How To Calculate Marginal Tax Rate 2018

Here are the tax rates for 2019 and beyond.

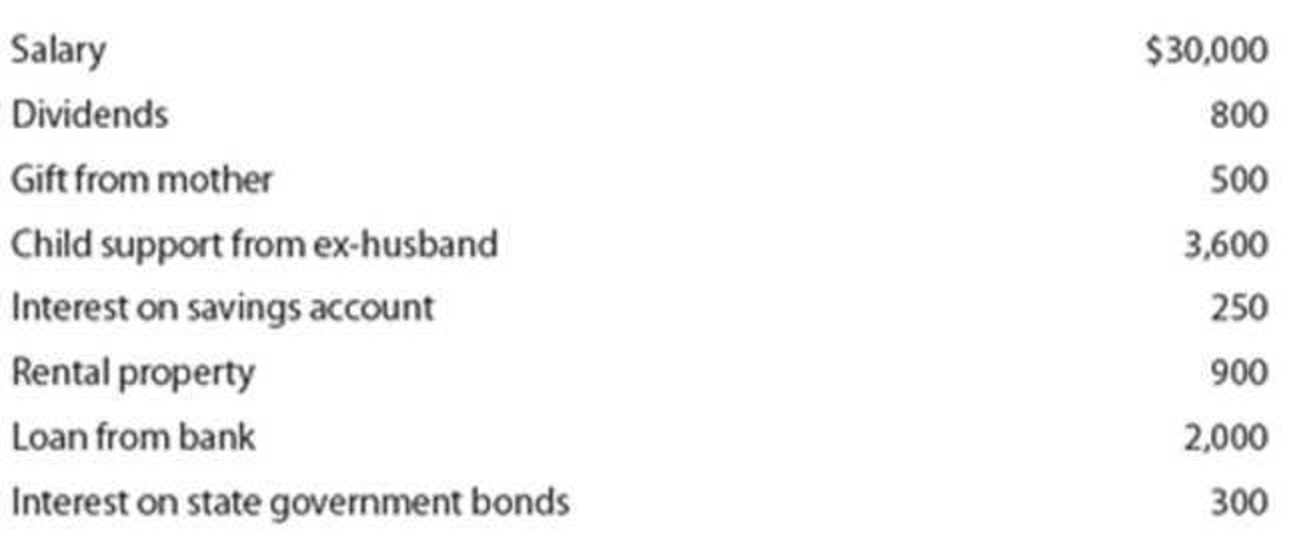

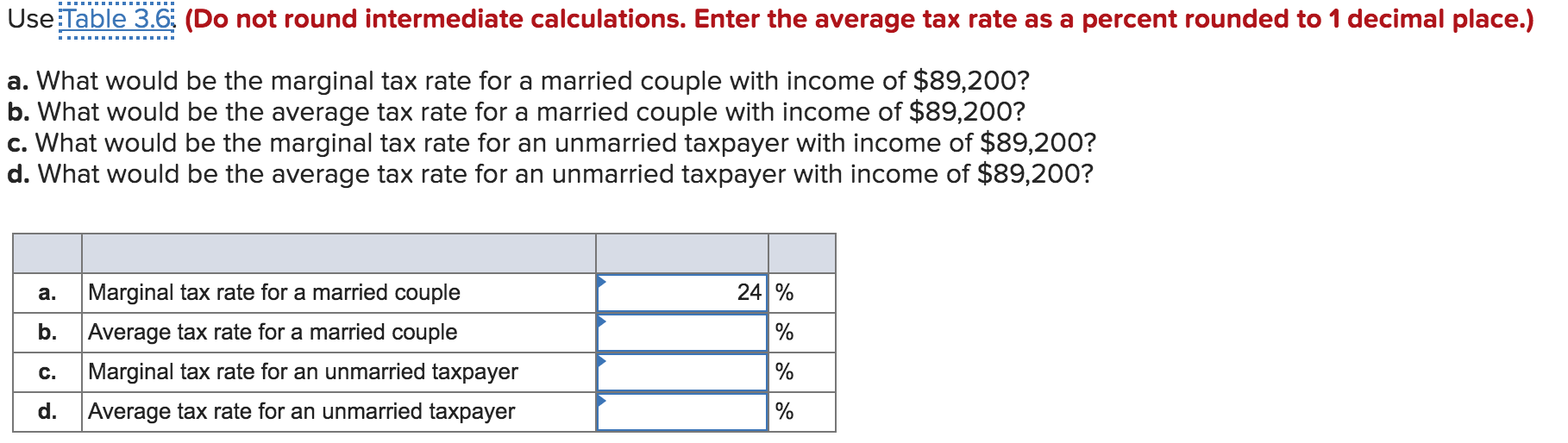

