How To Find Depreciation Expense

Lets discuss each one of them.

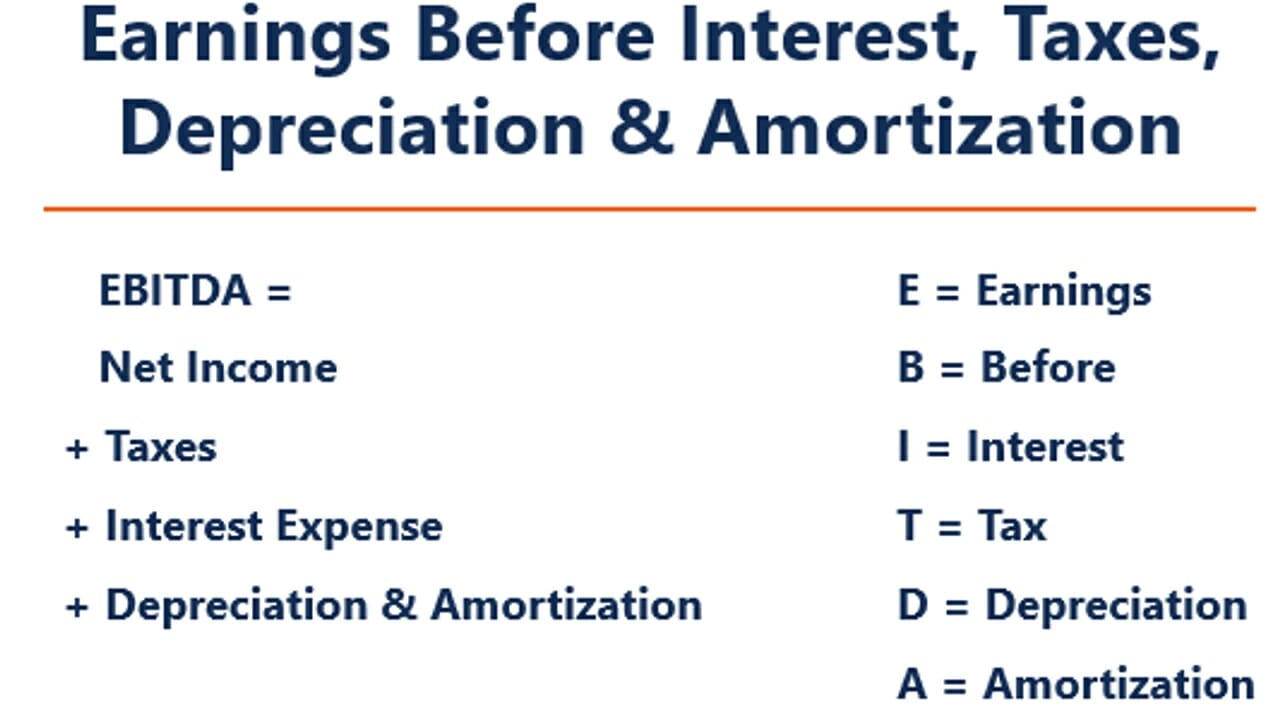

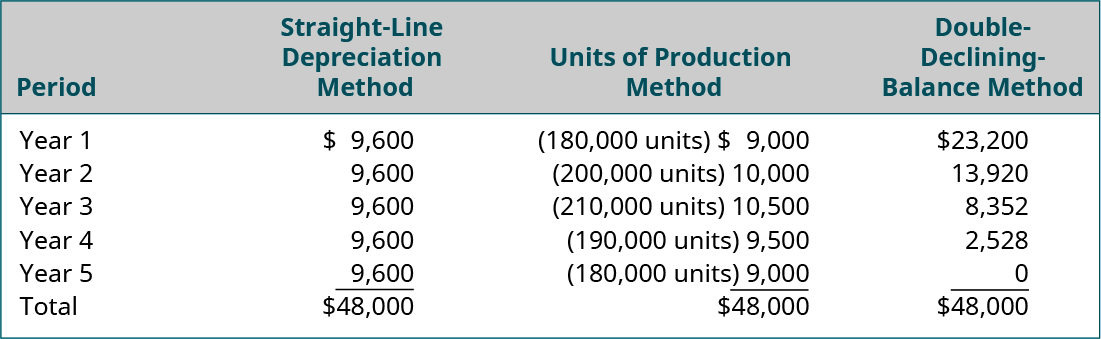

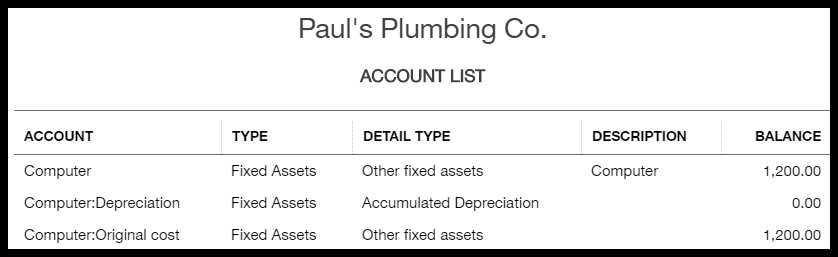

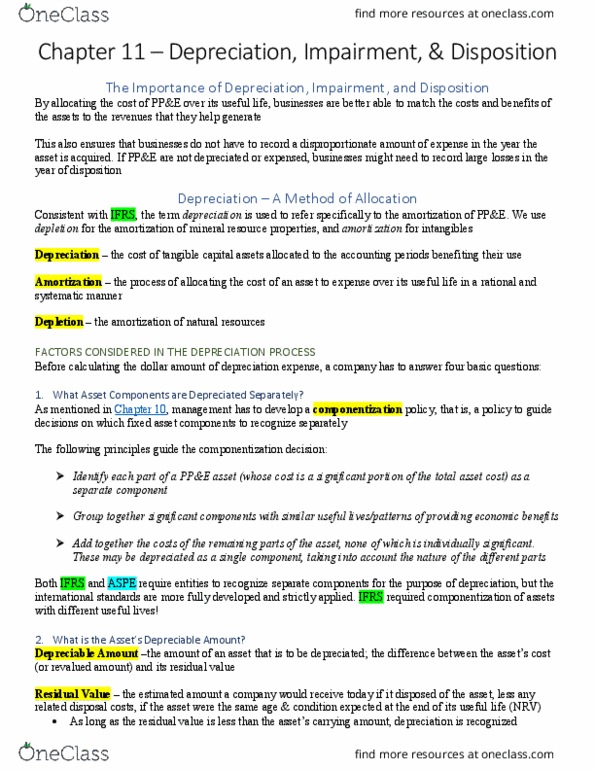

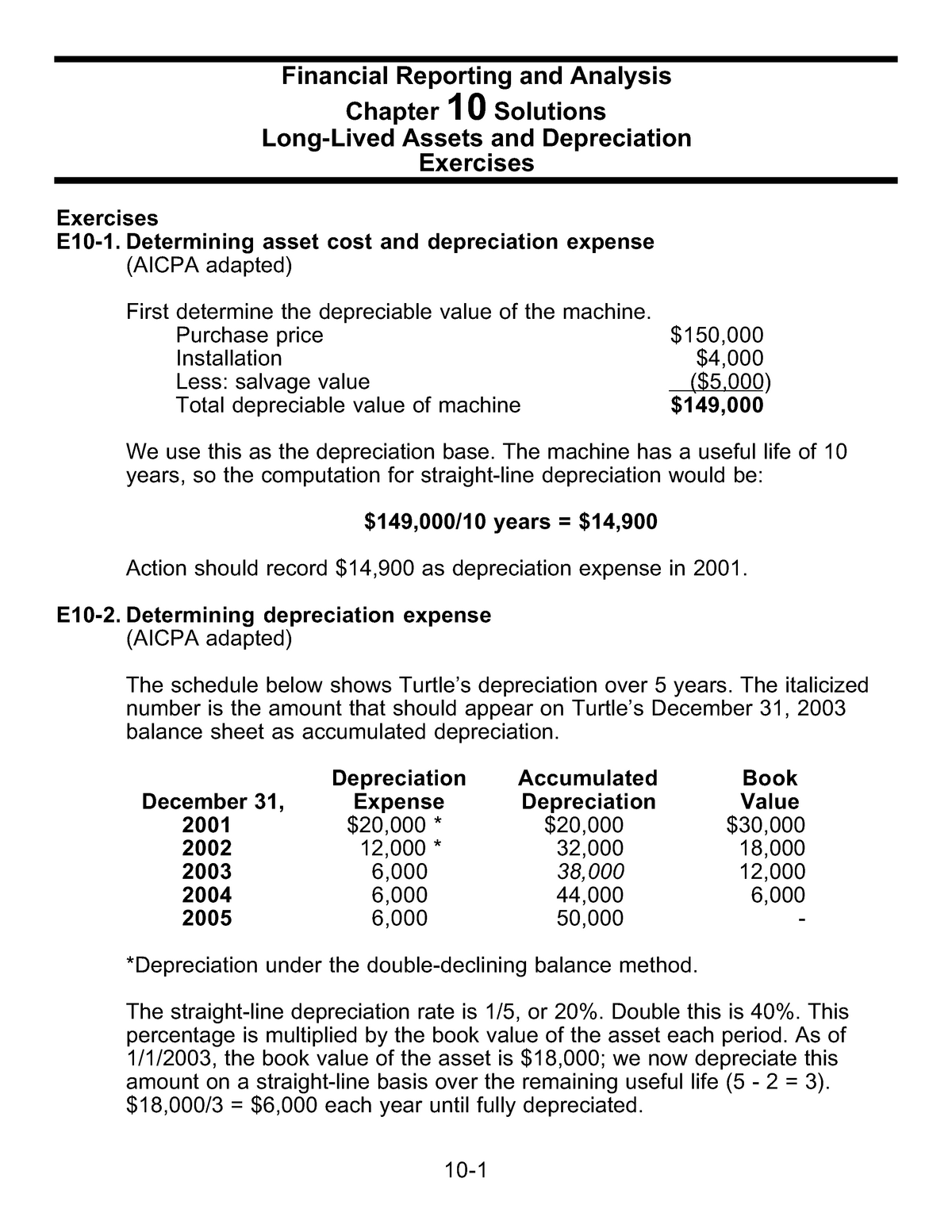

