How To Calculate Marginal Tax Rate Formula

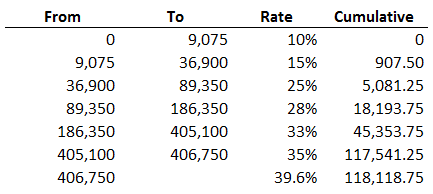

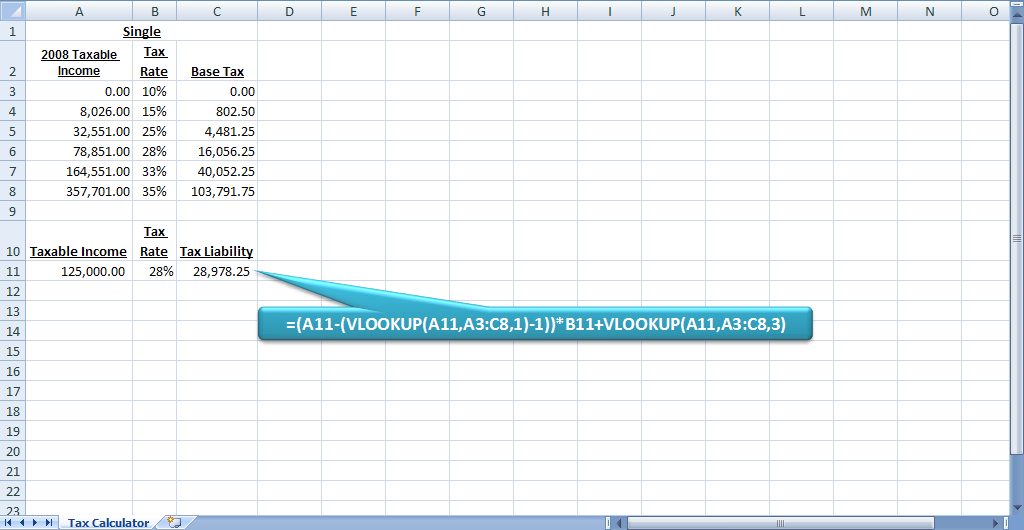

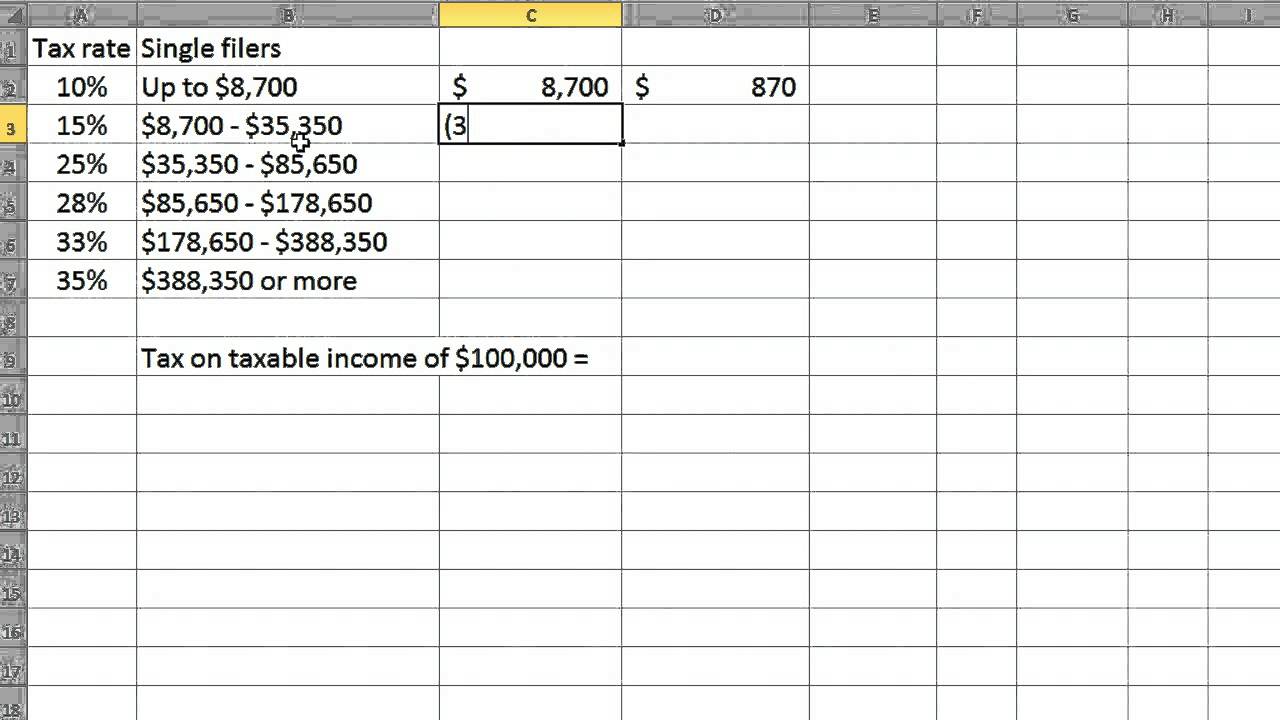

