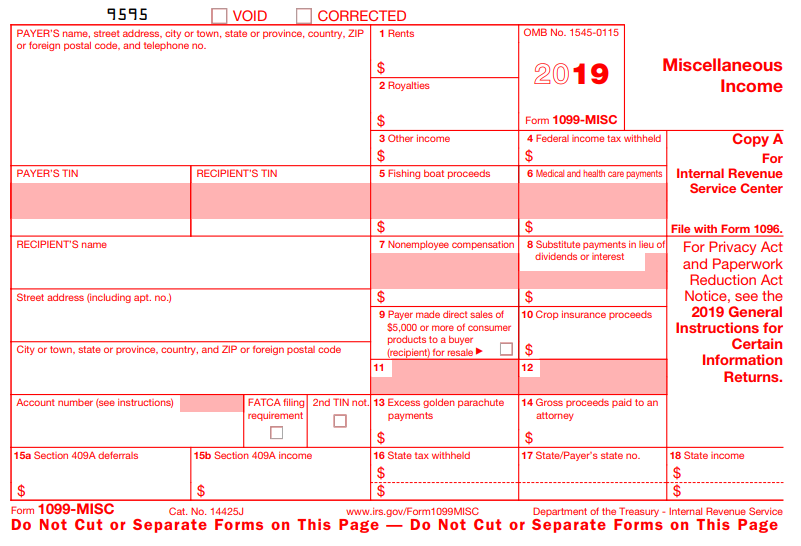

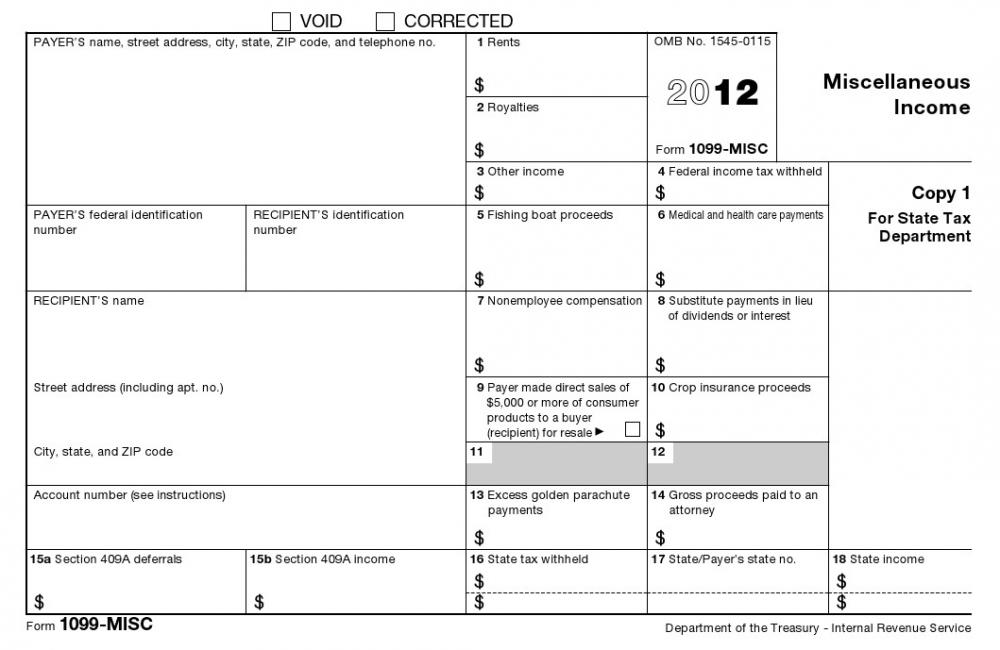

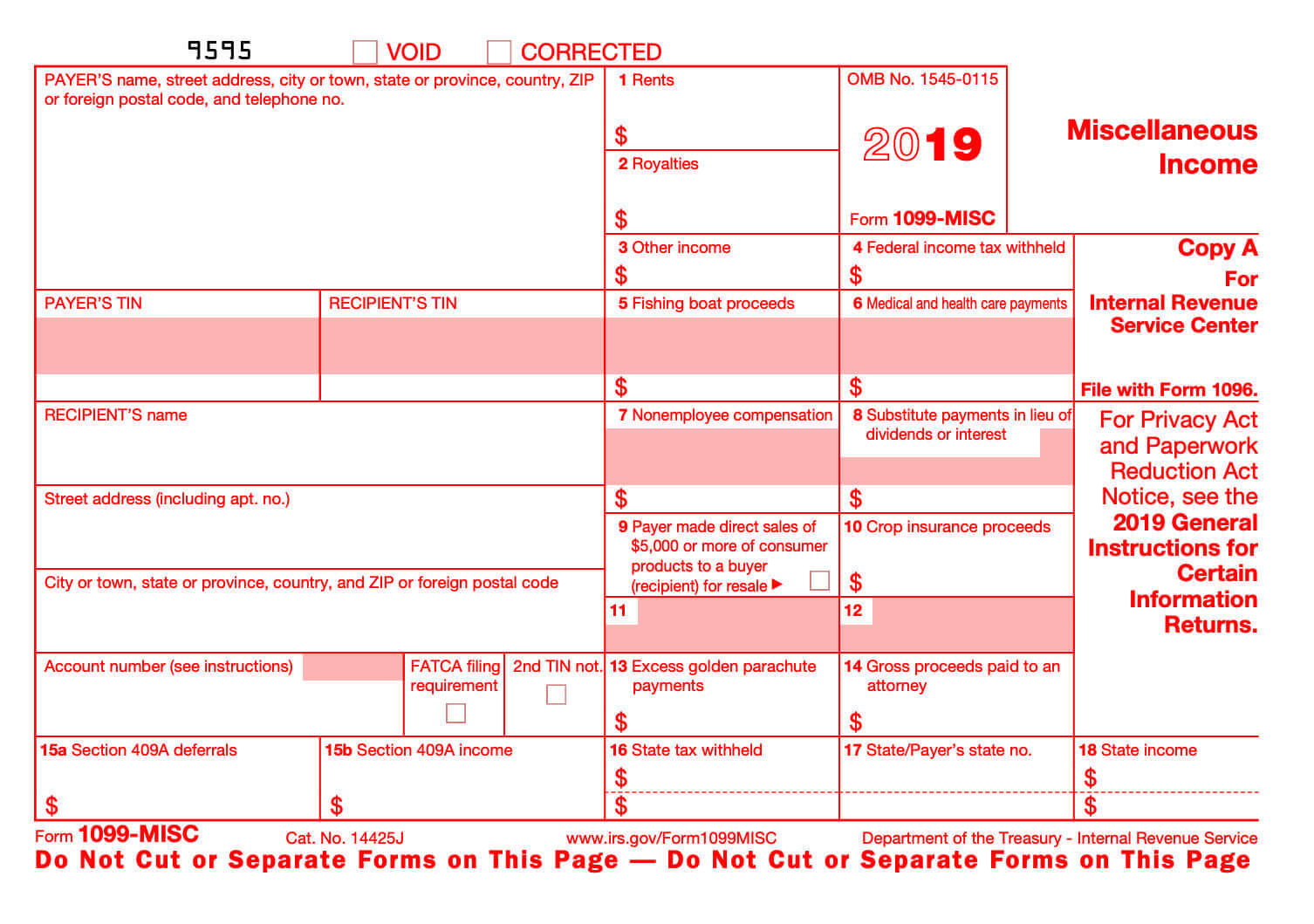