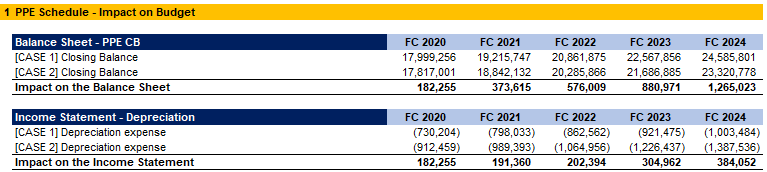

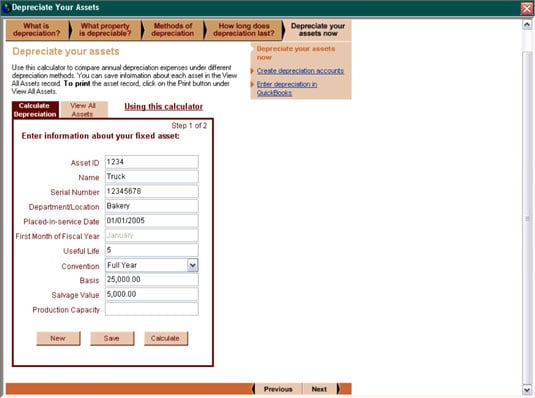

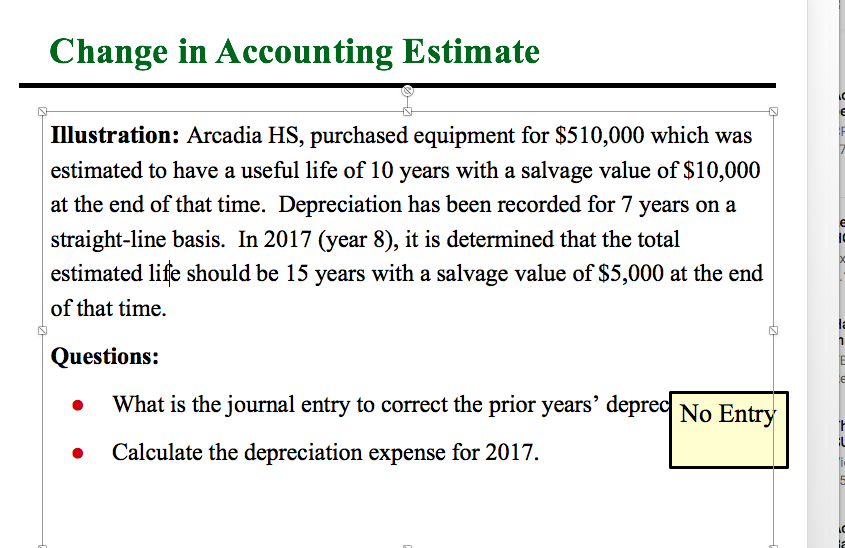

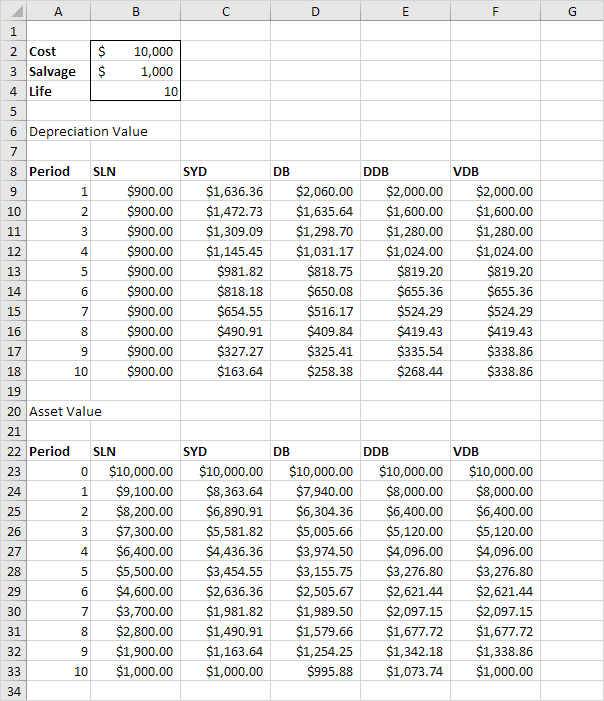

How to find depreciation expense. This would give you a 7273 annual depreciation expense. What if a business plans to use an asset for a few years and then sell it before it becomes entirely. Different kinds of property can be depreciated for a certain number of years. This calculation gives investors a more accurate representation of the companys earning power.

