How To Price A Bond

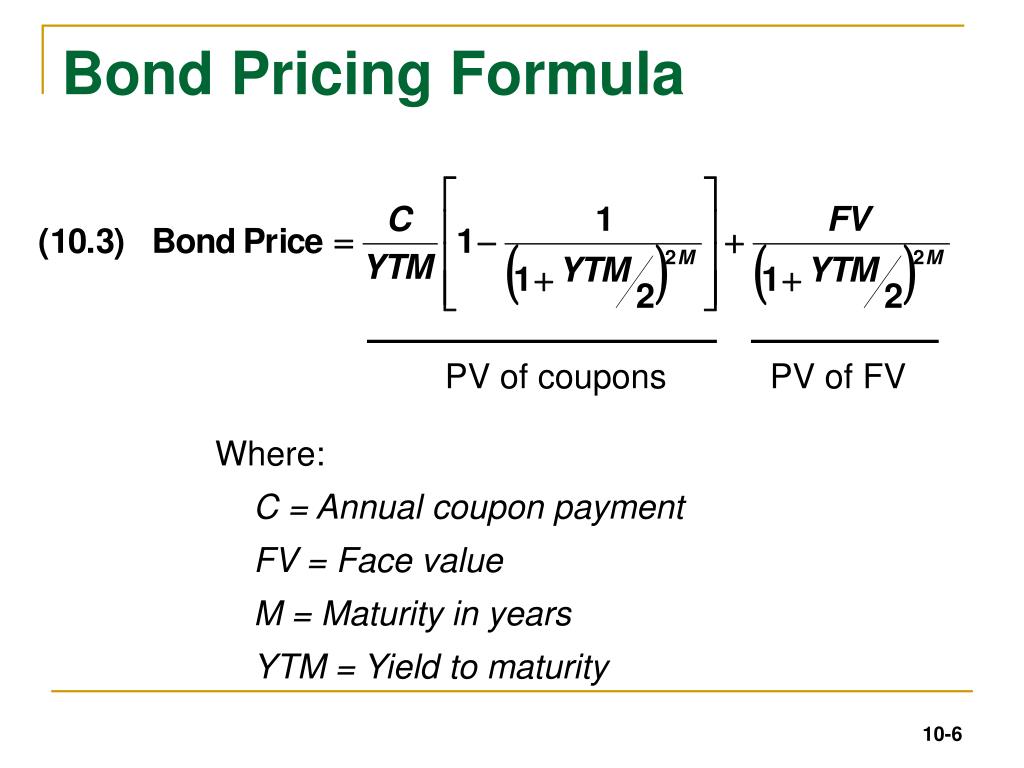

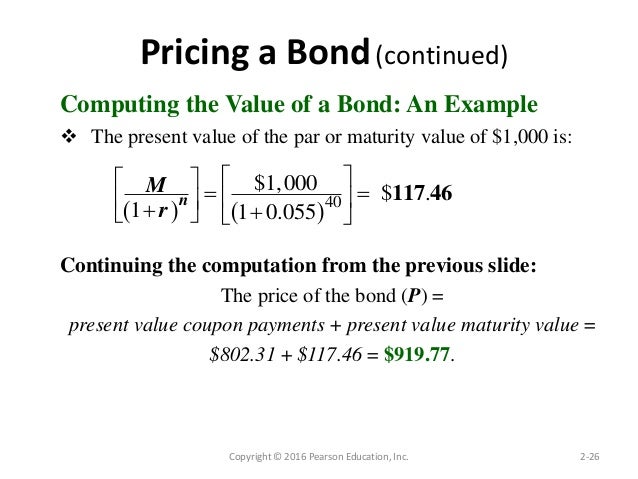