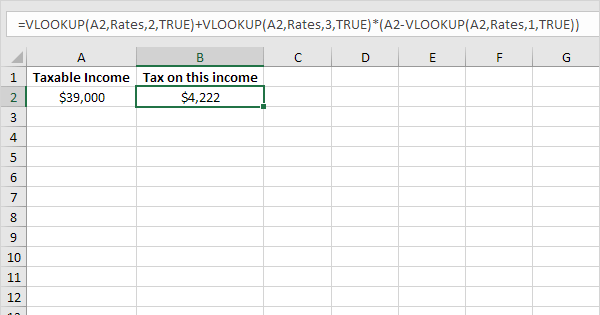

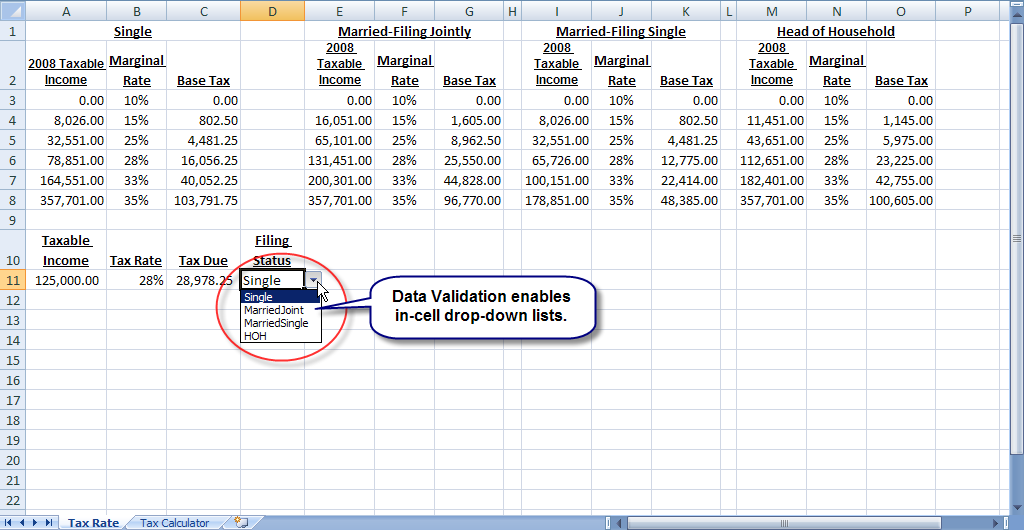

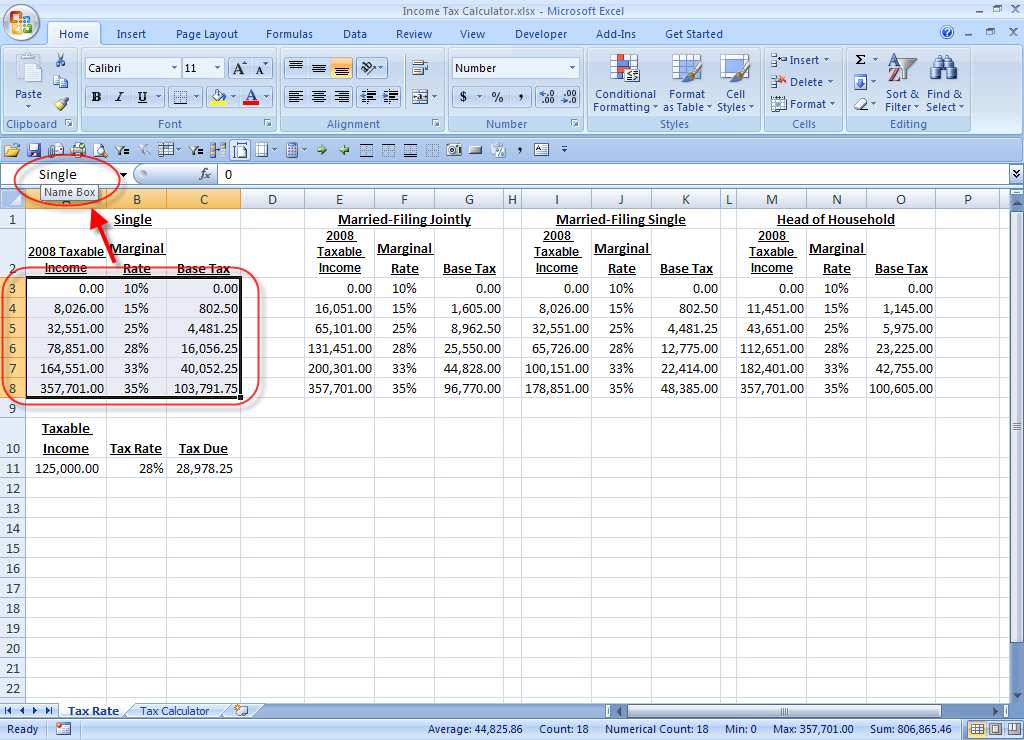

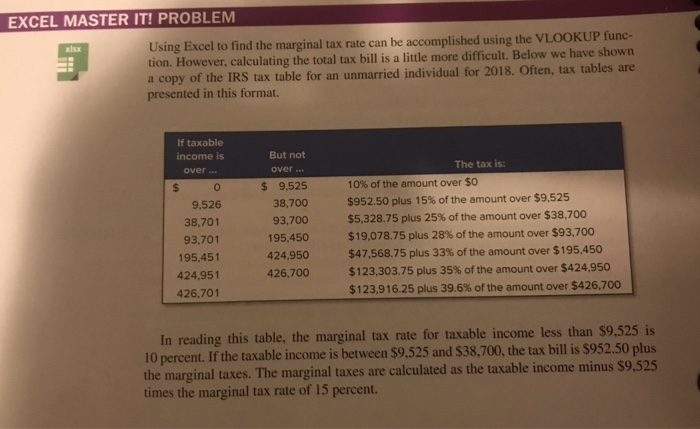

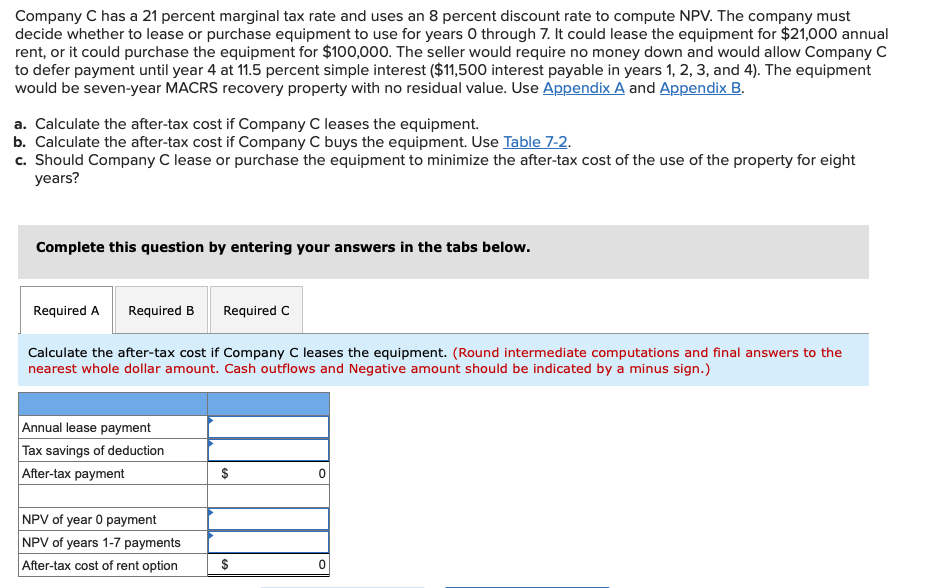

