How To Calculate Marginal Tax Rate And Average Tax Rate

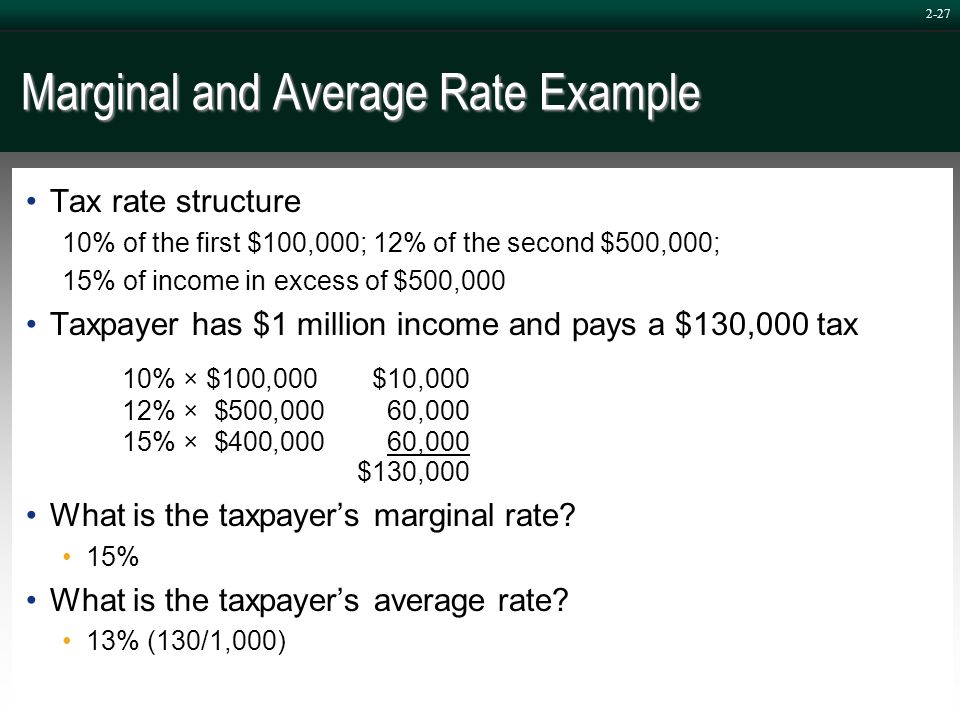

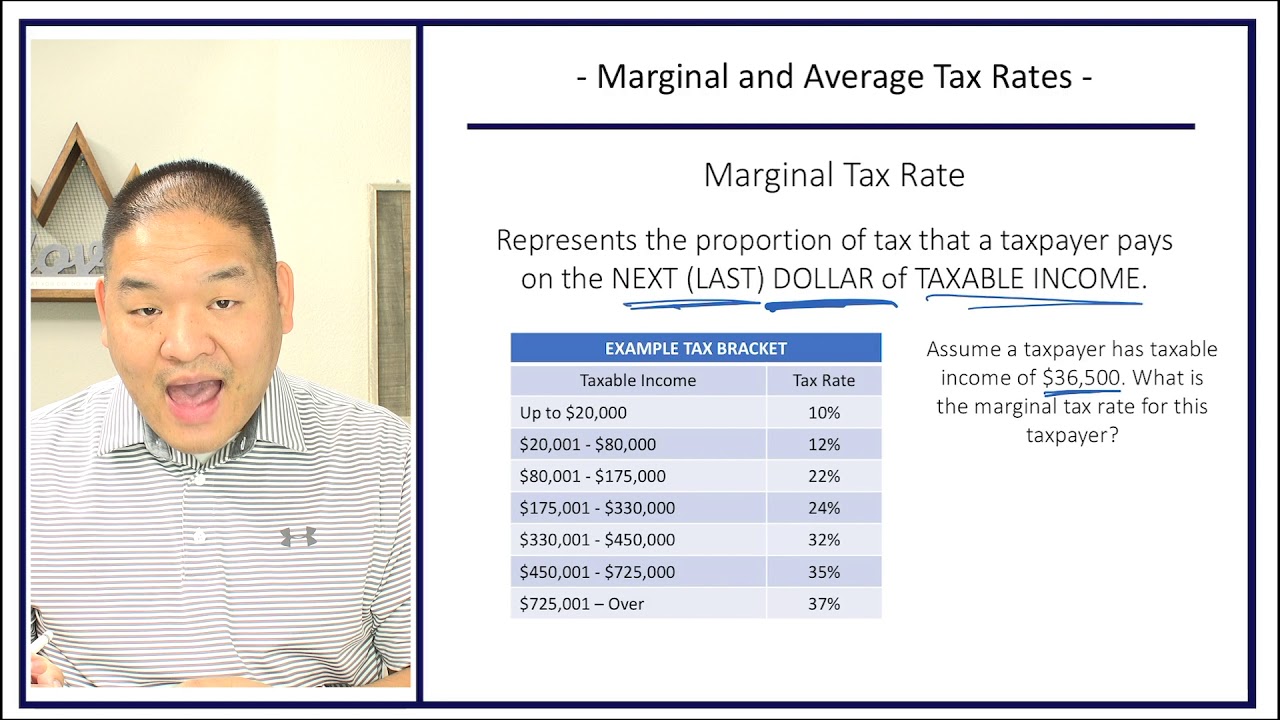

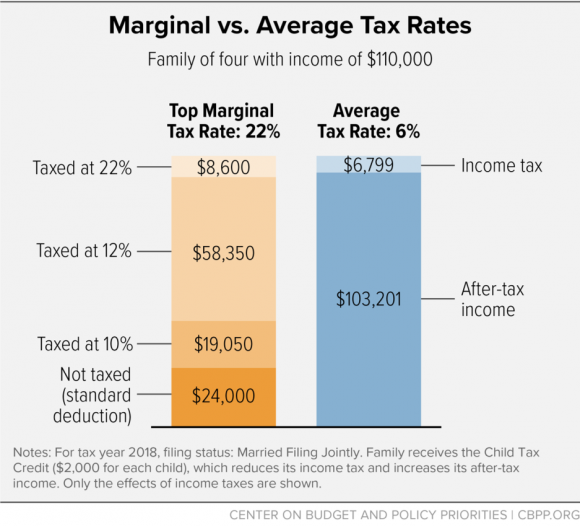

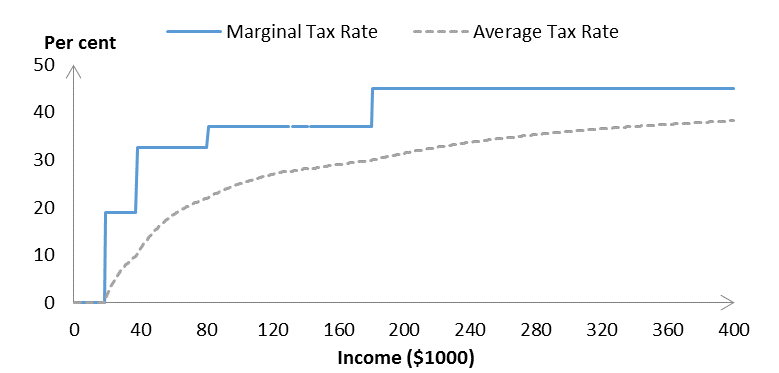

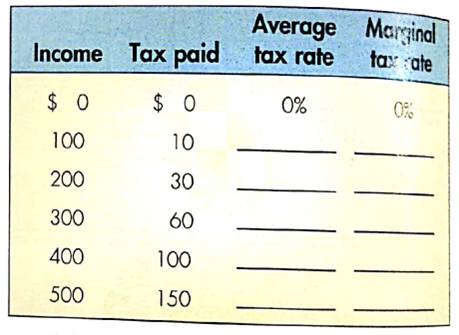

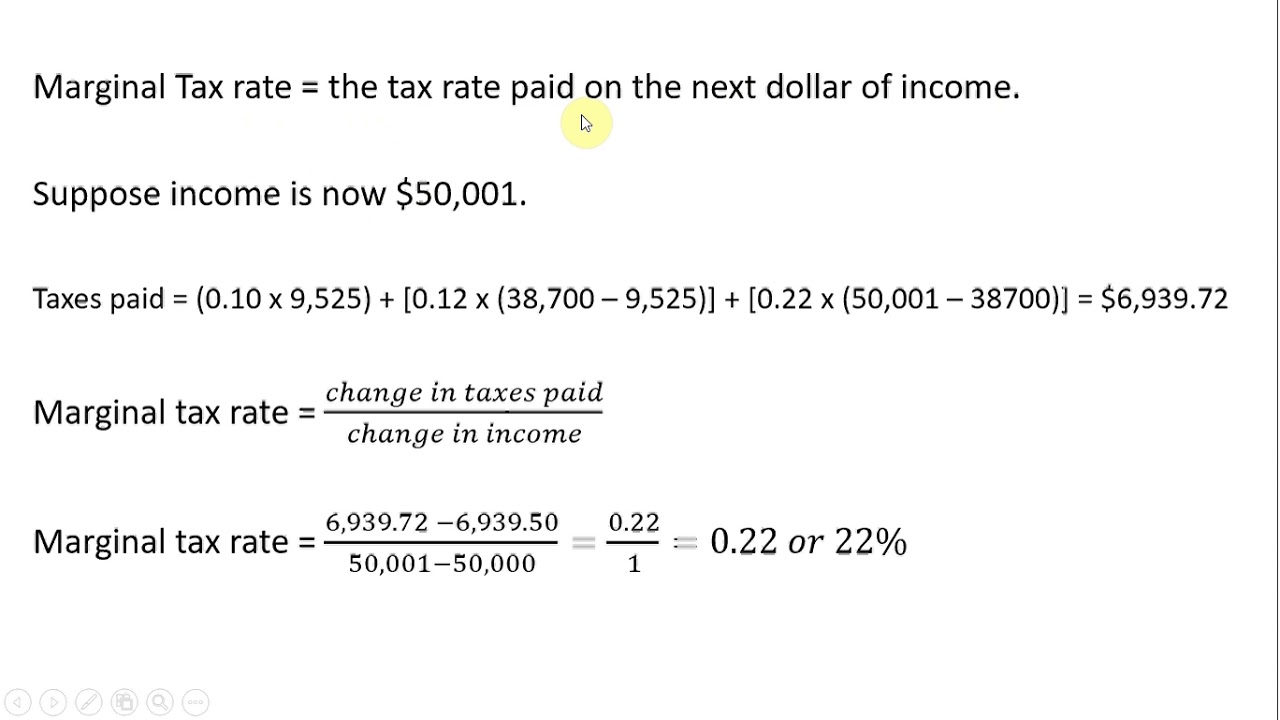

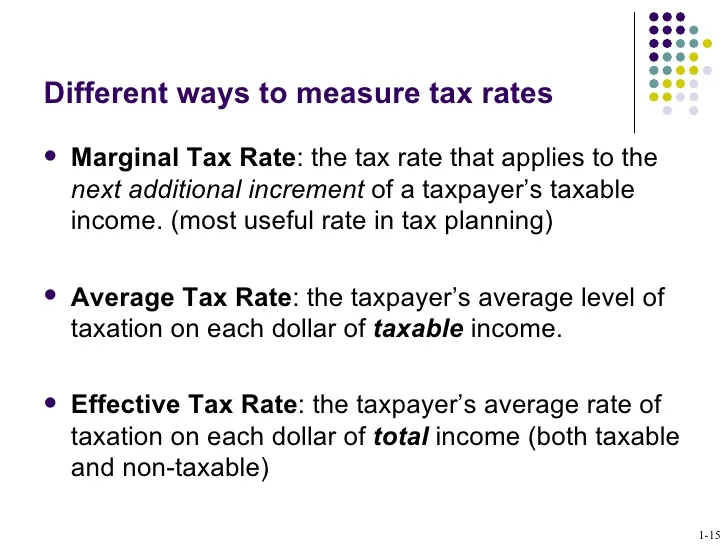

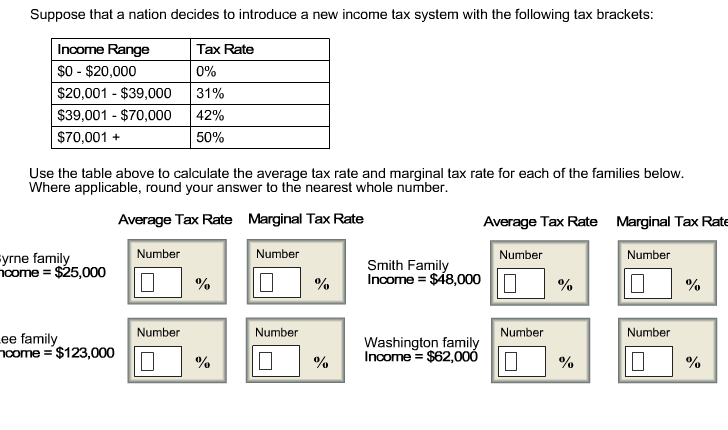

The marginal tax rate is the incremental tax paid on incremental income.

