How To Calculate Your Paycheck

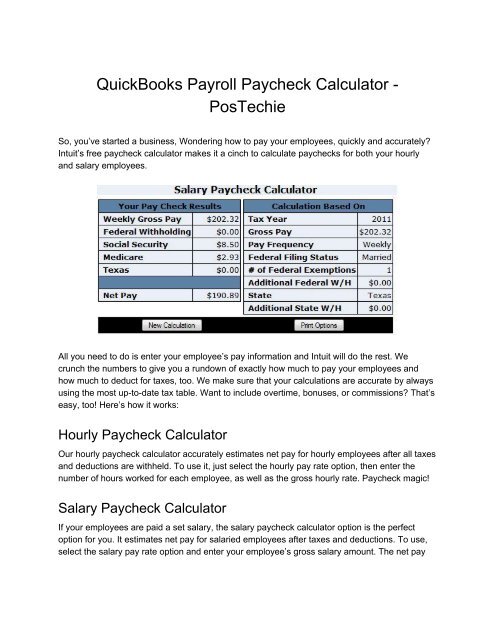

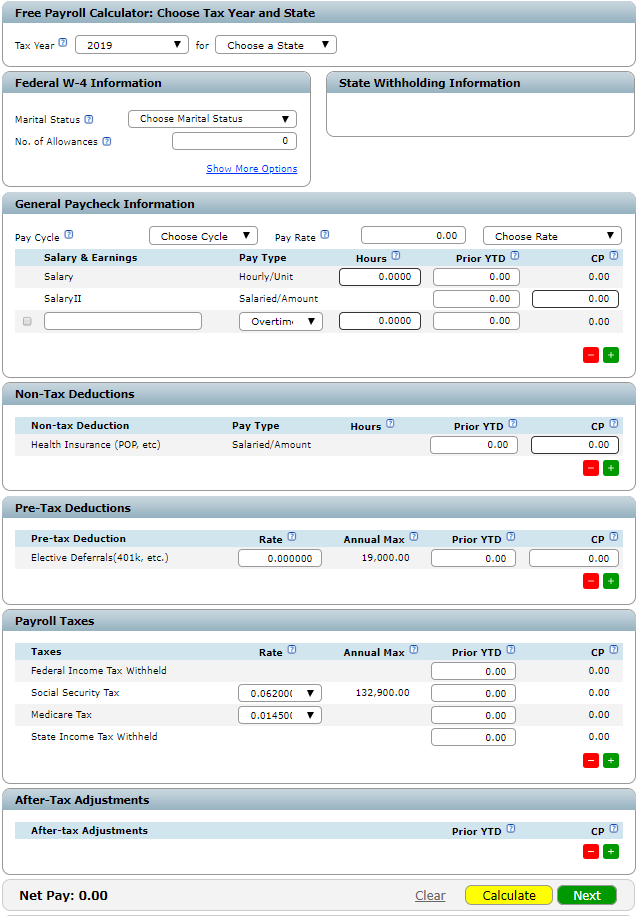

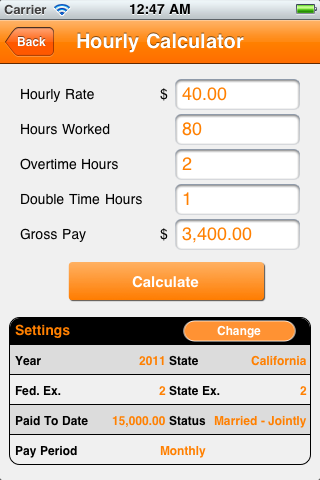

Our hourly paycheck calculator accurately estimates net pay sometimes called take home pay or home pay for hourly employees after withholding taxes and deductions.