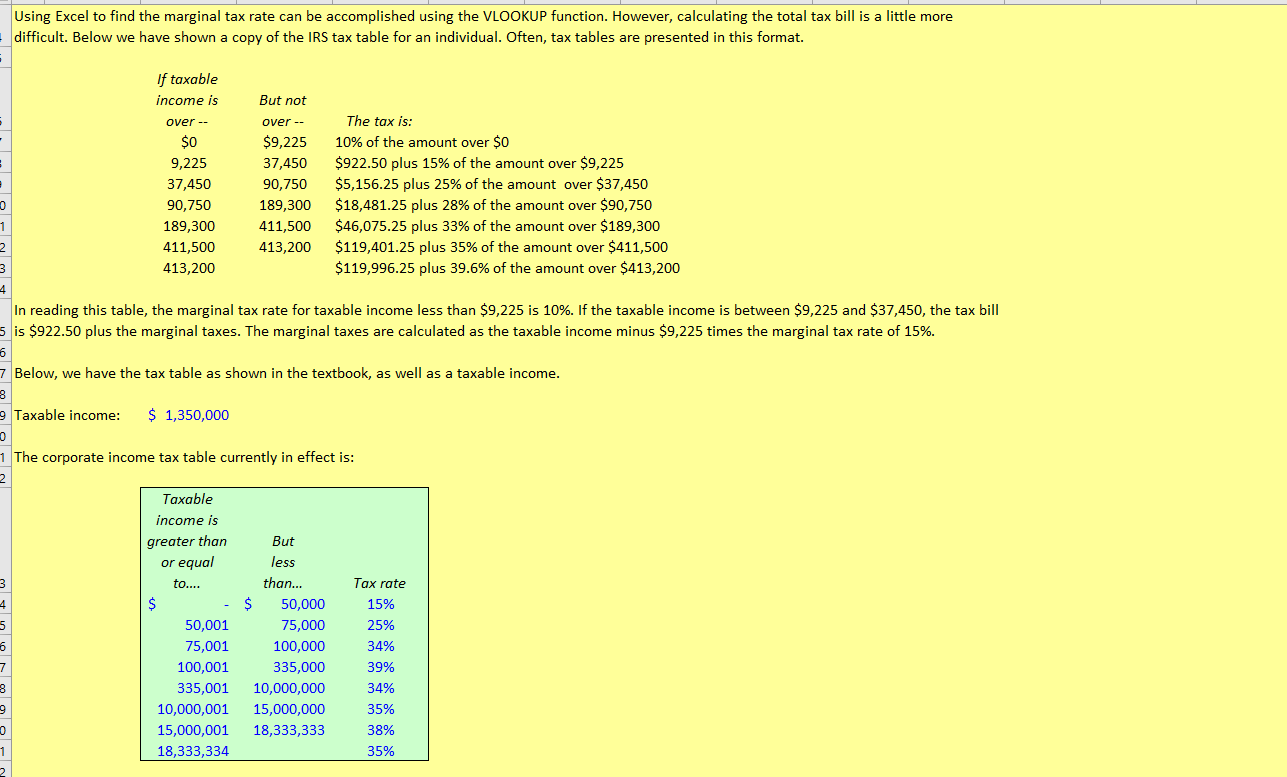

In order for vlookup to retrieve the actual cumulative tax amounts these have been added to the table as a helper column in column d.