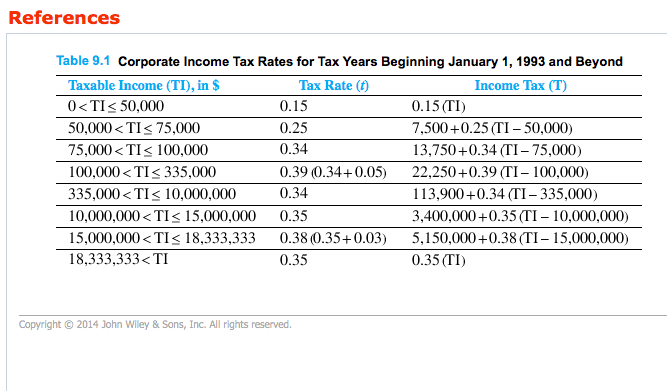

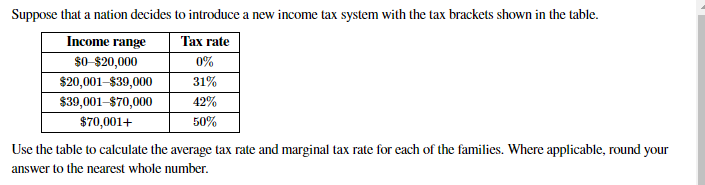

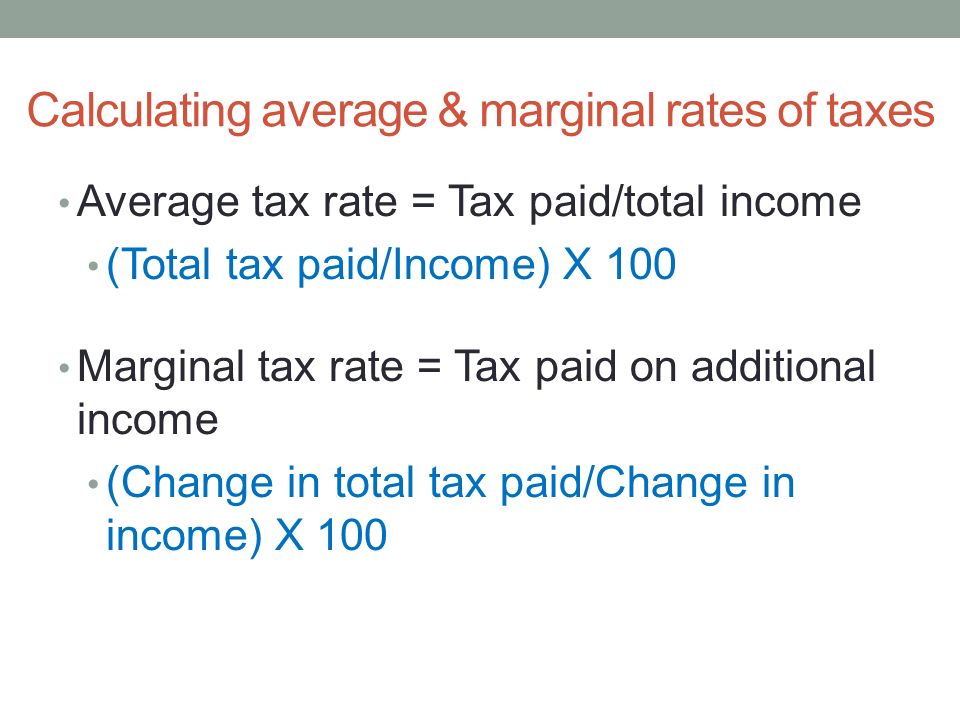

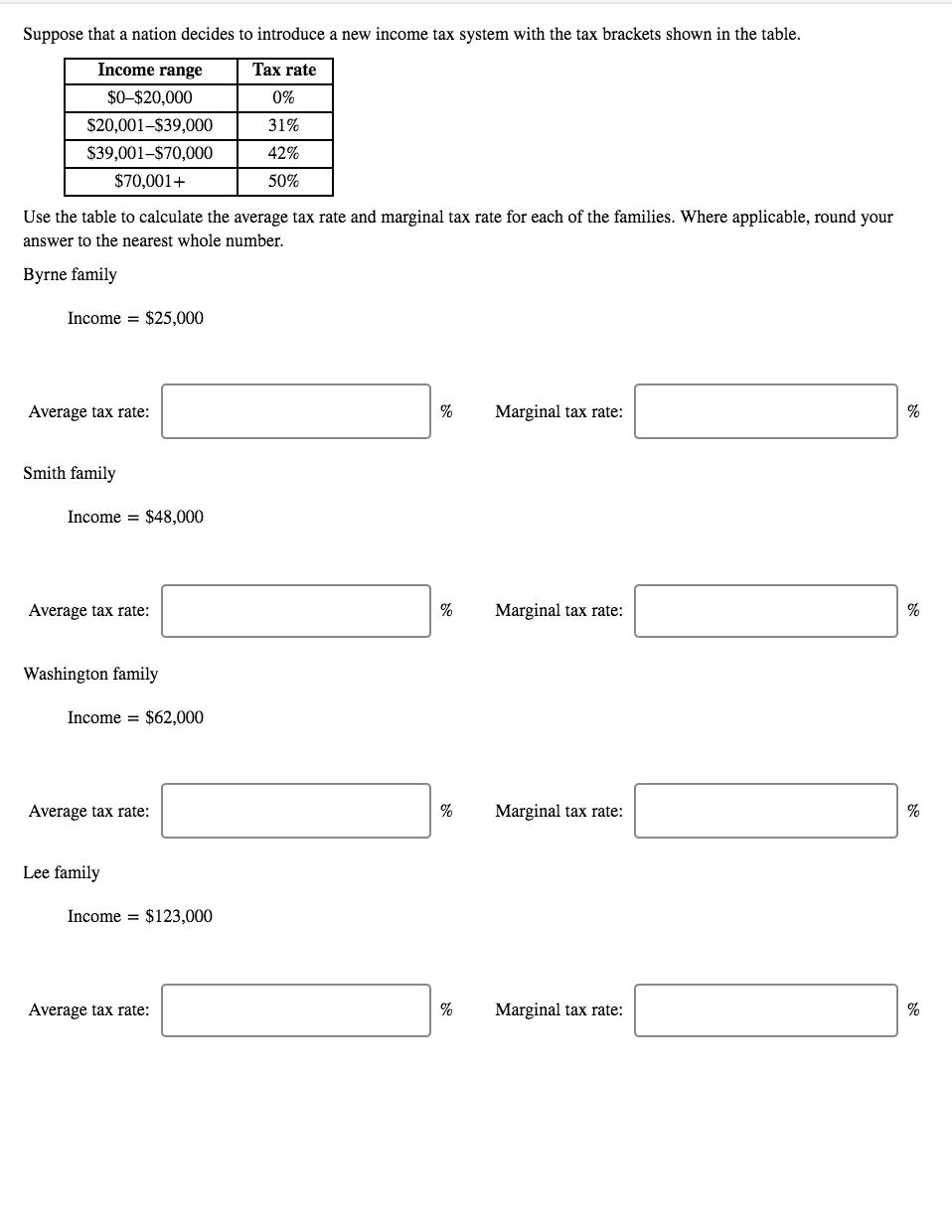

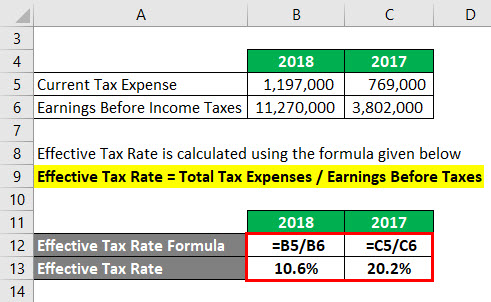

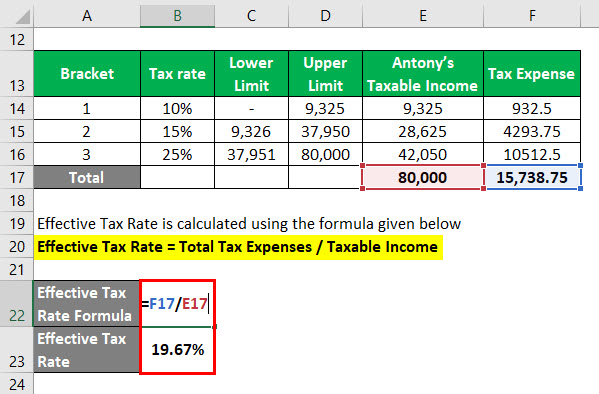

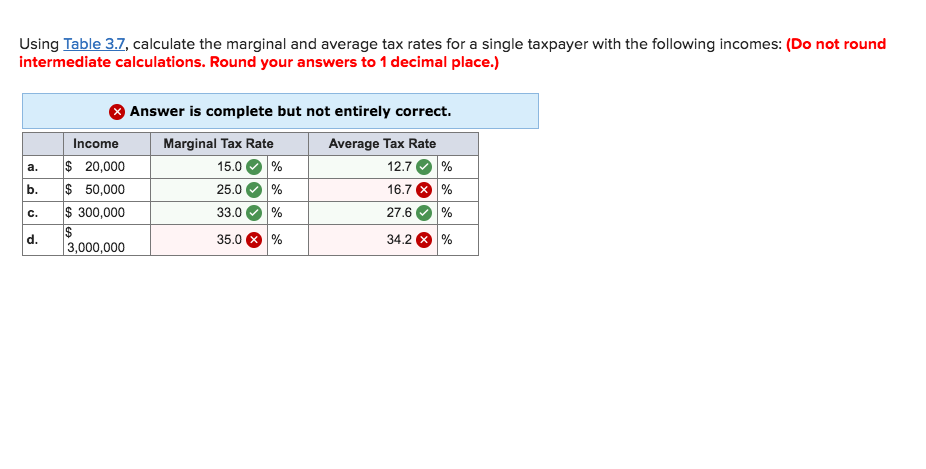

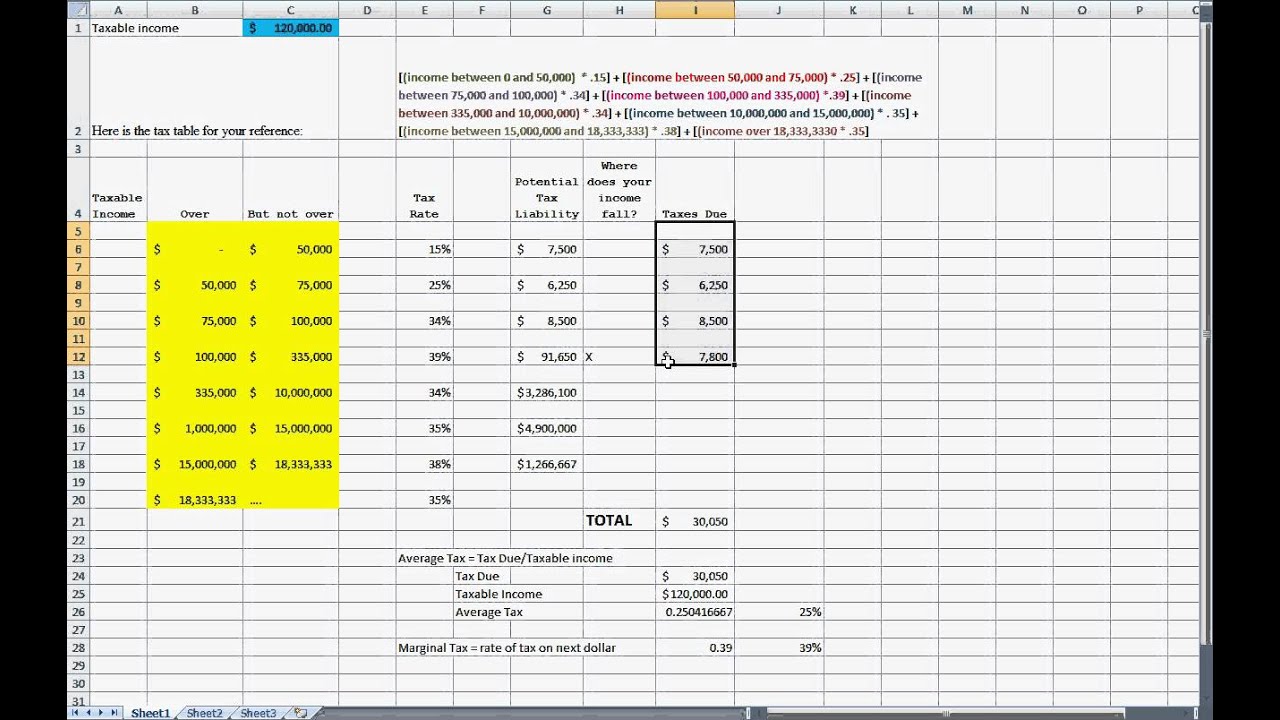

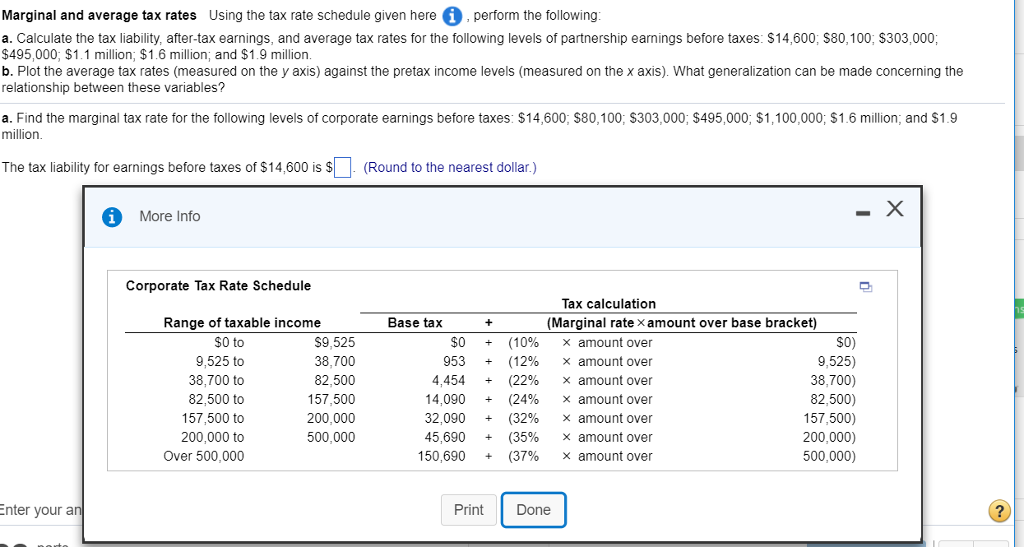