/when-you-can-expect-to-get-your-first-and-last-paycheck-2060057_FINAL-5c6c1bc446e0fb000165cba9.png)

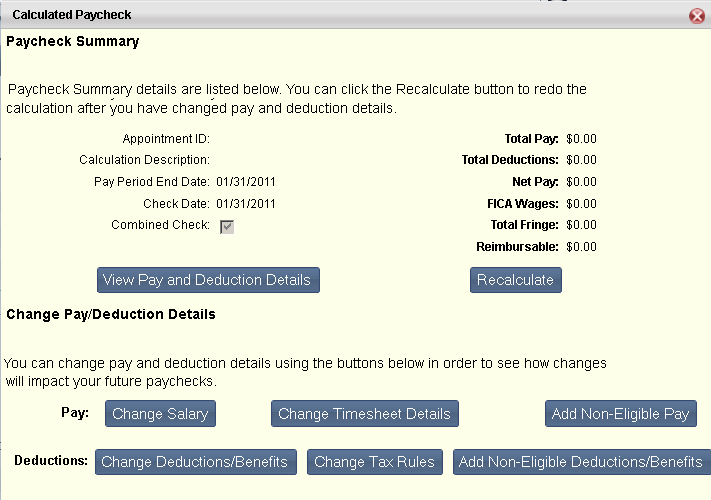

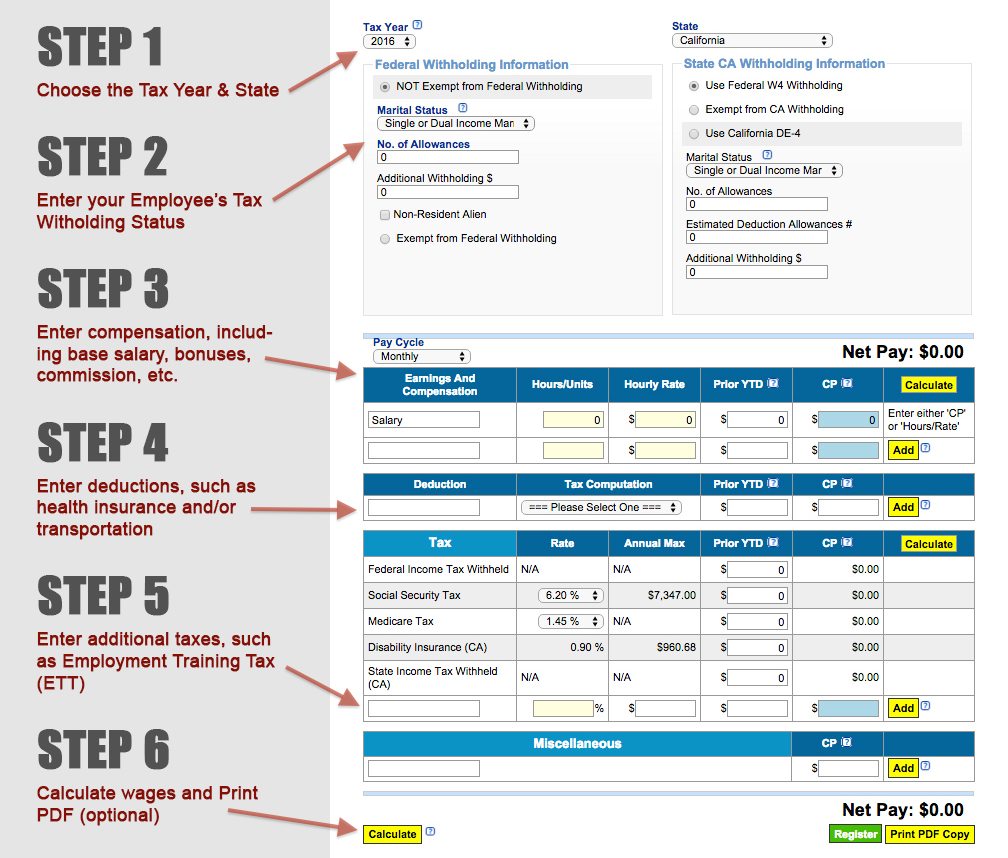

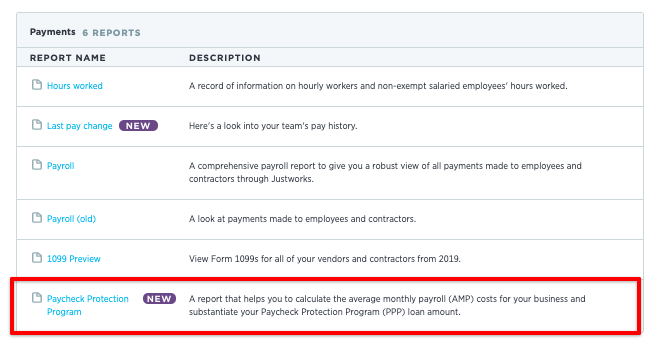