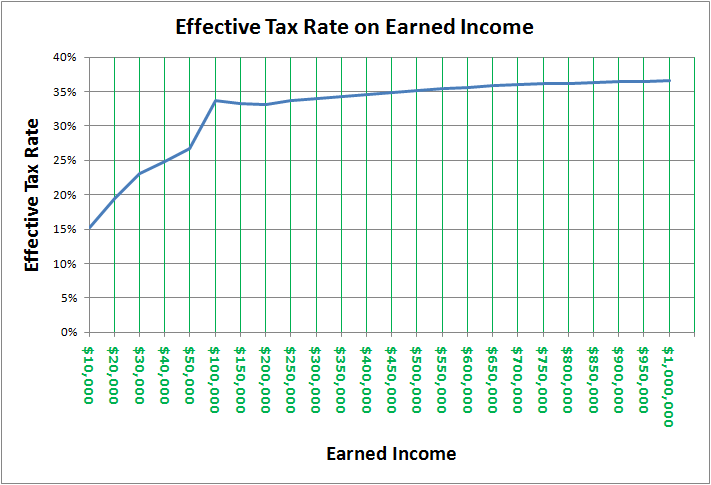

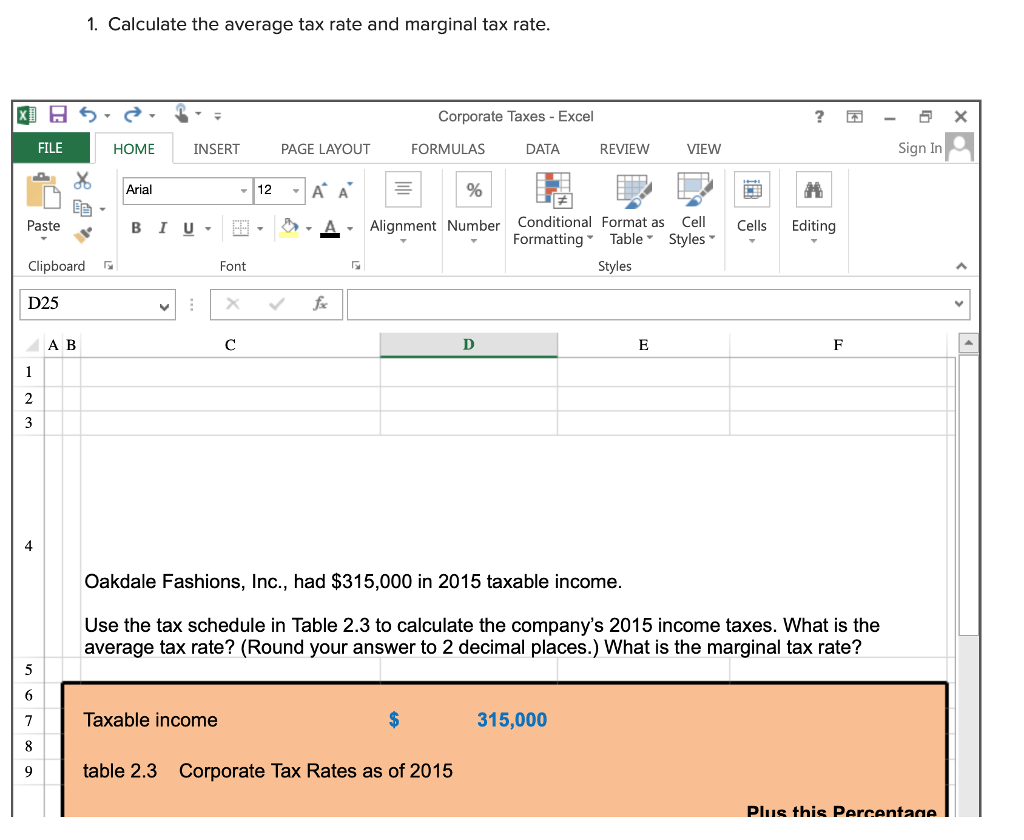

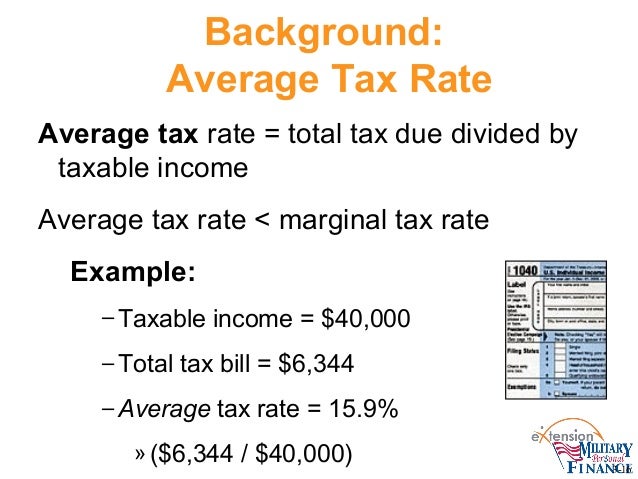

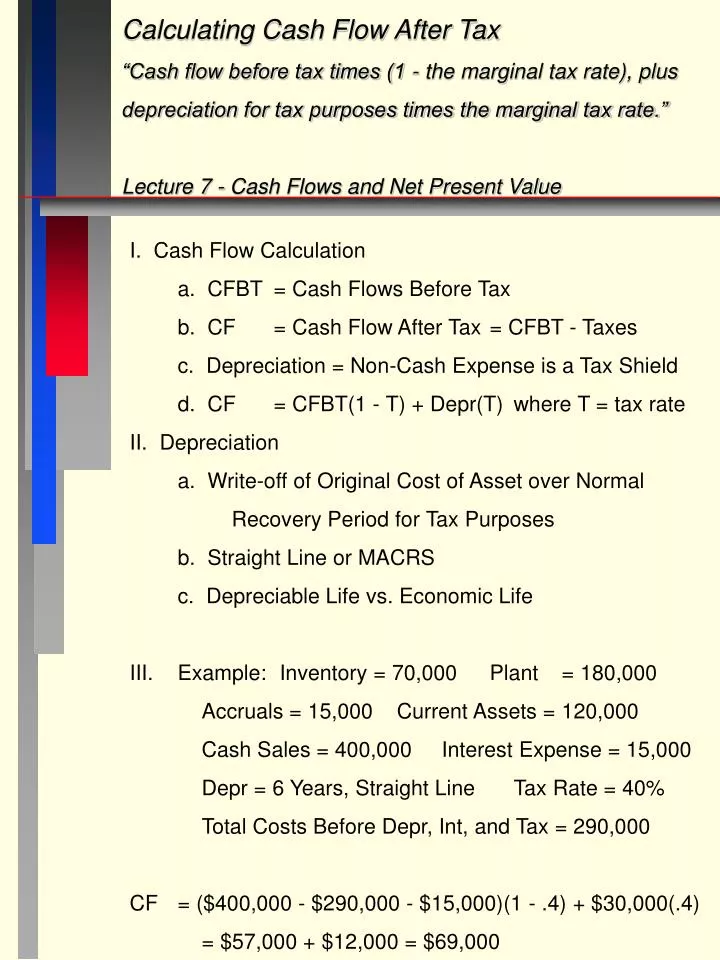

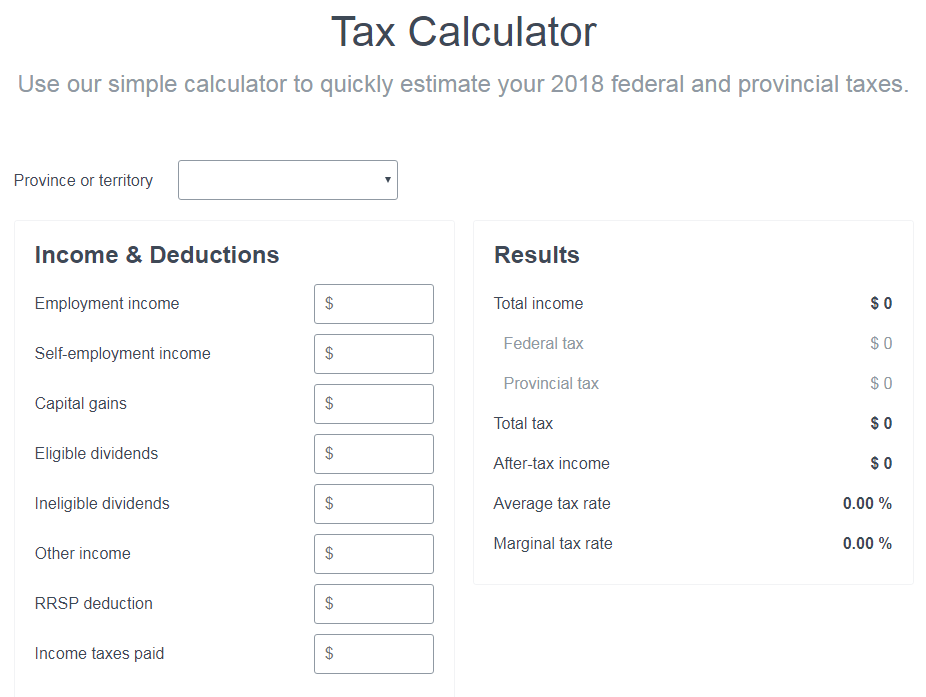

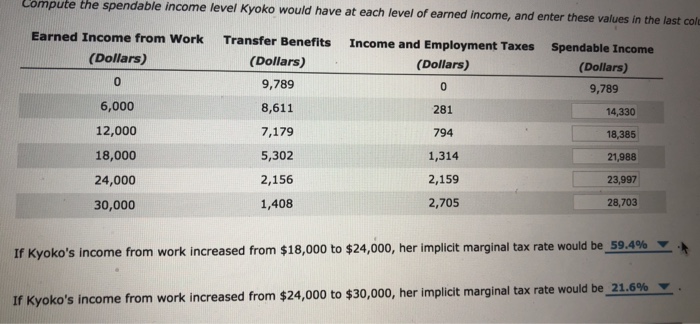

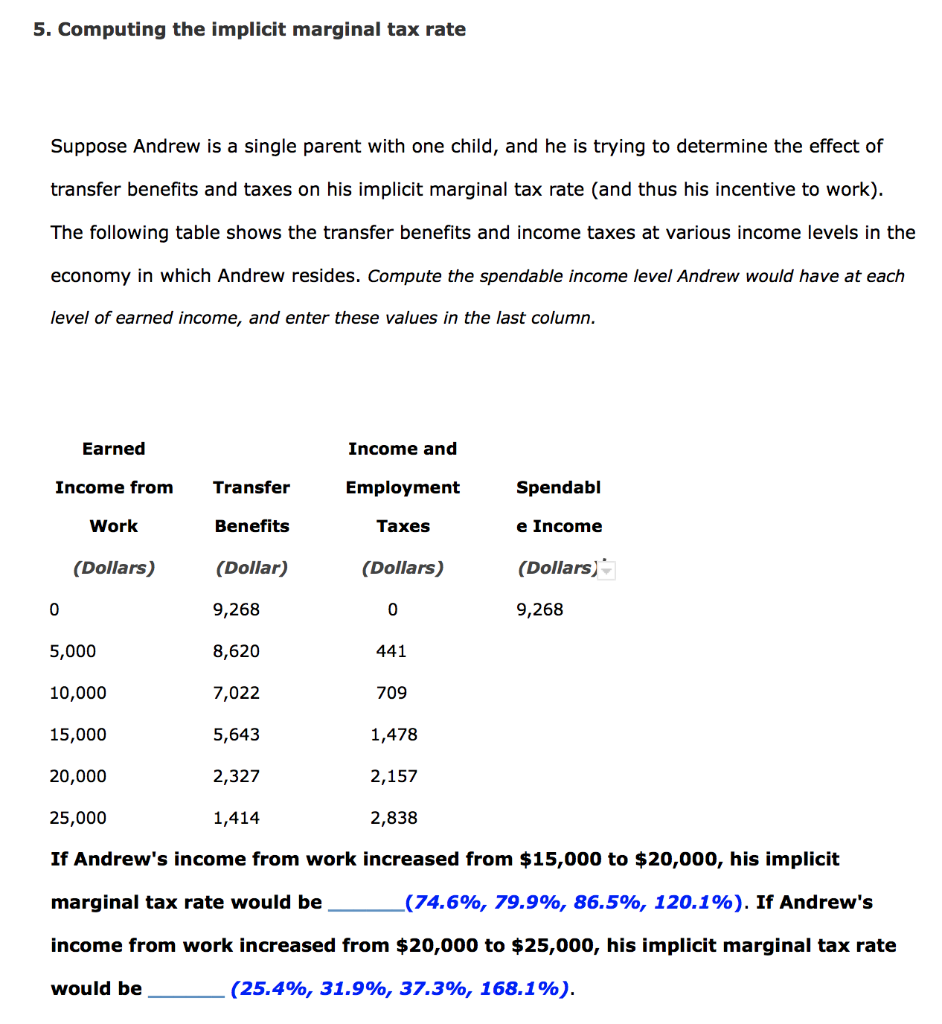

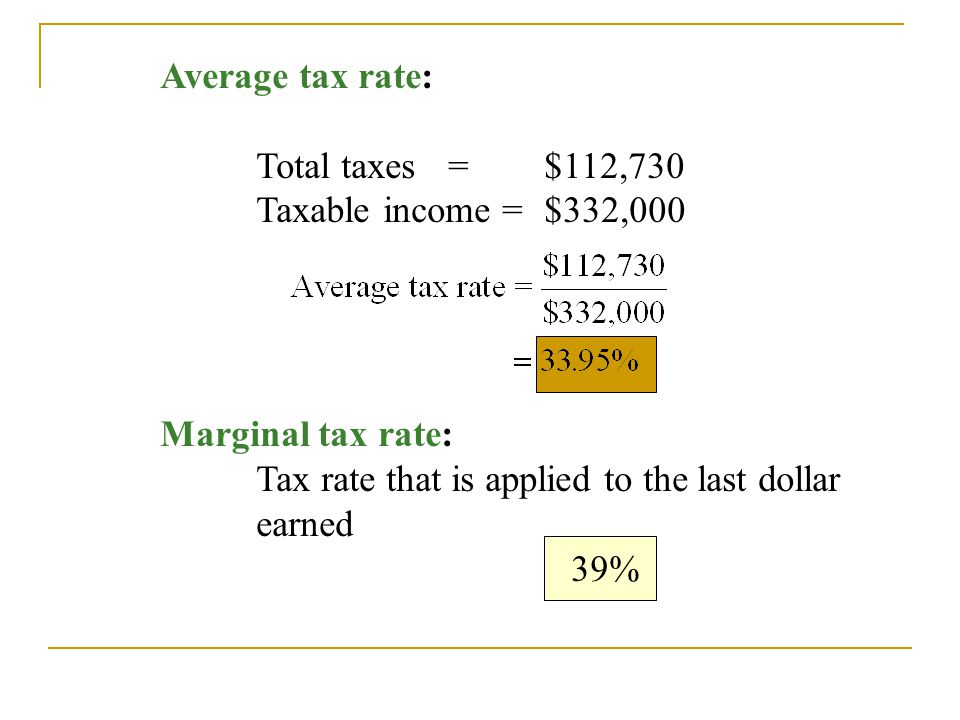

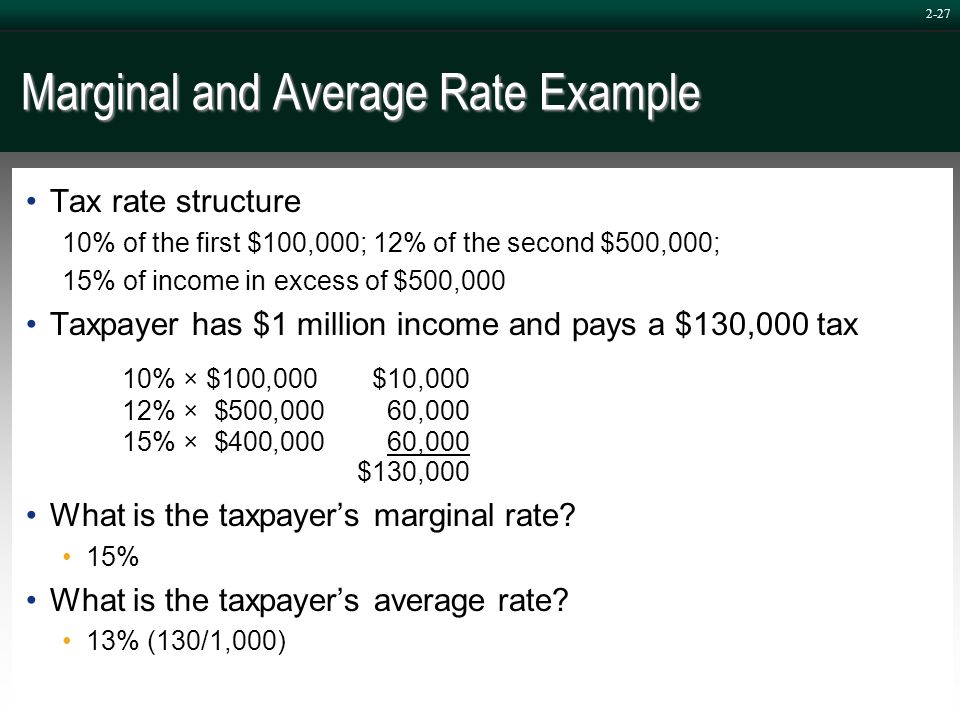

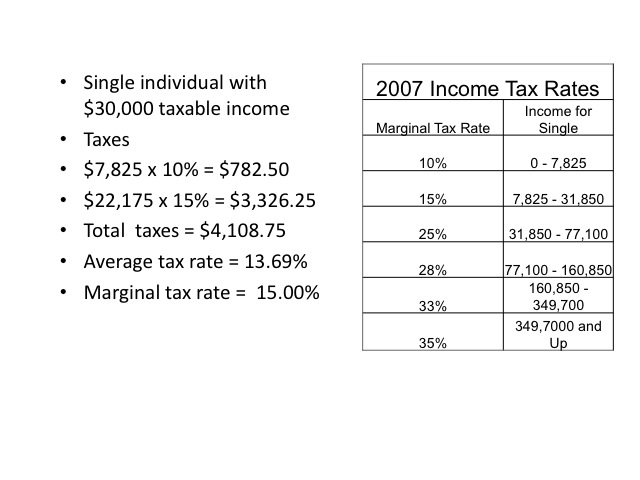