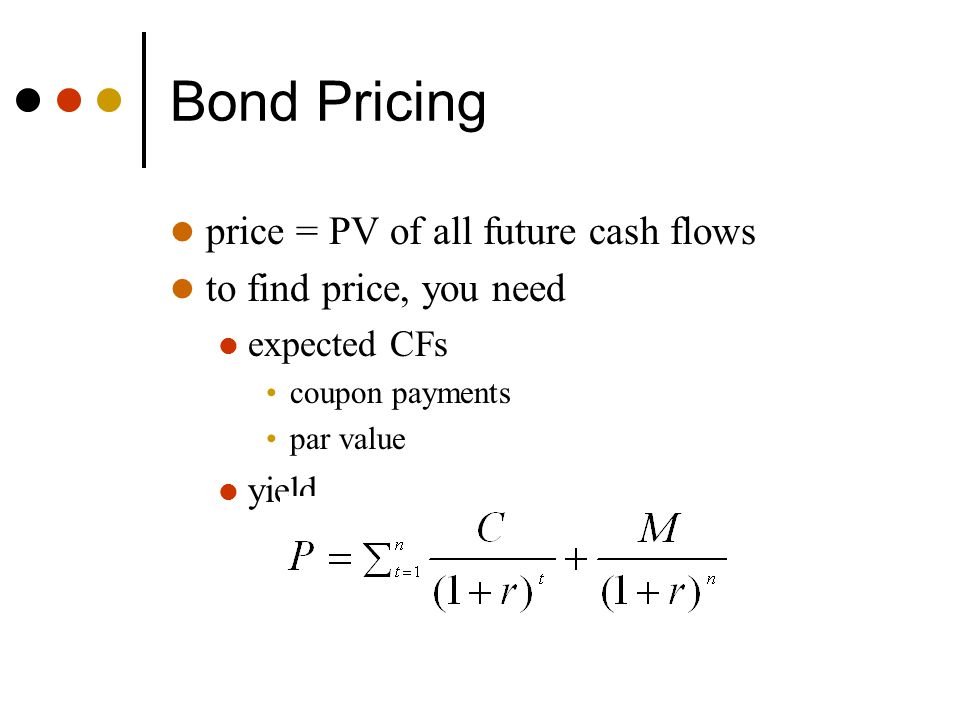

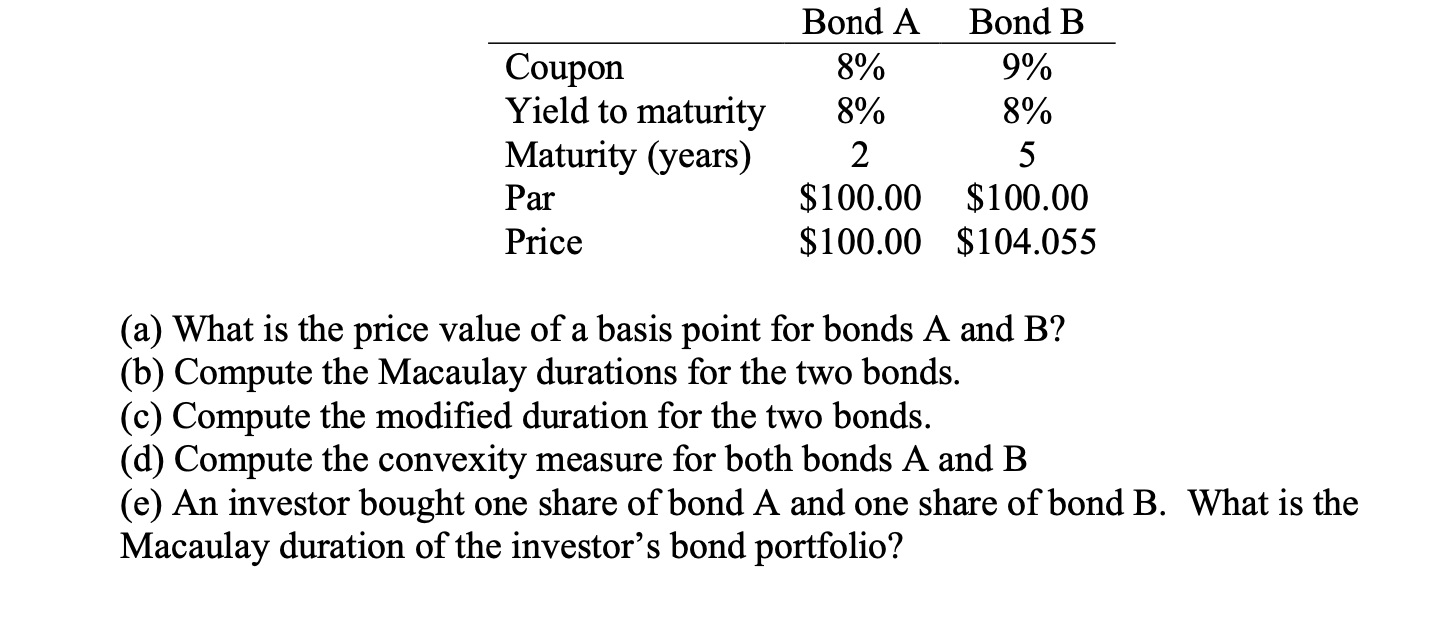

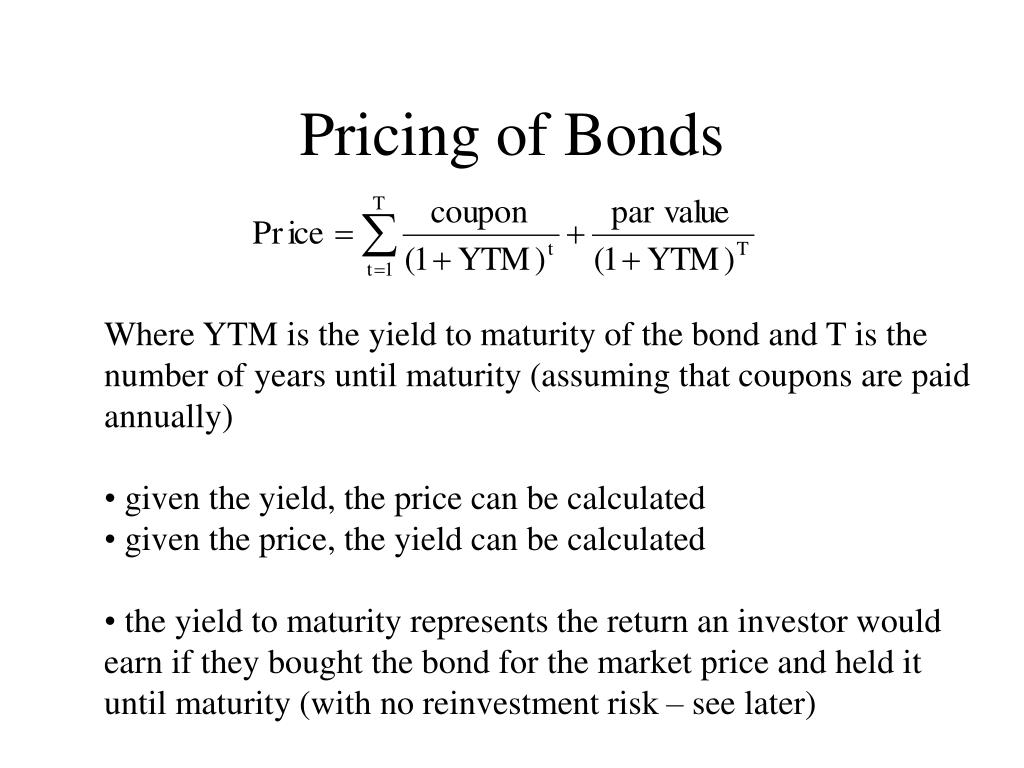