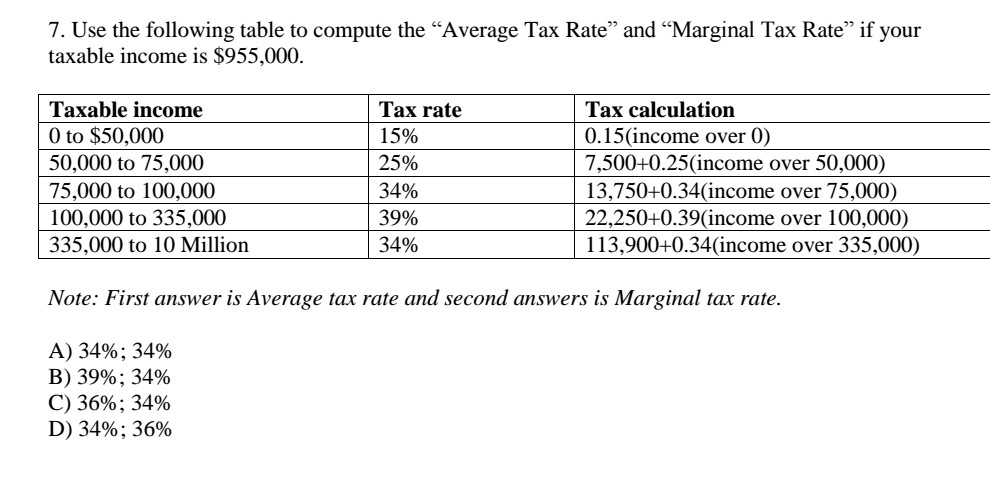

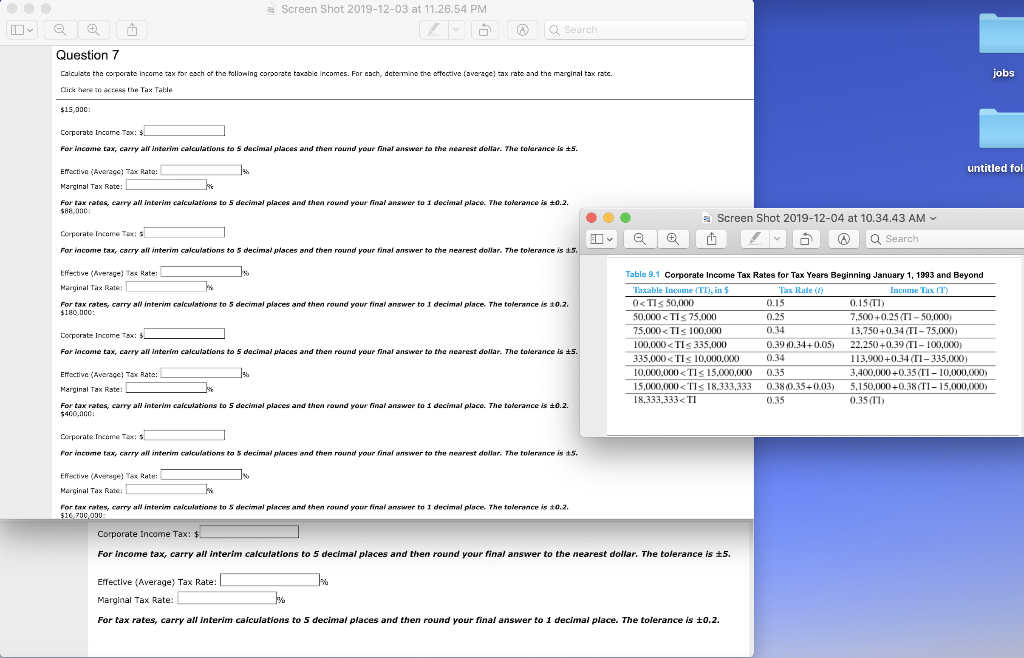

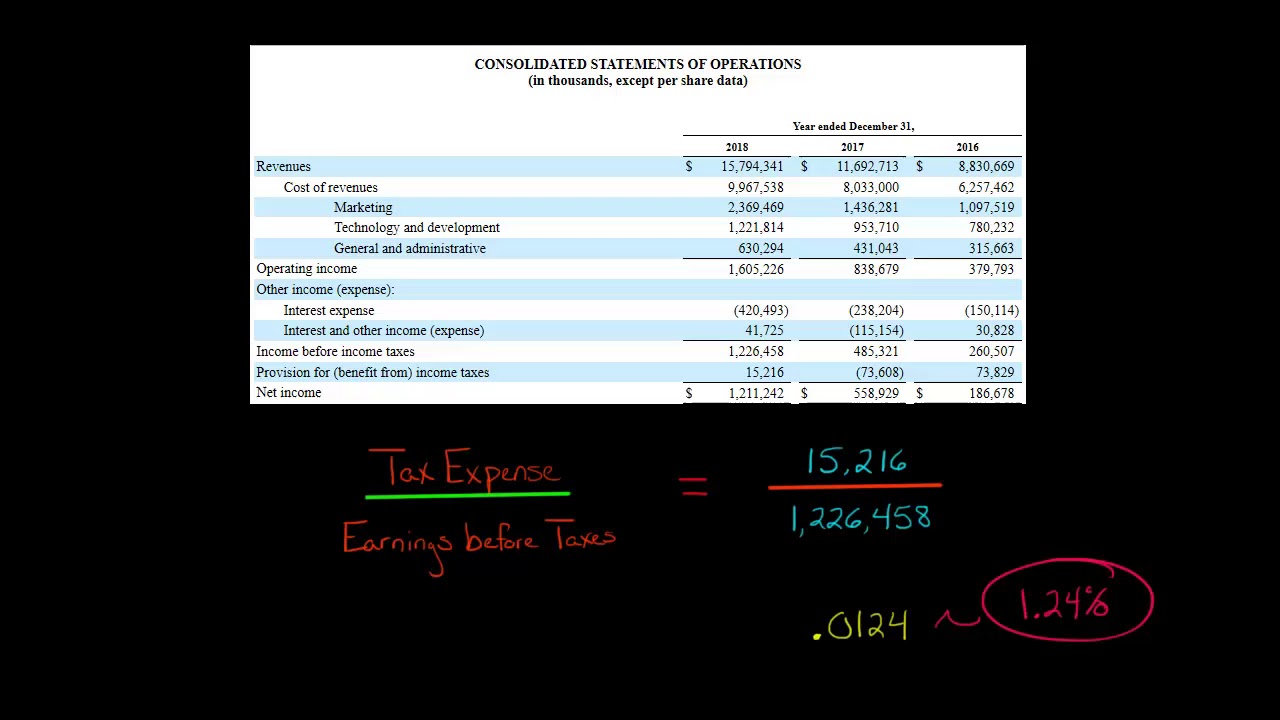

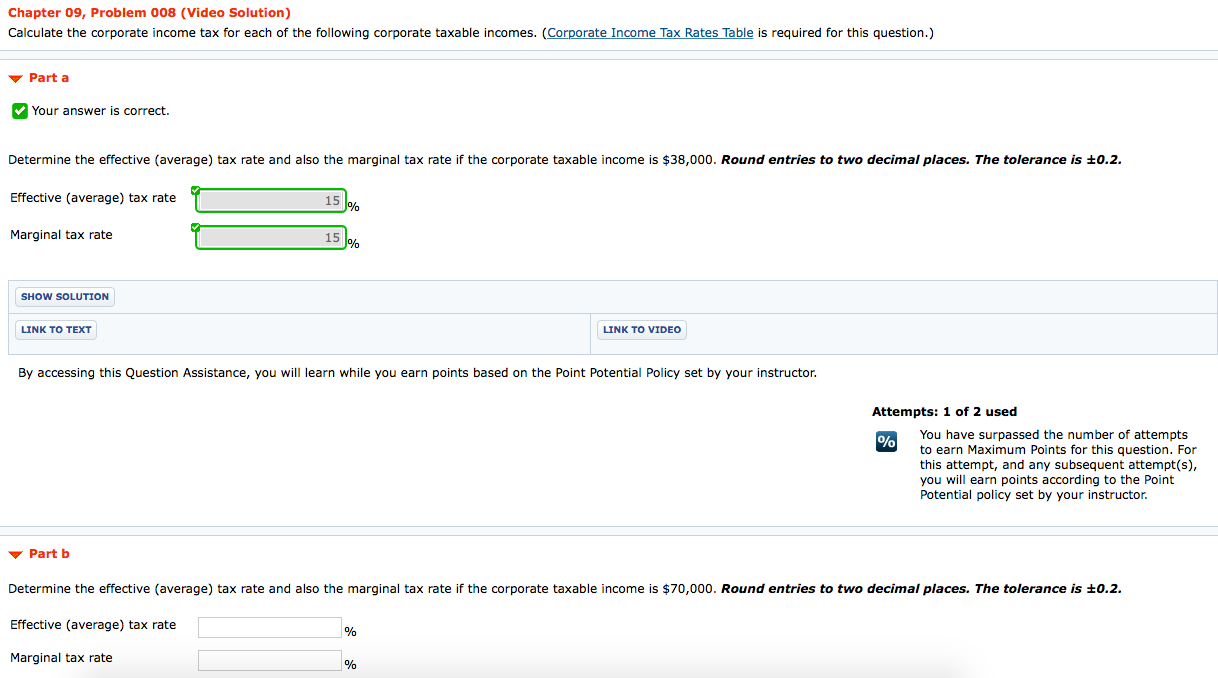

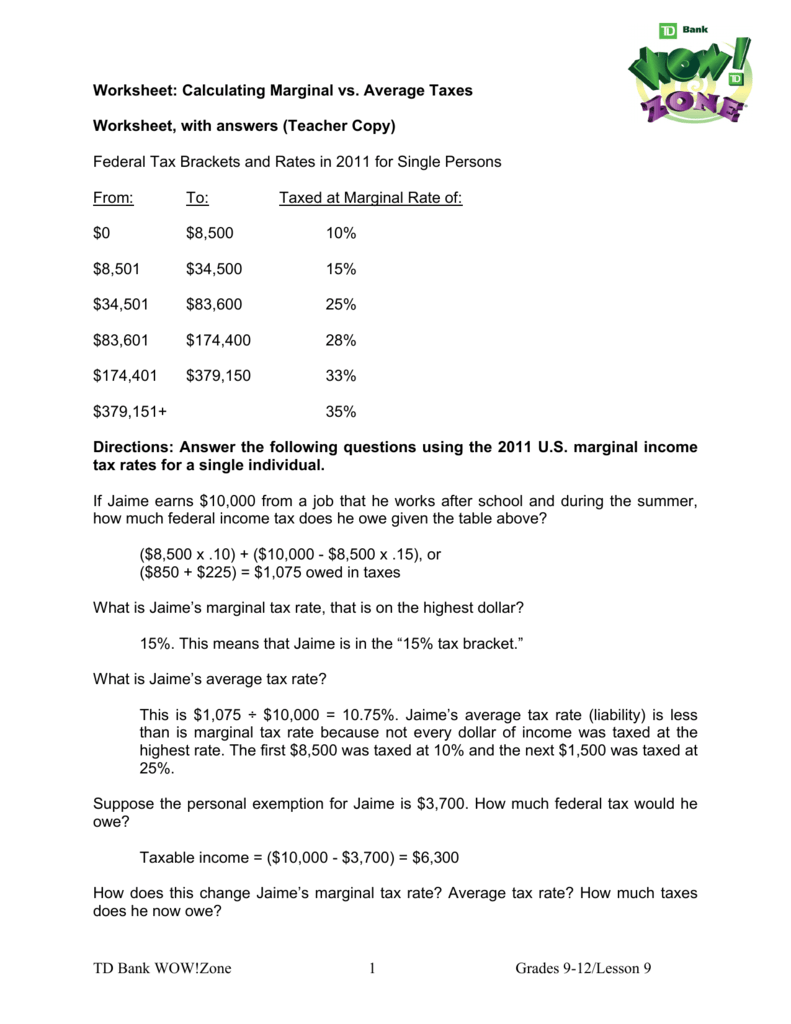

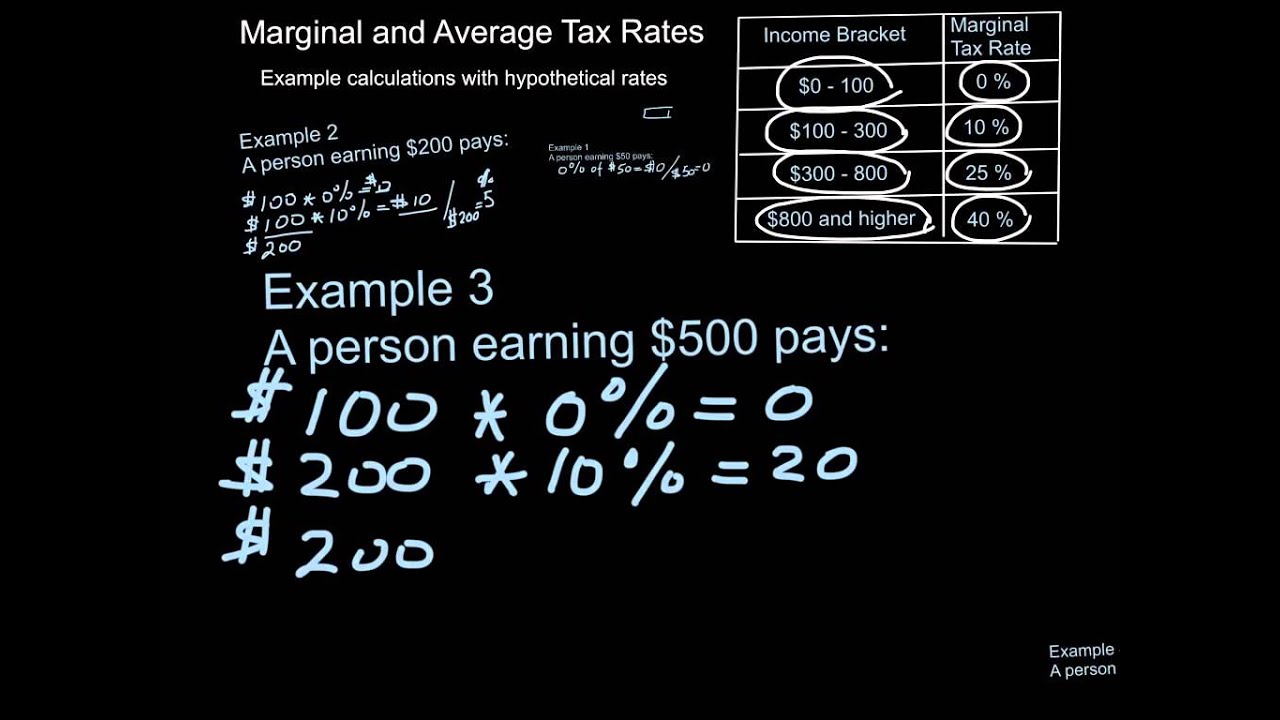

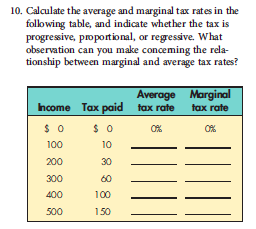

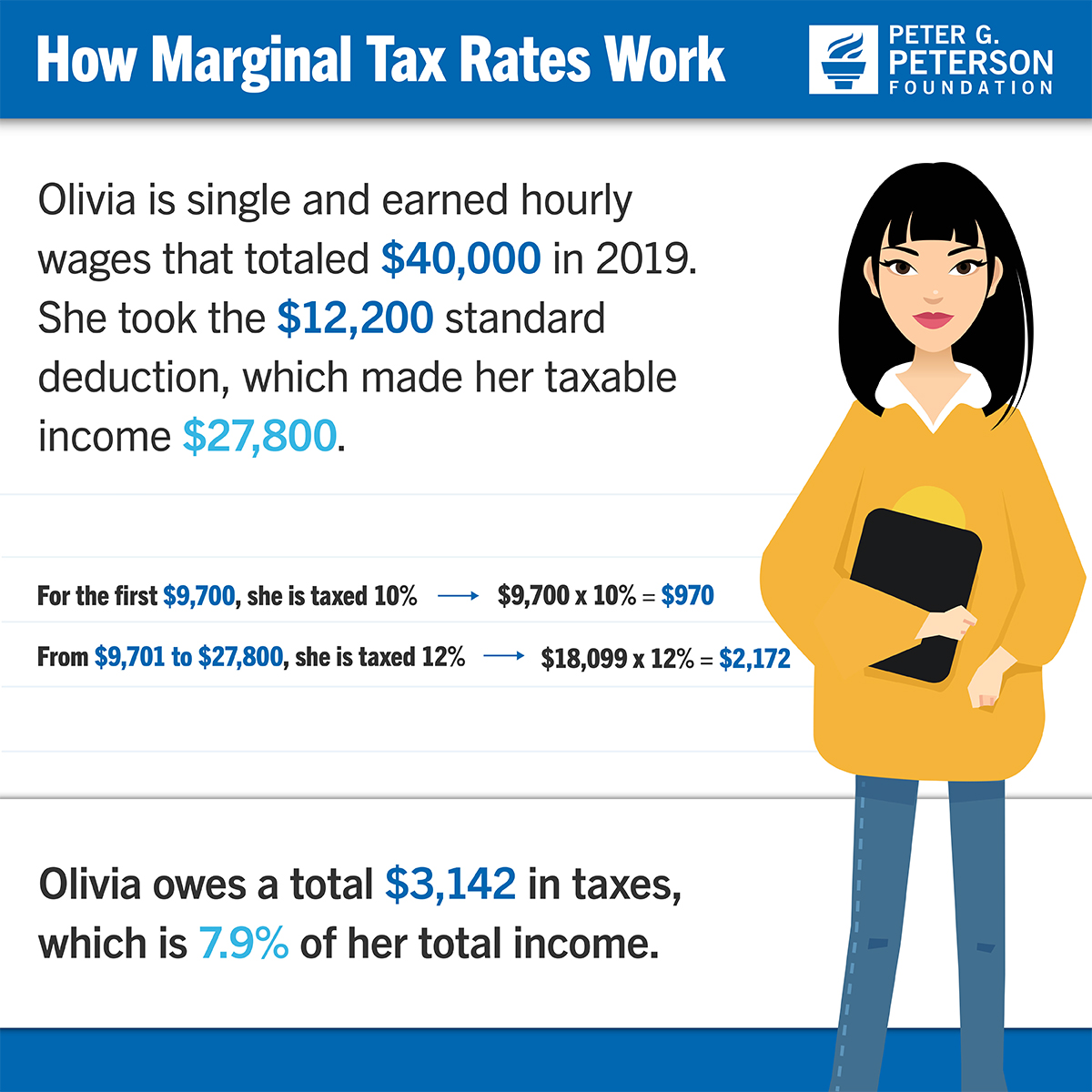

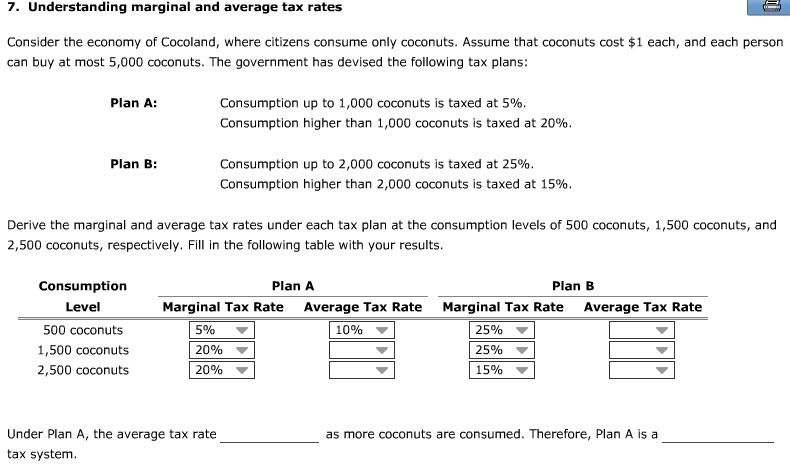