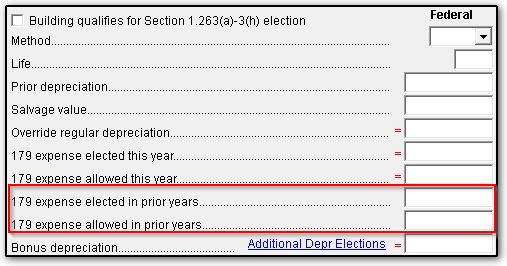

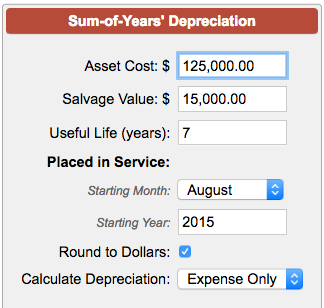

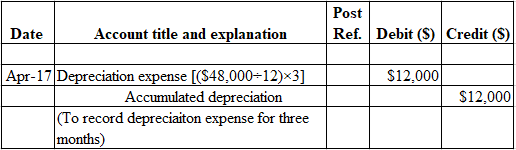

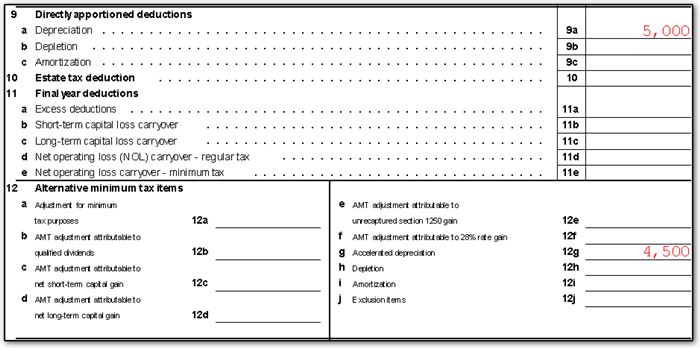

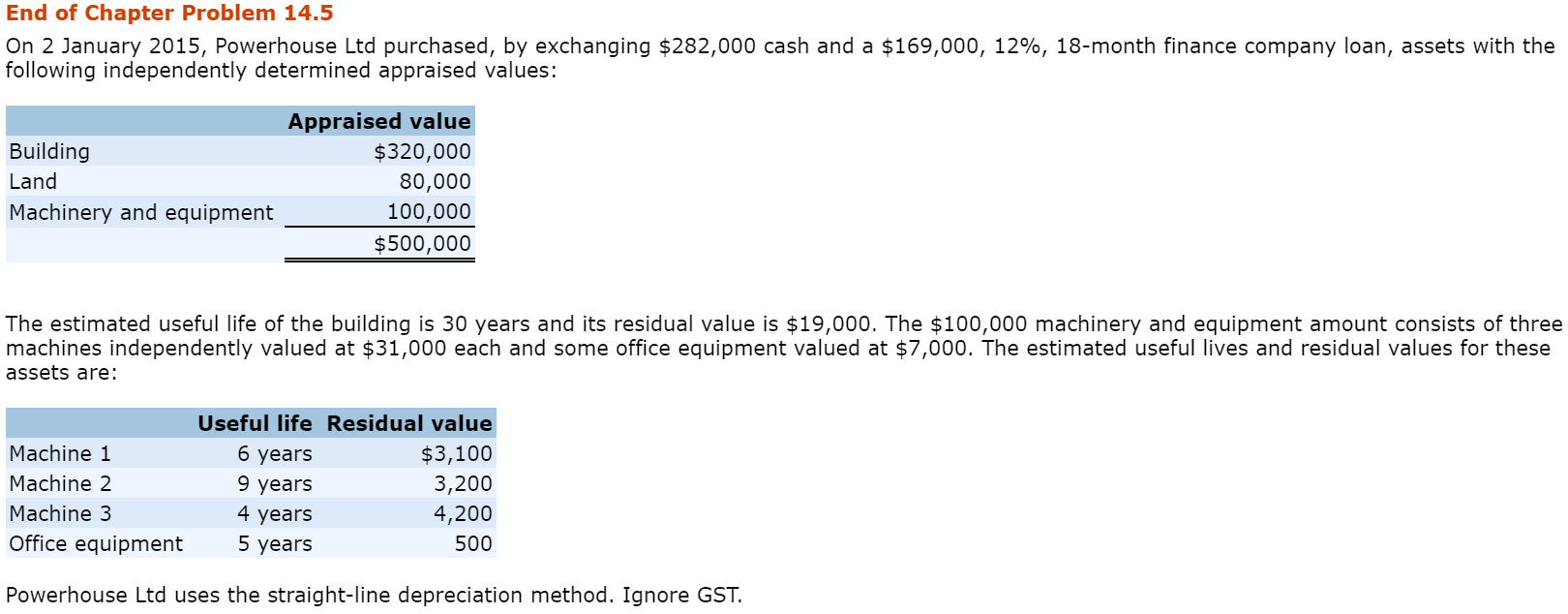

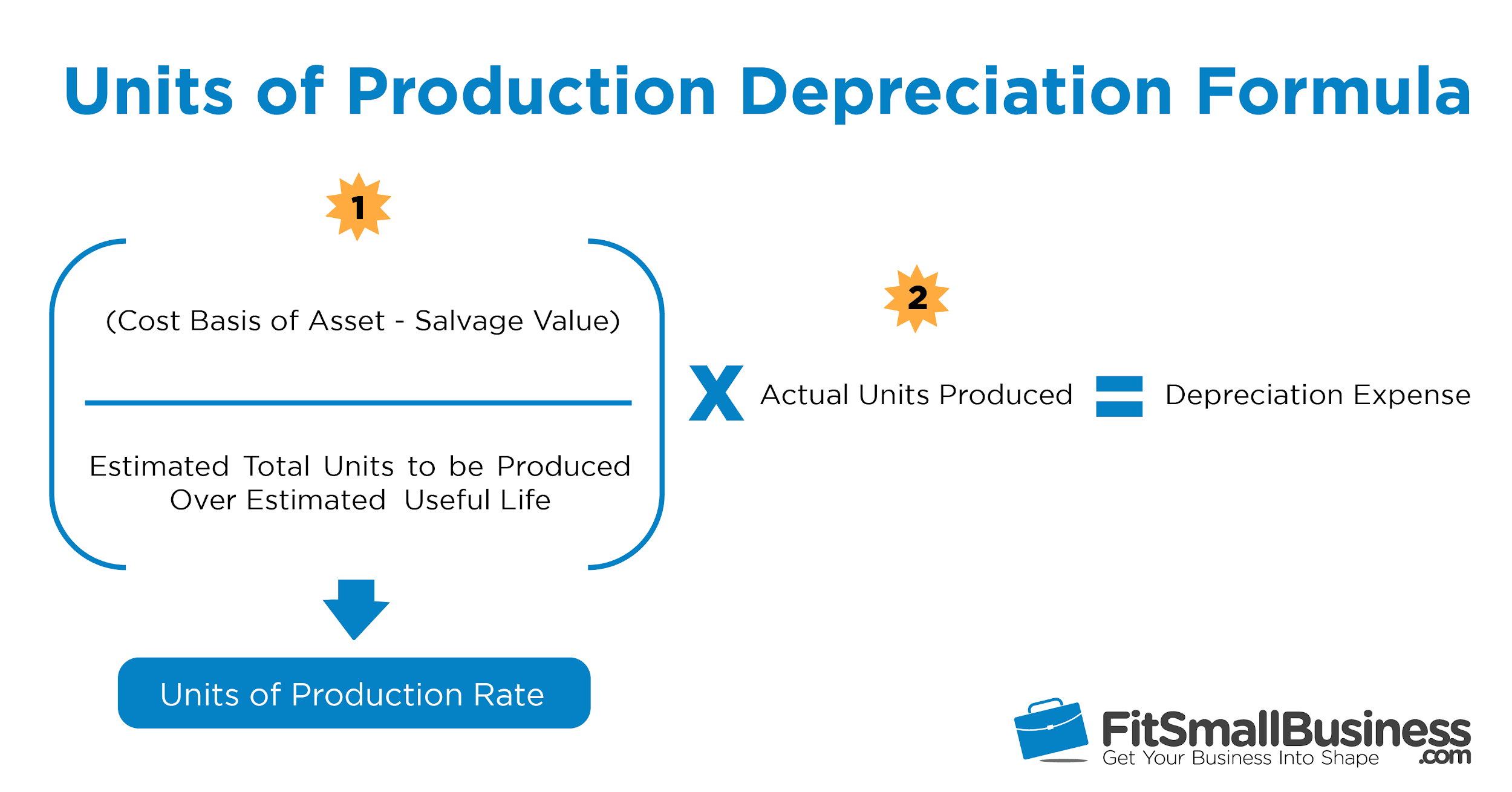

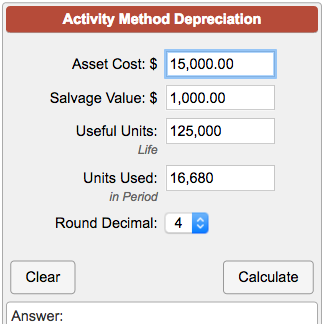

Determine depreciation per unit like this. The yearly depreciation expense using straight line depreciation would be 22500 per year. This will be the. Take a depreciation deduction on your tax return by attaching form 4562 depreciation and amortization to your tax return.