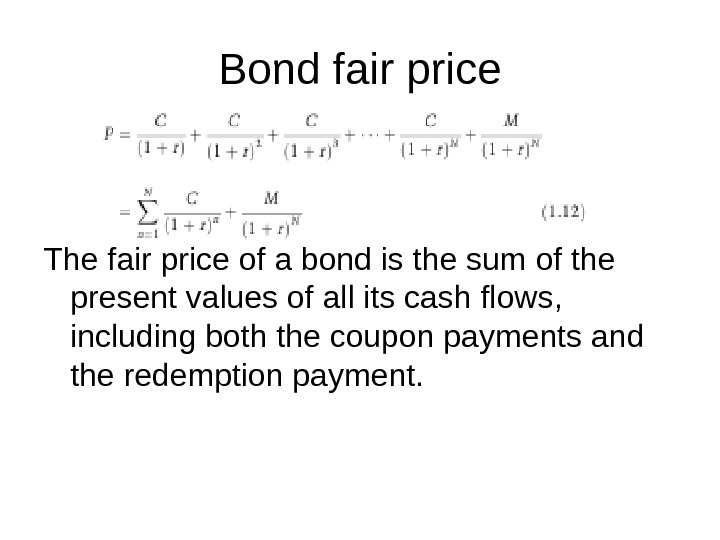

Many investors calculate the present value of a bond.