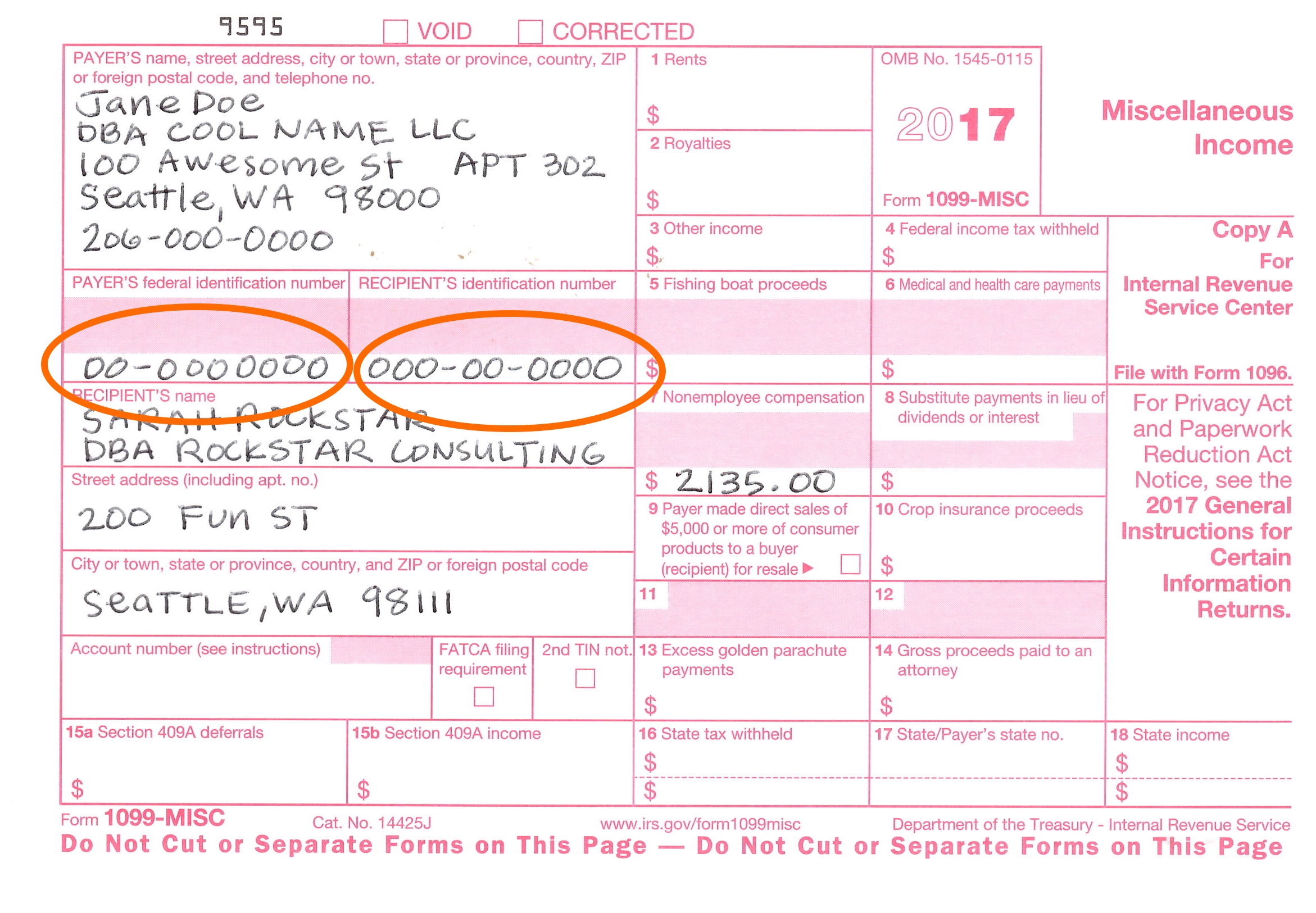

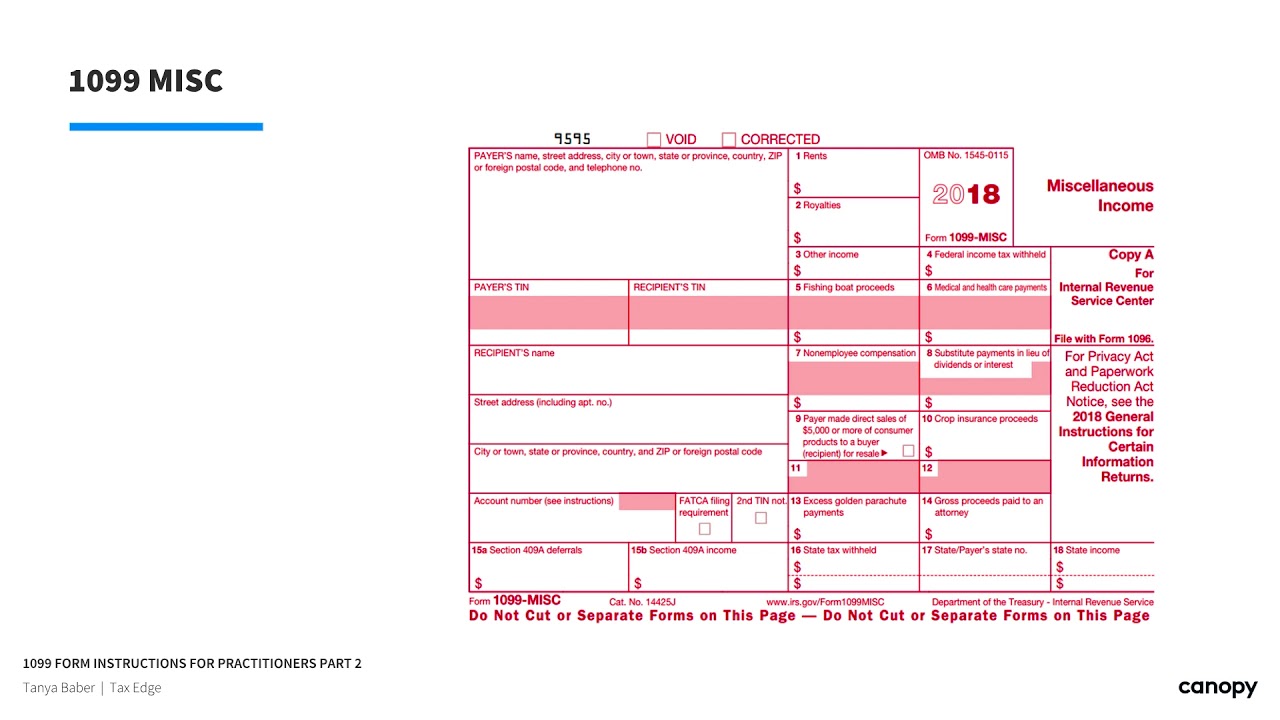

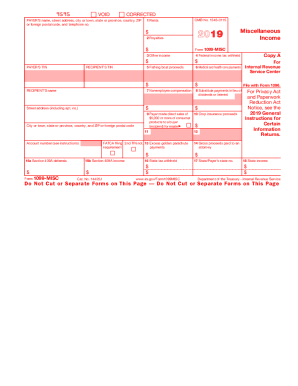

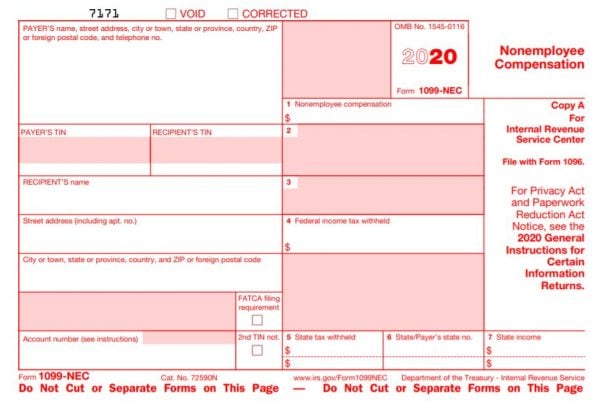