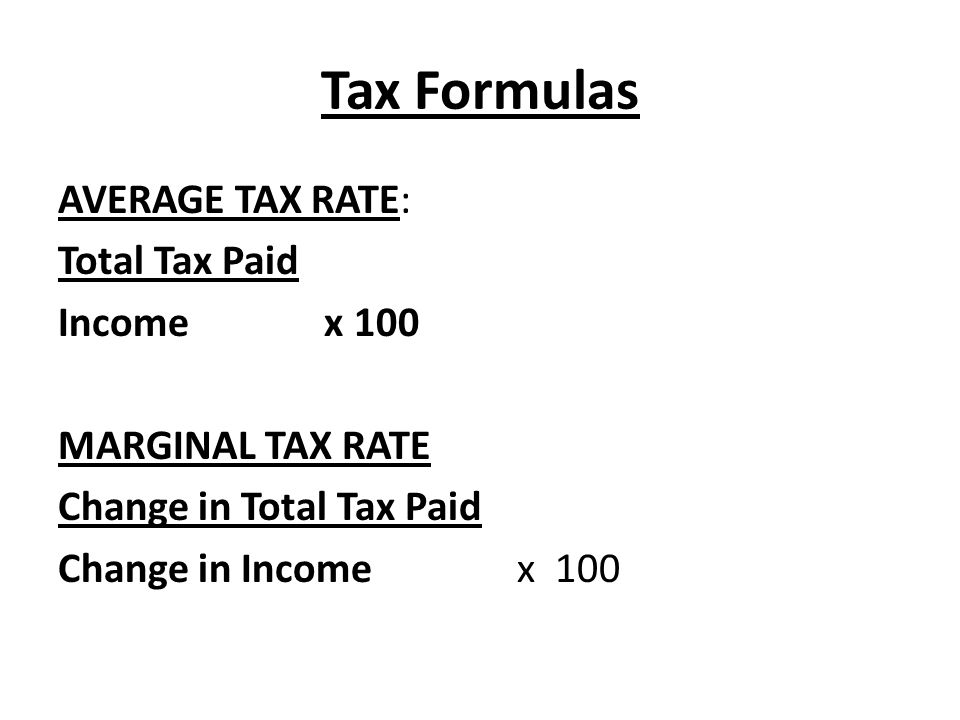

How to calculate marginal tax rate formula. Create a spreadsheet to create an excel spreadsheet that calculates the marginal tax rate begin by opening a spreadsheet and create columns with the titles taxable income marginal tax rate. To find your effective tax rate add up the amounts of the varying tax rates to find a single sum. Alternatively the marginal tax rate formula is as follows. Divide that number by income to find your average tax rate.

B6 b5 c5 d5. Considering the american progressive system your marginal tax rate rises with income and is equal to the rate of the highest tier you reach through. Technically speaking the marginal tax rate is the percentage rate within any given bracket. The formula in d6 copied down is.

