How To Get Tax Exempt Certificate

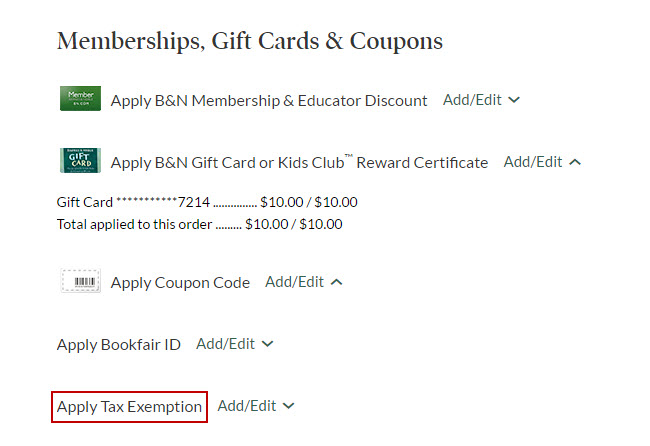

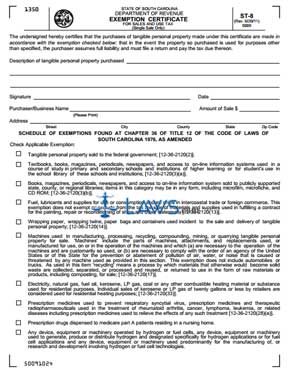

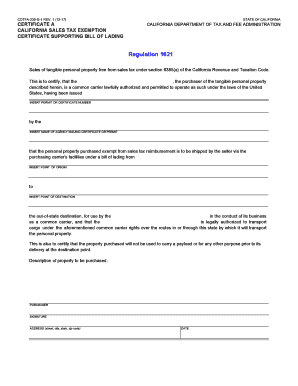

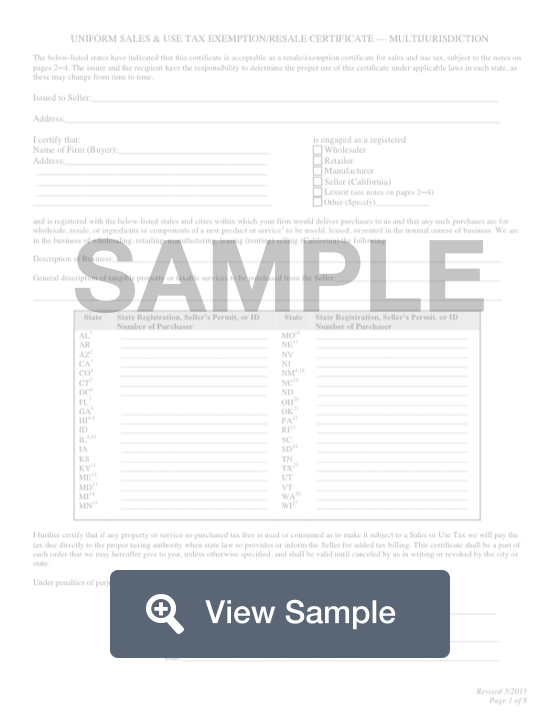

A sales tax exemption certificate is needed in order to make tax free purchases of items and services that are taxable.

