How To Calculate Taxes From Paycheck Ct

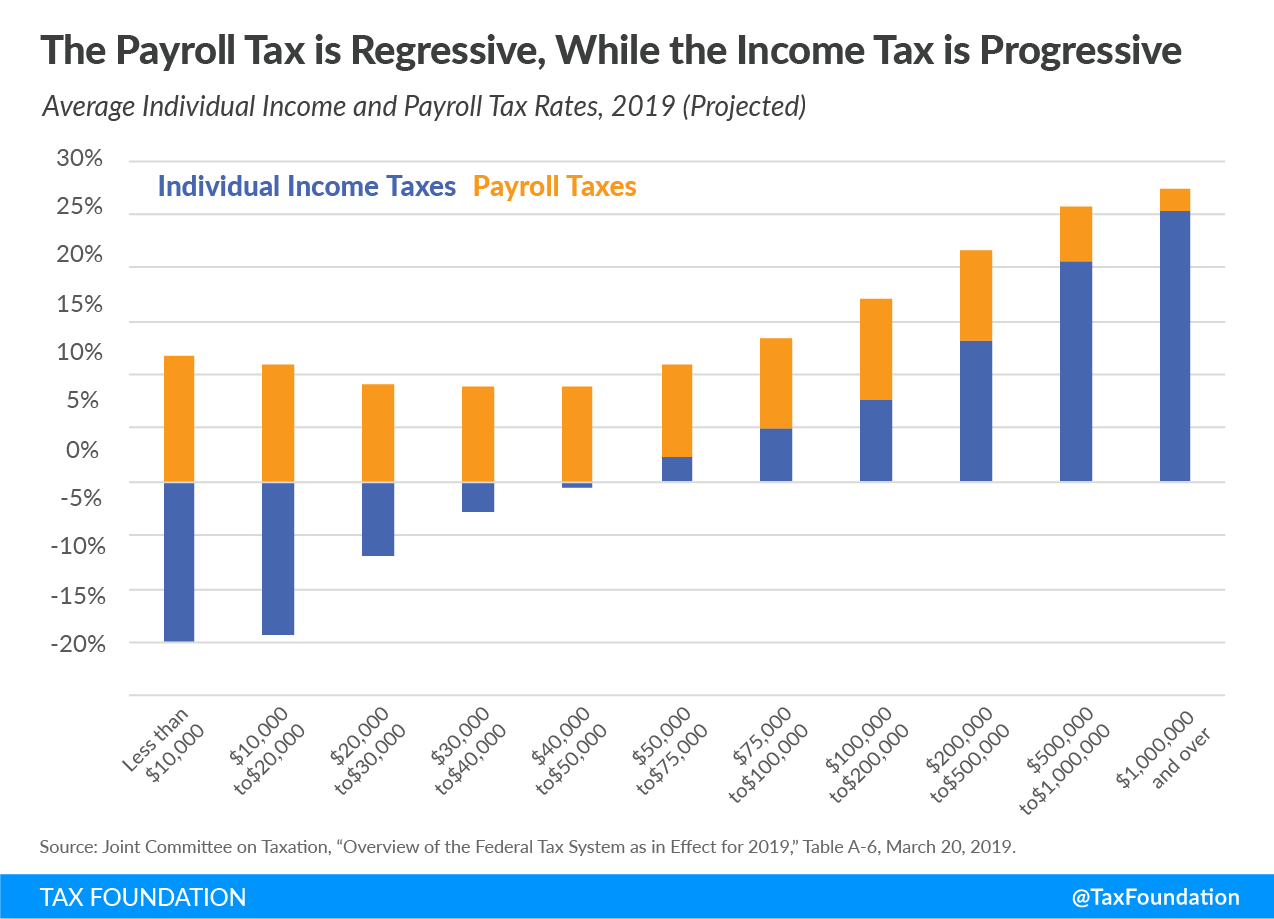

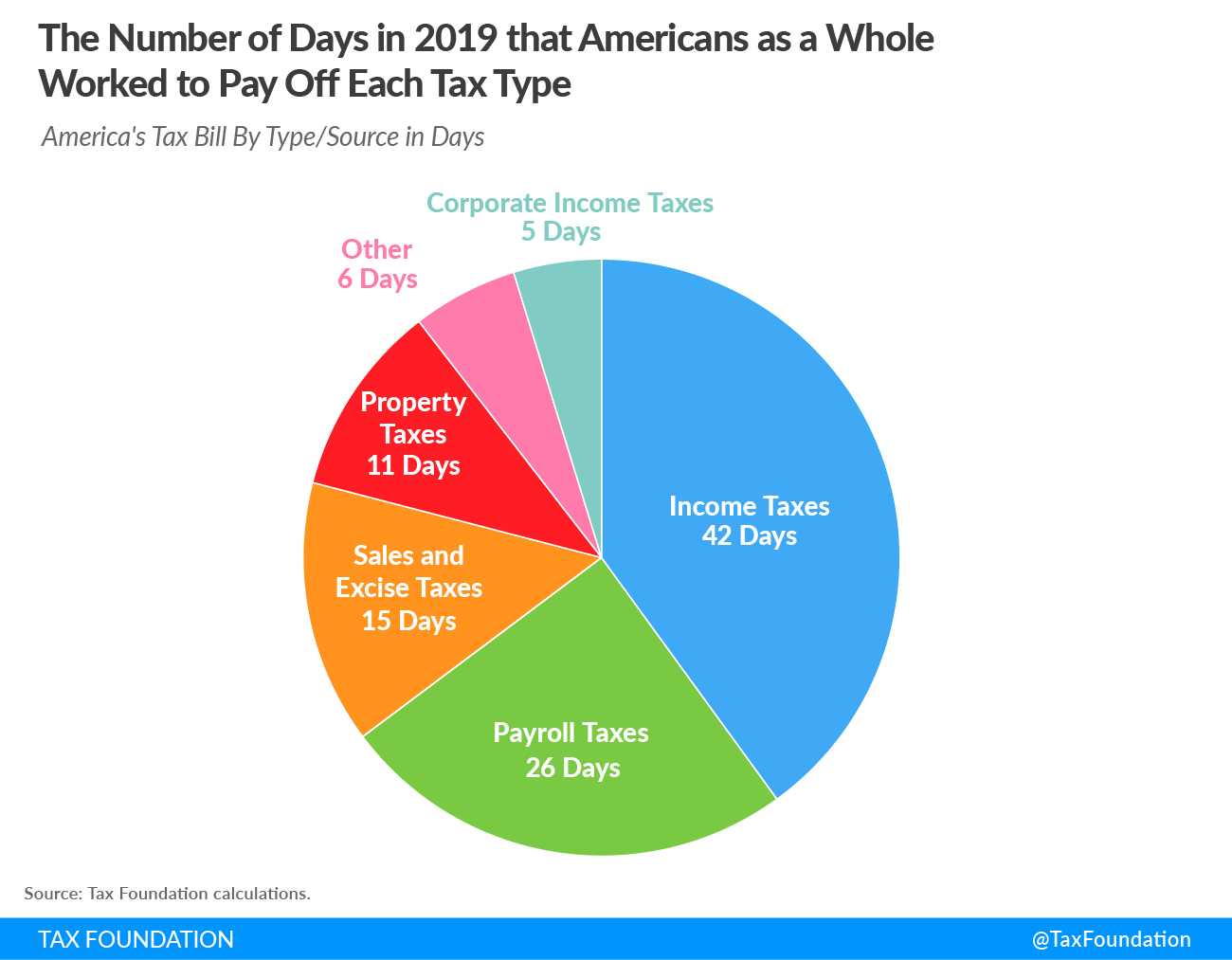

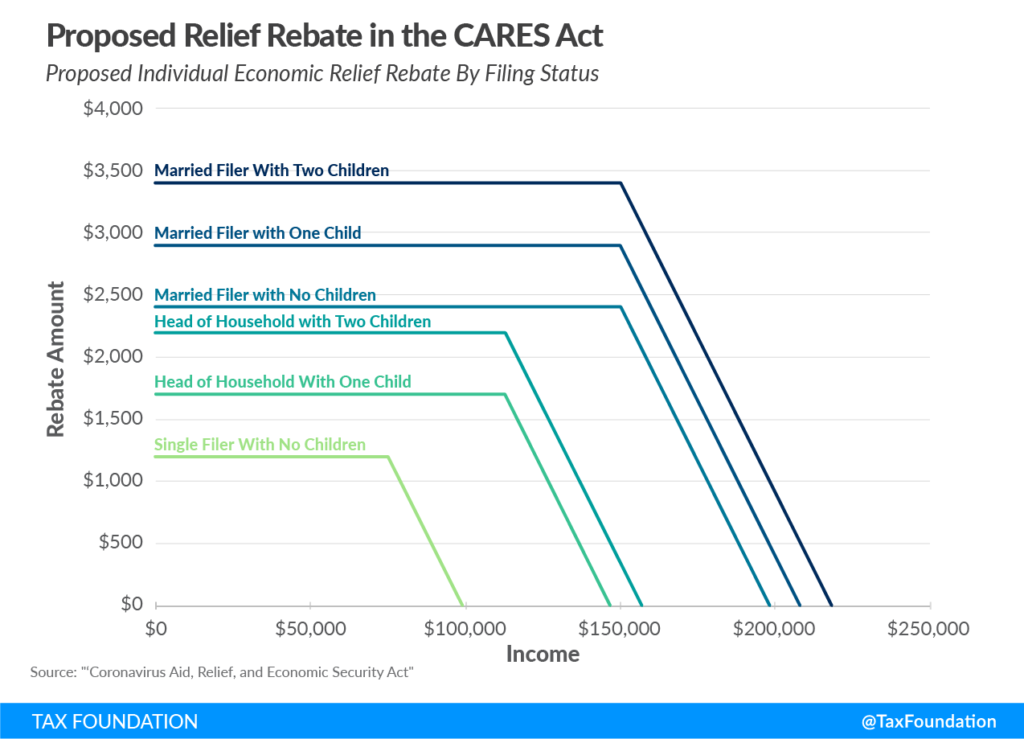