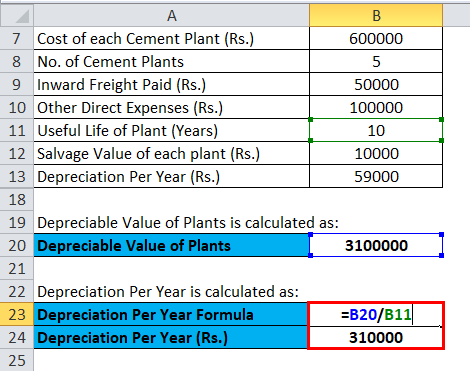

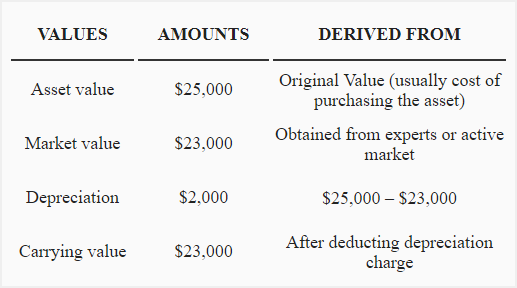

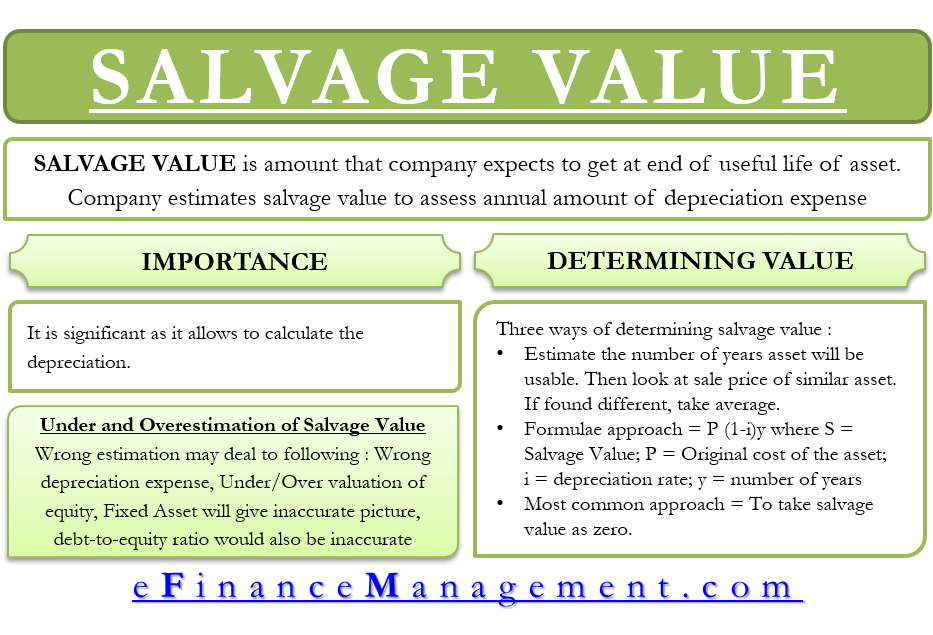

Determine the cost of the asset. 800 x 515 800 x 3333 percent 26667. To find out how long you can depreciate assets review the irss publication 946 how to depreciate property. The most basic form of depreciation is known as straight line depreciation.