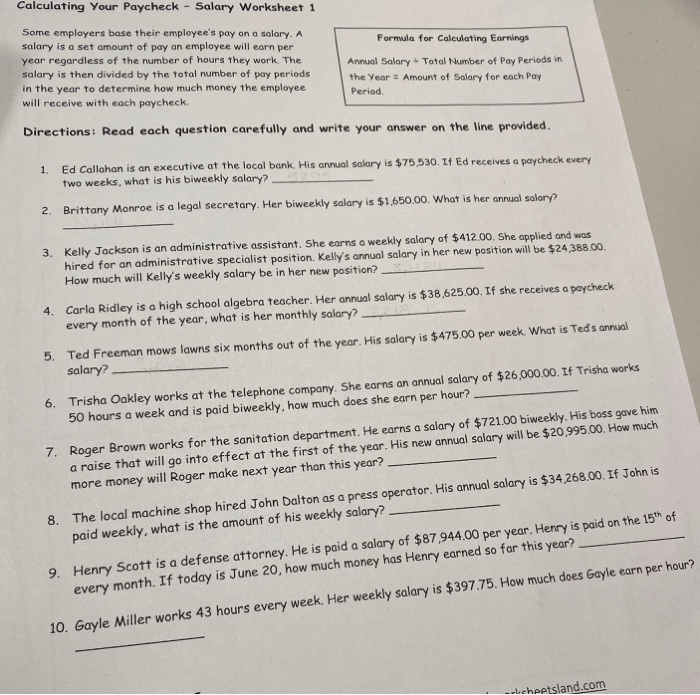

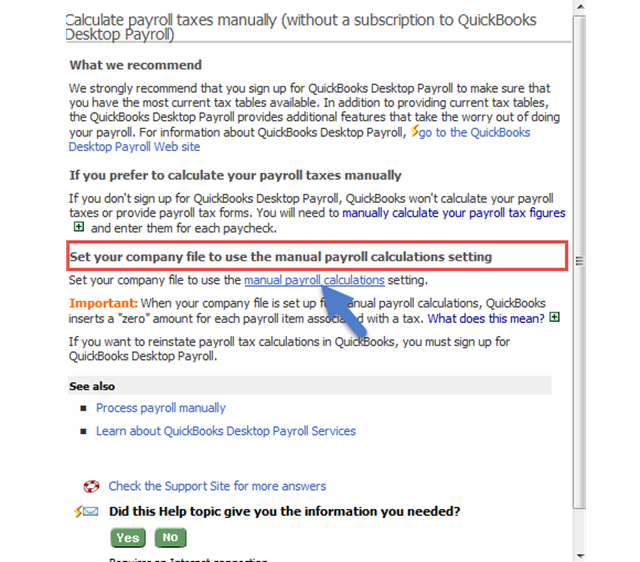

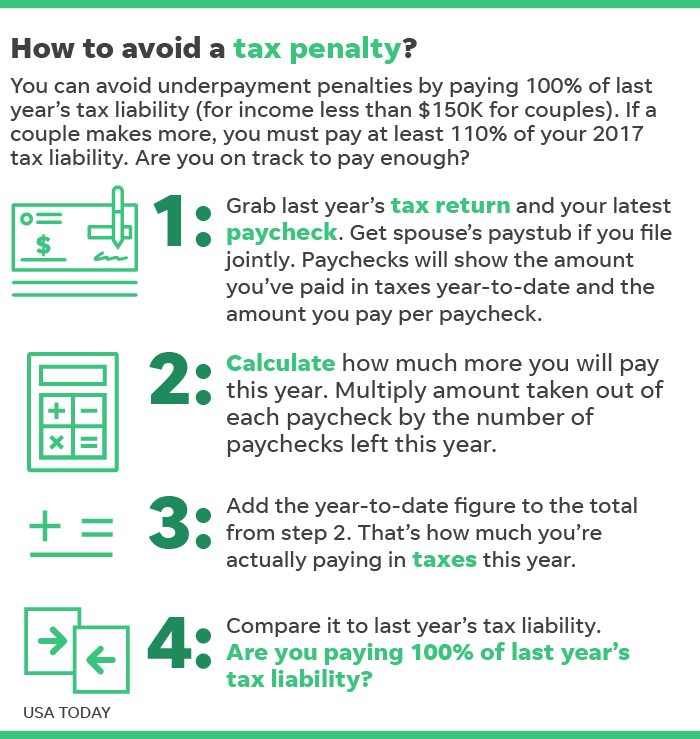

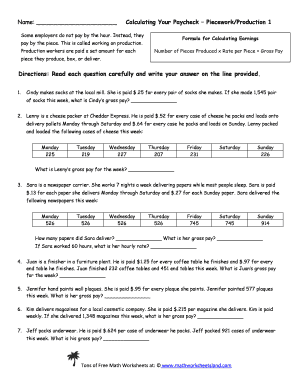

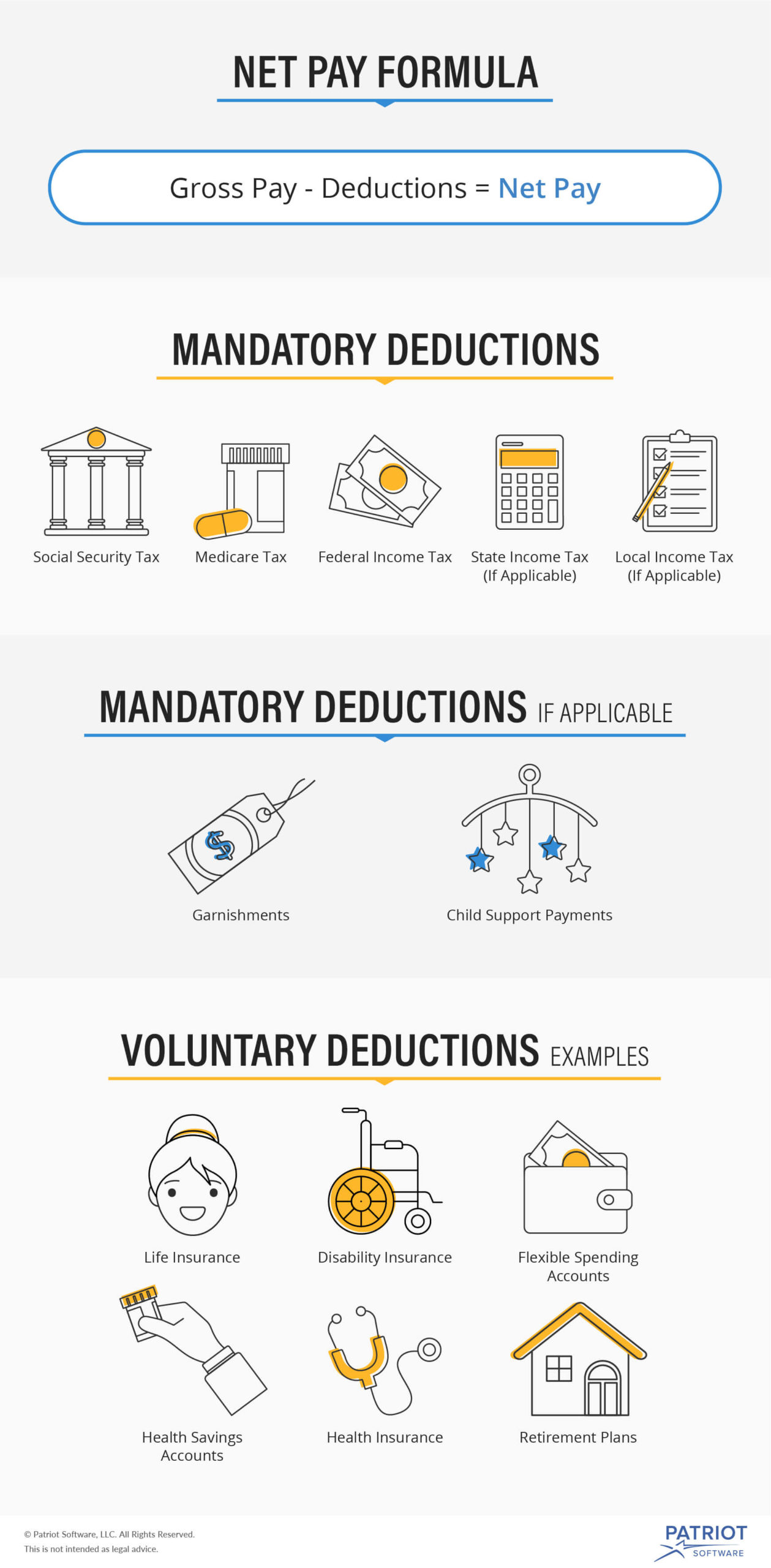