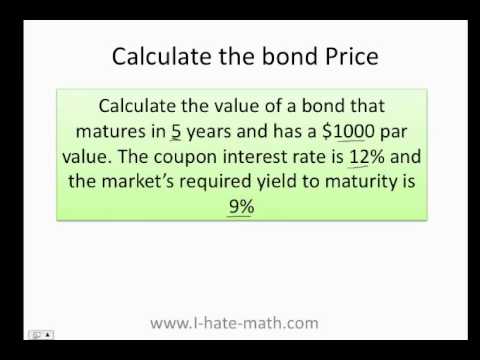

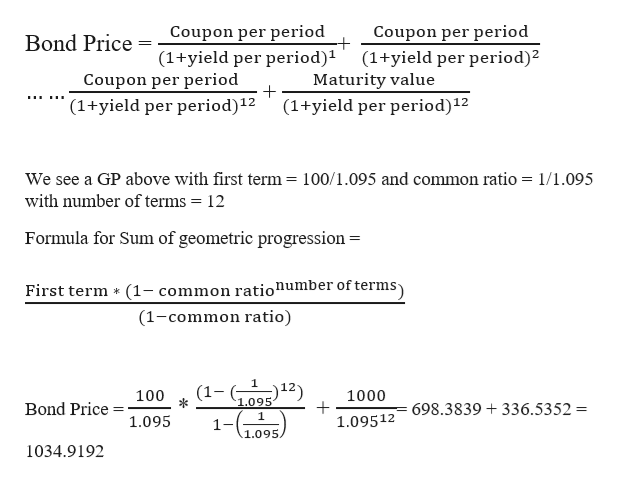

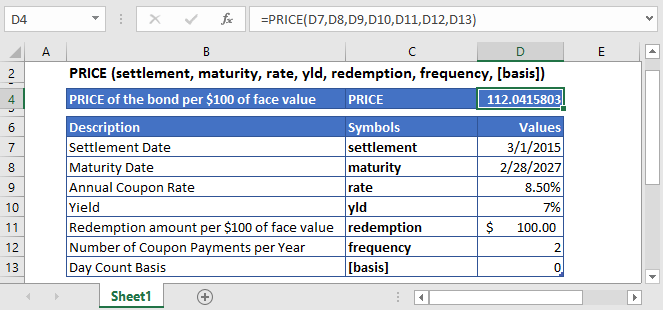

How to price a bond. For example a bond with a price of 100 and a factor of 10 will cost 1000 to buy omitting commission. Conversion value market price per common share conversion ratio. This gives you the coupon payment as a percentage of the current bond price. When a bond matures the principal amount of the bond is returned to the bondholder.