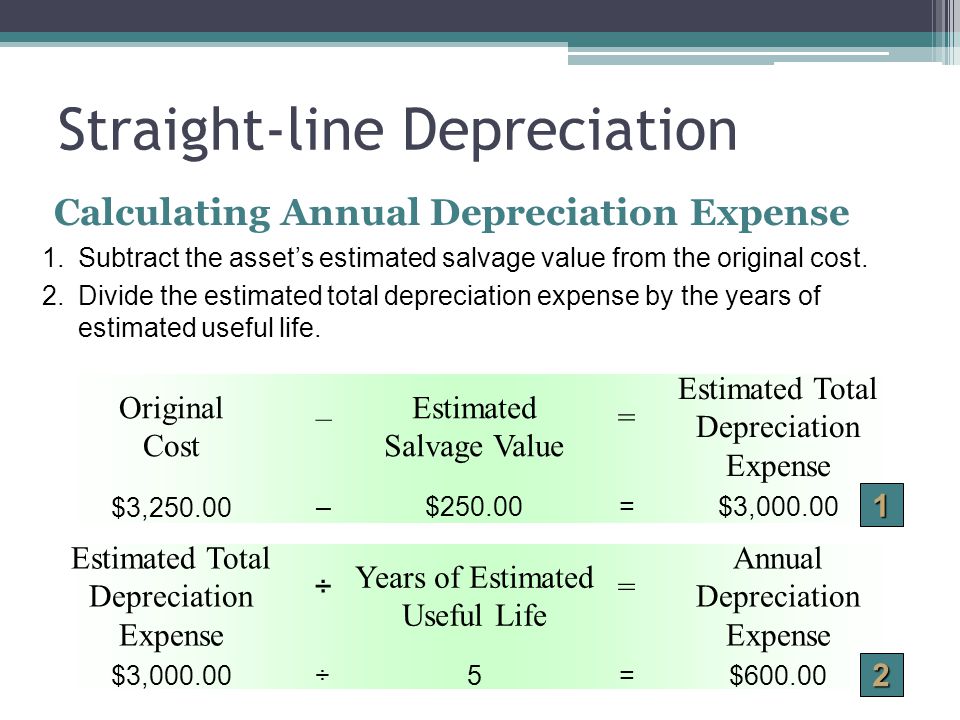

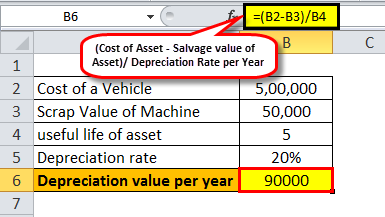

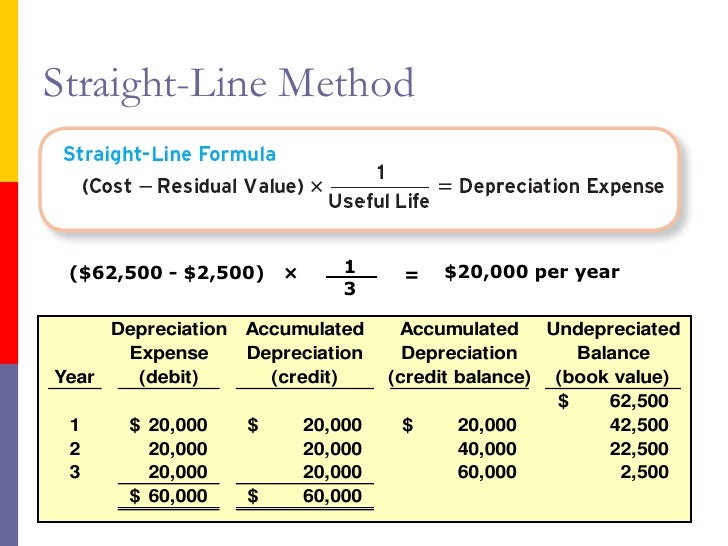

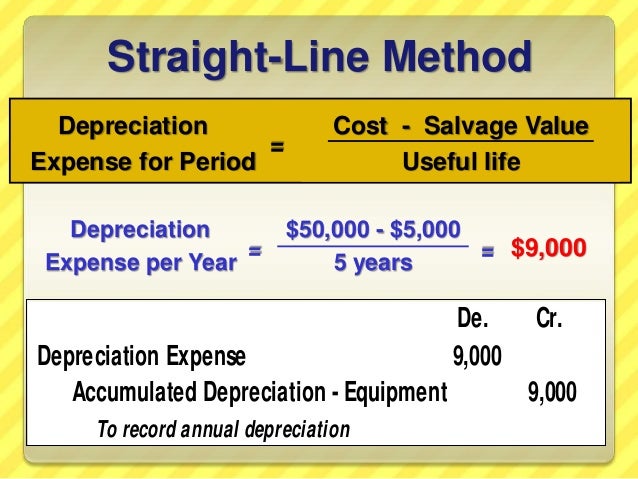

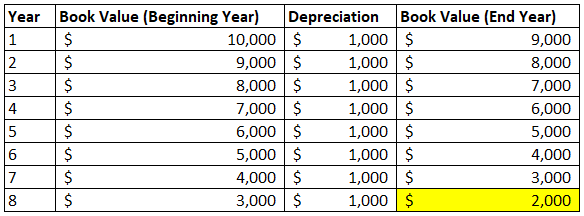

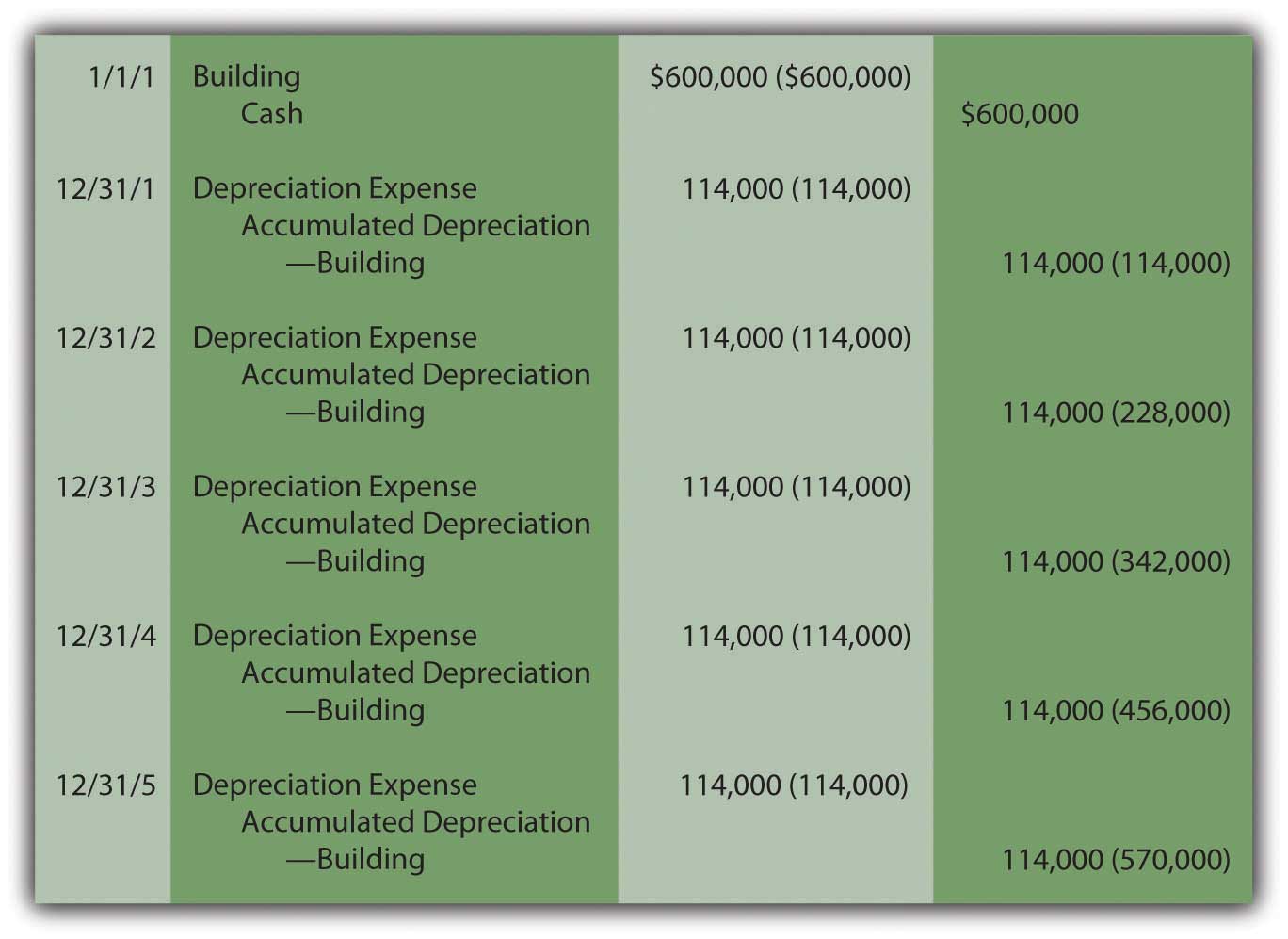

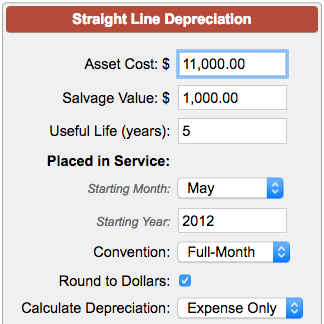

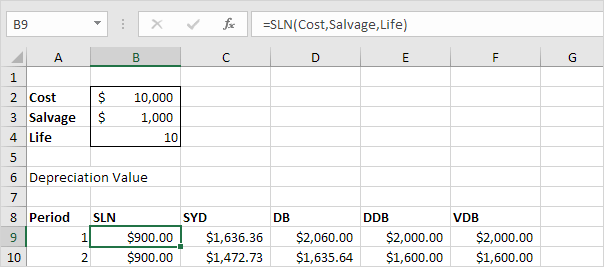

Straight line depreciation method cost of an asset residual valueuseful life of an asset. Each year 22500 is added to the accumulated depreciation account. Calculate it as follows. Youll use the sum you derived above to reach this value.

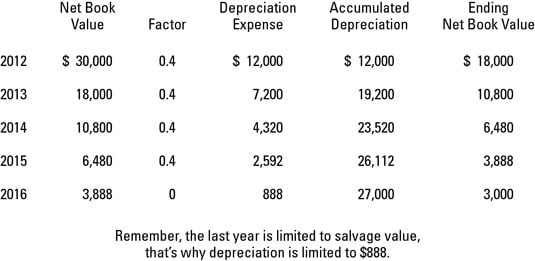

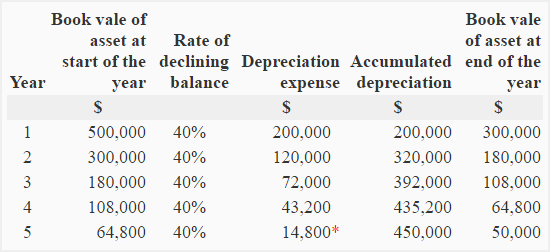

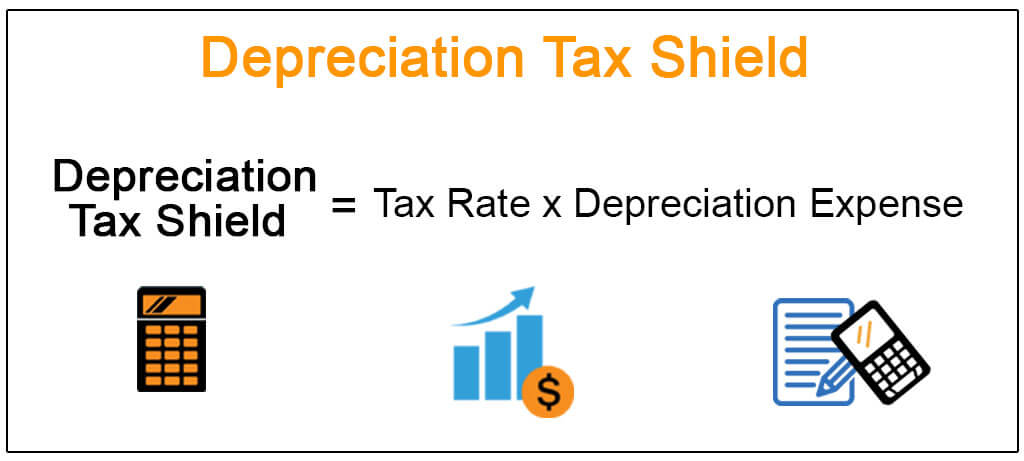

Figure the total depreciation of the units actually produced. Find the depreciation expense by multiplying the depreciable cost in the first year by the depreciation rate. Instead of realizing a large one time expense for that year the company subtracts 1500 depreciation each year for the next five years and reports annual earnings of 8500 10000 profit minus 1500. After two years it would reduce your cost basis to 185454.

Diminishing balance method cost of an asset rate of depreciation100. At the end of year five the. But this approach also presents a dilemma. Per unit depreciation asset cost residual value useful life.

There are primarily 4 different formulas to calculate the depreciation amount. After one year of ownership this would reduce your cost basis to 192727. Gain or loss on sale. Completing the calculation the purchase price subtract the residual value is 10500 divided by seven years of useful life gives us an annual depreciation expense of 1500.

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)