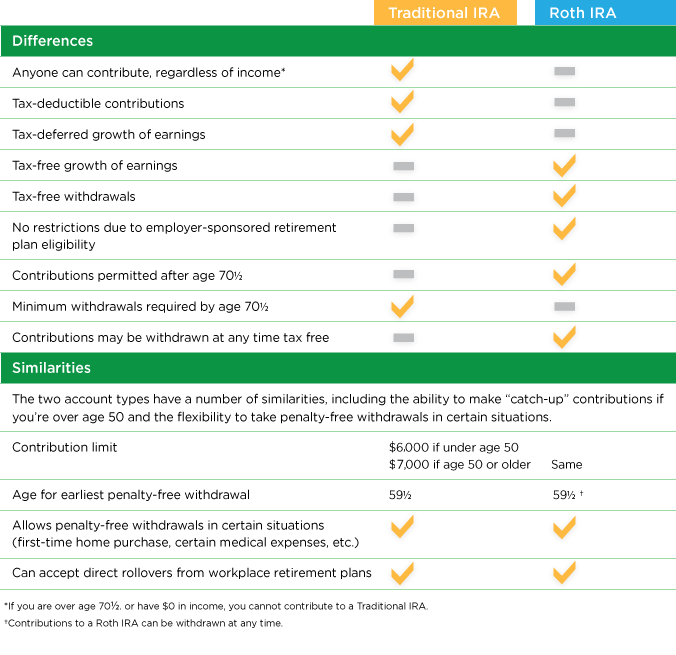

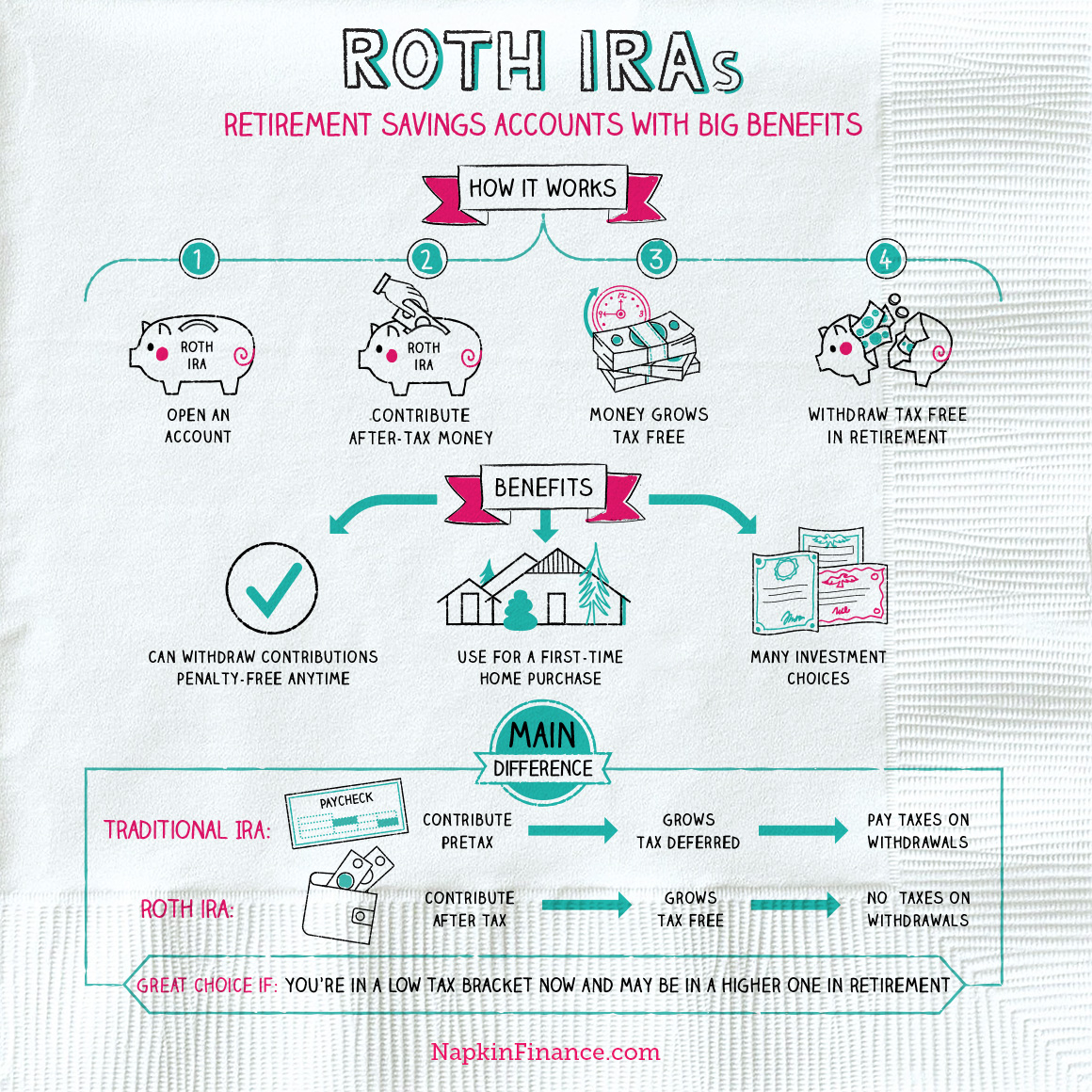

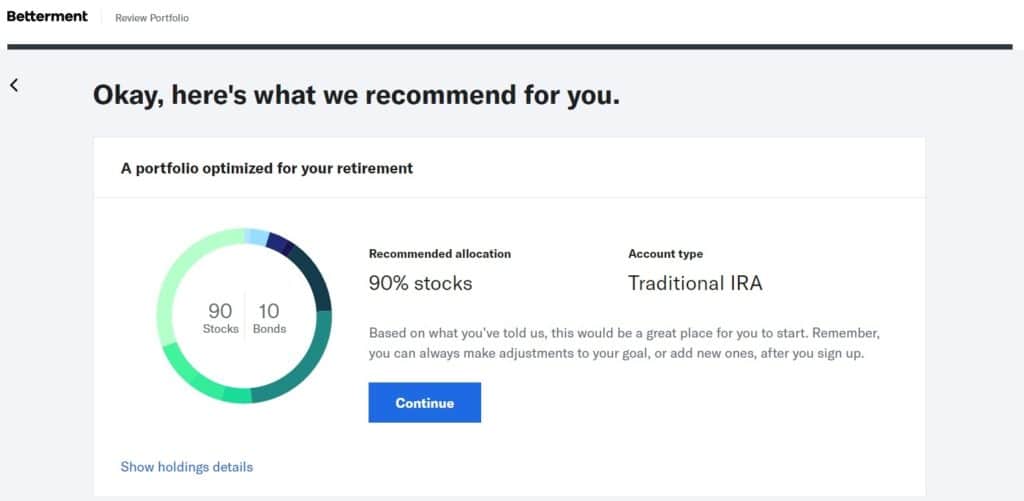

How to start a roth ira account. Learn more about iras and how these retirement savings accounts can help you save for your retirement. An individual retirement account ira is a tax friendly retirement savings account. If your bank doesnt offer roth ira accounts you can open one with a brokerage firm. The new law changed how much time many non spouse beneficiaries of an ira can take before they have to empty the account and they now must close out an inherited ira within 10 years.