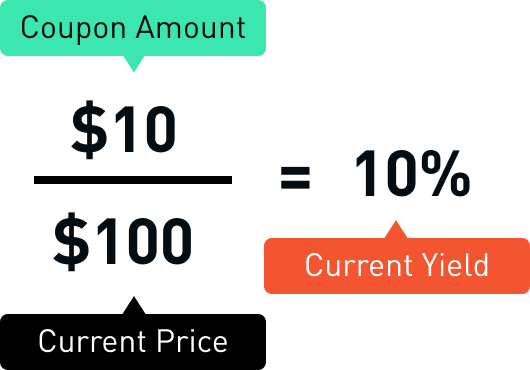

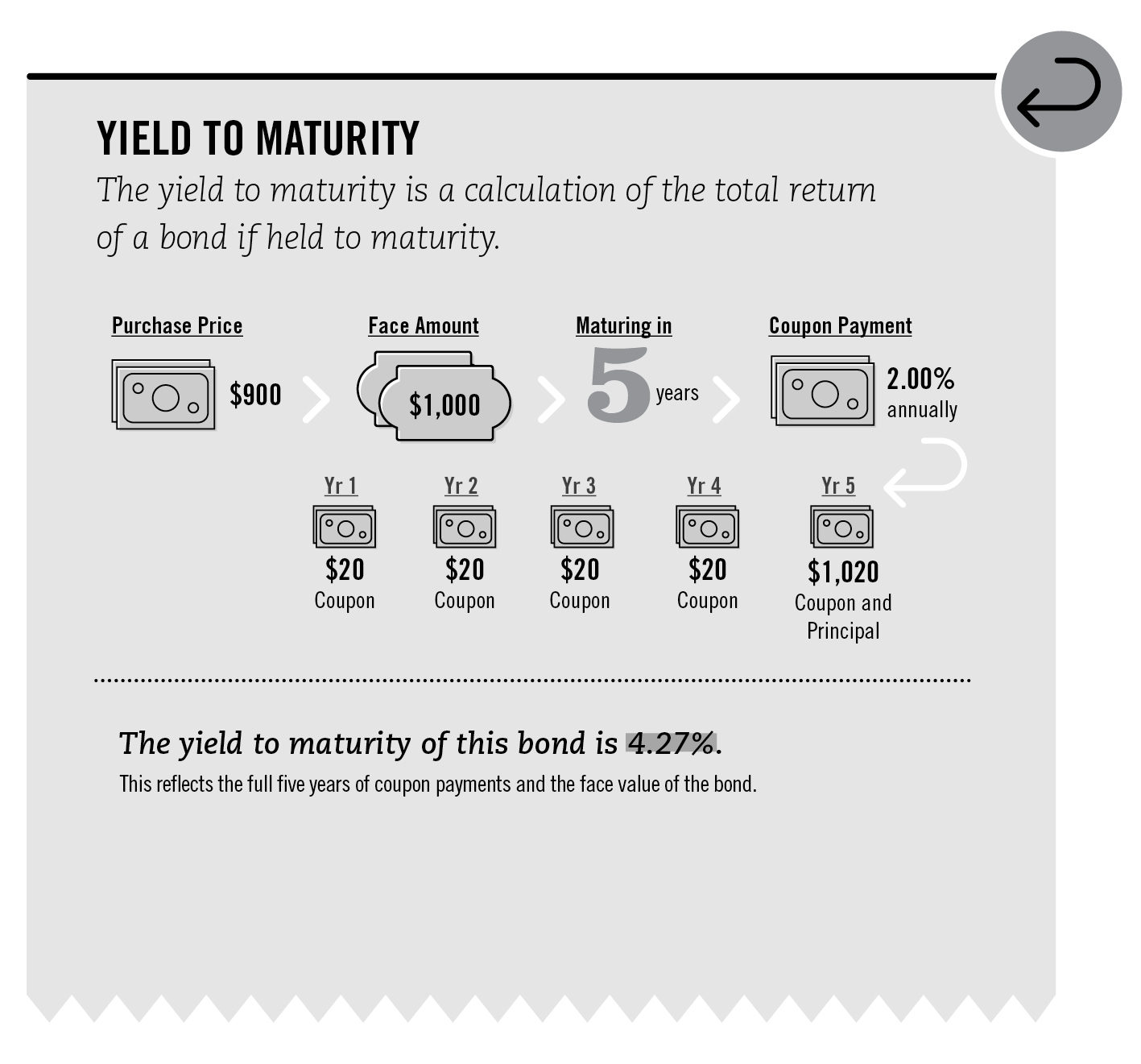

The current yield is the annual coupon payment amount divided by the current bond price. Find the present value of the bond. A price of 100 is called par. Bond price conventions a bonds price multiplied by the bond factor the value at maturity divided by 100 equals the amount you will actually pay for the bond.

Determine the interest paid by the bond. Alternatively the causality of the relationship between yield to maturity. If the coupon payment is for example 500 and you calculate the bonds price value to be 4800 then the current yield is 5004800 which would be 104. Price where the bond would trade if it were not convertible to stock.