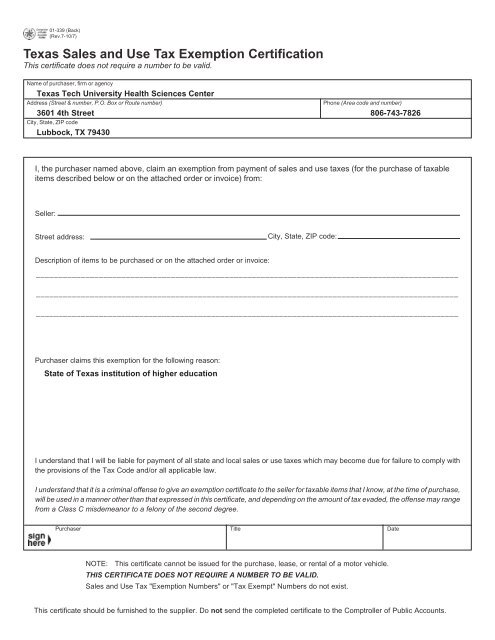

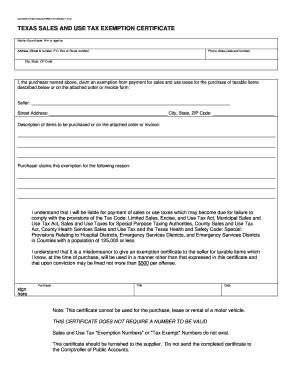

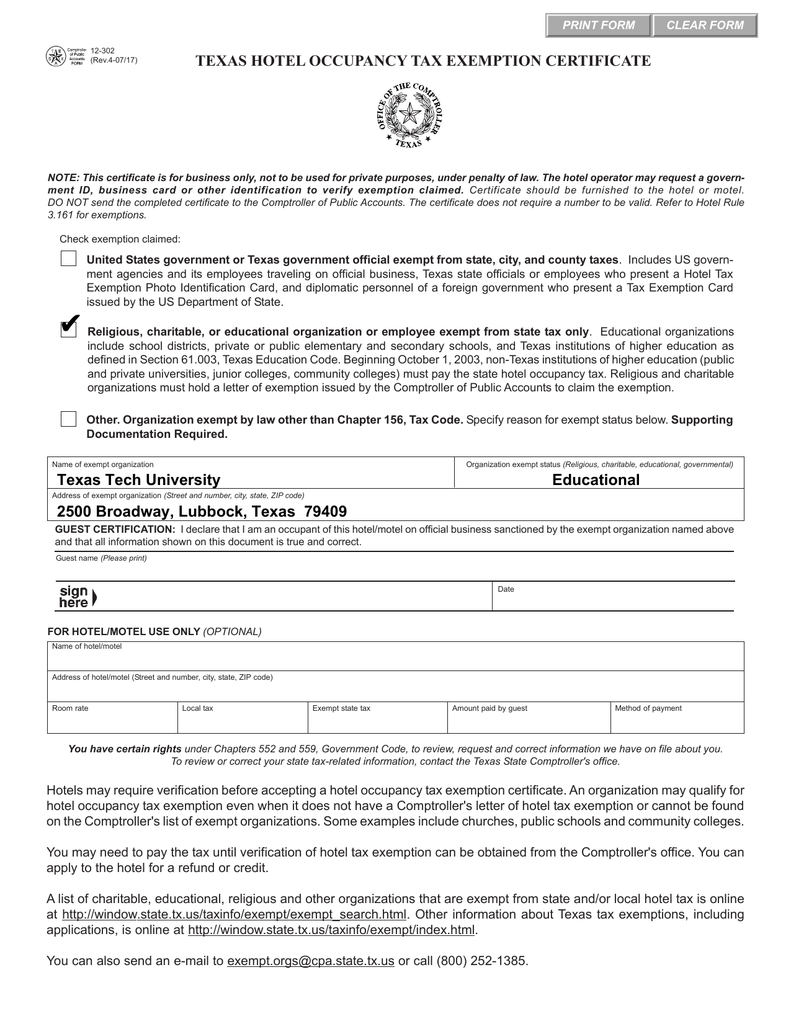

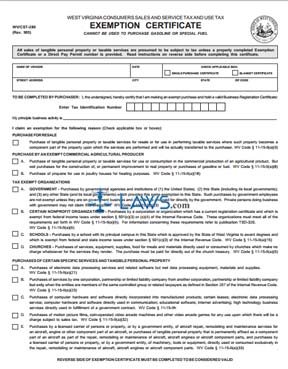

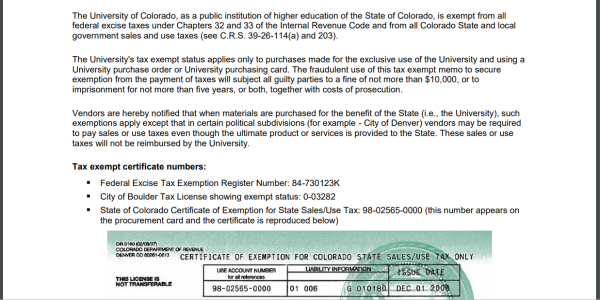

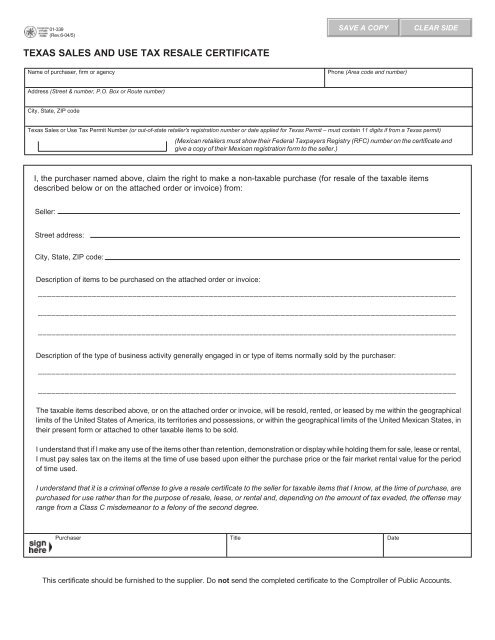

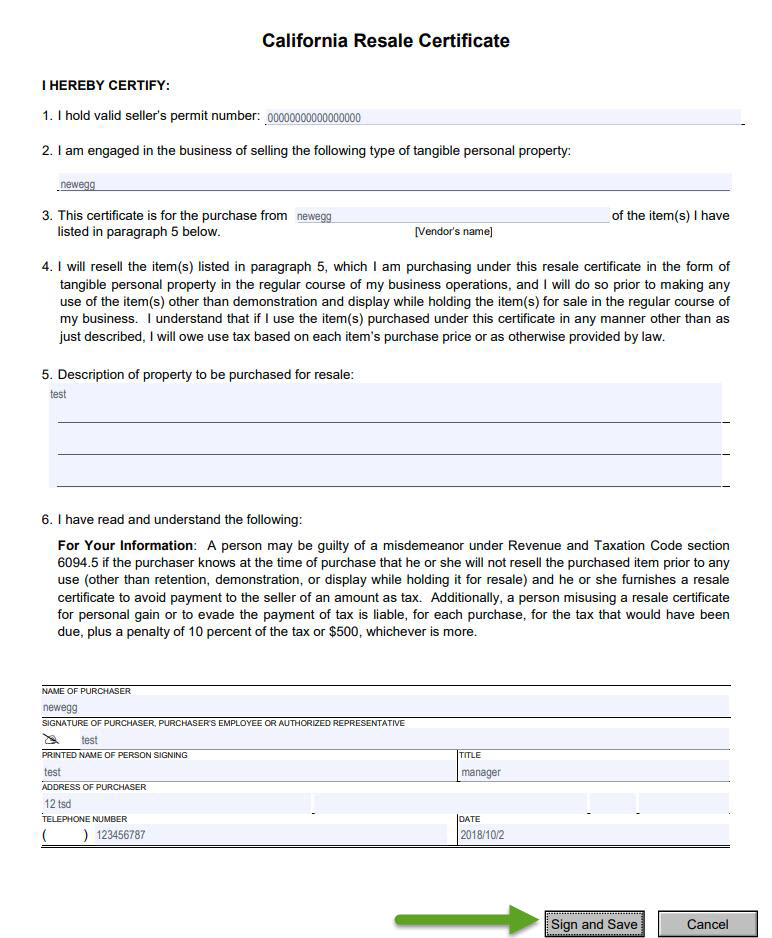

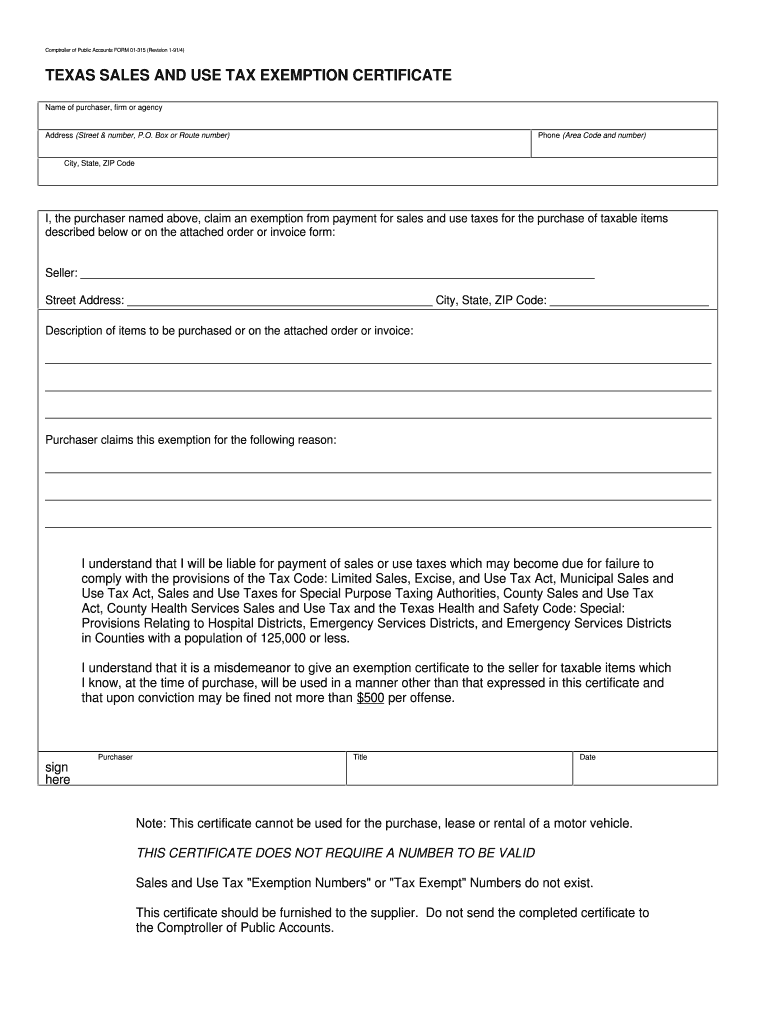

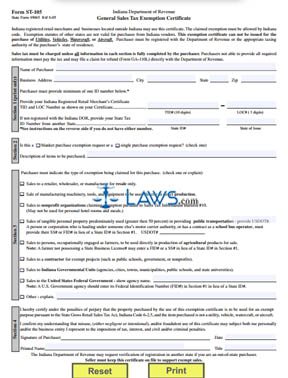

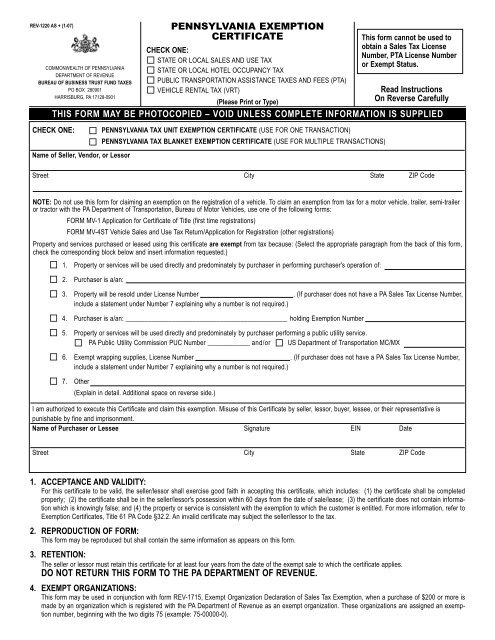