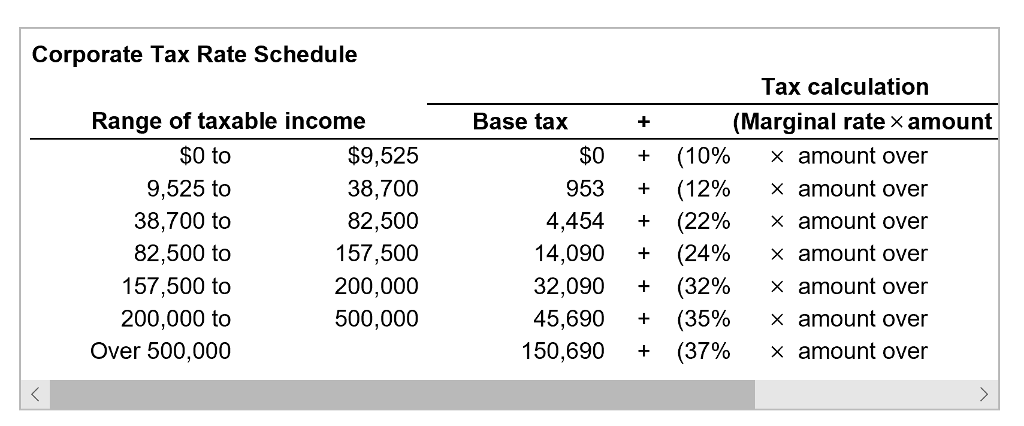

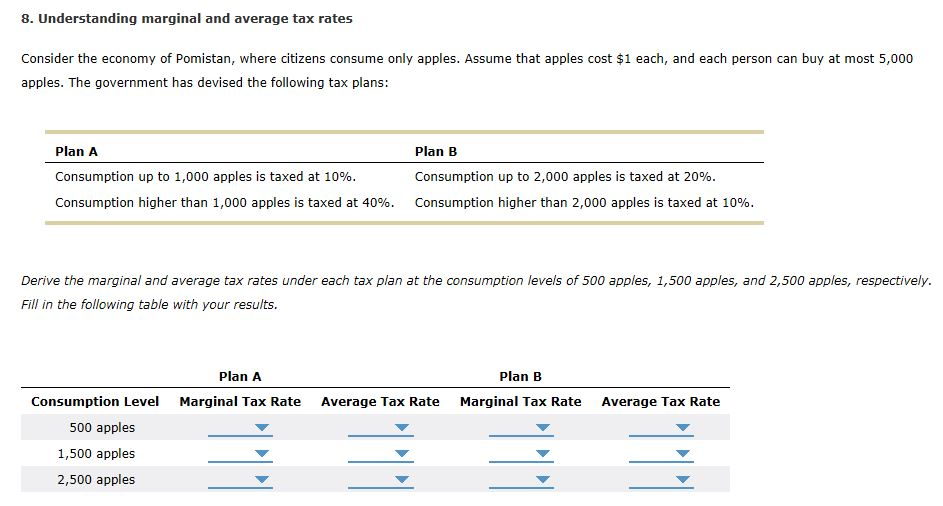

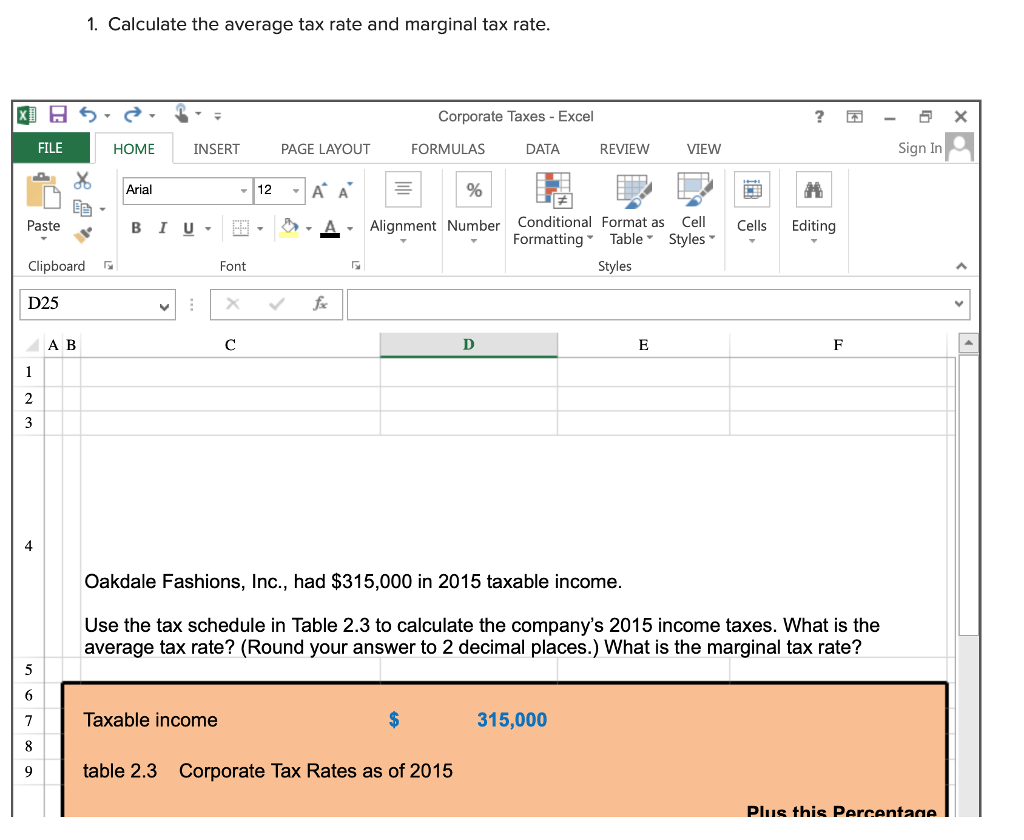

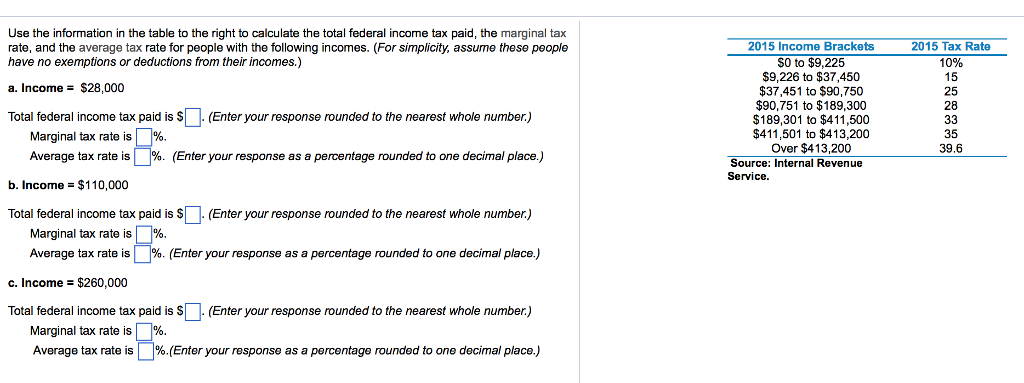

How to calculate marginal tax rate and average tax rate. For example if a household has a total income of 100000 and pays taxes of 15000 the households average tax rate is 15 percent. Divide that number by income to find your average tax rate. Create a spreadsheet to create an excel spreadsheet that calculates the marginal tax rate begin by opening a spreadsheet and create columns with the titles taxable income marginal tax rate. Total income tax taxable income n x tax rate under a tax bracket m taxable income n1 x tax rate under a tax bracket m1.