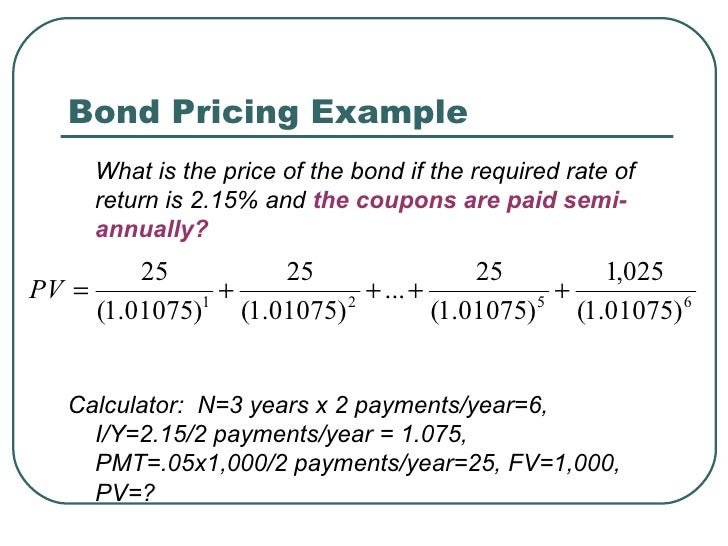

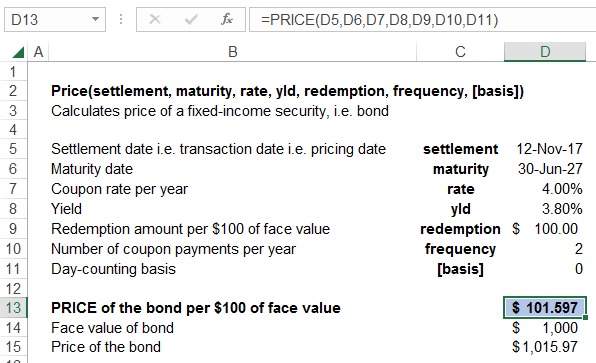

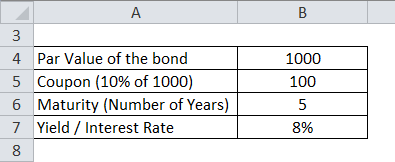

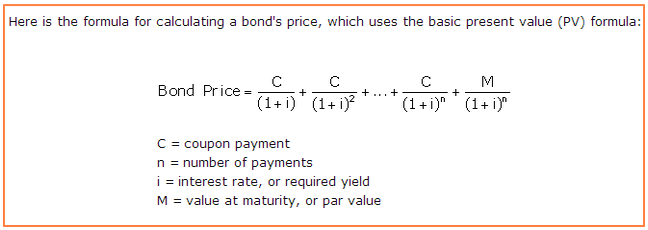

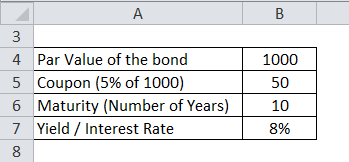

Thus we can value each cash flow in present dollars add the present values up and. Convertible bond analysis process. For corporate bonds the face value of a bond is usually 1000 and for government bonds the face value is 10000. The basic steps required to determine the issue price are.

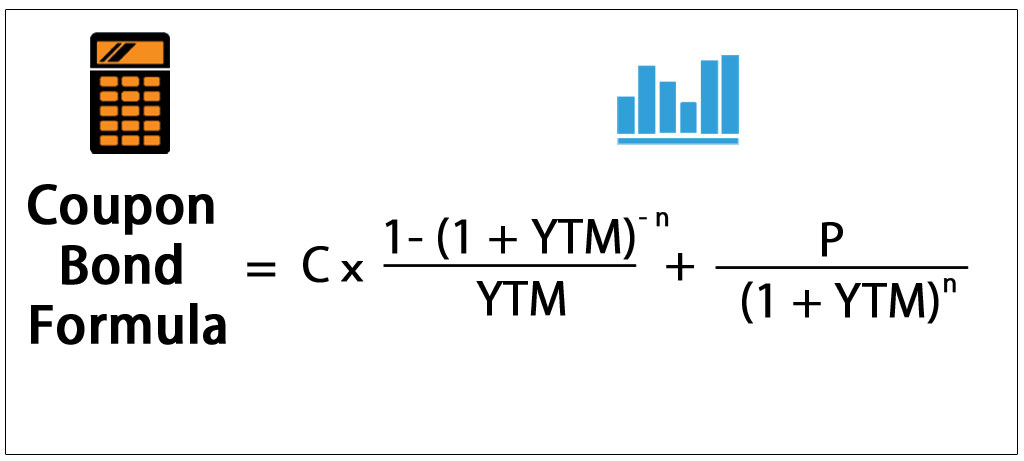

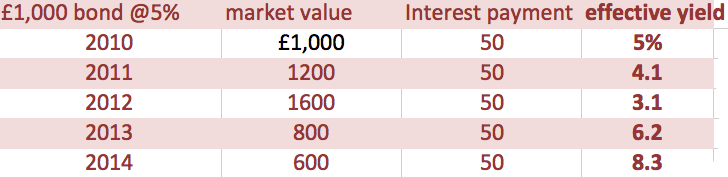

Now the coupon rate which is analogous to interest rate of the bond and the frequency of the. A bond that sells at a premium where price is above par value will have a yield to maturity that is lower than the coupon rate. Which is the current market value of the shares that the bond can be converted into. For example if a bond pays a 5 interest rate once a year on a face amount of 1000 the interest payment is 50.