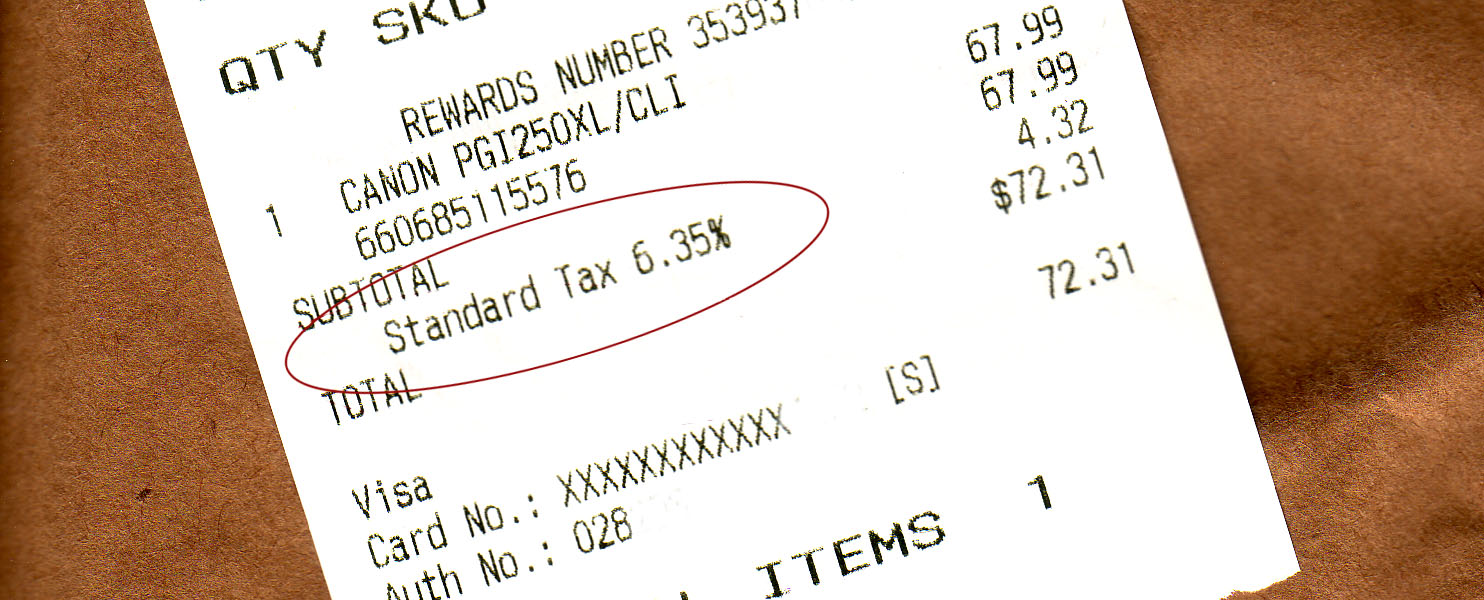

This includes taxpayers who owe alternative minimum tax or certain other taxes and people with long term capital gains or qualified dividends.