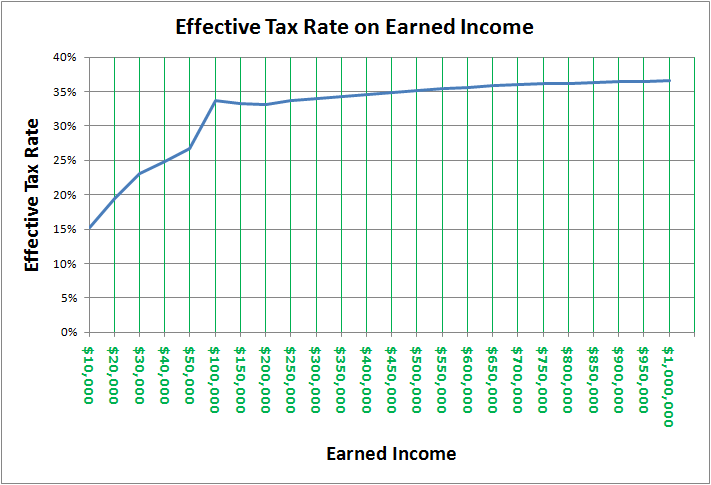

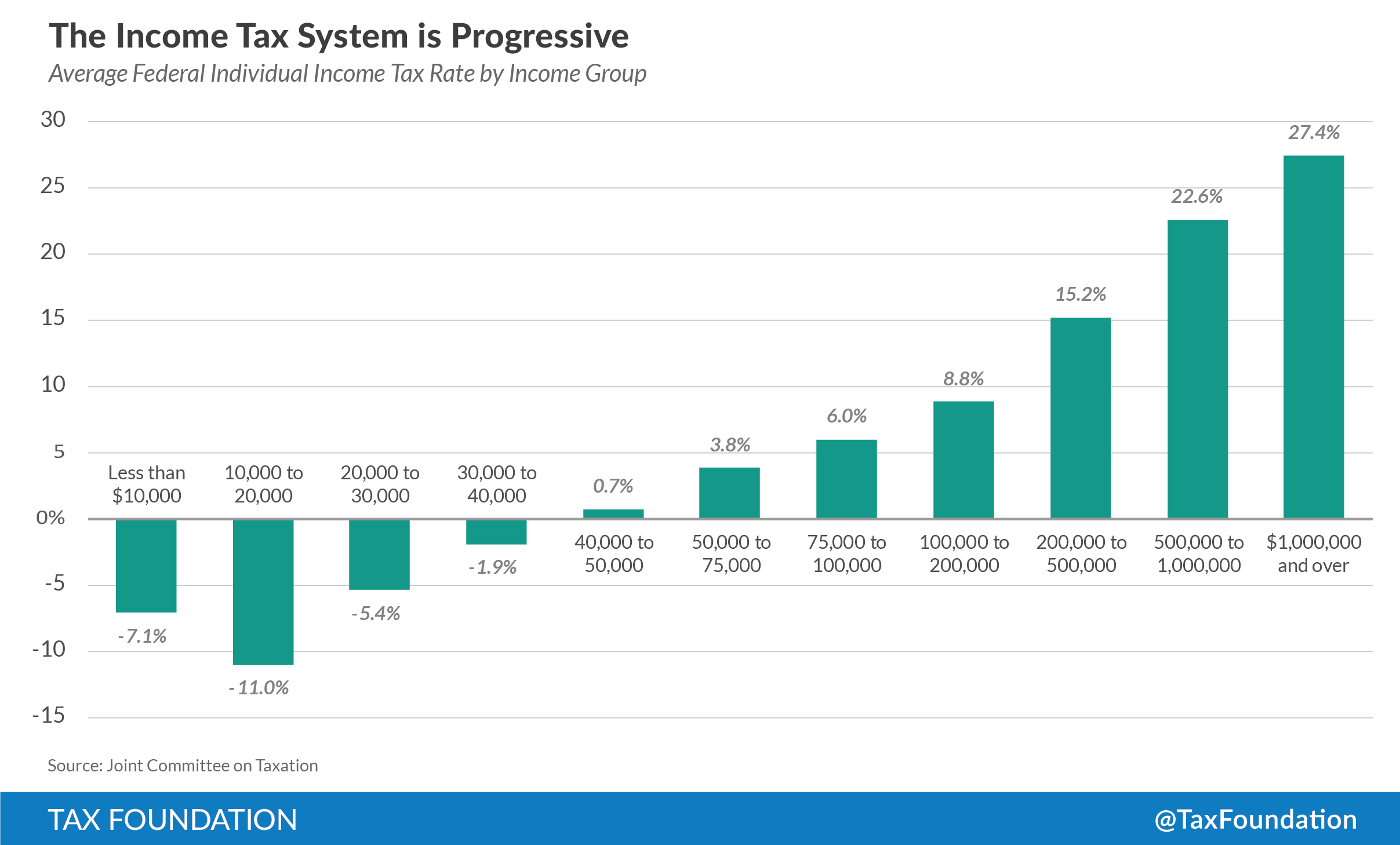

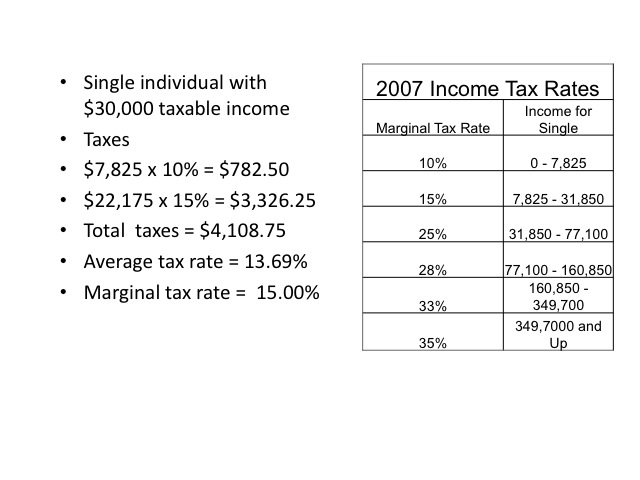

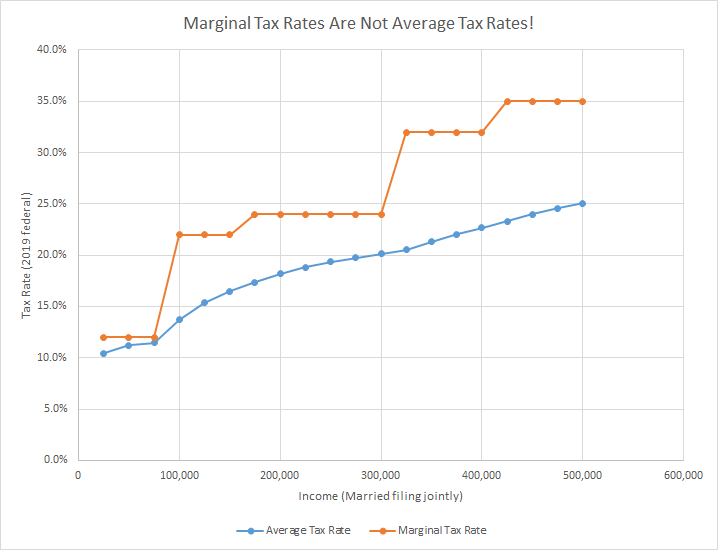

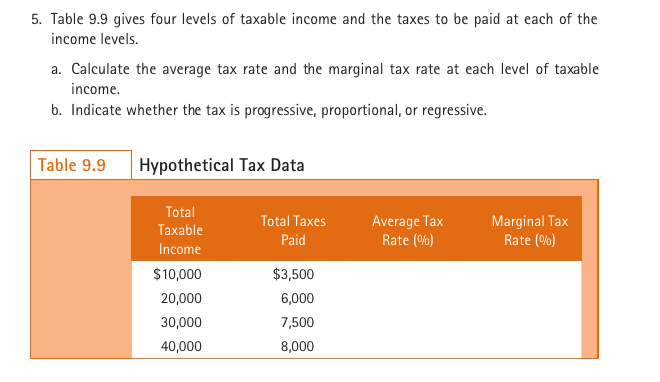

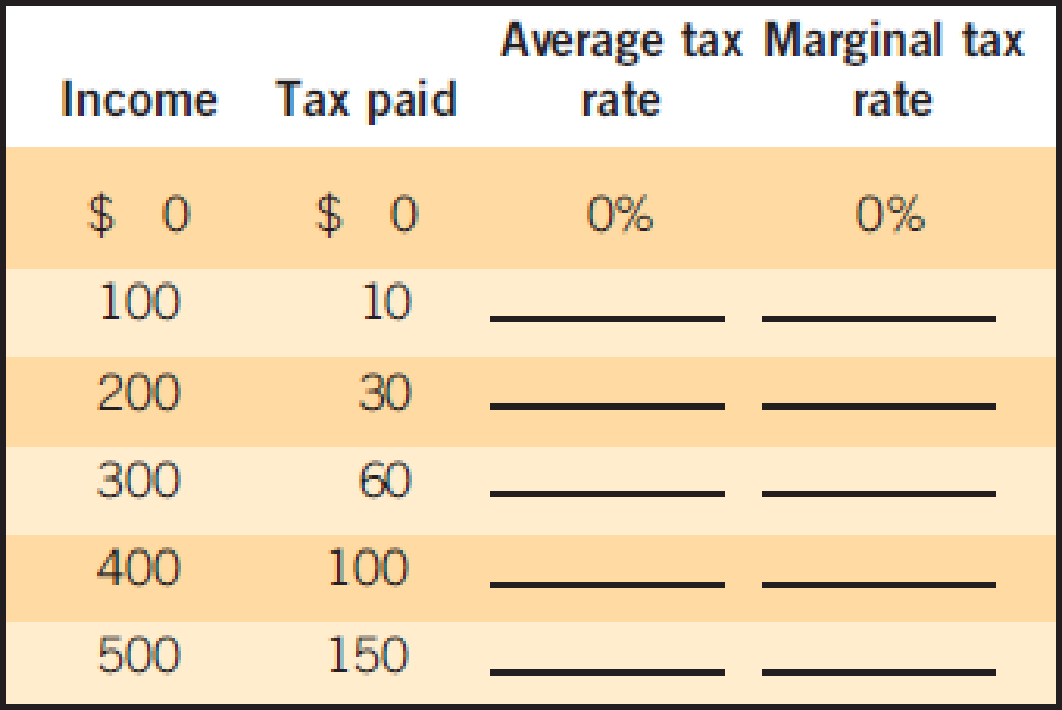

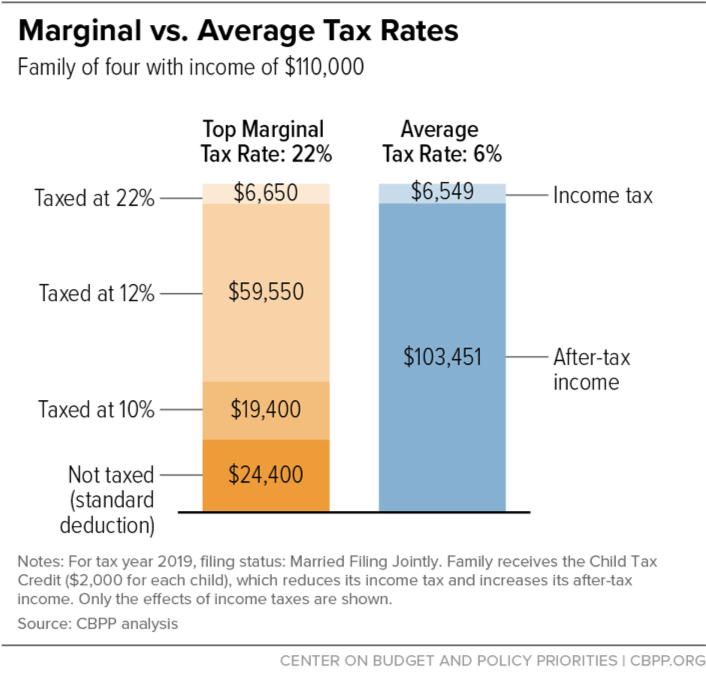

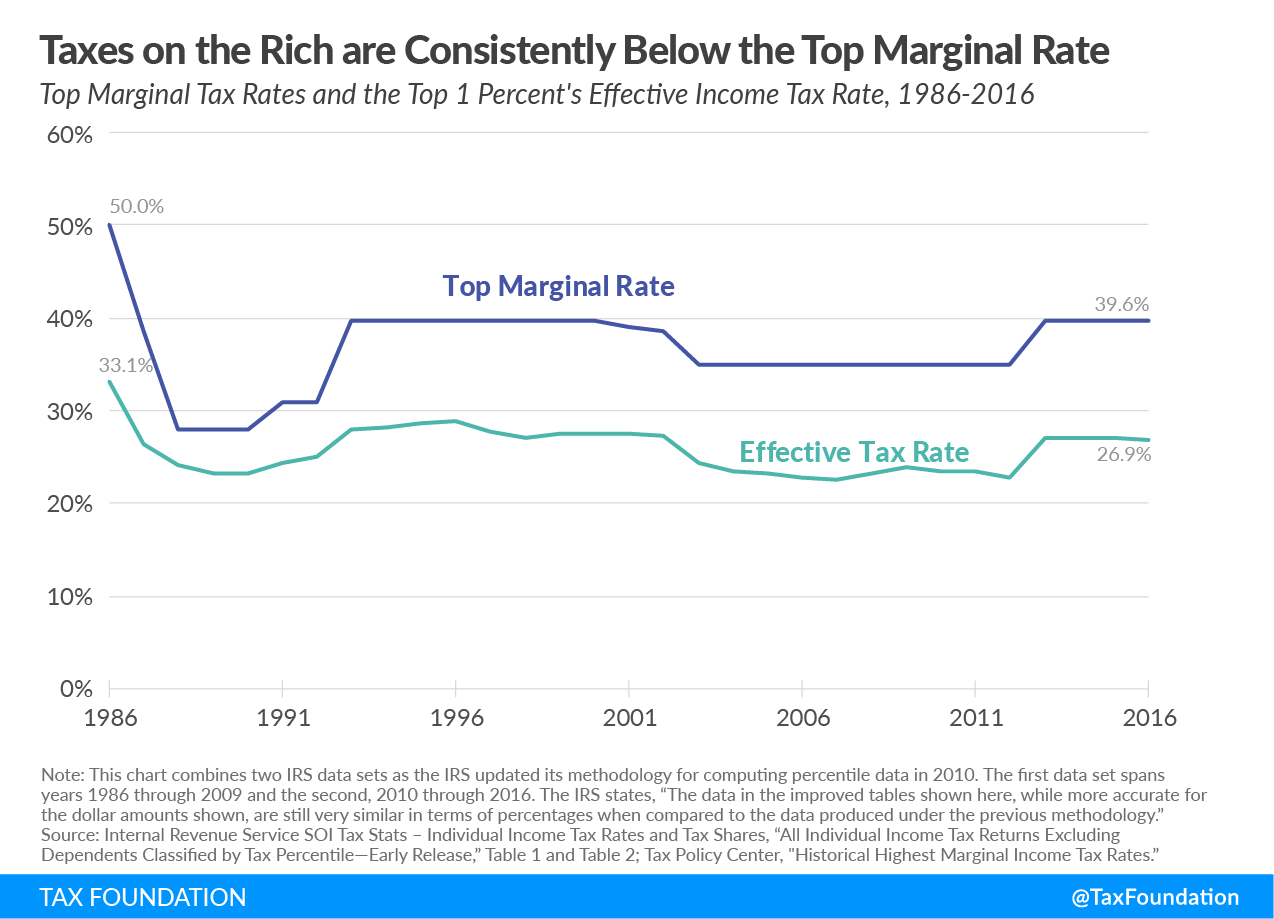

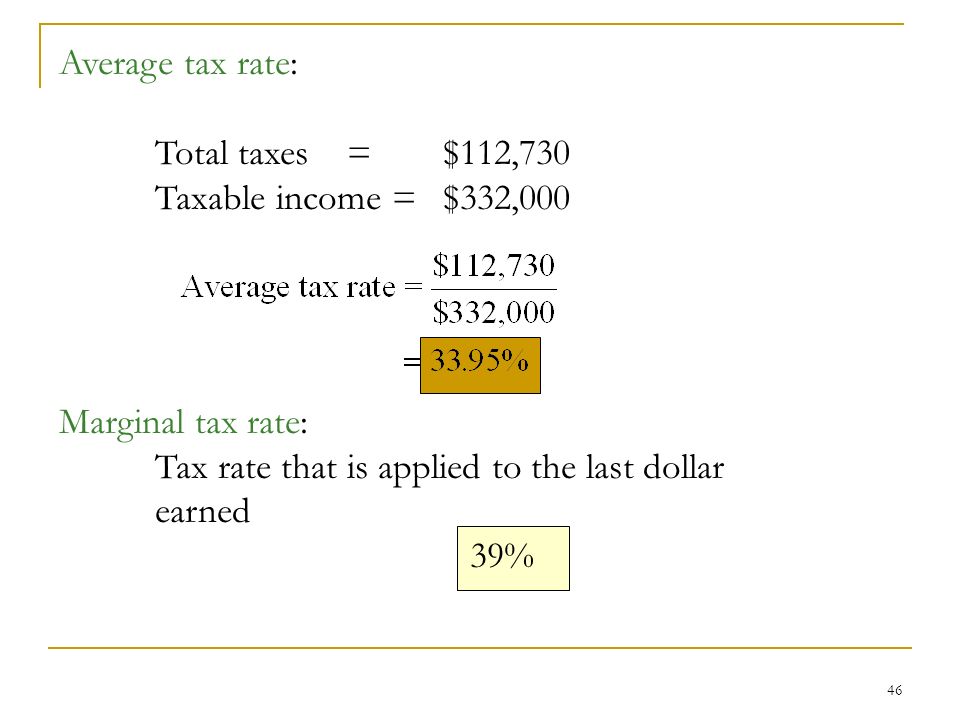

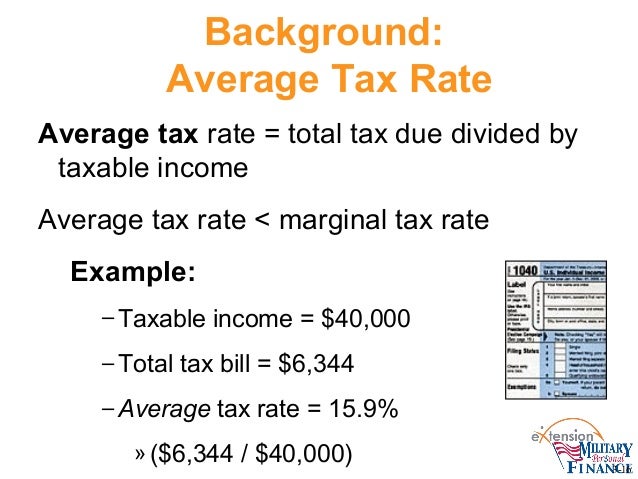

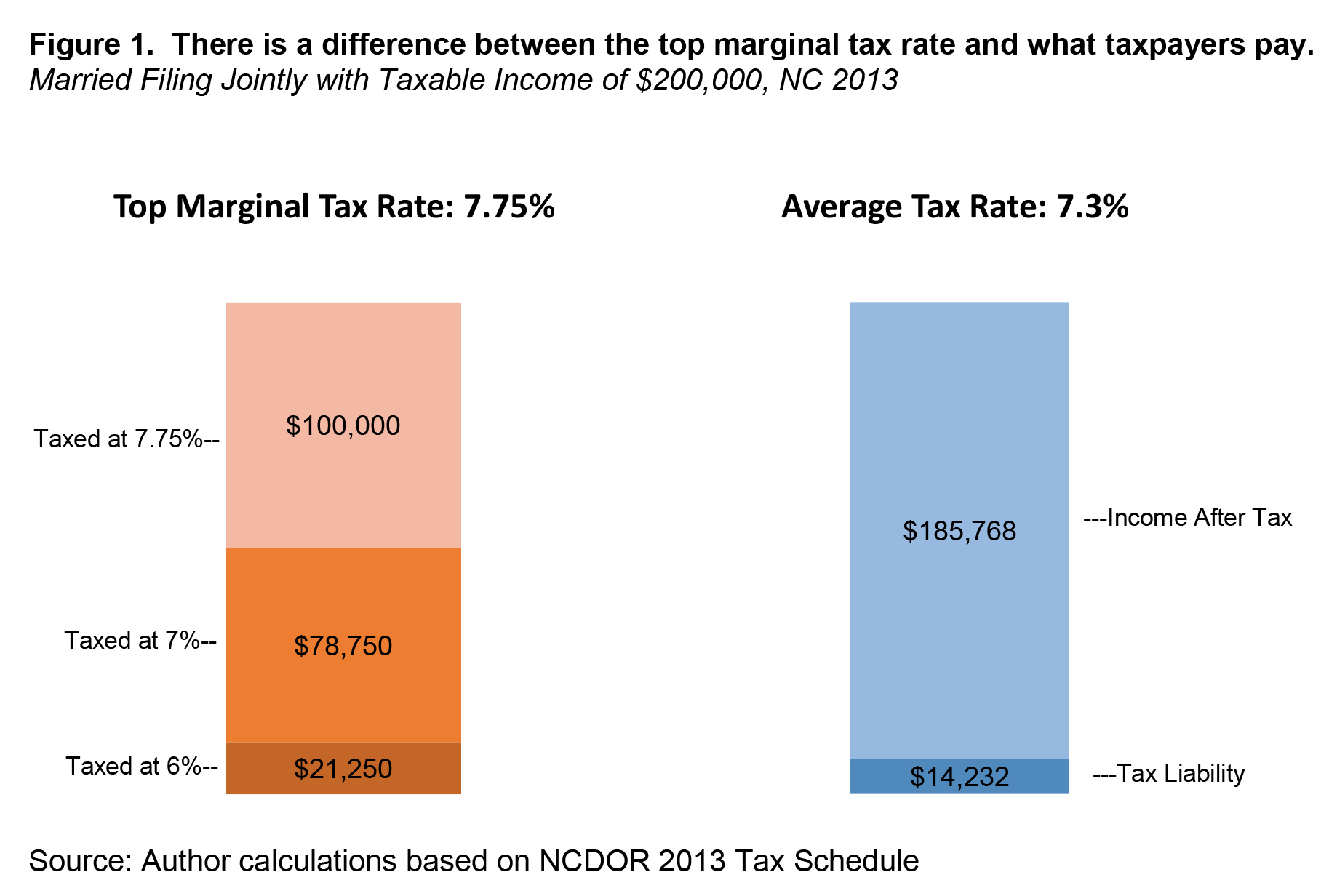

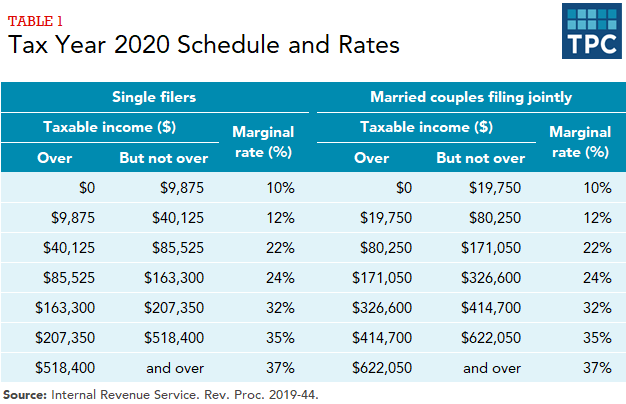

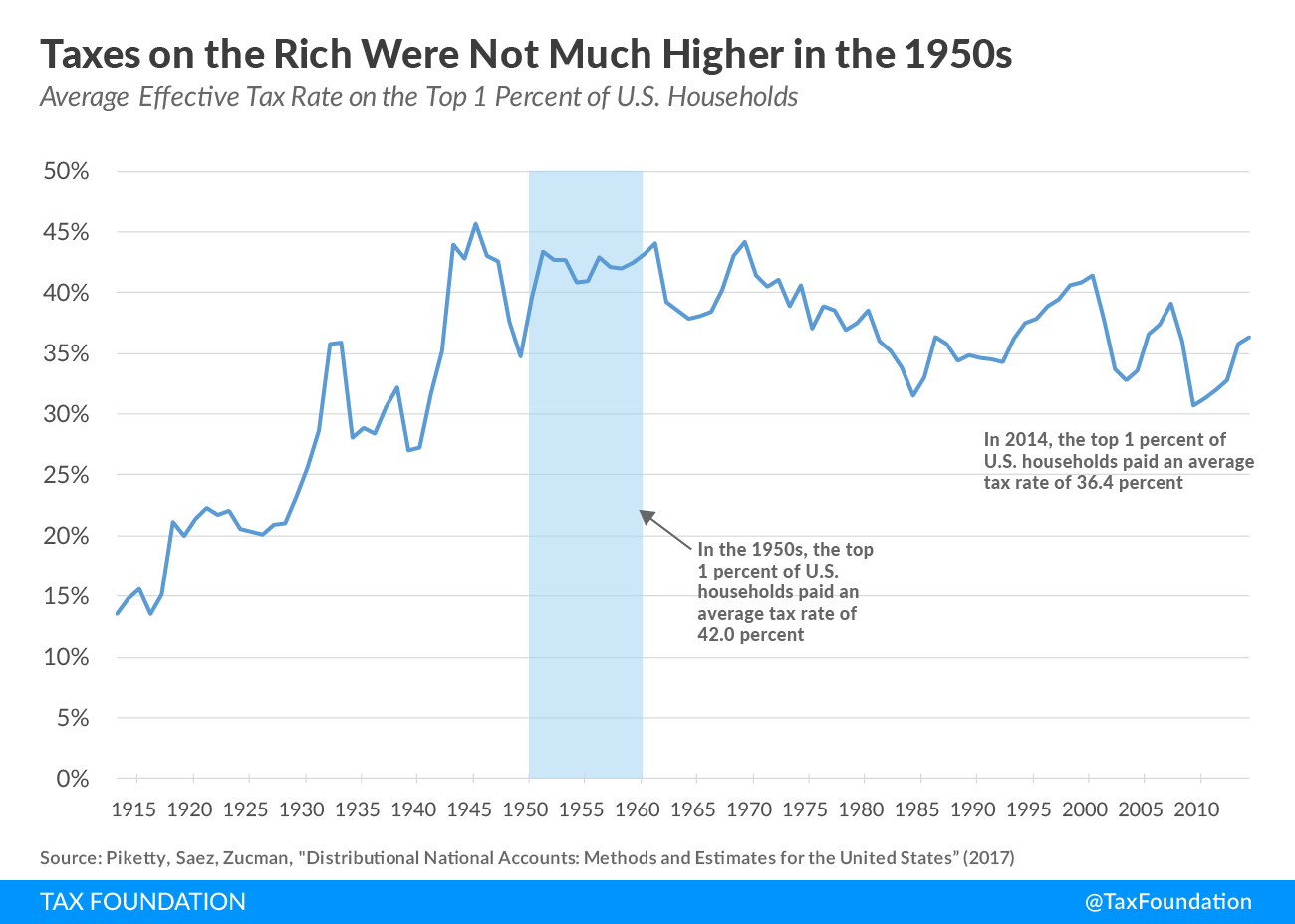

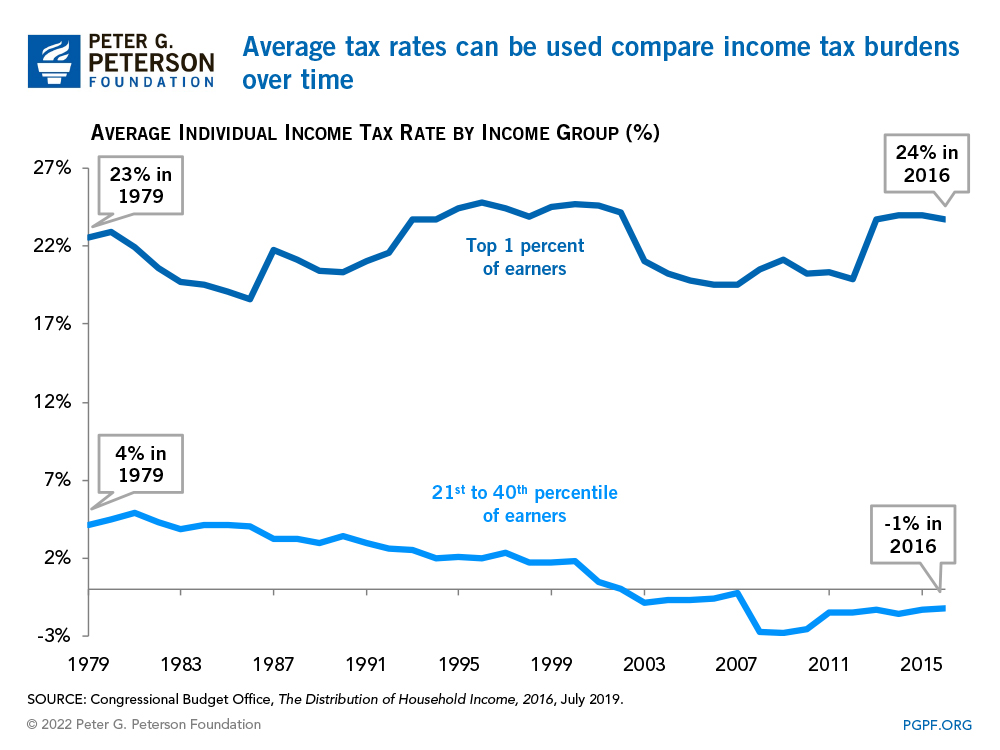

Your marginal tax rate would be 22 percent if your existing income is 80000 and someone kindly hands you 5000 that you dont have to repay. Considering the american progressive