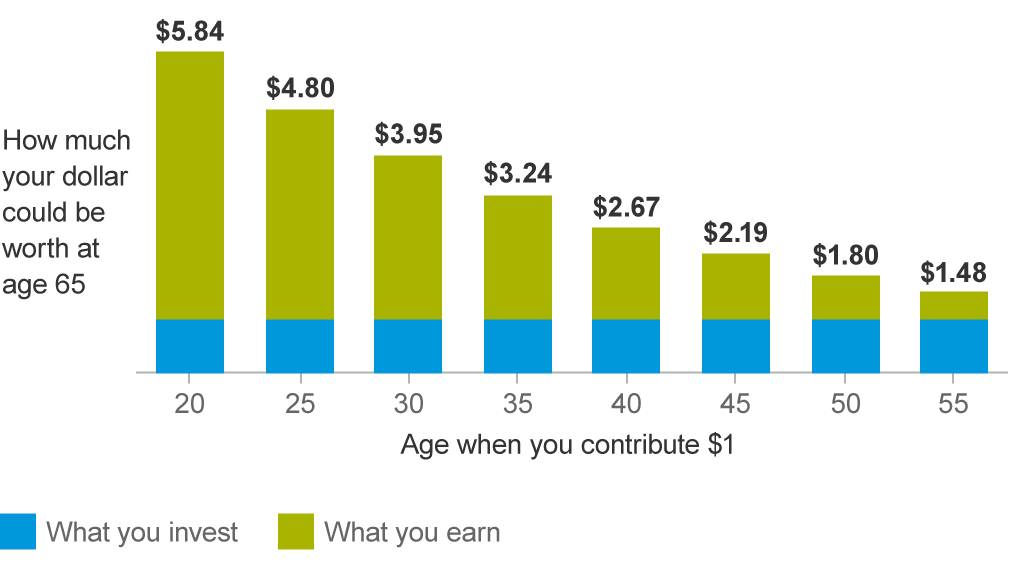

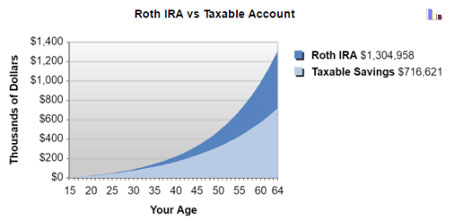

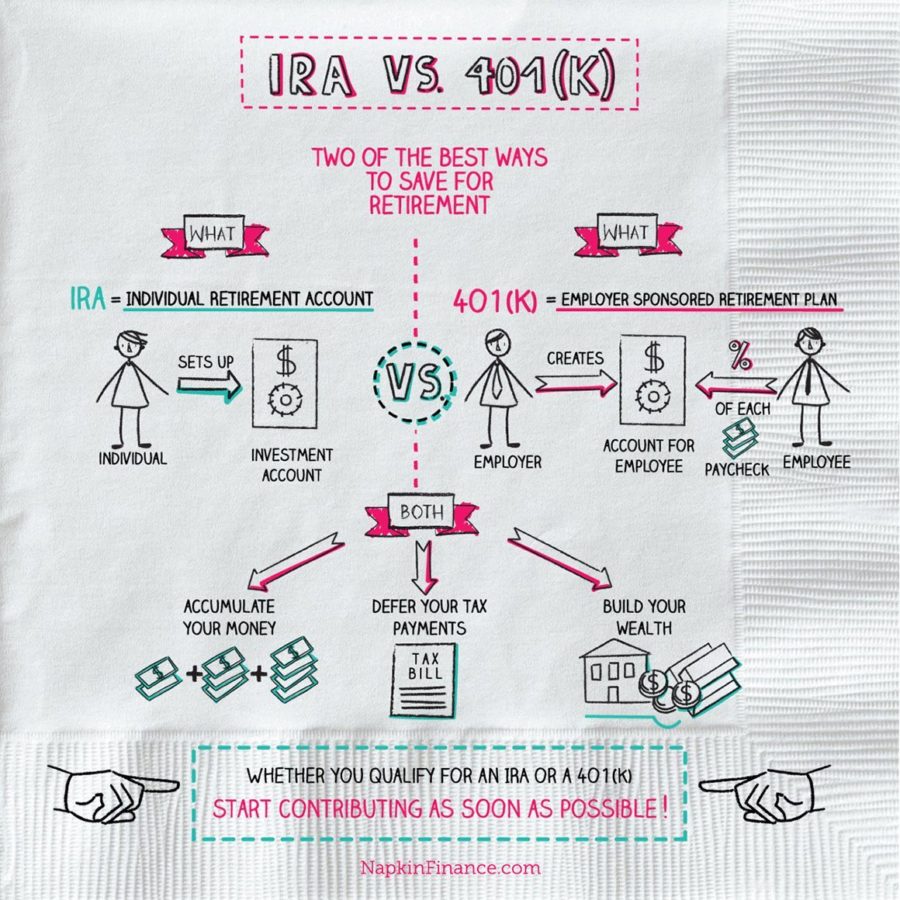

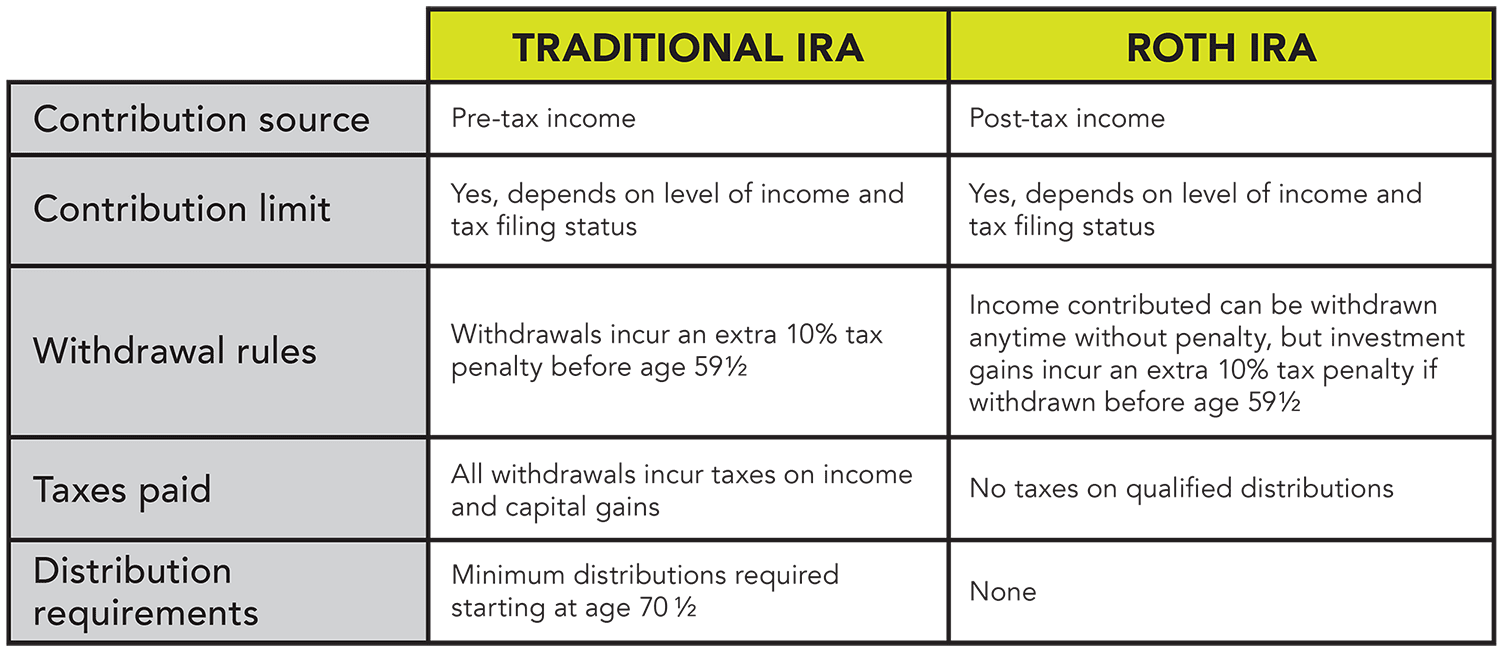

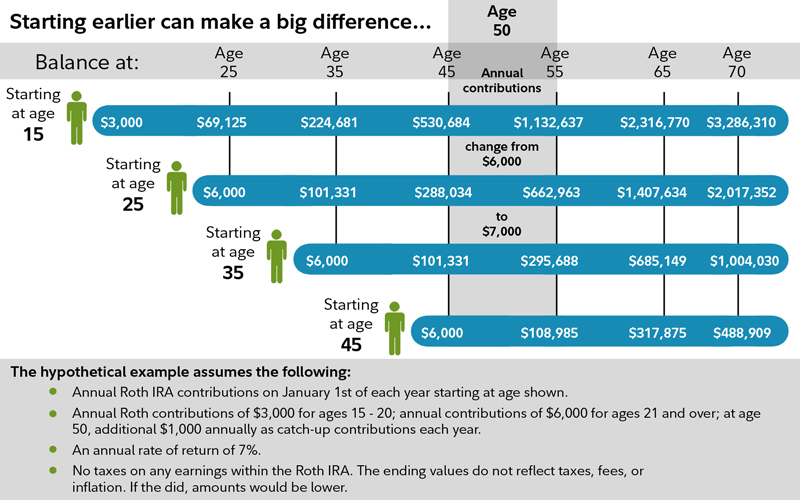

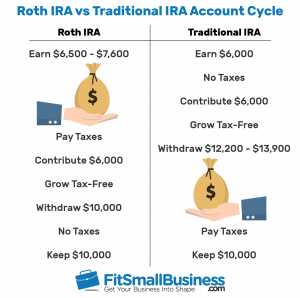

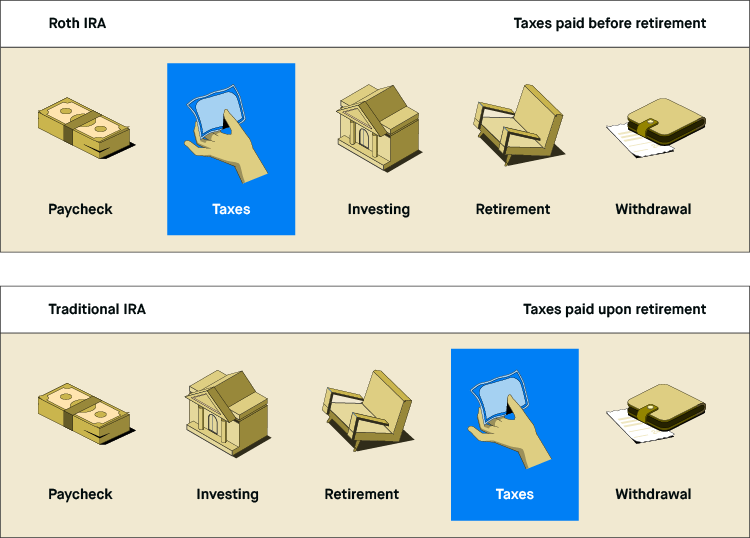

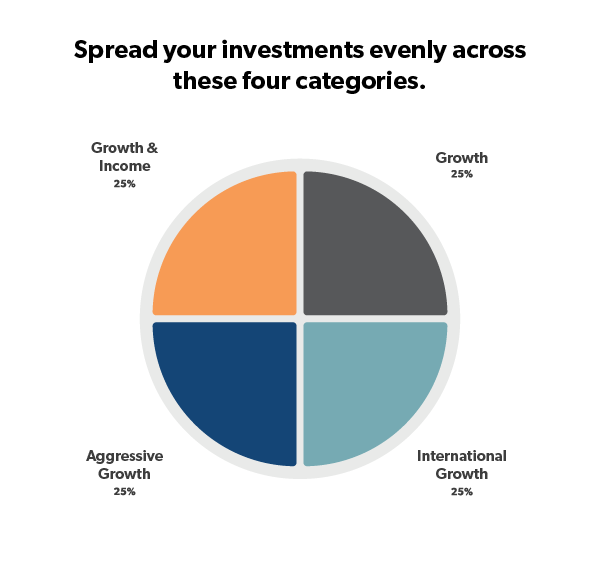

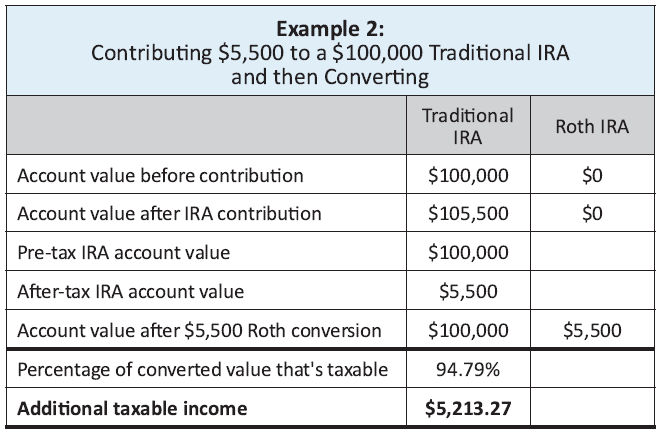

Open a traditional ira or use a newly emptied one to make a nondeductible traditional ira contribution. But most people dont fully understand how the work or