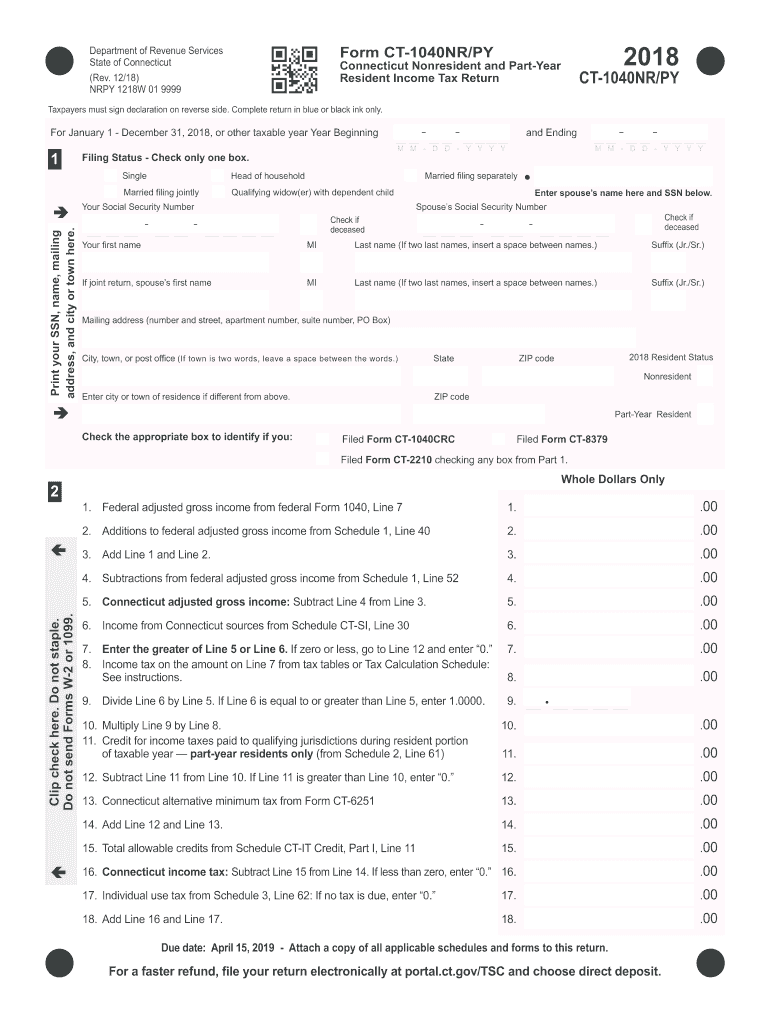

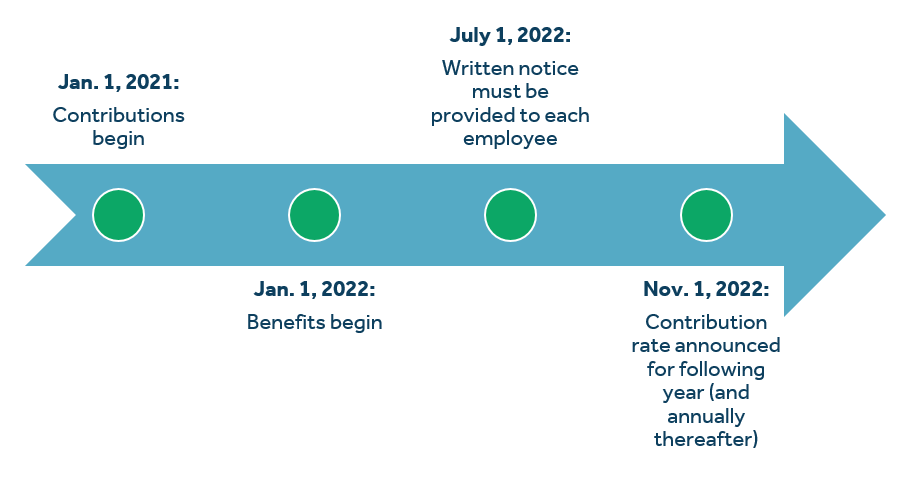

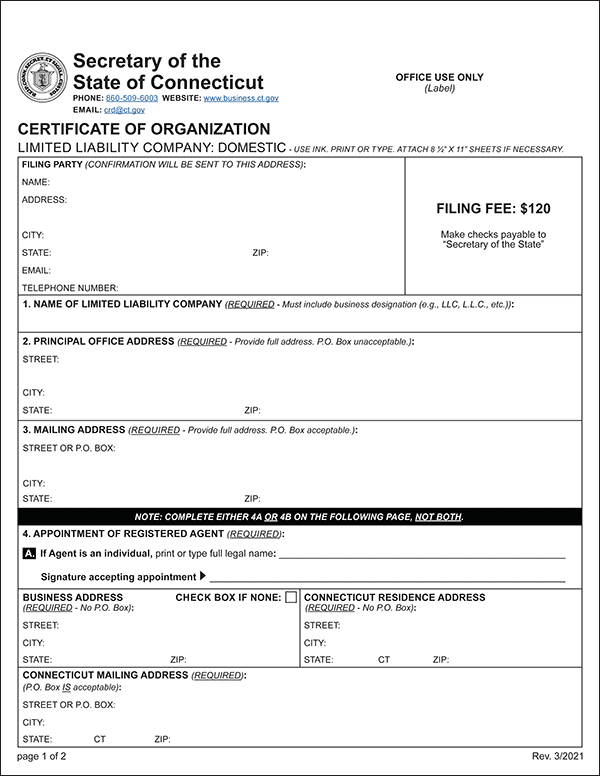

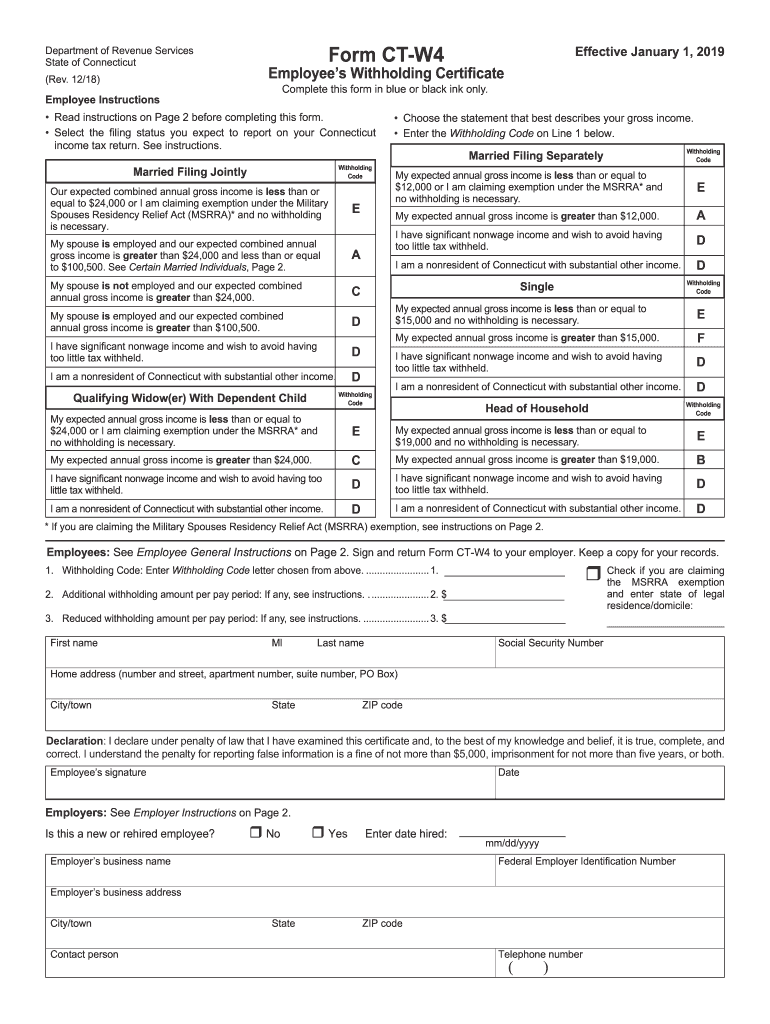

How to calculate taxes from paycheck ct. This tax withholding estimator works for most taxpayers. Enter the date and payment amount of the estimated income tax payments below. For more information on how to calculate your payments select on the filing instructions link. I am a nonresident of connecticut with substantial other income.

Then enter the number of hours worked the gross pay hourly rate and pay period. There are seven tax brackets that range from 300 to 699. Form ct 1040es or form ct 1041es validation. My expected gross income is less than or equal to 15000 my expected gross income is greater than 15000 i have significant nonwage income andwith to avoid having too little tax withhold.