system your marginal tax rate rises with income and is equal to the rate of the highest tier you reach through. If you had taxable income of 510000 for example your average tax rate according to the irs table for 2018 is 15068950 the total of all taxes due in the lowest six brackets plus 37. The average tax rate is defined as total taxes paid divided by total income.

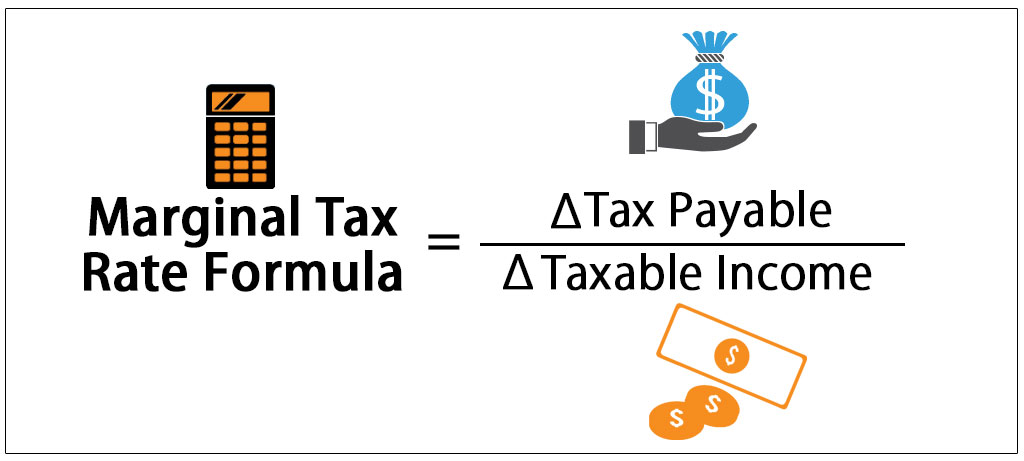

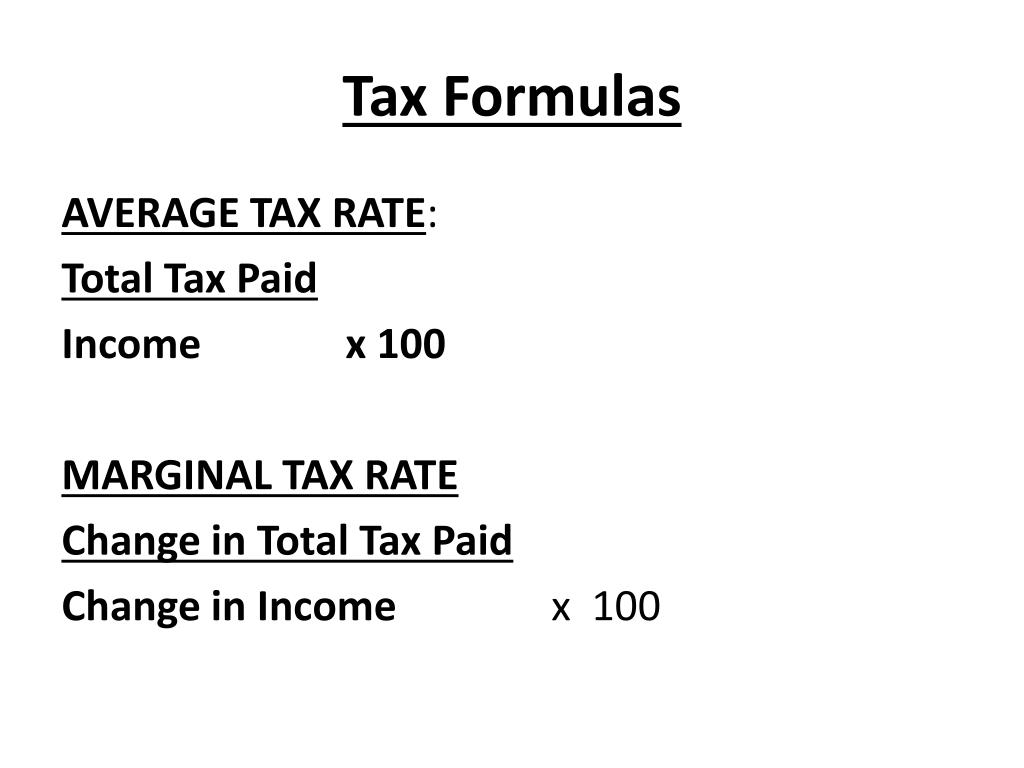

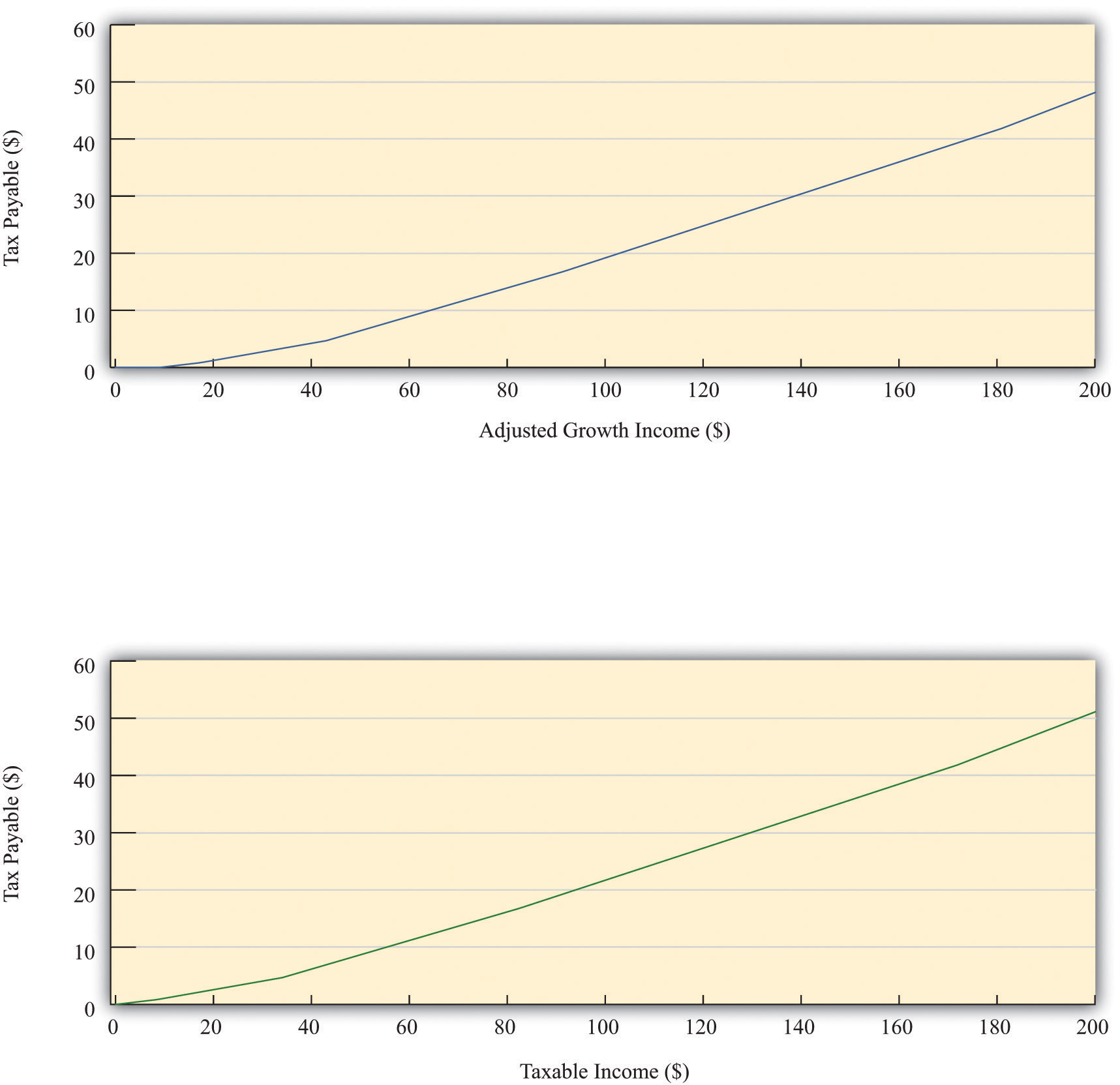

In those cases we can distinguish between two different notions of the tax rate. In this example the average tax is only 176 879827 divided by 50000 of total income. Marginal tax rate dtax payable dtaxable income. An easy way to think of marginal tax rate is to define it as the rate you would pay on a fictional additional dollar of income.

Its how much youd pay on the extra money if you experience an unforeseen windfall. Alternatively the marginal tax rate formula is as follows. The average and the marginal rate. In this example 500 will be taxed at 15 and 500 at 25.

The term marginal tax rate refers to that highest tax bracket. The marginal tax rate of 305 is the amount of tax paid on any additional dollar made up to the next tax bracket. The average tax rate is the total amount of tax divided by total income. The pattern continues on up the chart.

The marginal tax rate however depends on your taxable income within the seven tax brackets 10 12 22 24 32 35 and 37 and represents the highest tax rate that a taxpayers income.