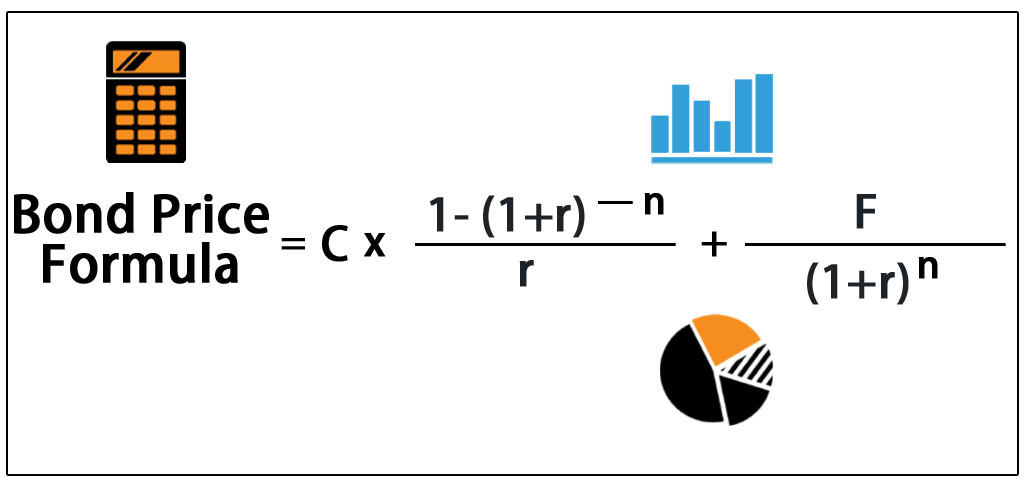

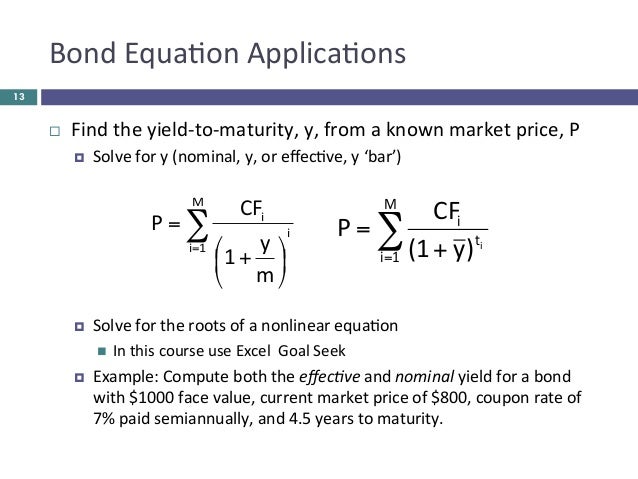

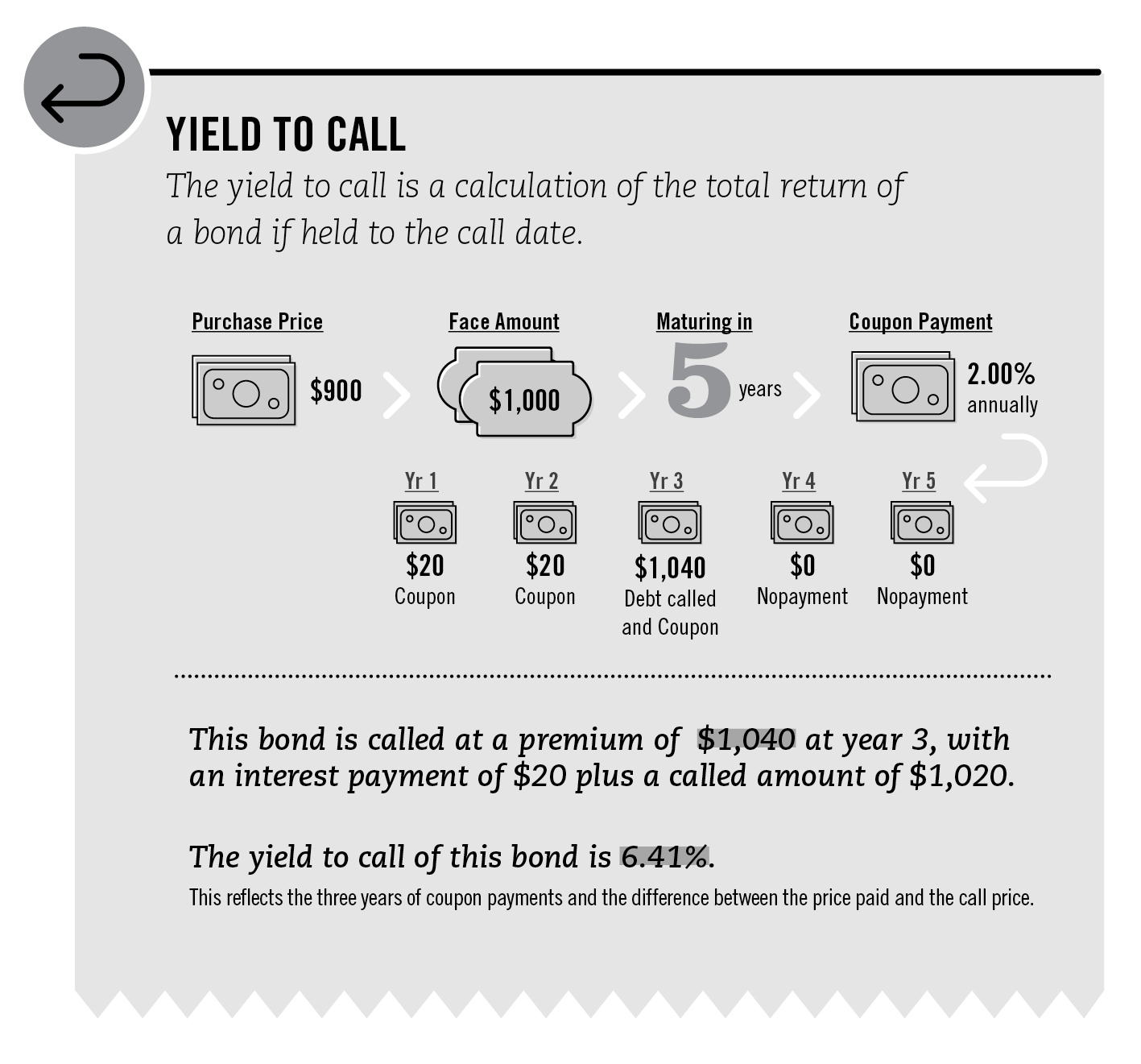

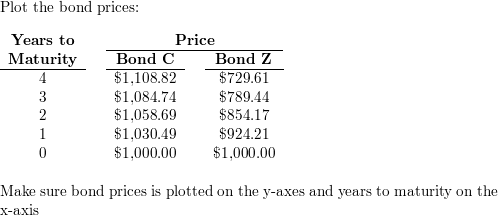

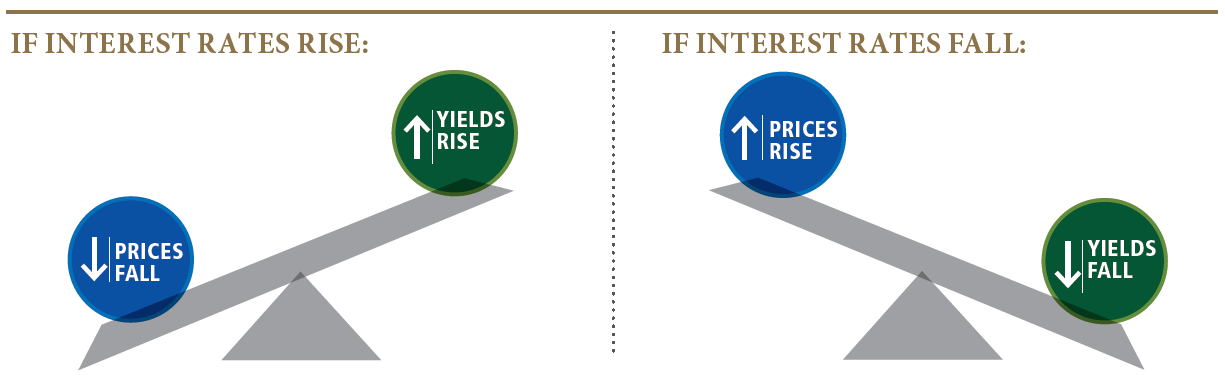

Yield to maturity bonds are priced to yield a certain return to investors. A bond is a debt security that pays a fixed amount of interest until maturity. The formula for bond pricing calculation by using the following steps.

.png)