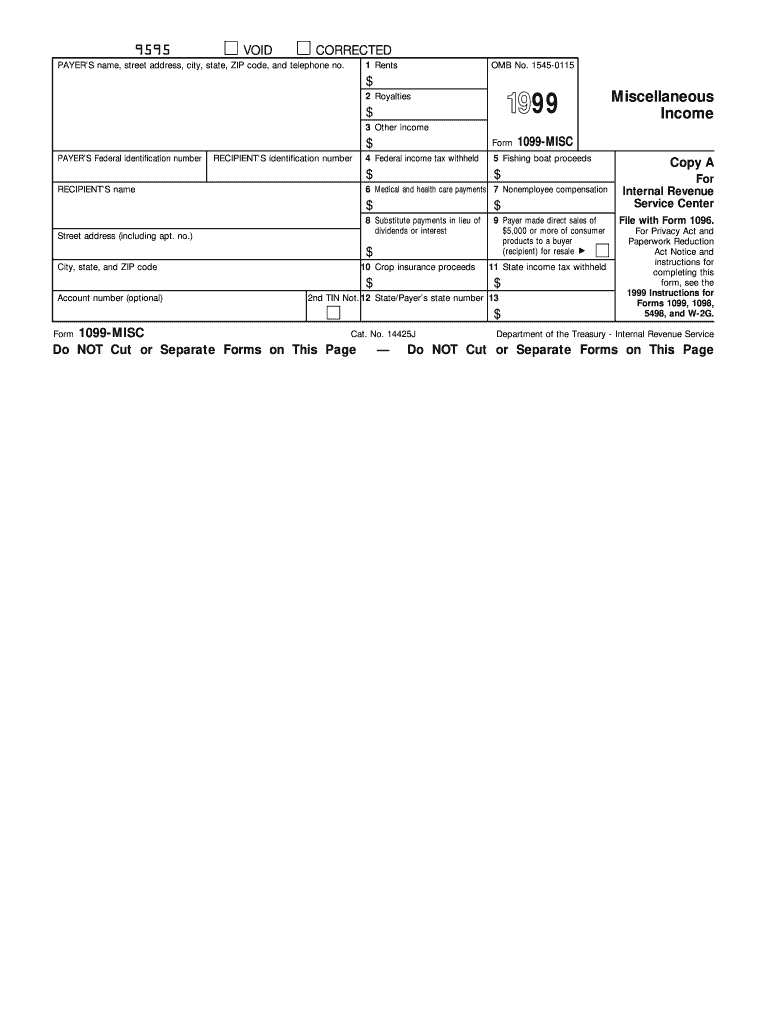

How To Fill Out 1099 Misc

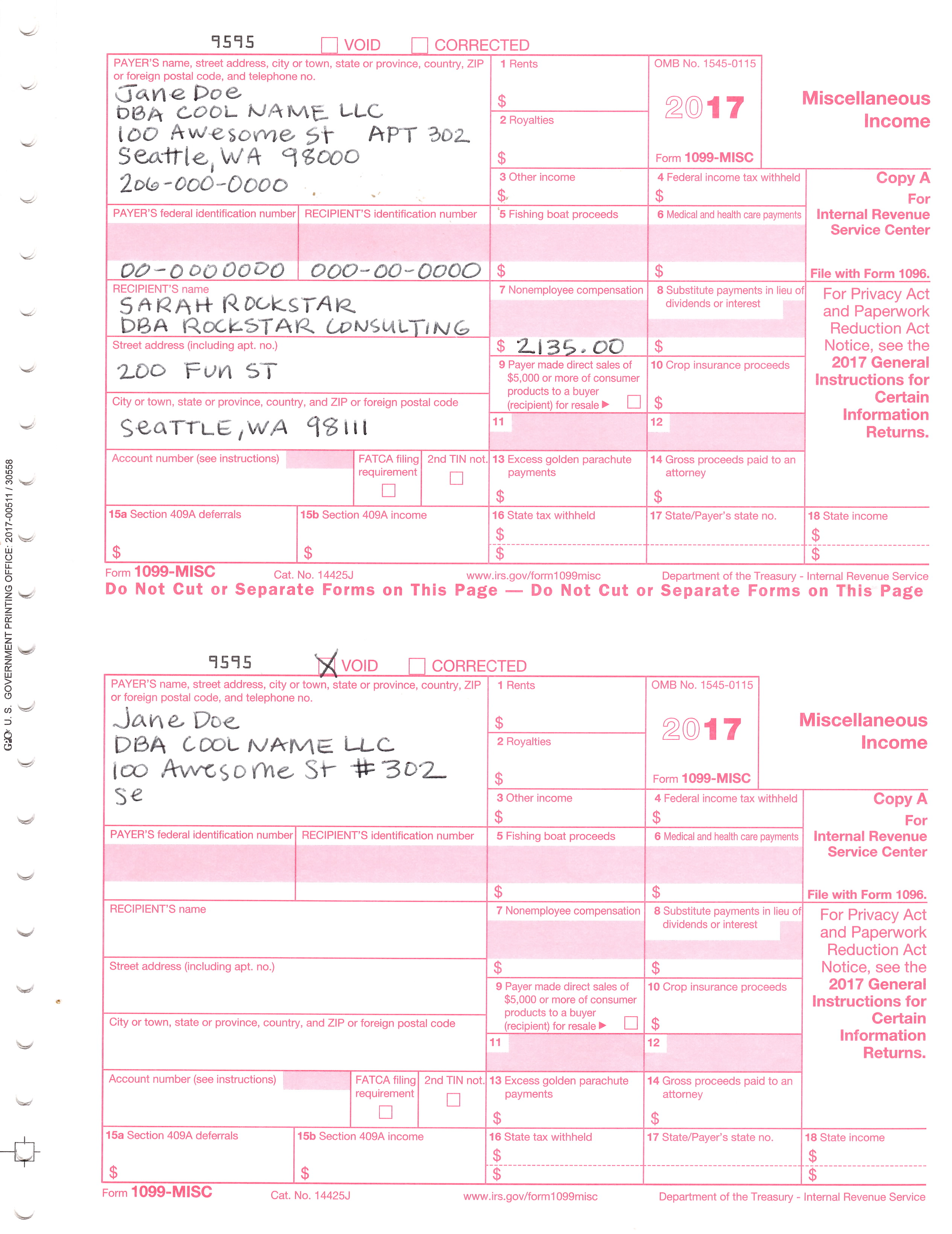

Fill in form 1099 misc 2017.