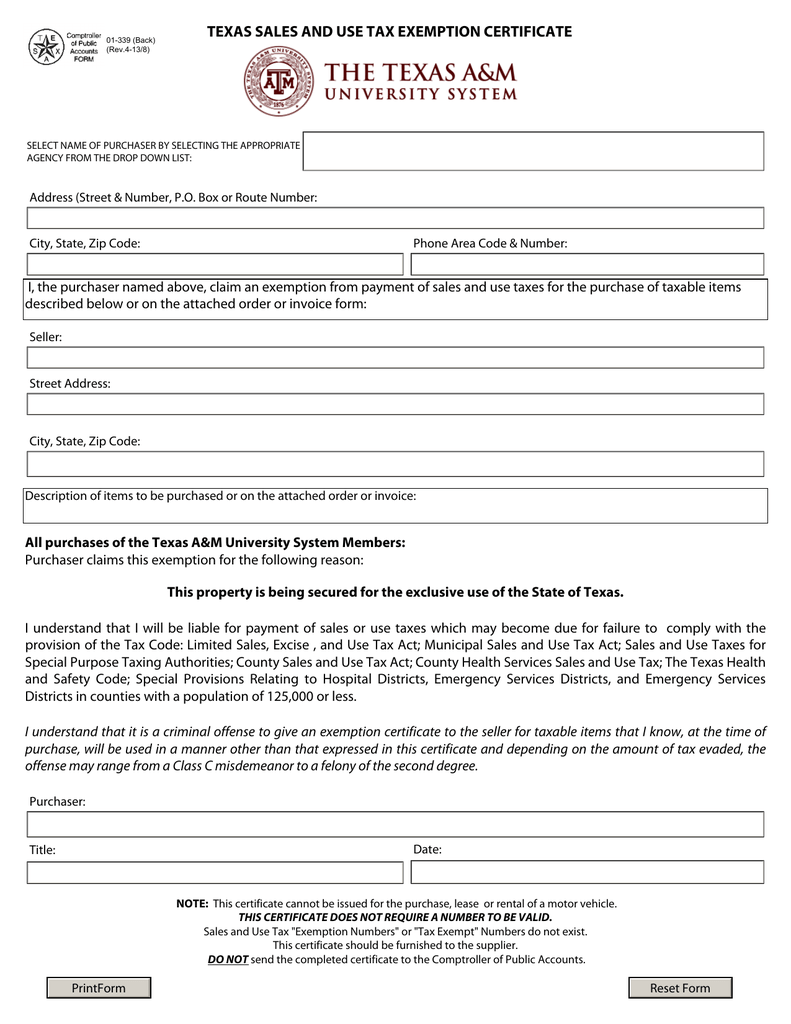

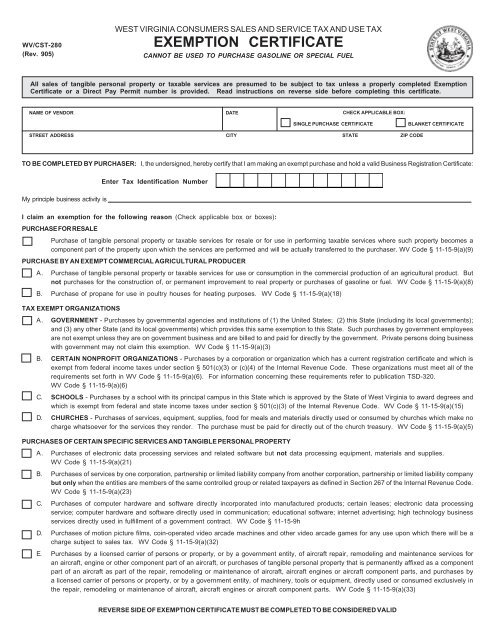

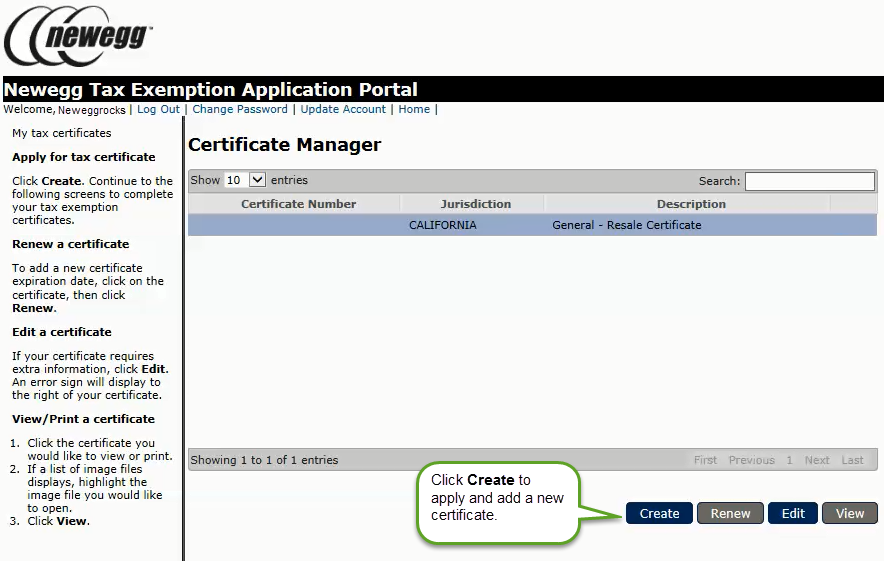

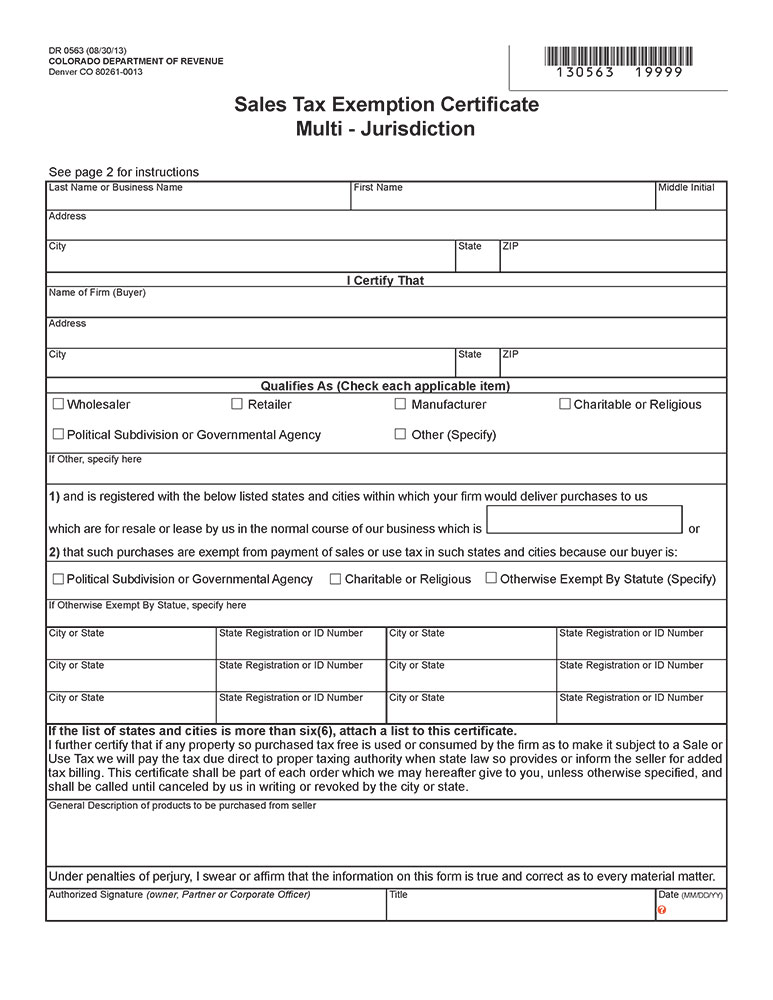

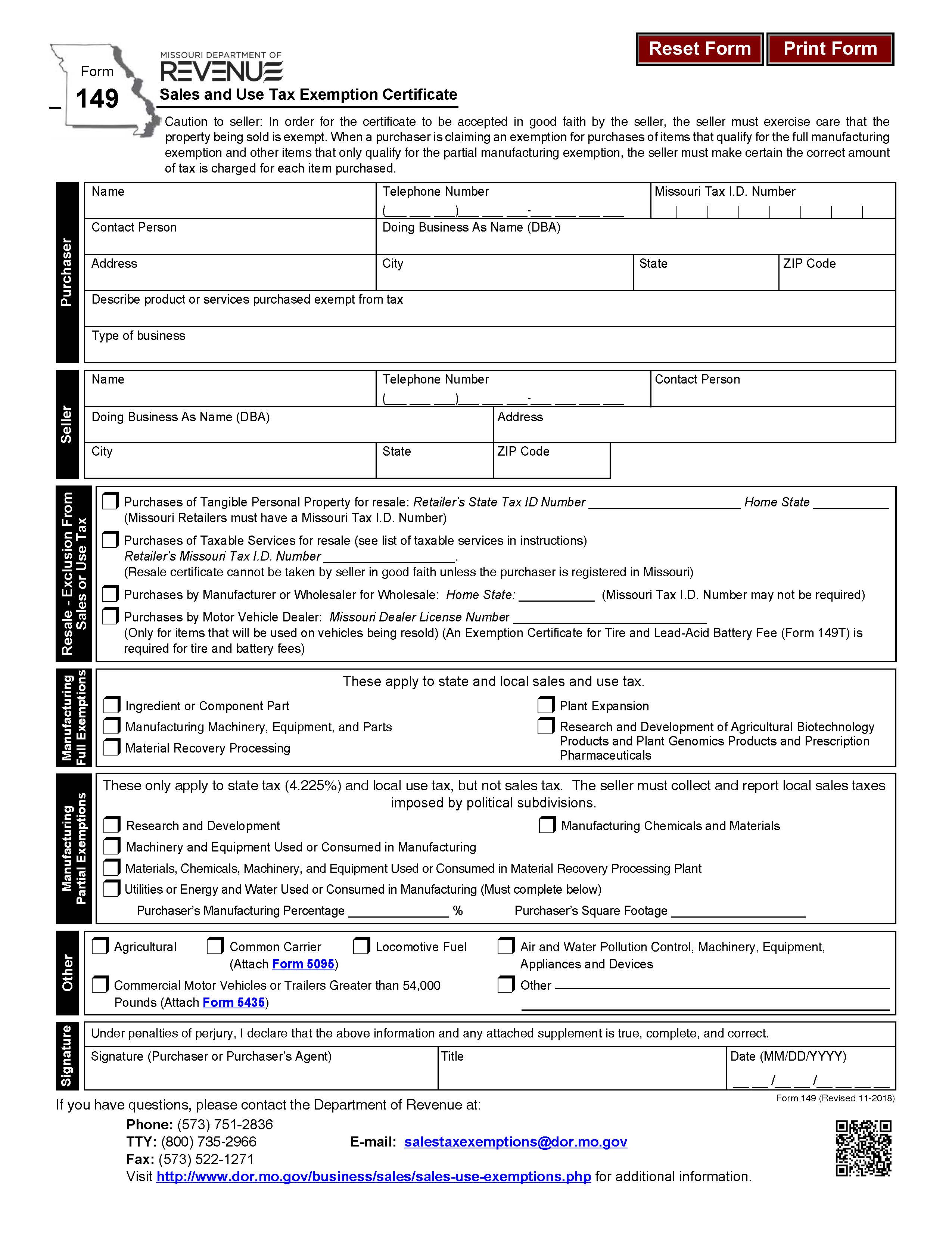

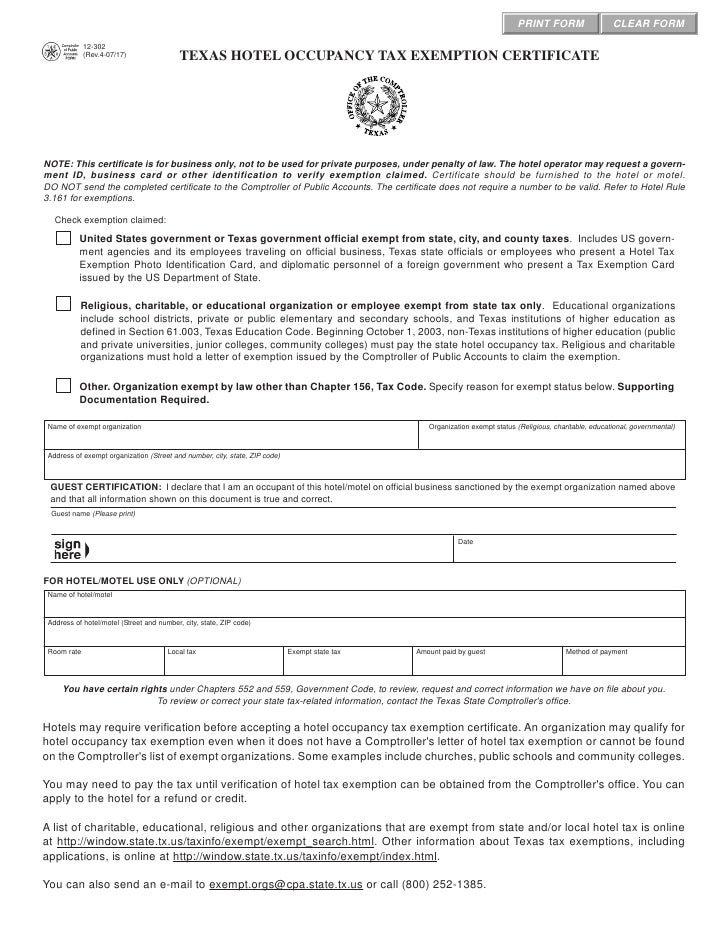

How to get tax exempt certificate. 01 339 texas sales and use tax resale certificate exemption certification pdf 12 302 texas hotel occupancy tax exemption certification pdf 50 299 primarily charitable organization property tax exemption pdf. Provide a copy of the statute or law creating or describing the federal or state agency county municipality or political subdivision with your application. General exemption certificate forms. I the purchaser named above claim an exemption from payment of sales and use taxes for the purchase of taxable items described below or on the attached order or invoice from.

