How To File 2017 Taxes In 2019

Irs summertime tax tip 2017 11 july 26 2017 taxpayers should keep copies of their tax returns for at least three years.

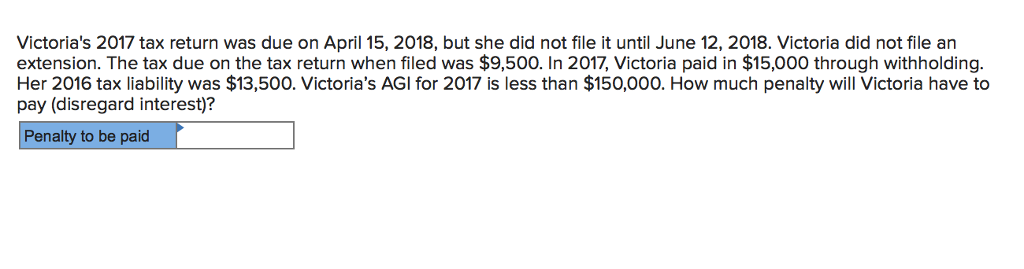

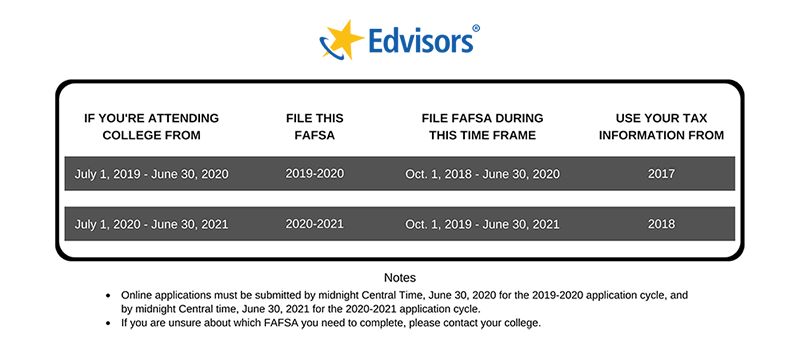

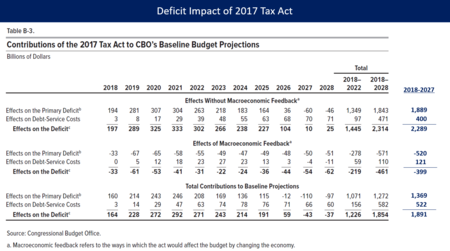

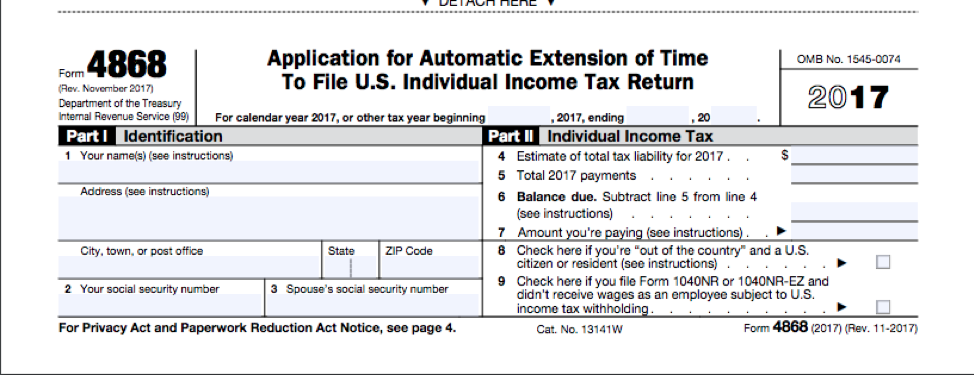

How to file 2017 taxes in 2019. For those that need tax transcripts however irs can help. And when you file your 2017 tax return it will still be subject to the 2017 tax laws not the new tax laws. Prepare and efile your 2019 taxes until oct. To get the extension you must estimate your tax liability on this form and should also pay any amount due.

The poster disclaims any legal responsibility for the accuracy of the information that is contained in this post. If you are wondering if you can file your 2017 tax return in the year 2019 yes you can with turbotax 2017 program. A new law enacted in december 2019 has extended tax breaks but caused delays for many 2019 tax forms instructions and publications. How to file your federal taxes.