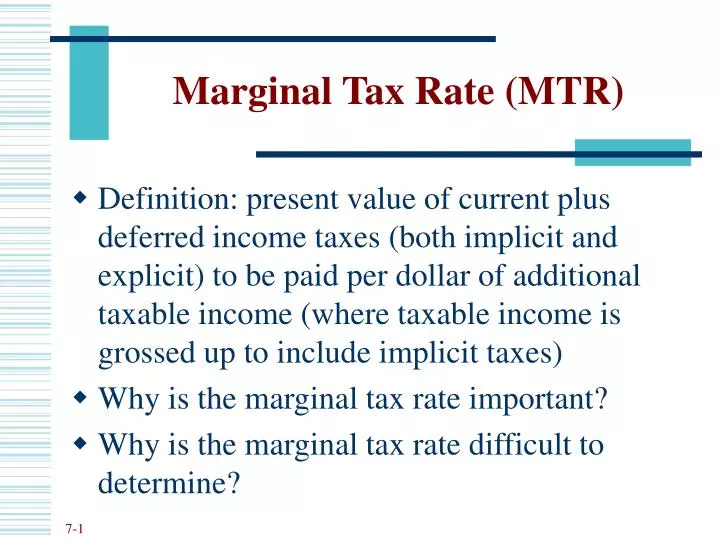

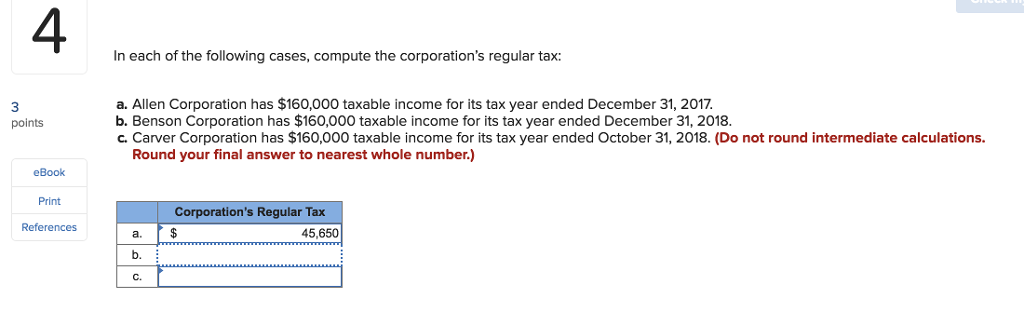

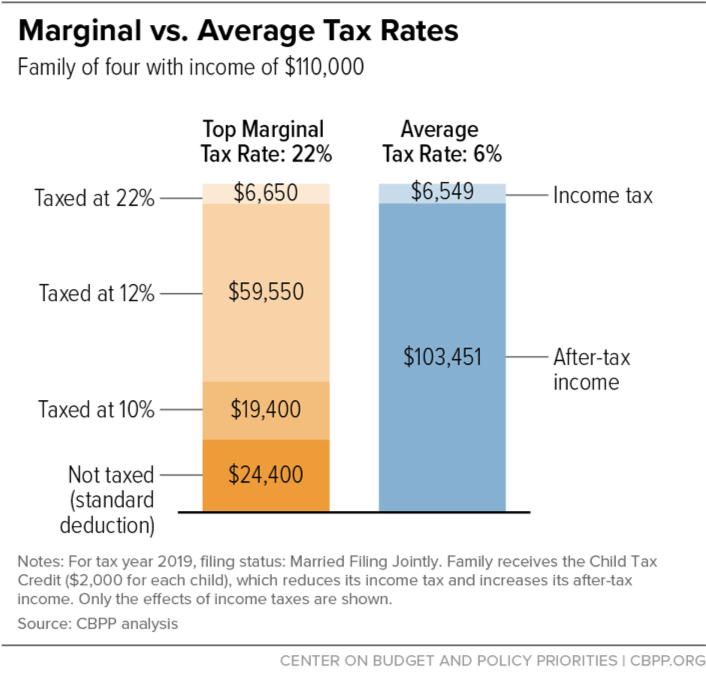

It can be calculated by dividing increase in tax payable in response to a 1 increase in taxable income. The marginal rate in the first bracket is 10 percent and the marginal rate in the second bracket is 12. Total income tax taxable income n x tax rate under a tax bracket m taxable income n1 x tax rate under a tax bracket m1. At each row this formula applies the rate from the row above to the income in that bracket.