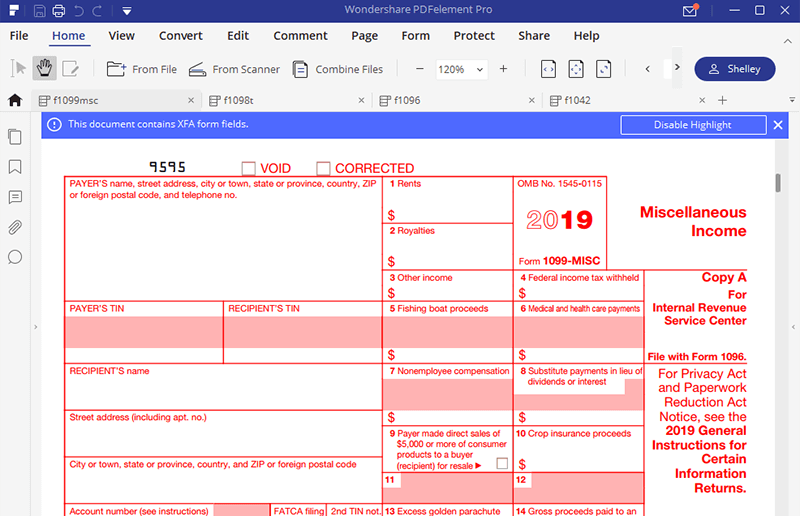

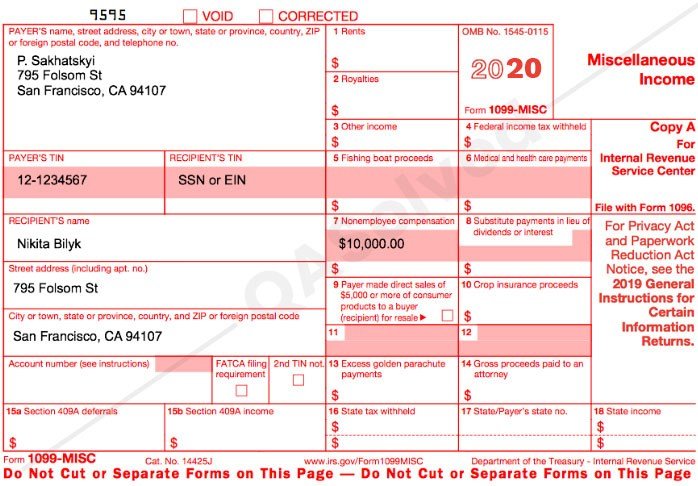

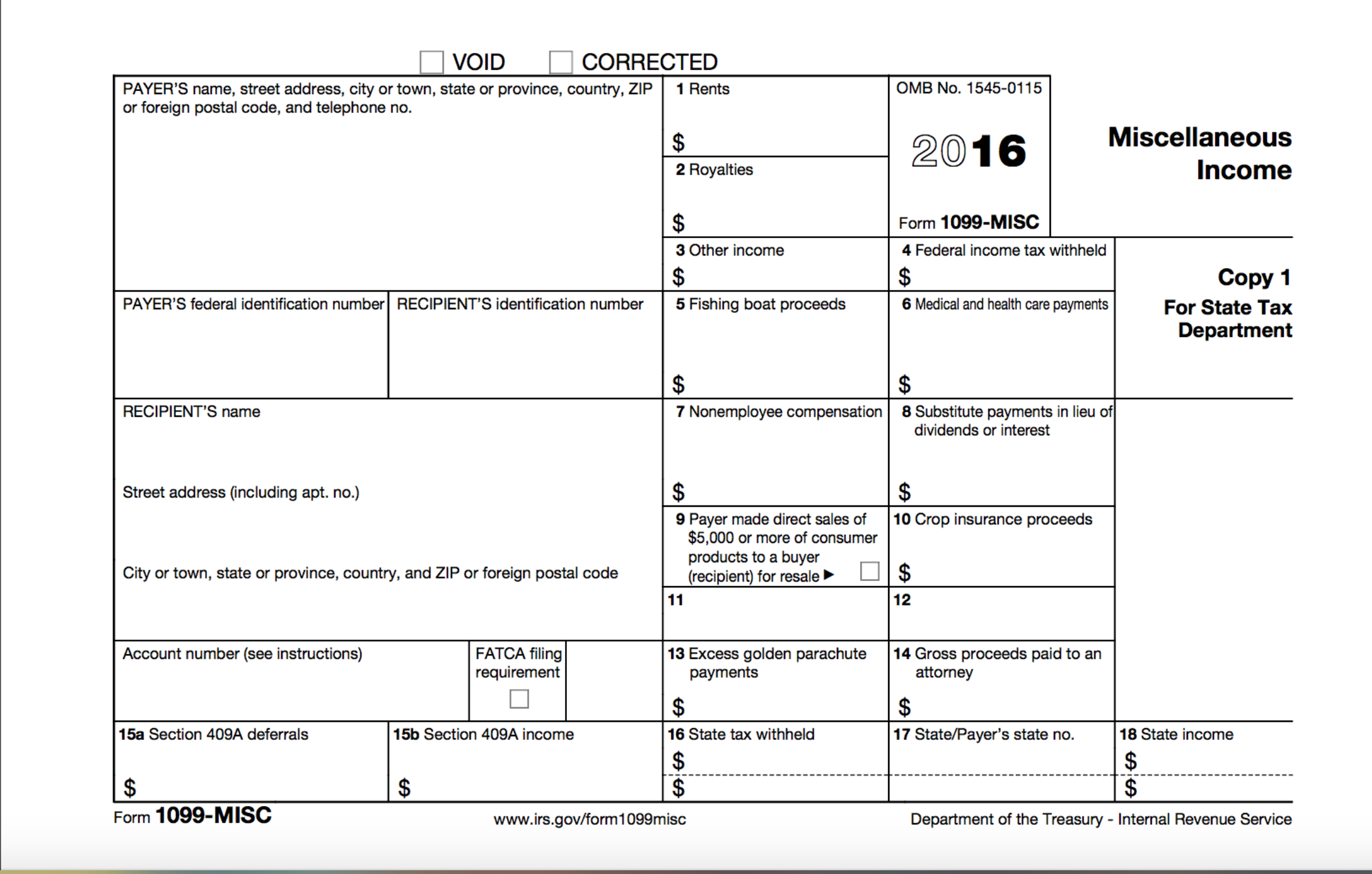

How to fill out 1099 misc. You fill out a w 2 form if the person in question is your employee. I noticed in quicken summary that i used the owners name on some checks and their company name on others. The right hand side is slightly more complicated because you need to break out payments into the correct category. The short answer is yes.