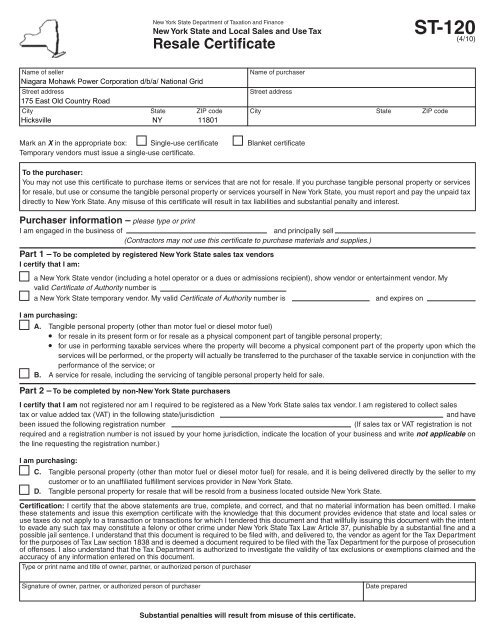

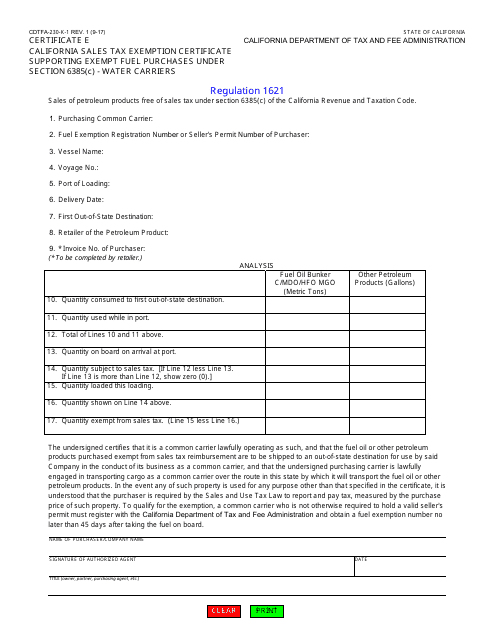

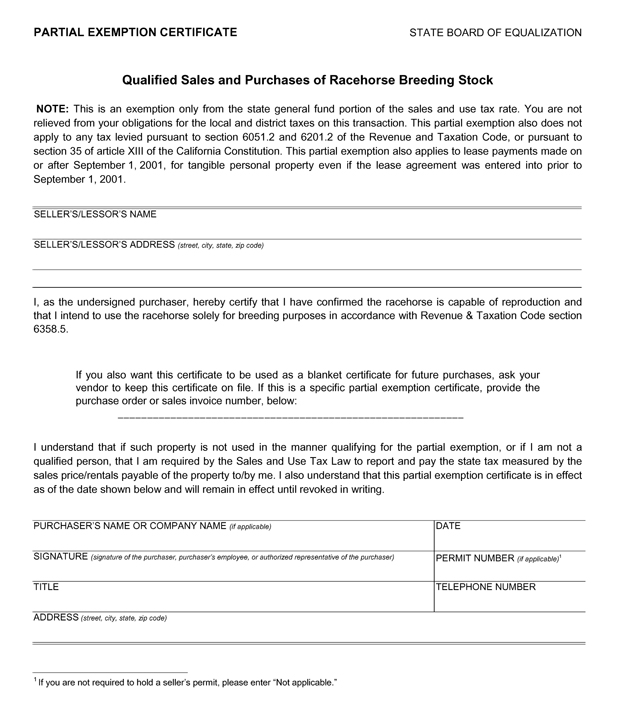

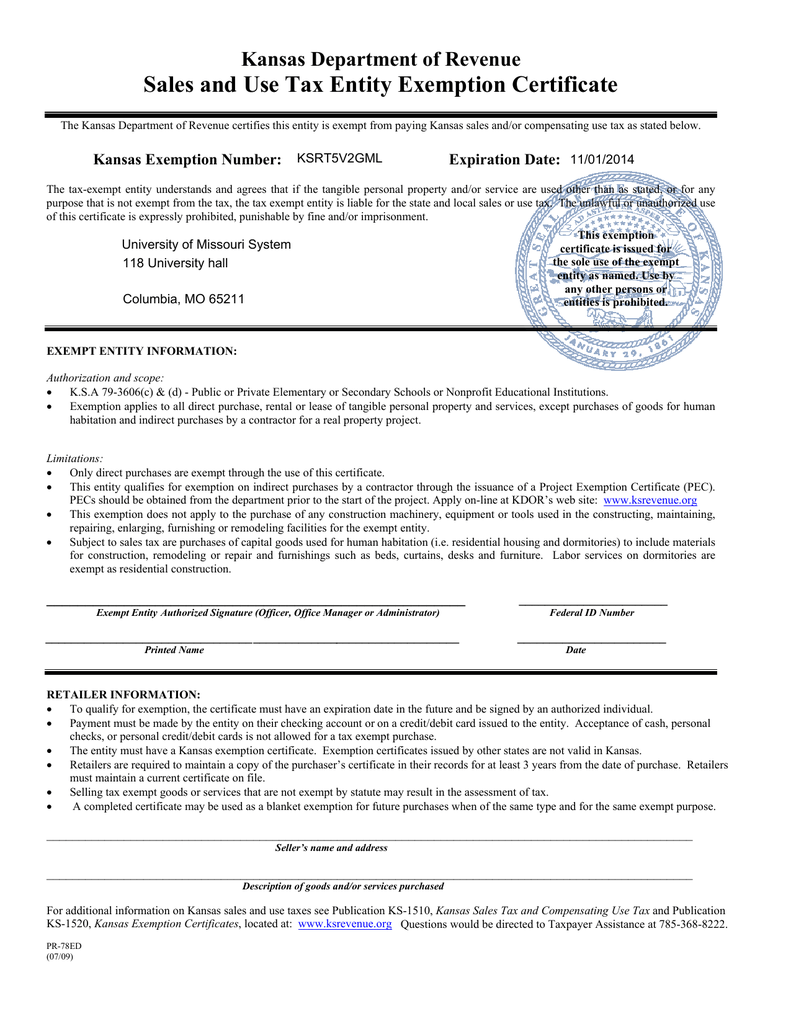

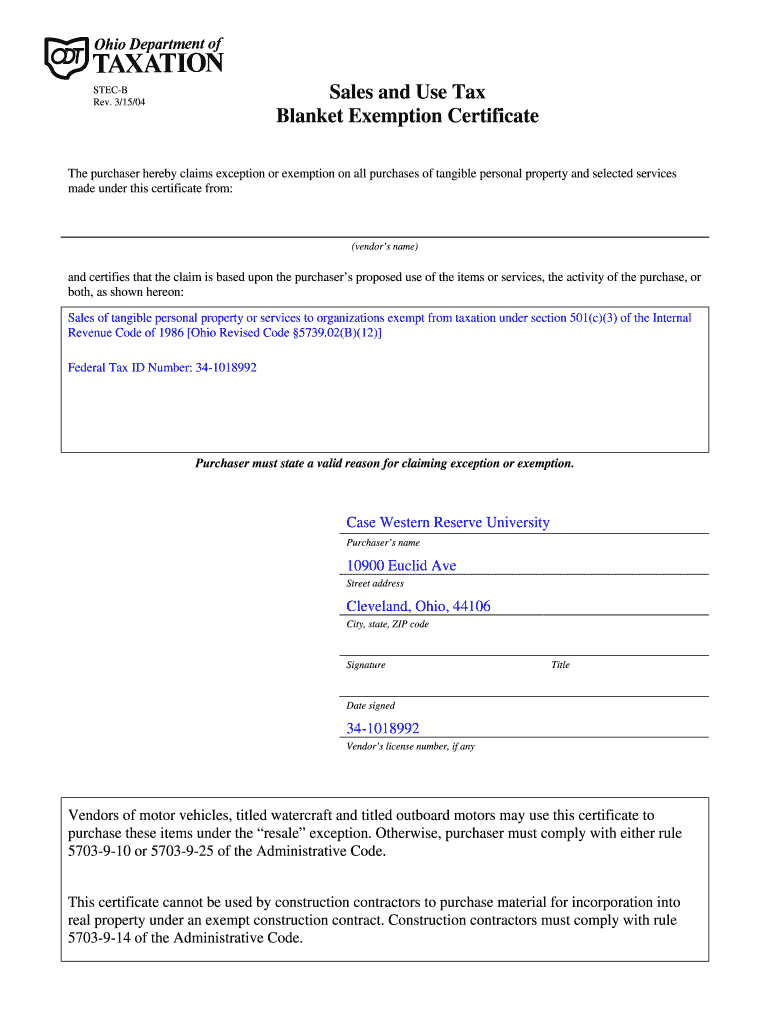

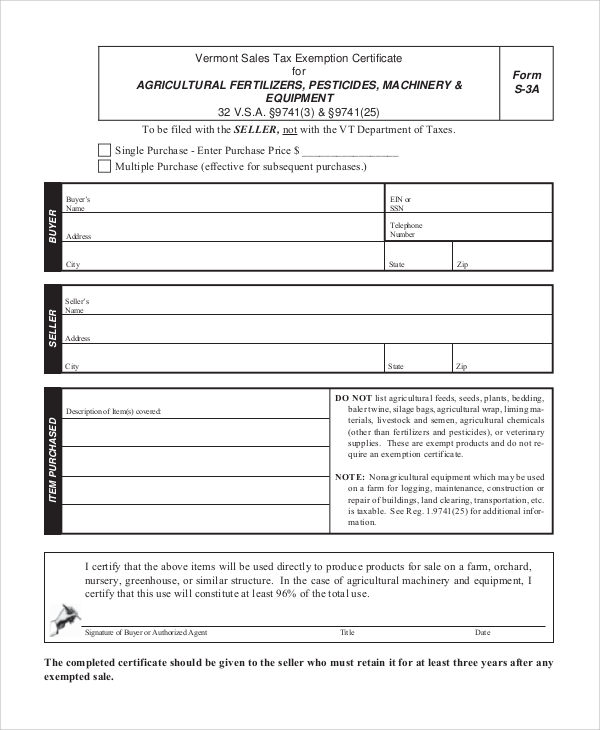

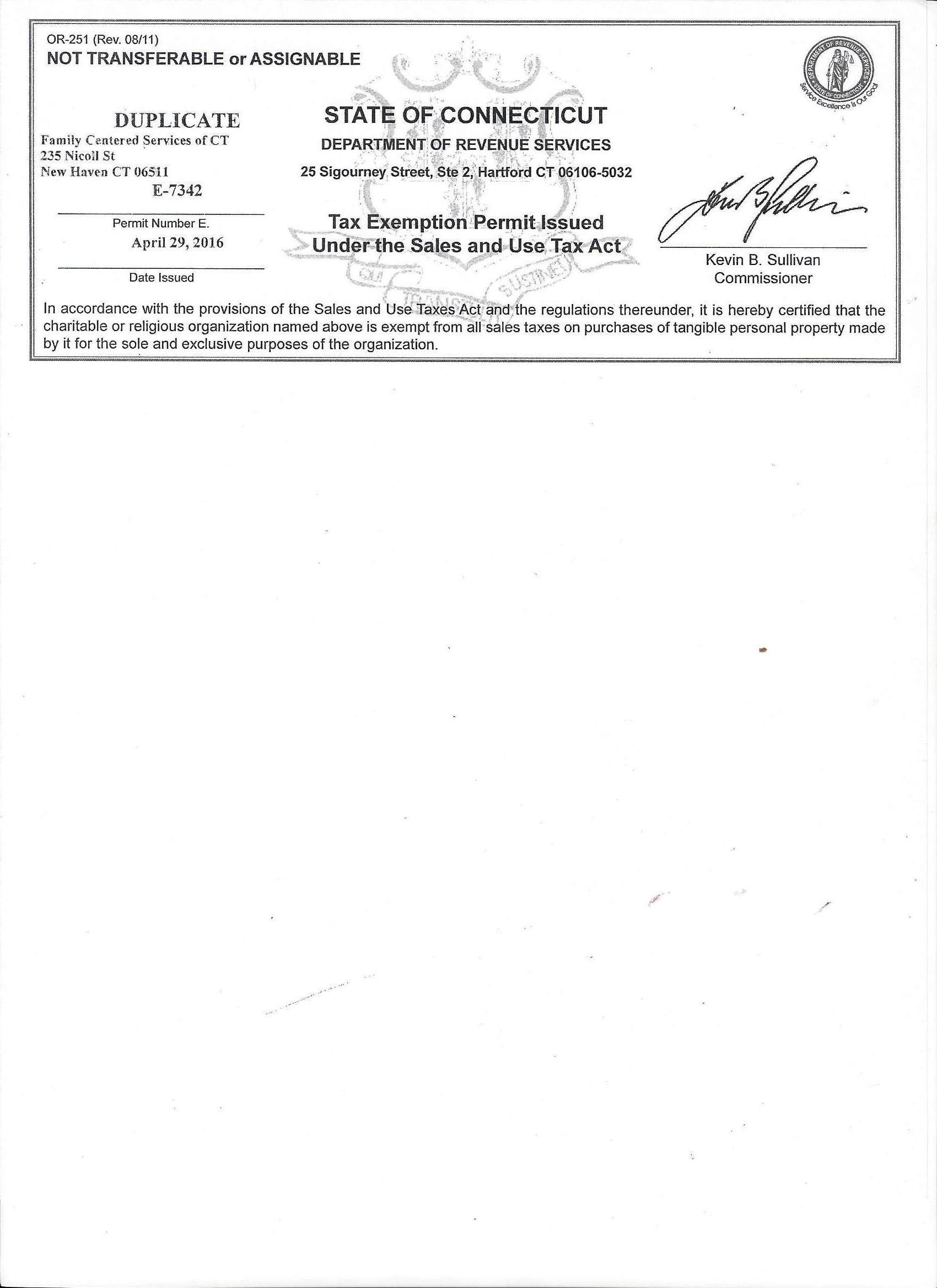

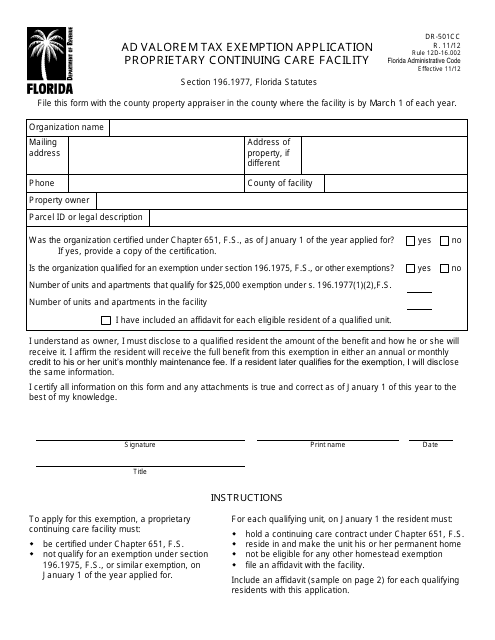

Contractors exempt purchase certificate for a renovation contract with a direct payment permit holder. This exemption certificate is used to claim exemption or exception on a single purchase. These services are found in krs 139200 g q and include landscaping services janitorial services small animal veterinary services pet care services industrial laundry services non coin. Sales and use tax exemption for purchases made under the buy connecticut provision.