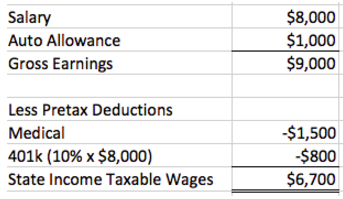

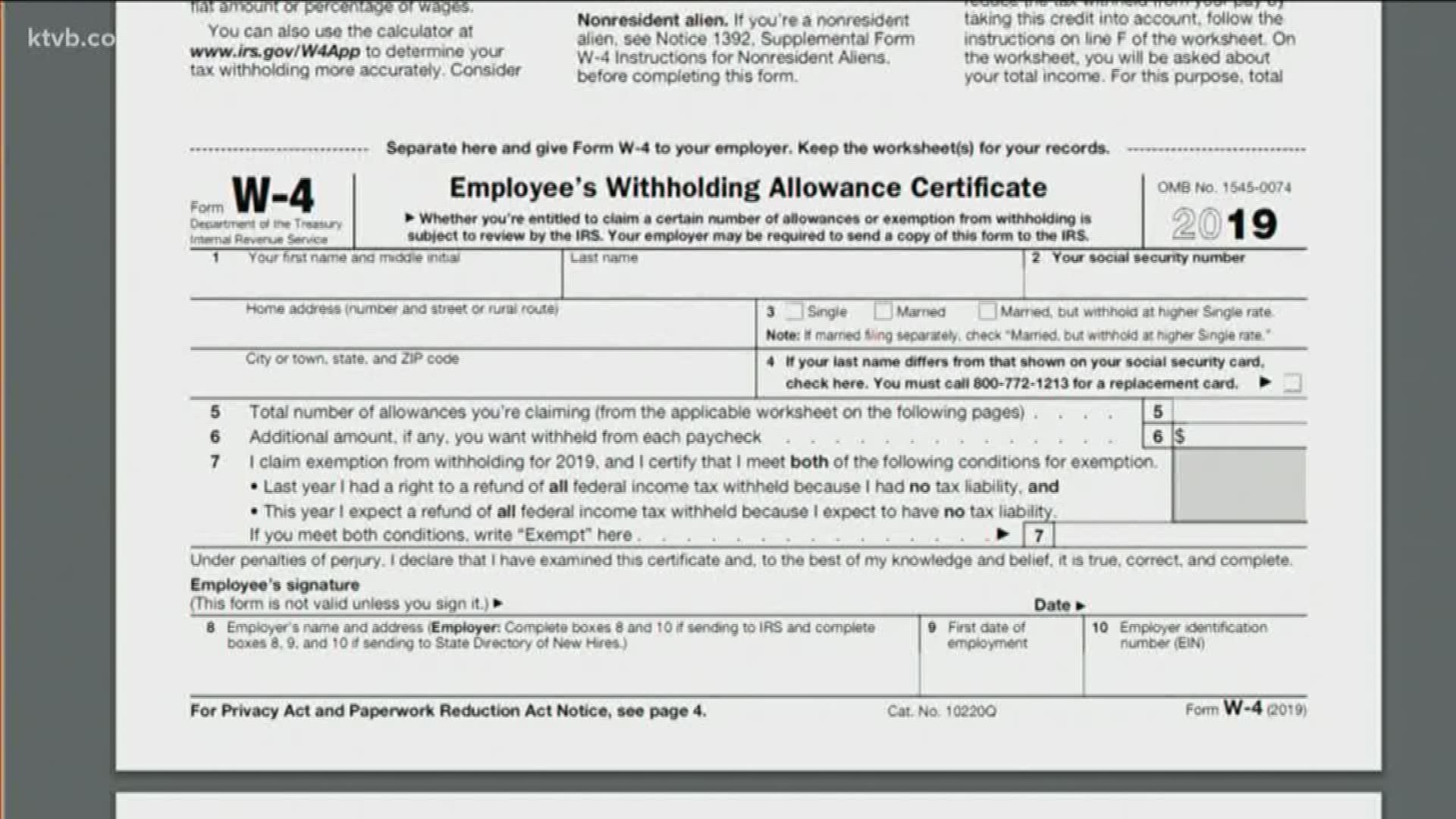

How to calculate your paycheck. But calculating your weekly take home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. Use paycheckcitys free paycheck calculators withholding calculators gross up and bonus calculators 401k savings and retirement calculator and other specialty payroll calculators for all your paycheck and payroll needs. How your paycheck works. If a data record is.

Dont want to calculate this by hand. This number is the gross pay per pay period. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. A data record is a set of calculator entries that are stored in your web browsers local storage.