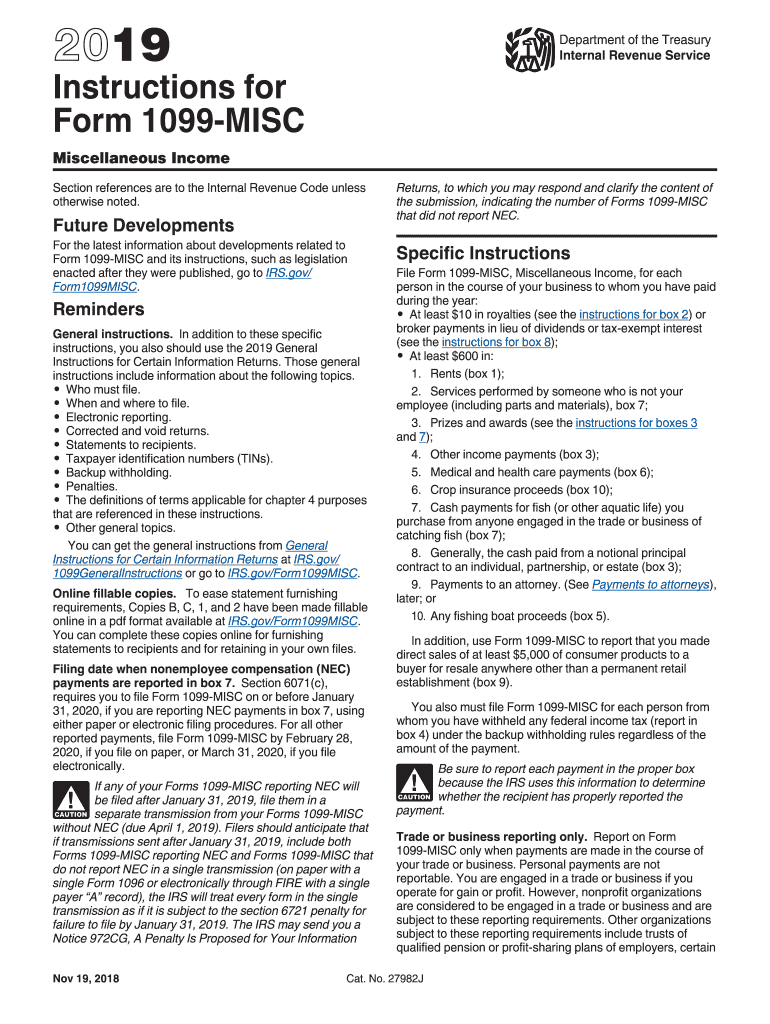

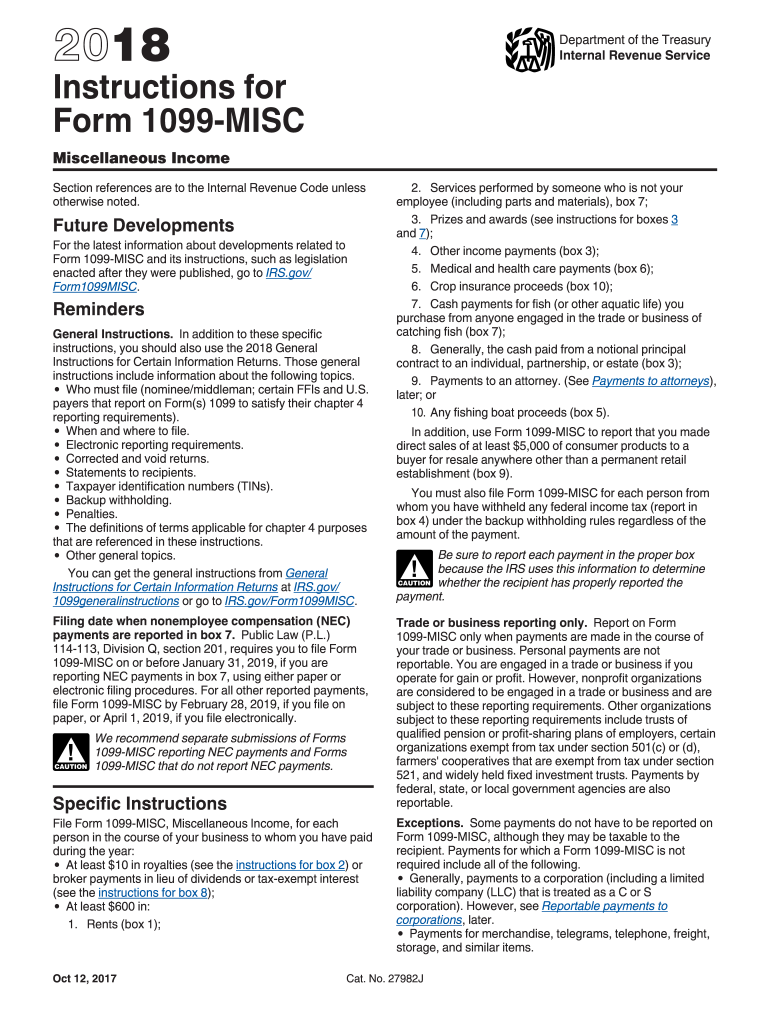

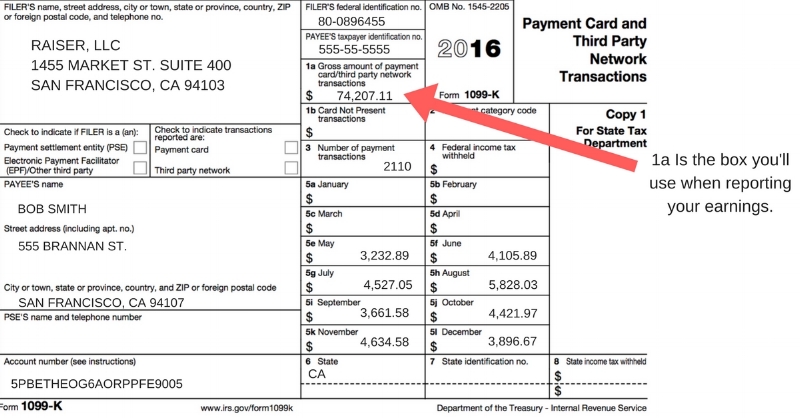

Once tax information has been checked the taxpayer will receive a second email confirmation. According to the instructions for form 1099 misc payments of rent to real estate agents are exempt but the real estate agent must use form 1099 misc. Form 1099 misc consists of various financial information and you must take utmost care while filling out such important information. You should have collected this information during the year so it should be fairly easy to fill out.