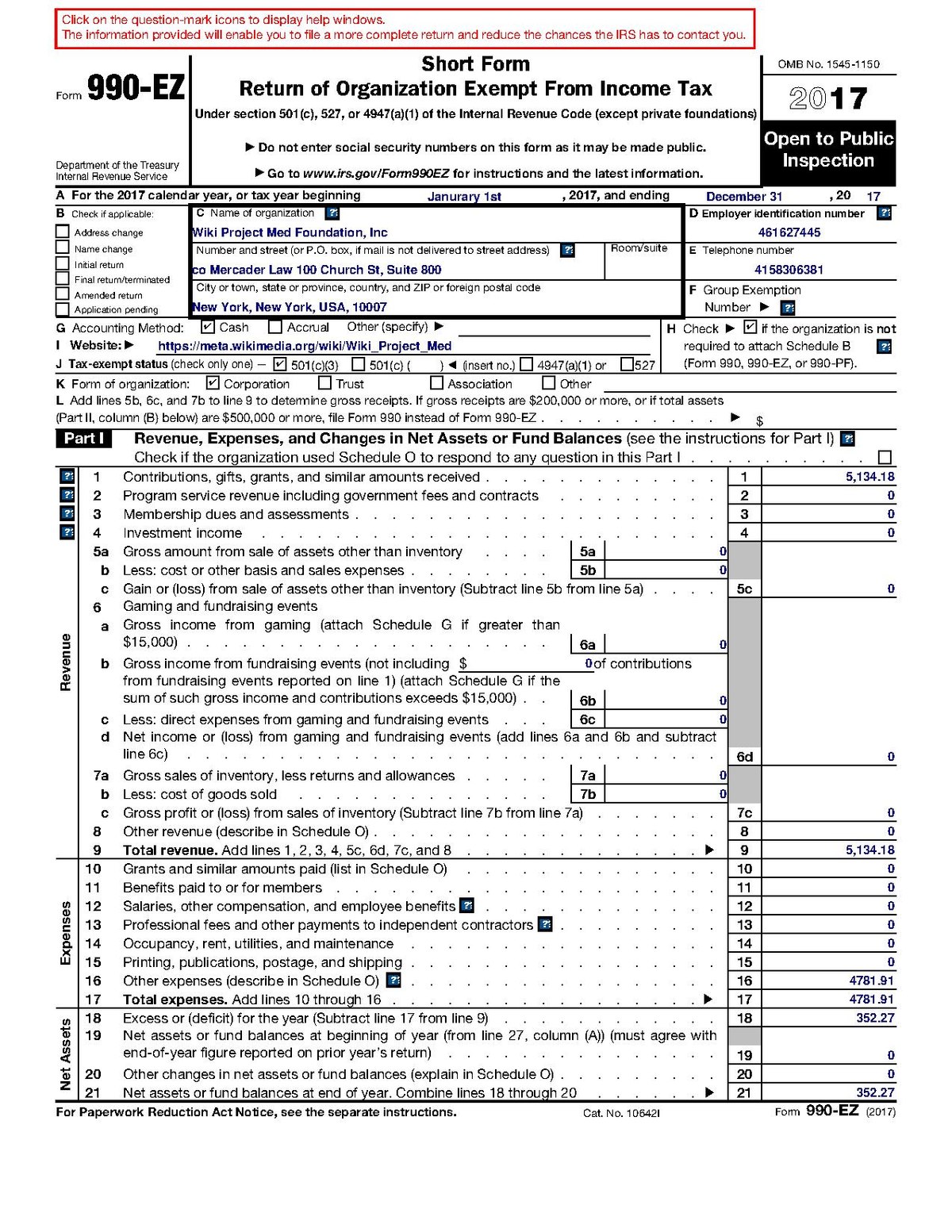

Get your employer id number ein find form 941 prepare to file make estimated payments and more. If you file a joint return both spouses must sign the return. If your spouse cannot sign because of a medical condition and requests that you sign the return sign your spouses name in the proper place followed by the word by then your signature followed by the word husband or wife. Find form 990 and apply for and maintain your organizations tax exempt status.

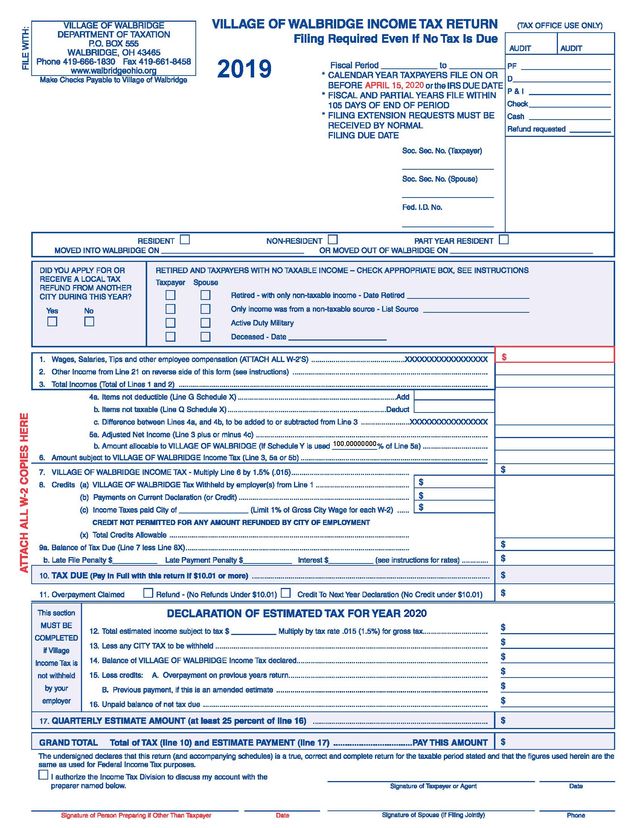

In order to file a 2017 irs tax return click on any of the form links below. If you owe taxes you should efile by july 15 2020 as you otherwise would be subject to late filing fees. Federal income tax returns are due on july 15 2020. If you would normally file a 2019 tax return you can still use free file now.