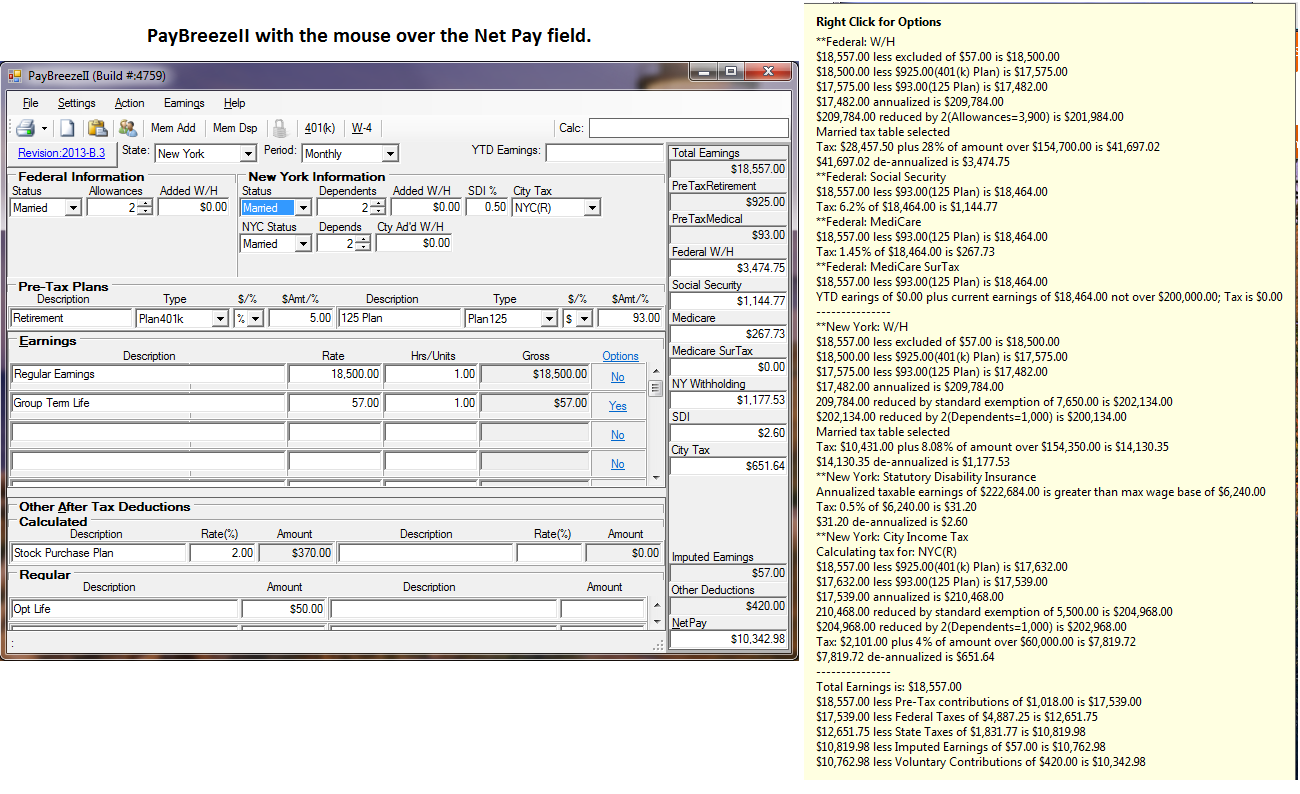

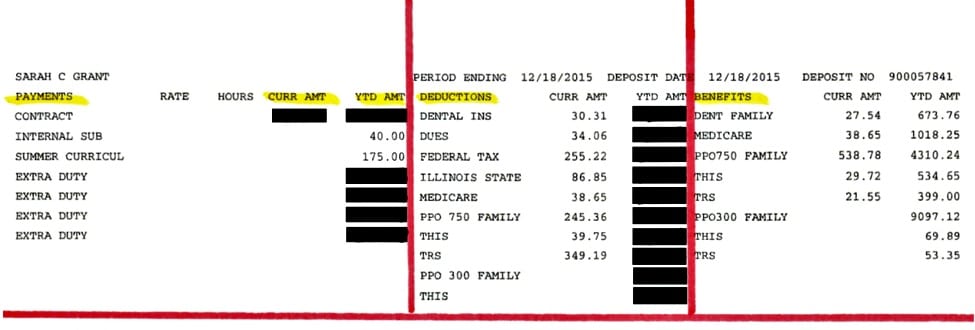

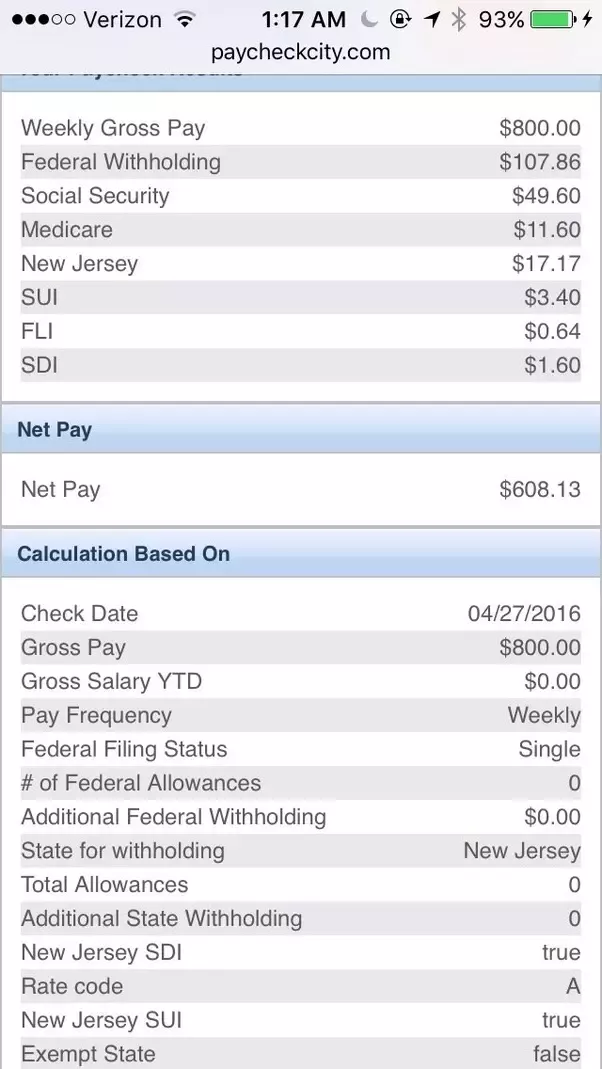

Income tax withholding when you start a new job or get a raise youll agree to either an hourly wage or an annual salary. After verifying your information select next to proceed. But calculating your weekly take home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. How your paycheck works.