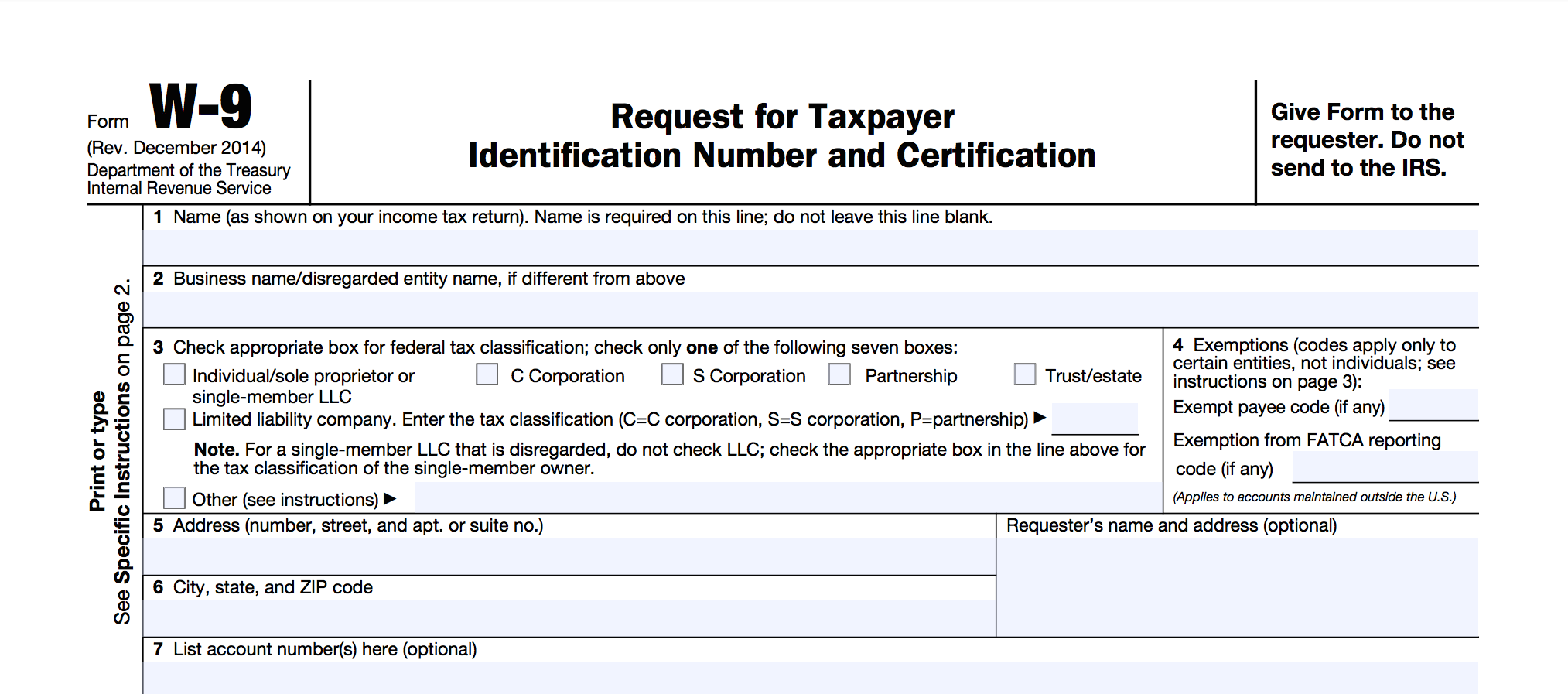

If some cause taxpayer tax information is not validated the irs will send an email asking the taxpayer to revisit any errors. You cant fill out and issue forms 1099 misc to your vendors and independent contractors unless you first obtain a completed form w 9 from each of them. 1099 miscellaneous form businesses will usually use and are provided to contractors or other non employees. The form itself will arrive in your mailbox filled out and it exists to report information that you include in your tax return.

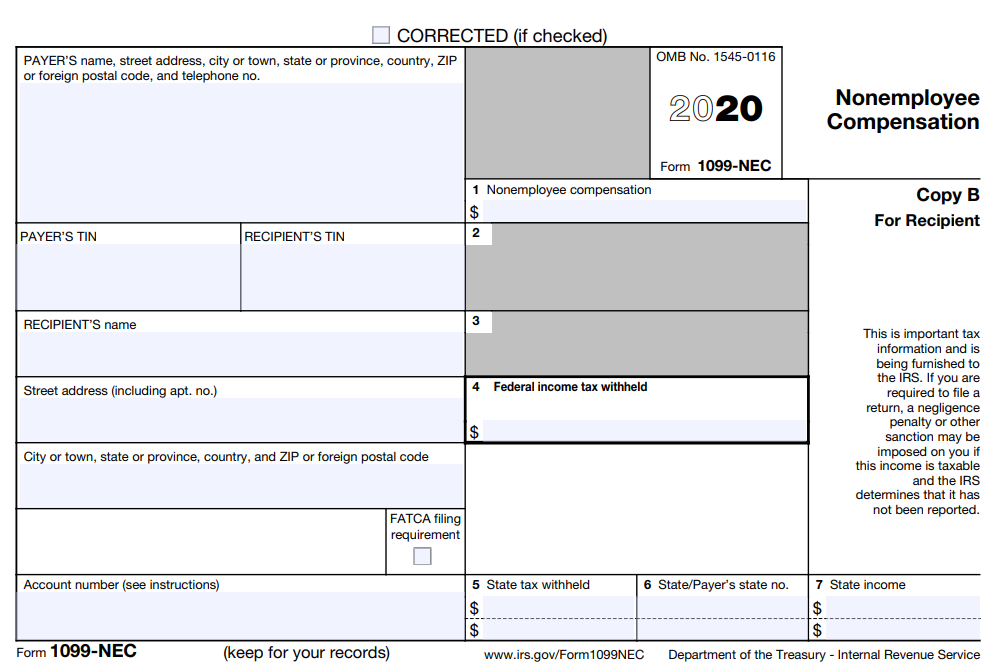

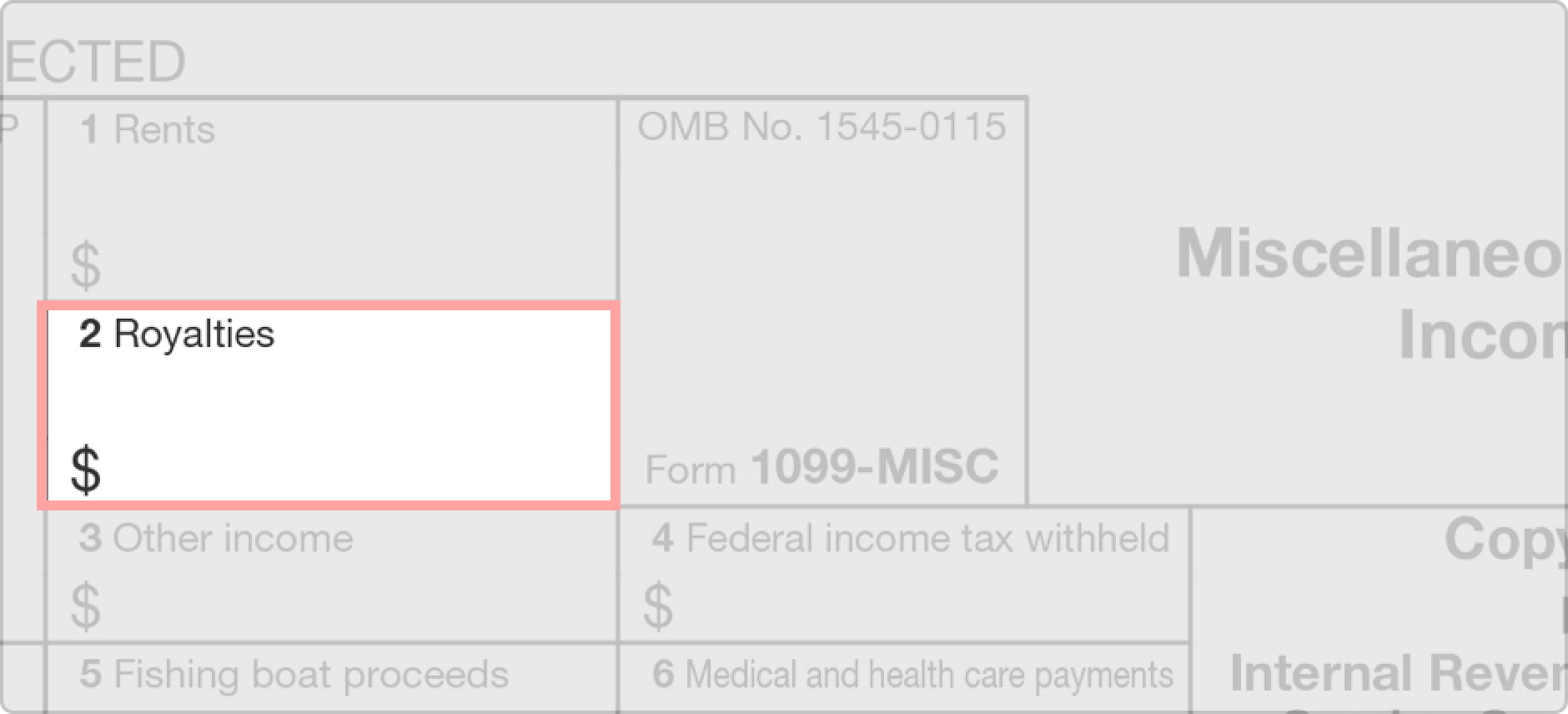

Make sure you enter correct information and numbers in correct fields. Form 1099 misc online. Can i combine the two on the 1099 misc form. Like other 1099 forms or even a w 2 for a salaried worker you dont technically do anything with a 1099 misc.