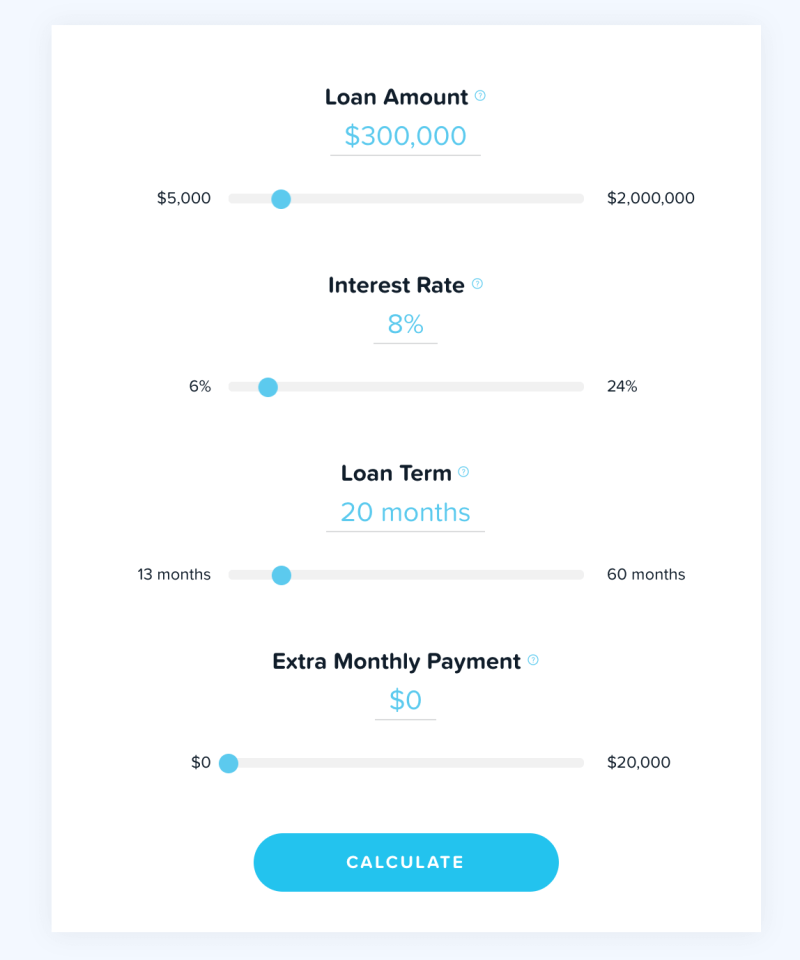

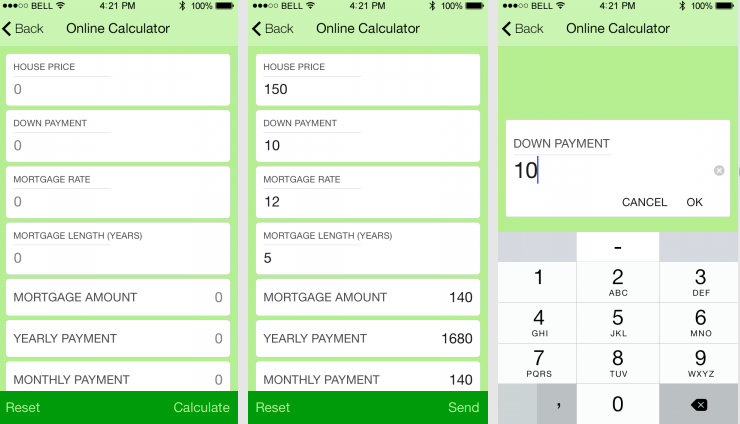

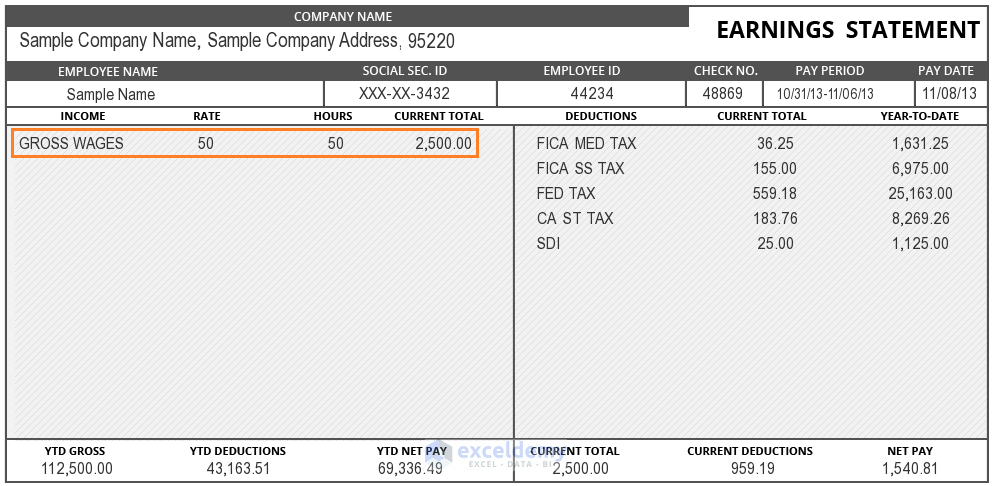

To try it out just enter the employee details and select the hourly pay rate option. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. For example if an employee is paid 1500 per week his or her annual income would be 1500 x 52 78000. Overtime hours this pay period.

Regular hours this pay period.

:max_bytes(150000):strip_icc()/what-is-gross-pay-and-how-is-it-calculated-398696-v1-5bbd1ae146e0fb0026778399.png)

/payroll-taxes-3193126-FINAL-ef94c8b30eda48fdbde6ab58d9a30d49.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/153349919-56a938693df78cf772a4e357.jpg)

/GettyImages-987375510-9321d56fc41b498a923cab34d20476de.jpg)

:max_bytes(150000):strip_icc()/how-to-calculate-your-unemployment-benefits-2064179-v2-5bb27c7646e0fb0026d9374f.png)