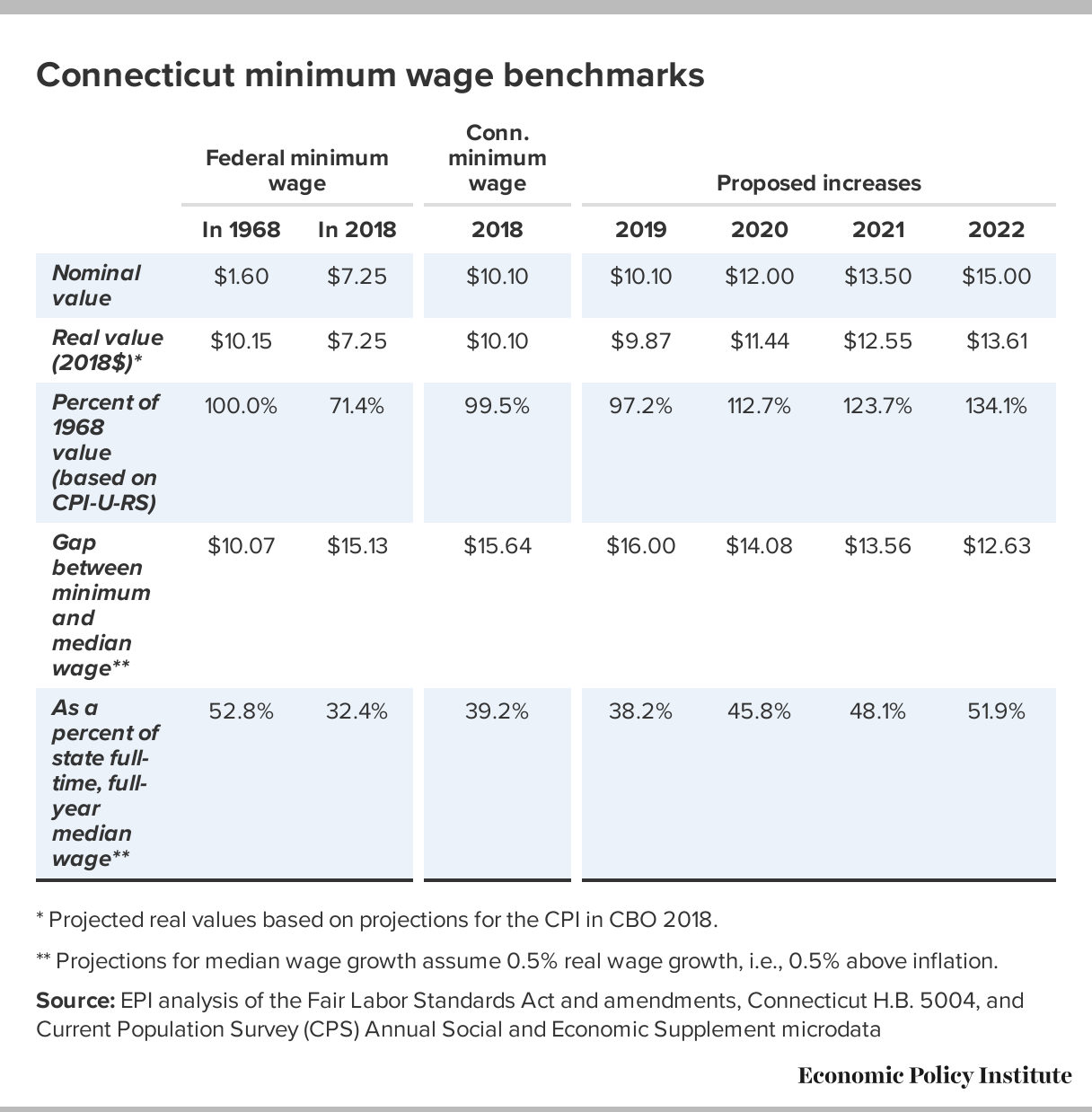

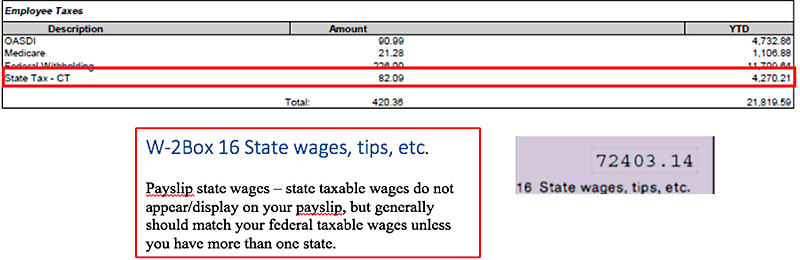

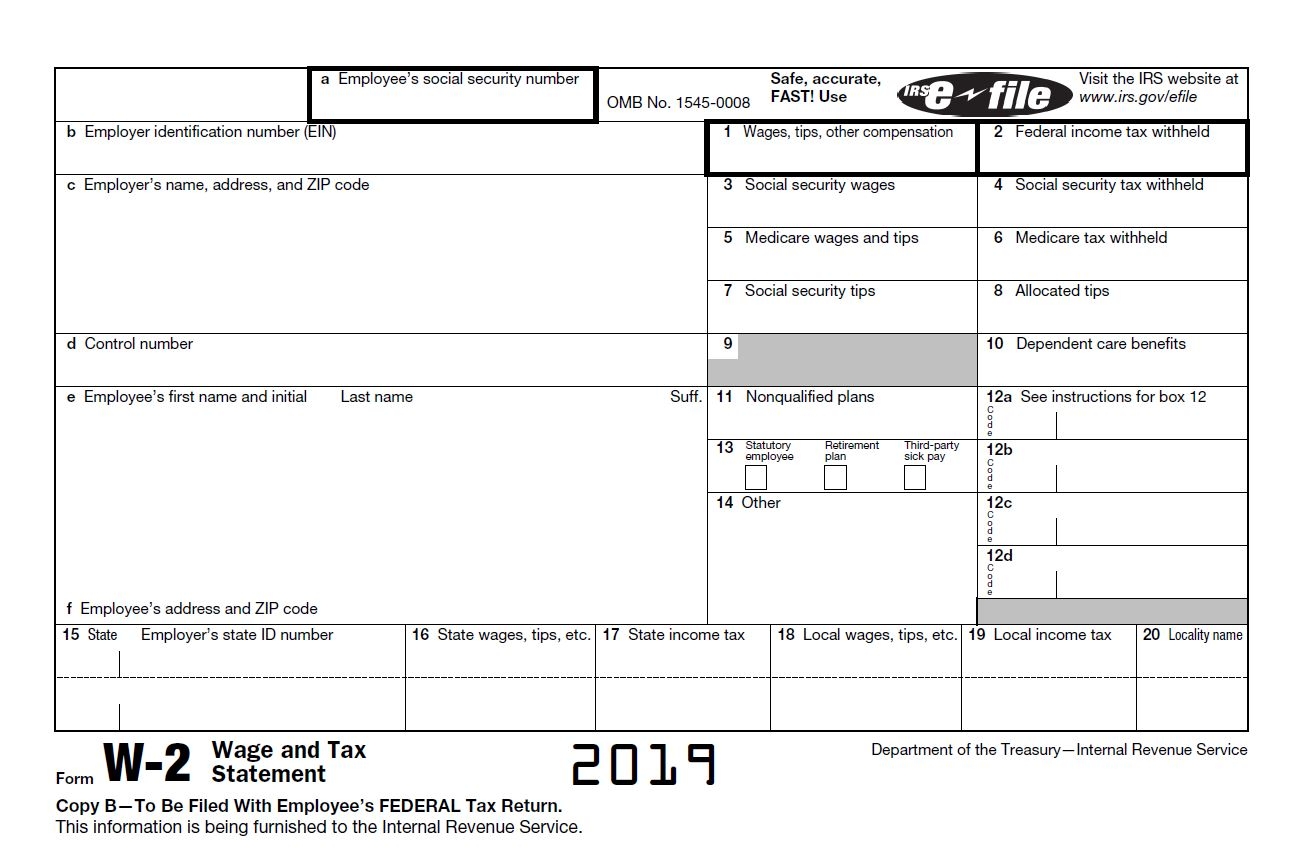

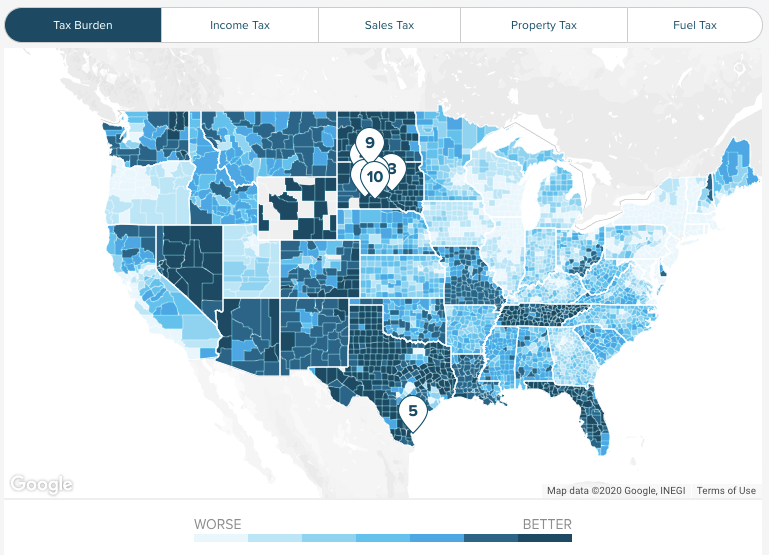

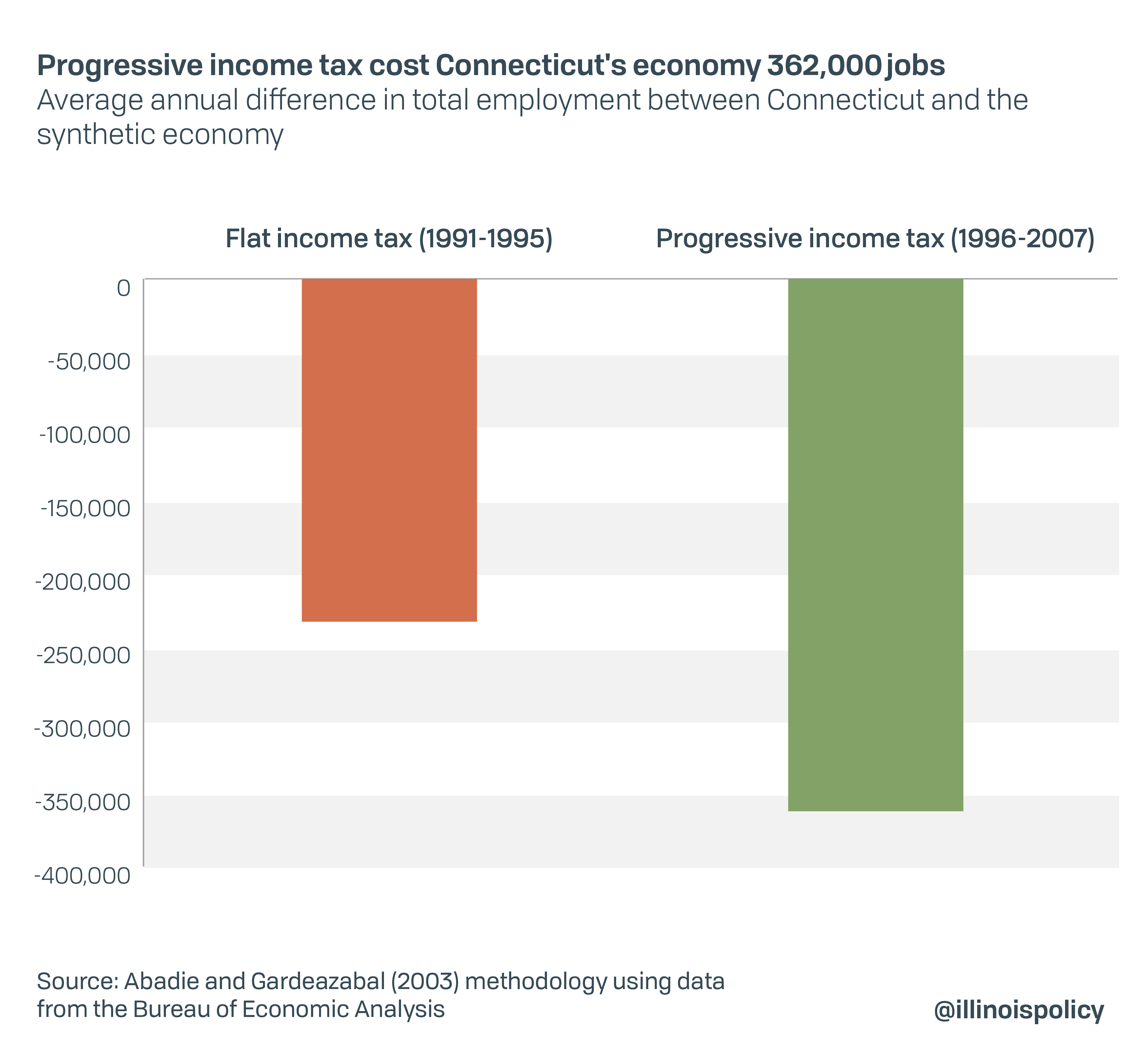

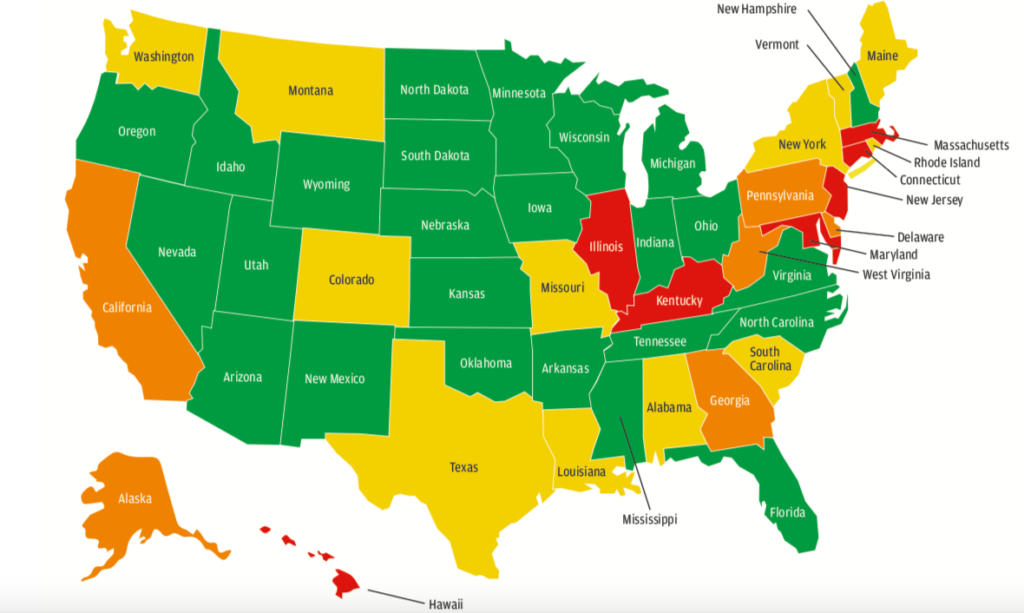

Monthly connecticut withholding calculator ct w4p. 2019 tax tables to 102k. Connecticut has a set of progressive income tax rates meaning how much you pay in taxes depends on how much you earn. After just a few paycheck and w 4 related entries the payucator tool below will provide you with your actual paycheck federal or irs tax withholding amount per selected pay period during tax year 2020.