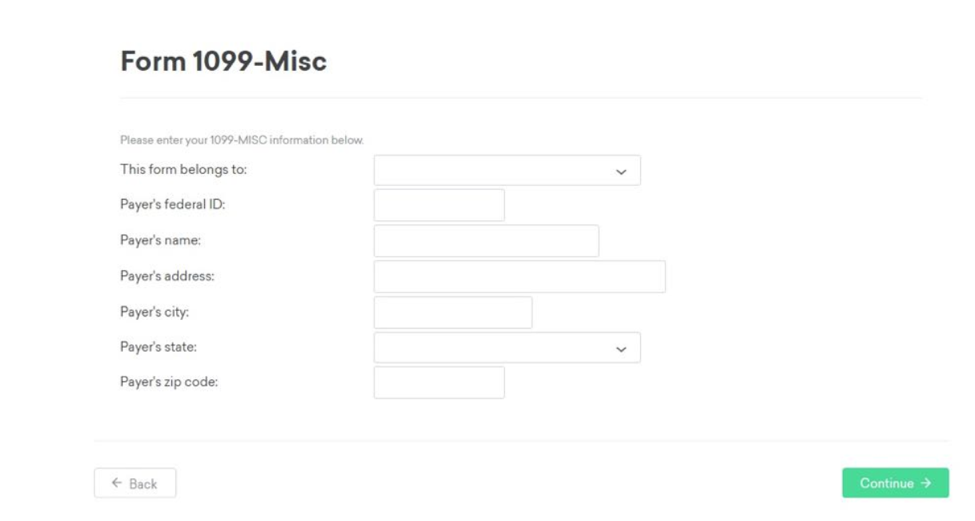

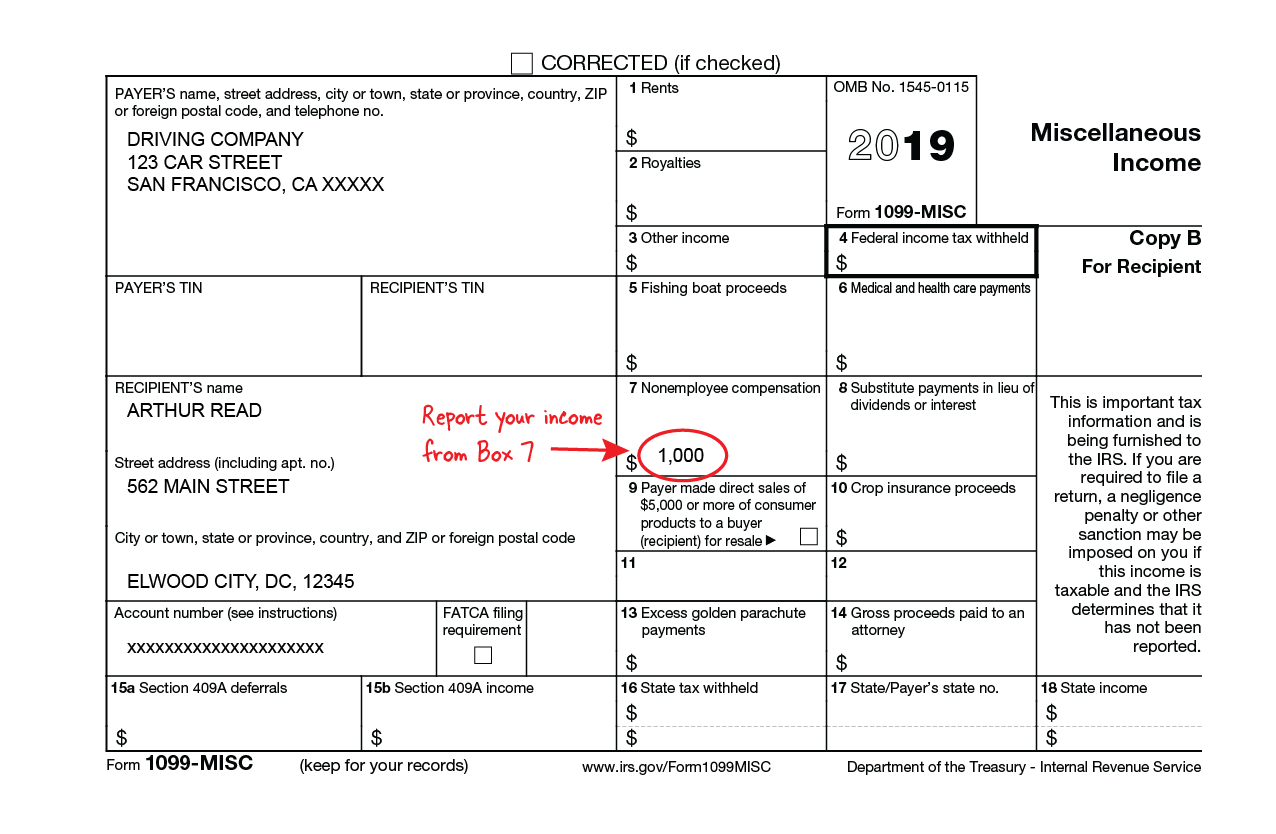

If the person your contacted person like an independent you fill out an irs form 1099. On the website hosting the document press start now and pass towards the editor. Fill out a 1099 misc form online. Again please double check the 1099 recipients identification number and make sure you entered the correct value.