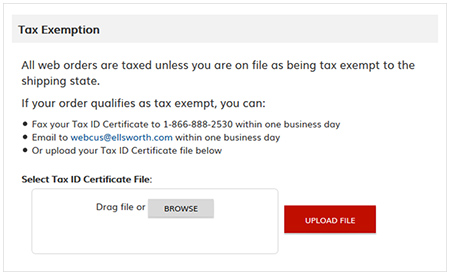

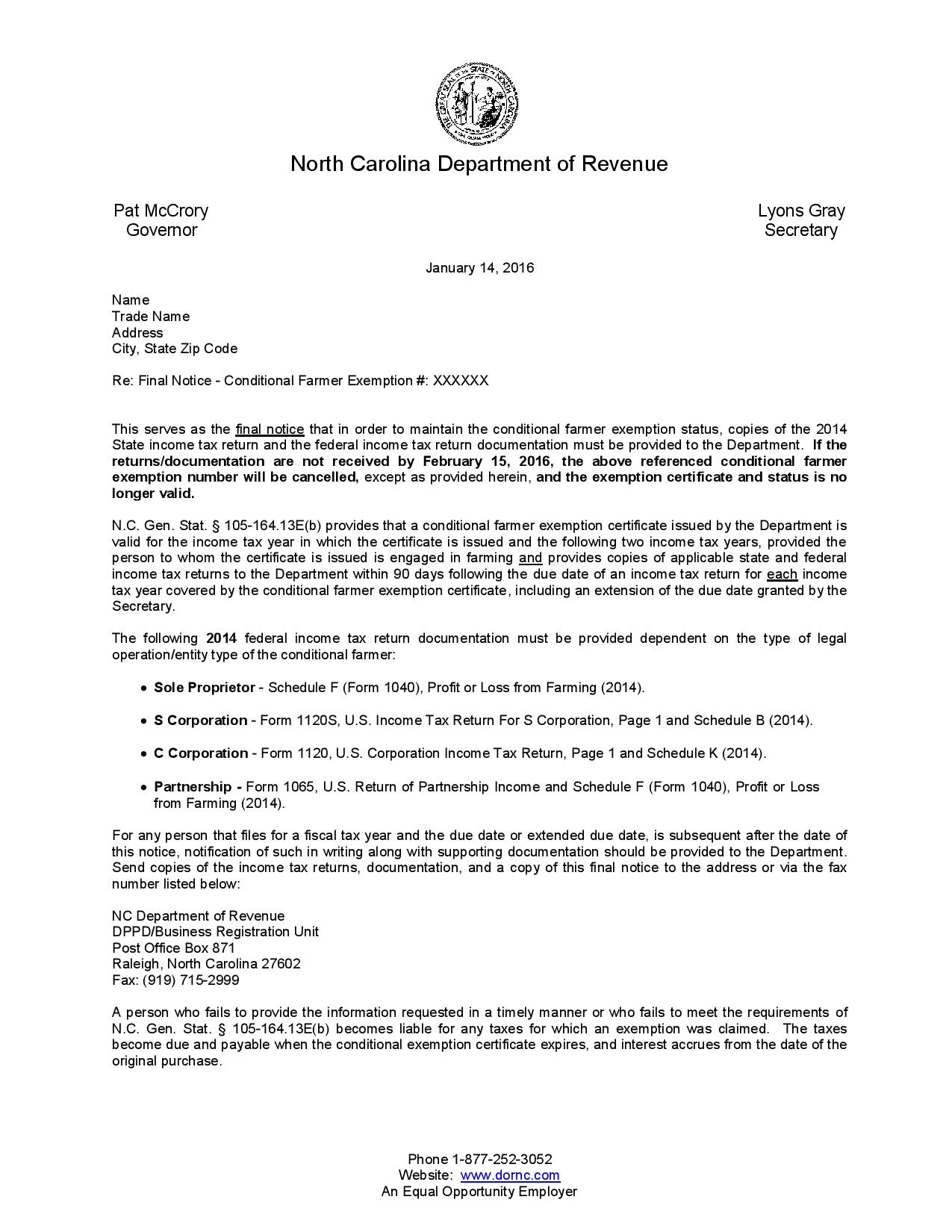

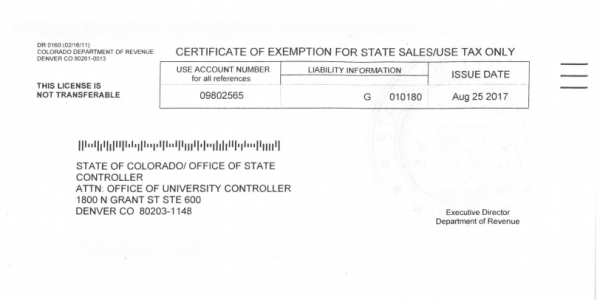

File a completed application for a consumers certificate of exemption form dr 5 with the department. Acquiring tax exempt status for a nonprofit. A sales tax certificate may also be called a resellers certificate resellers license or a tax exempt certificate depending on your state. This includes most tangible personal property and some services.

A sales tax certificate is for exemption from sales tax paid not sales taxes you collect from customers. Resale certificates for items purchased at retail that will be resold. For more information please refer to the form 1023 product page. To get these savings on sales taxes you must apply to your state for a sales tax certificate.

Once you have followed the steps outlined on this page you will need to determine what type of tax exempt status you want. A purchaser must give the seller the properly completed certificate within 90 days of the time the sale is made but preferably at the time of the sale. Due to recent legislative changes the department of revenue dor has updated the resale certificate form 51a105 to include the services that are now exempt for resale effective july 1 2019. Benefits of tax exempt.