2019 social security benefit adjustment worksheet. To try it out just enter the employee details and select the hourly pay rate option. 1 2020 you determine your 2020 irs paycheck tax withholding by tax return filing status pay period. 2019 property tax credit calculator.

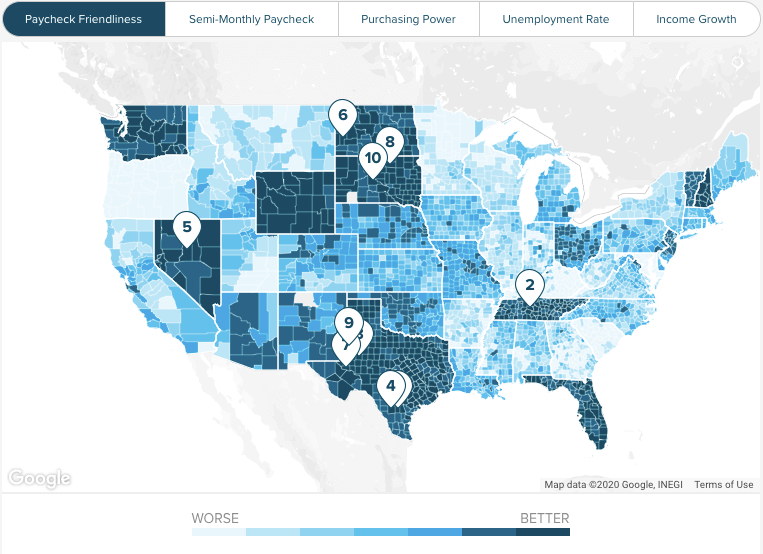

All you need to do to access that light is enter wage and w 4 information for each employee and our payroll tax calculator will calculate all the connecticut and federal payroll taxes for you. 2019 income tax calculator. Residents of connecticut dont have to pay local taxes as there are no cities or towns in the state that charge their own income taxes. 2019 tax tables to 500k.

Overview of connecticut taxes. People with more complex tax situations should use the instructions in publication 505 tax withholding and estimated tax. Calculate your connecticut net pay or take home pay by entering your per period or annual salary along with the pertinent federal state and local w4 information into this free connecticut paycheck calculator. Our hourly paycheck calculator accurately estimates net pay sometimes called take home pay or home pay for hourly employees after withholding taxes and deductions.

Just call us the long island sound of payroll taxes the people who will shine the light to guide you all the way home to write those paychecks.

:max_bytes(150000):strip_icc()/Form-w4-e54ebb209cbc48b48541a54b07e2d5c2.jpg)