how to use them that will maximize their true long term. A roth ira is a type of retirement account. An ira is an account set up at a financial institution that allows an individual to save for retirement with tax free growth or on a tax deferred basis.

But you dont have to handle the process on. Also a roth ira could be a good source of money to cover a major unexpected expense. Roth iras are similar to traditional iras with one key difference your roth ira contributions are not tax deductible. Decide where to open your roth ira account.

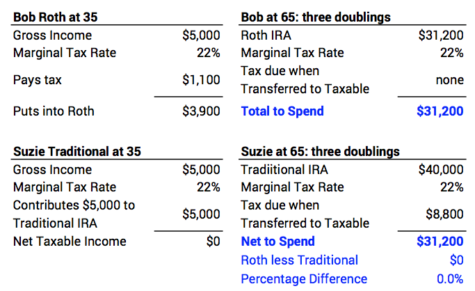

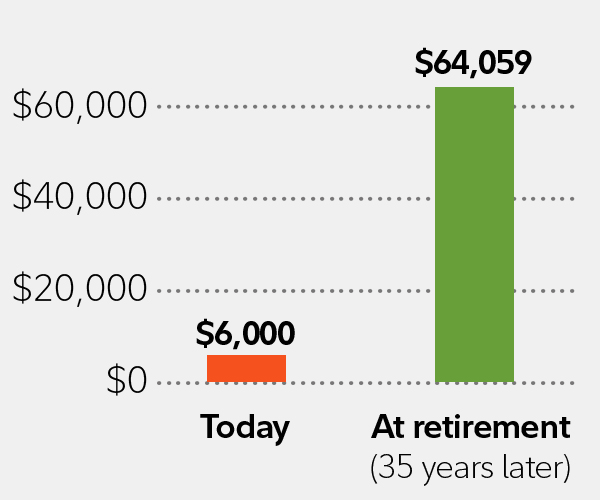

Opening a roth ira can be as simple as visiting your banks website and filling out an online application. This means if you contribute 5000 of your income to a roth ira you must pay tax on that income. The roth ira account is one of the very best financial accounts anyone can have. If you need 15000 to replace your roof that withdrawal from a tax deferred account could push you into a.

The benefit is unlike a traditional ira you pay no taxes when you withdraw your money. Most large firms also offer online access to start the account application. Immediately convert the traditional ira contribution to a roth ira or keep the funds in. Unlike a traditional ira or 401k you will not receive a tax deduction when you make contributions but your money will grow tax free and can be.

Almost all investment companies offer roth ira accounts.

/basics-of-the-cd-ira-315235-Final-c211c11d28734a7f83104425fd1a7b04.png)

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)