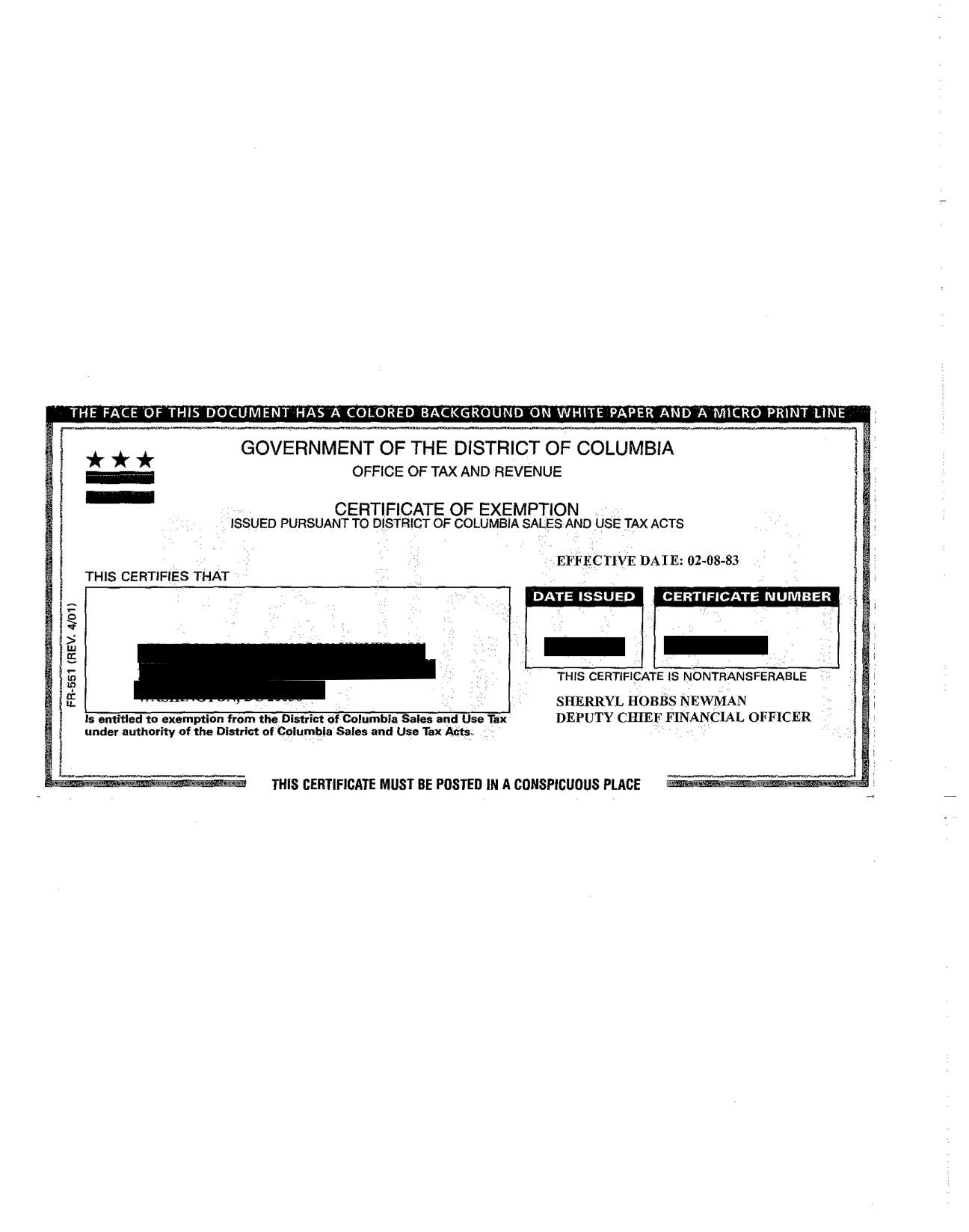

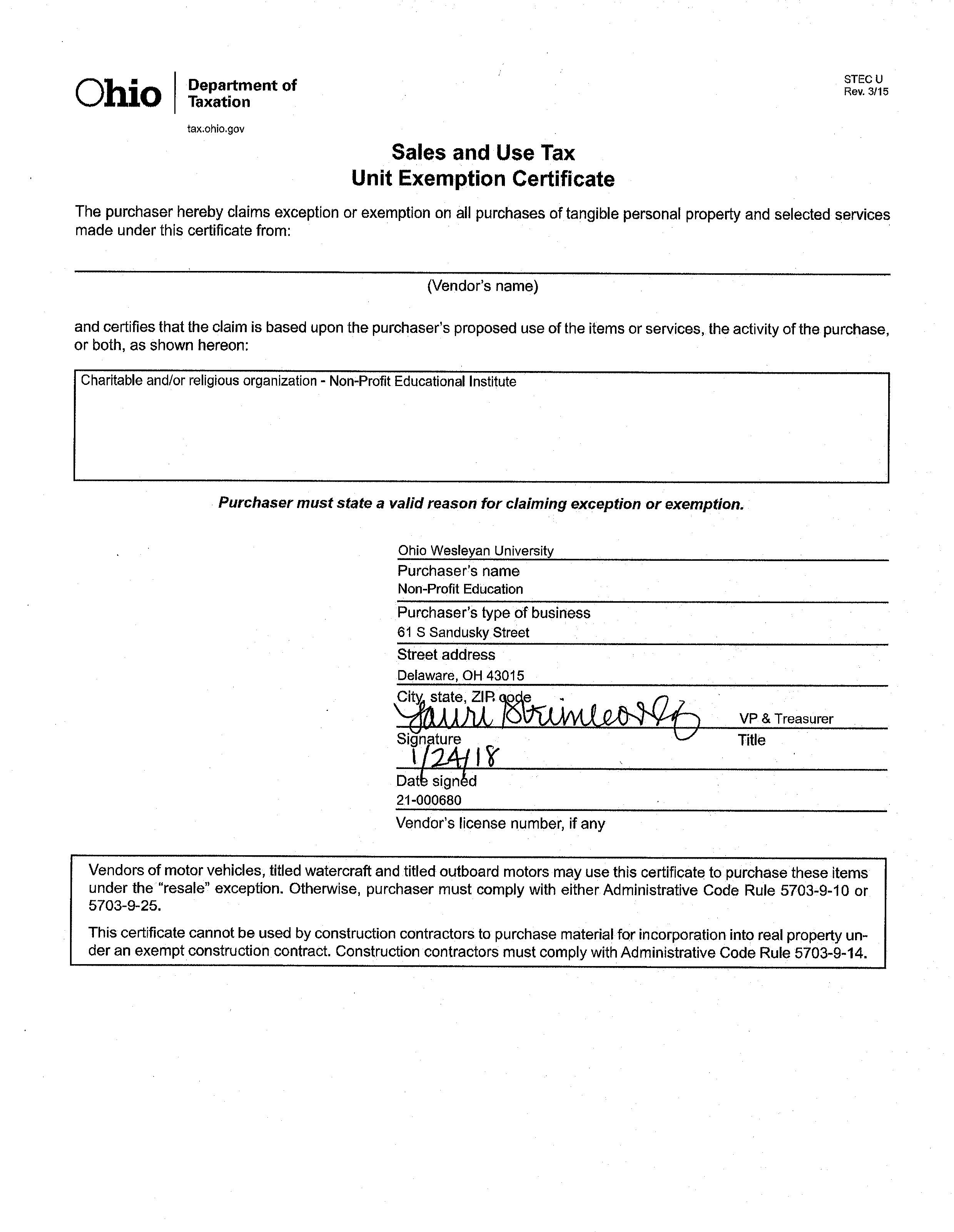

For more information on the proper use of exemption certificates in specific situations see rules 5703 9 03 5703 9 10 5703 9 14 and 5703 9 25 of the ohio administrative code. Sales and use tax exemption for purchases by qualifying governmental agencies. When a nonprofit is formed it does not automatically have tax exempt. As of january 31 the irs requires that form 1023 applications for recognition of exemption be submitted electronically online at wwwpaygov.

Box or route number phone. Area code and number city state zip code.