Understand it cannot be efiled because it is past the deadline but it can be mailed in. 15 2020 to e file your return. Individual tax filers regardless of income can use free file to electronically request an automatic tax filing extension. View solution in original post 1.

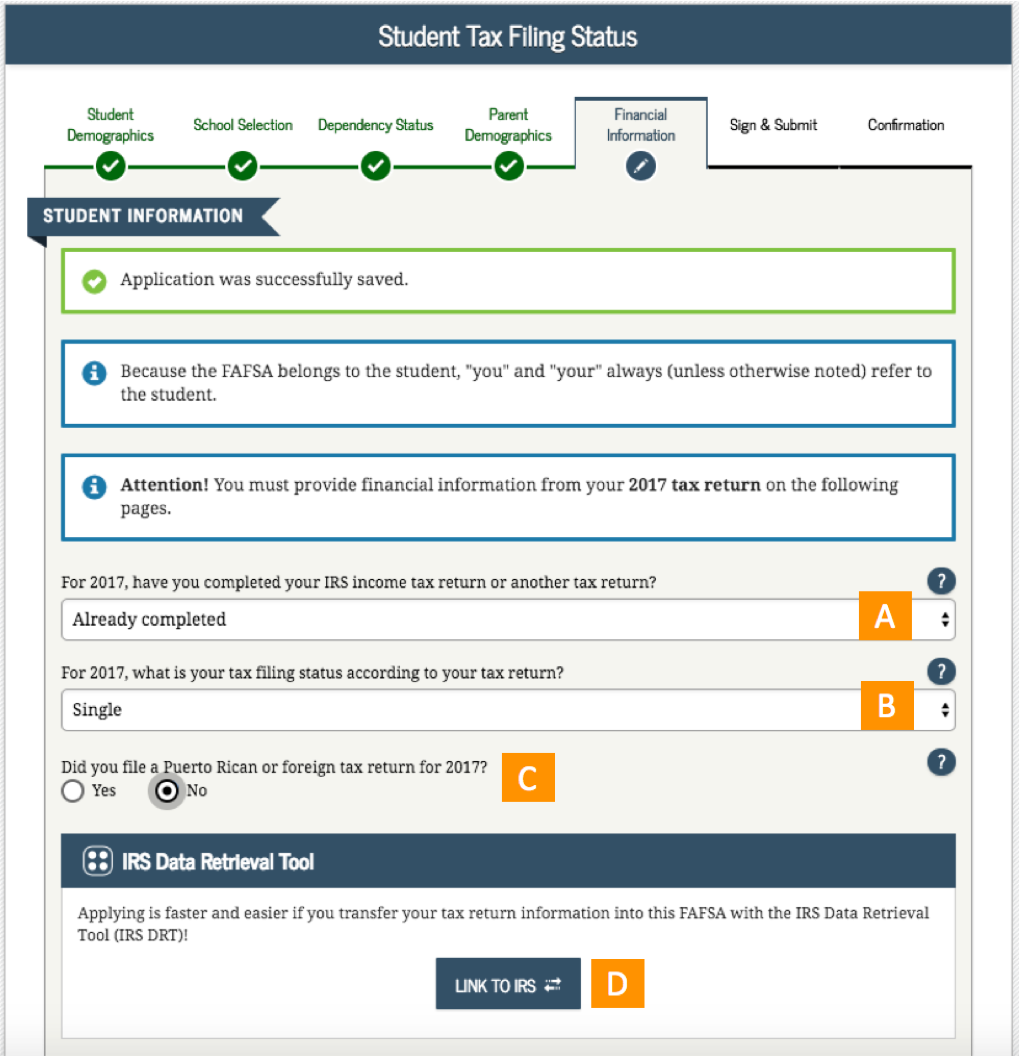

This provides taxpayers an extra three months due to the coronavirus pandemic. You can complete and sign the forms online. Enter your info here tool or any irs free file company to register for economic impact payments. Those who need a copy of their tax return should check with their software provider or tax preparer.

Filing this form gives you until oct. 15 to file a return. If you were not required and did not file a 2018 or 2019 federal income tax return because you had no income or your gross income was under 12200 24400 for married couples you can now use our irs non filers. Prior year tax returns are available from irs for a fee.

Irs free file or e file get your tax record and view your account.

/ScheduleA-ItemizedDeductions-fc8aa38a36d84f93a4fc2cbb62779cd0.png)