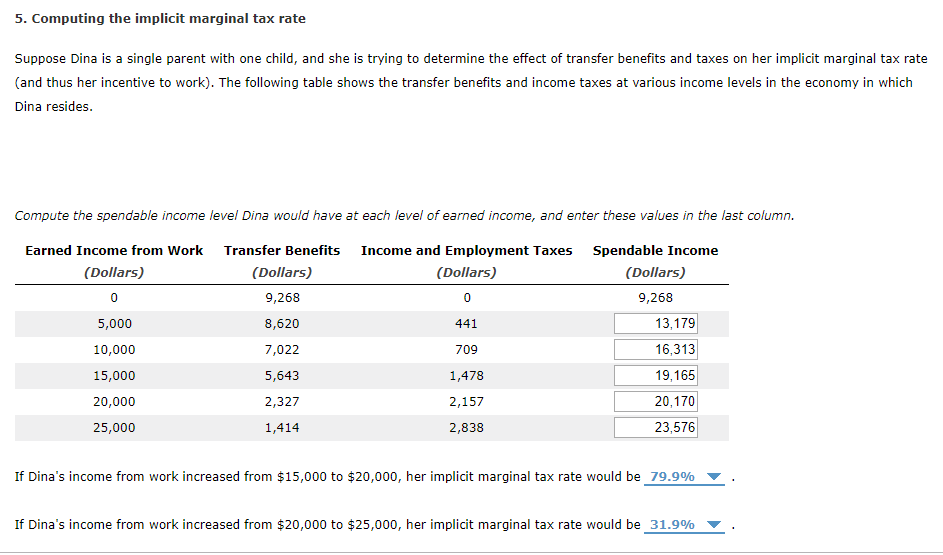

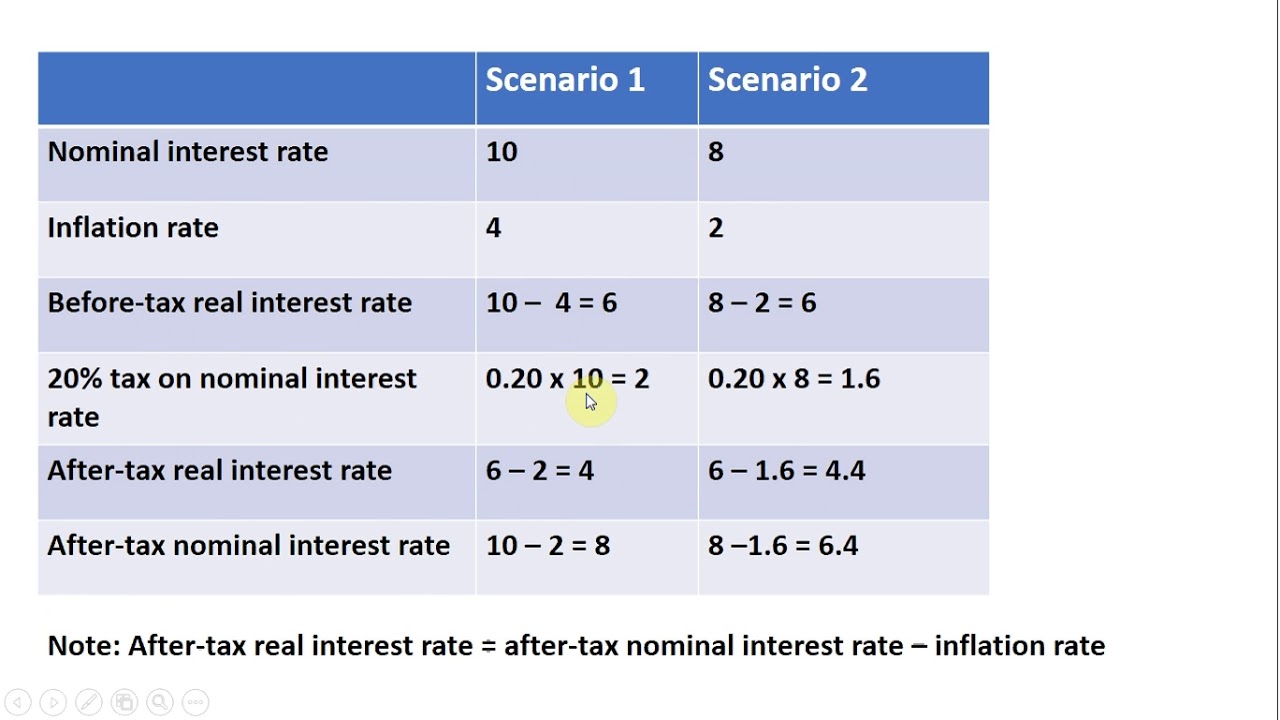

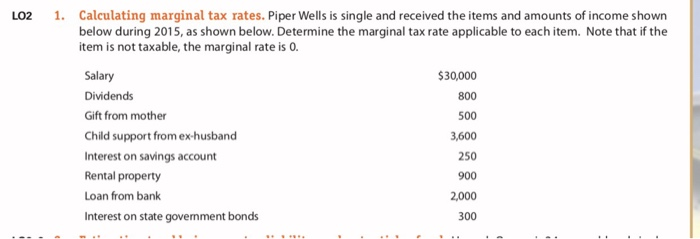

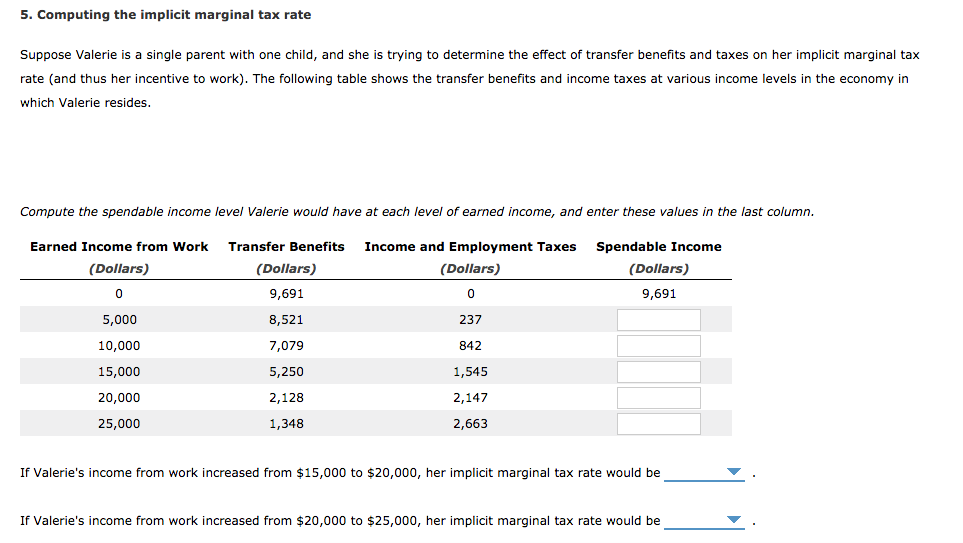

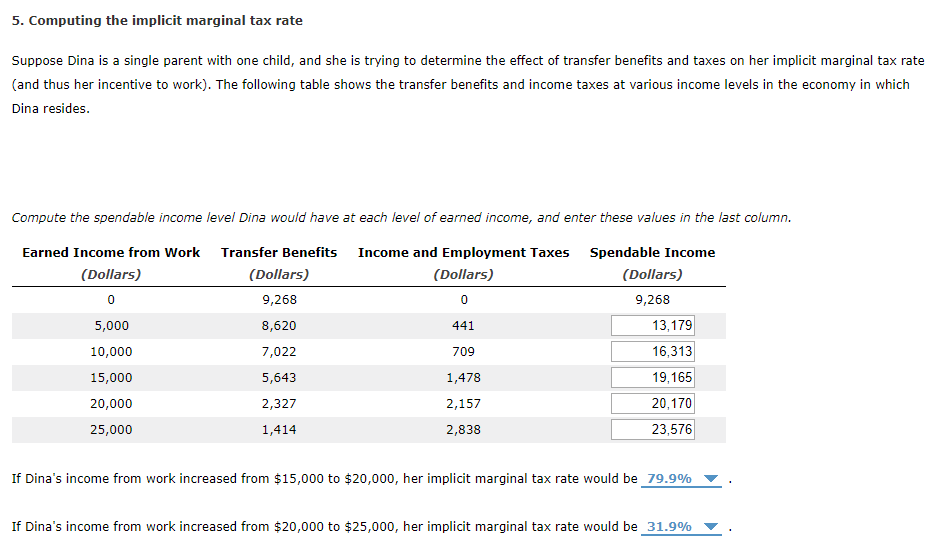

To calculate the marginal tax rate on the investment youll need to figure out the additional tax on the new income. When considering how marginal tax rate will affect an increase in income you must first consider where in the bracket your current income lies. How to calculate marginal tax rate marginal tax rate is calculated by multiplying the income in a given bracket by the adjacent tax rate. An easy way to think of marginal tax rate is to define it as the rate you would pay on a fictional additional dollar of income.

:max_bytes(150000):strip_icc()/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)