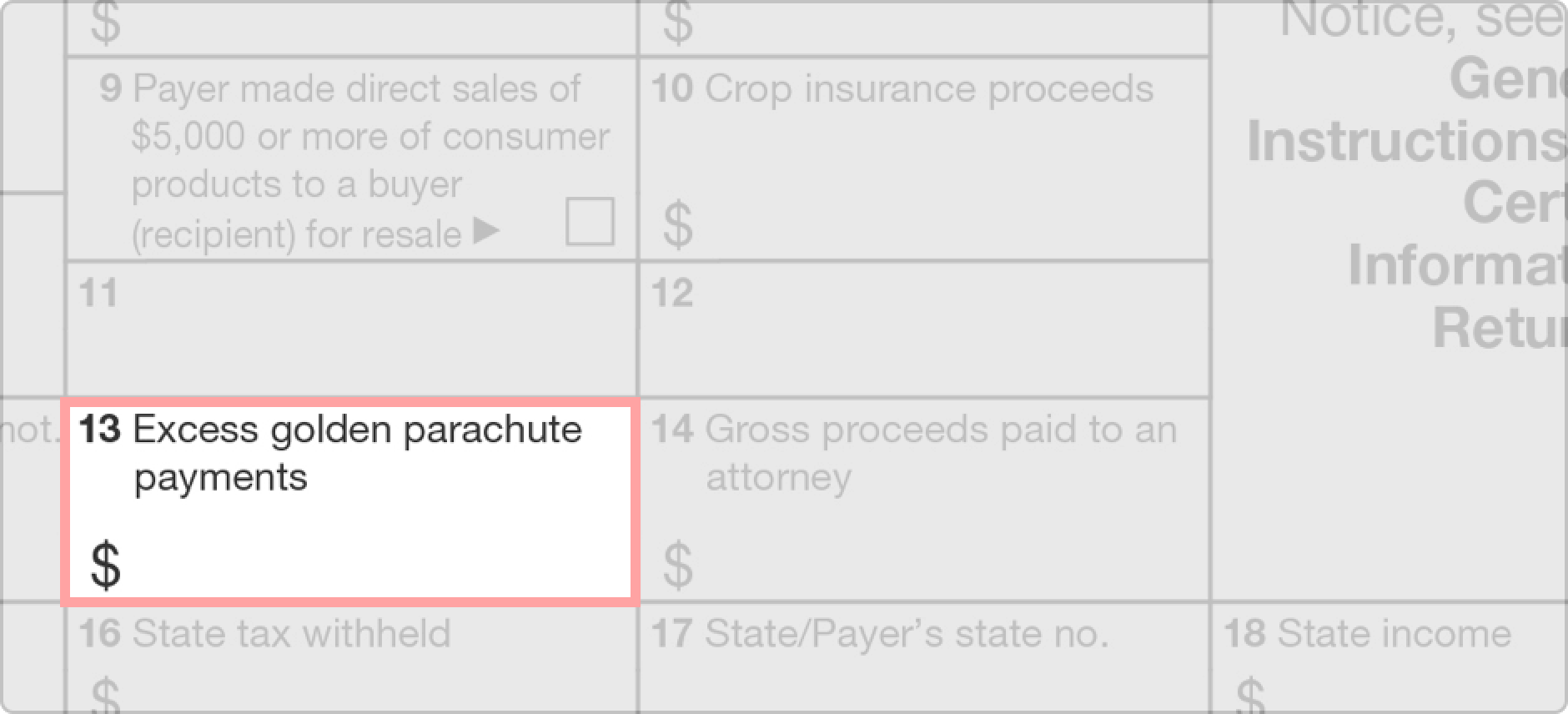

The general backup withholding rules apply to this payment. Try to fill out as much information related to the1099 recipient as you can the software will make sure you fill out the basic required 1099 information. Fill in 1099 misc form free. Use the clues to fill out the pertinent fields.

The end of the year is quickly approaching and a common question at tax time is whether or not residential property managers need to file a 1099 misc for their owners. Instructions to file a irs form 1099 misc box 1 for rents. Irs forms 1099 misc and w 9 go hand in hand. Include your personal information and contact details.

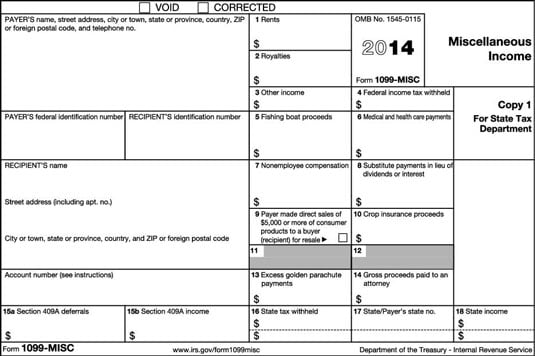

Once youve filled out the forms you must provide each of the listed individuals or entities with a copy of the form or a substitute form with all the same information. Fill in form 1099 misc 2015. You must fill out a separate 1099 form at the beginning of each calendar year for each individual partnership or llc that you paid in the previous year. Can i fill out a 1099 misc form online.

Enter the name and tin of the payment recipient on form 1099 misc. If the recipient is the estate enter the name and employer identification number of the estate. Once you get the 1099 misc form you can then begin the process of putting together your tax return. I am filling out 1099 misc for subcontractors that i hired last year.

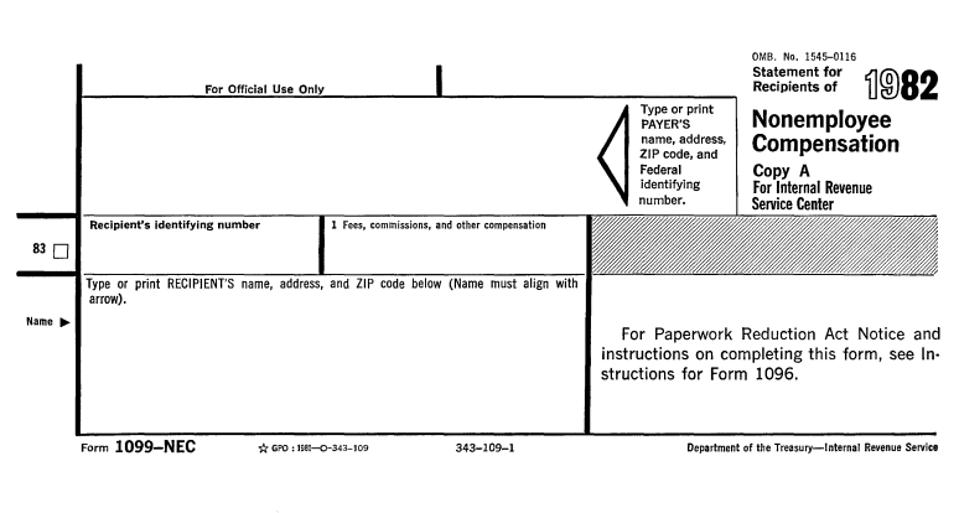

1099 g form best of how to fill out 1099 misc form. Fill in 1099 misc form 2014. Fill in 1099 misc form 2017. For many independent contractors this means filling out a schedule c which tallies up the.

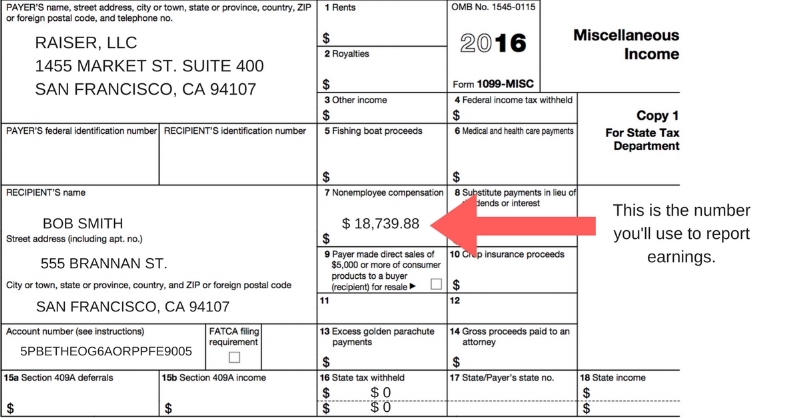

For example if the recipient is an individual beneficiary enter the name and social security number of the individual. Fill in 1099 misc form 2016. The payer is the business who made a payment during the year to the recipient listed on the 1099 misc. Fill out your form 1099 misc.

Required payee information to fill out a 1099.

/i-received-a-1099-misc-form-what-do-i-do-with-it-35d7e9d37e8949de8c556777494dde39.png)

/i-received-a-1099-misc-form-what-do-i-do-with-it-35d7e9d37e8949de8c556777494dde39.png)

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

/1099_misc_form-569fcc0f5f9b58eba4ad3afa.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)