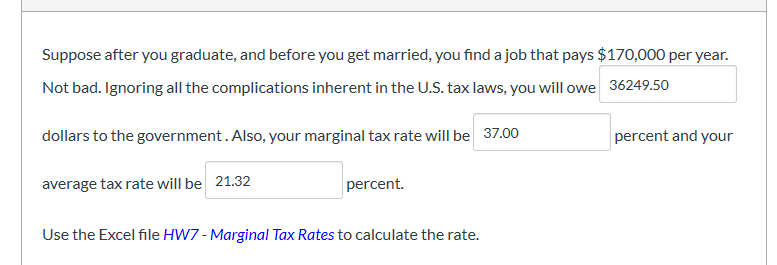

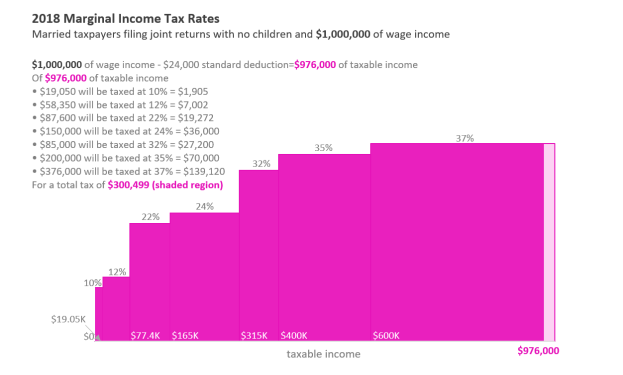

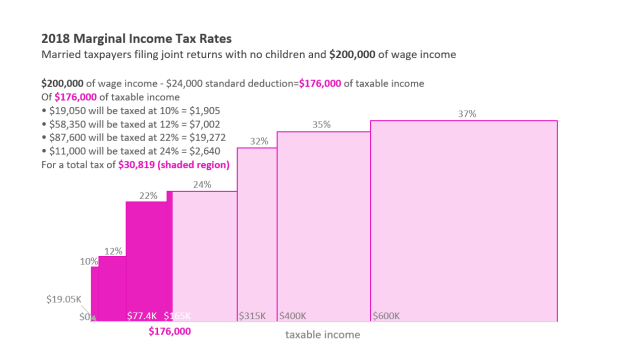

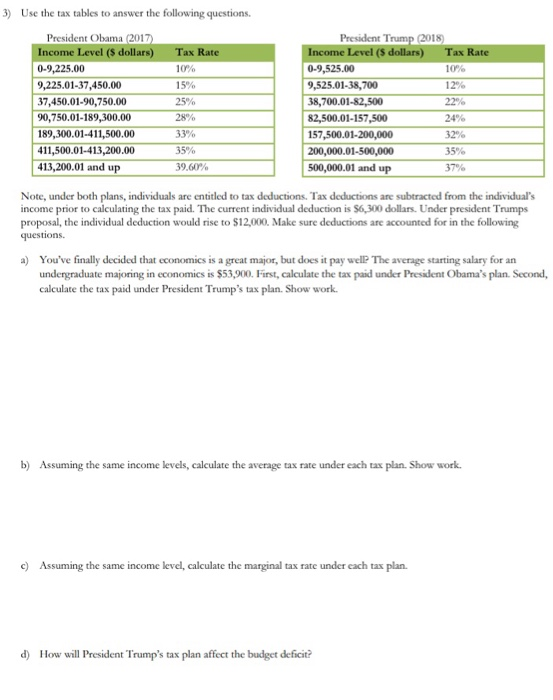

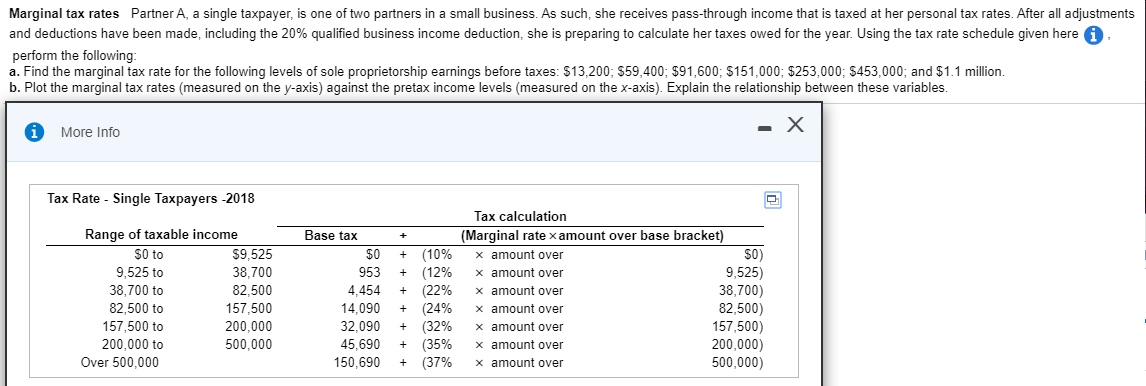

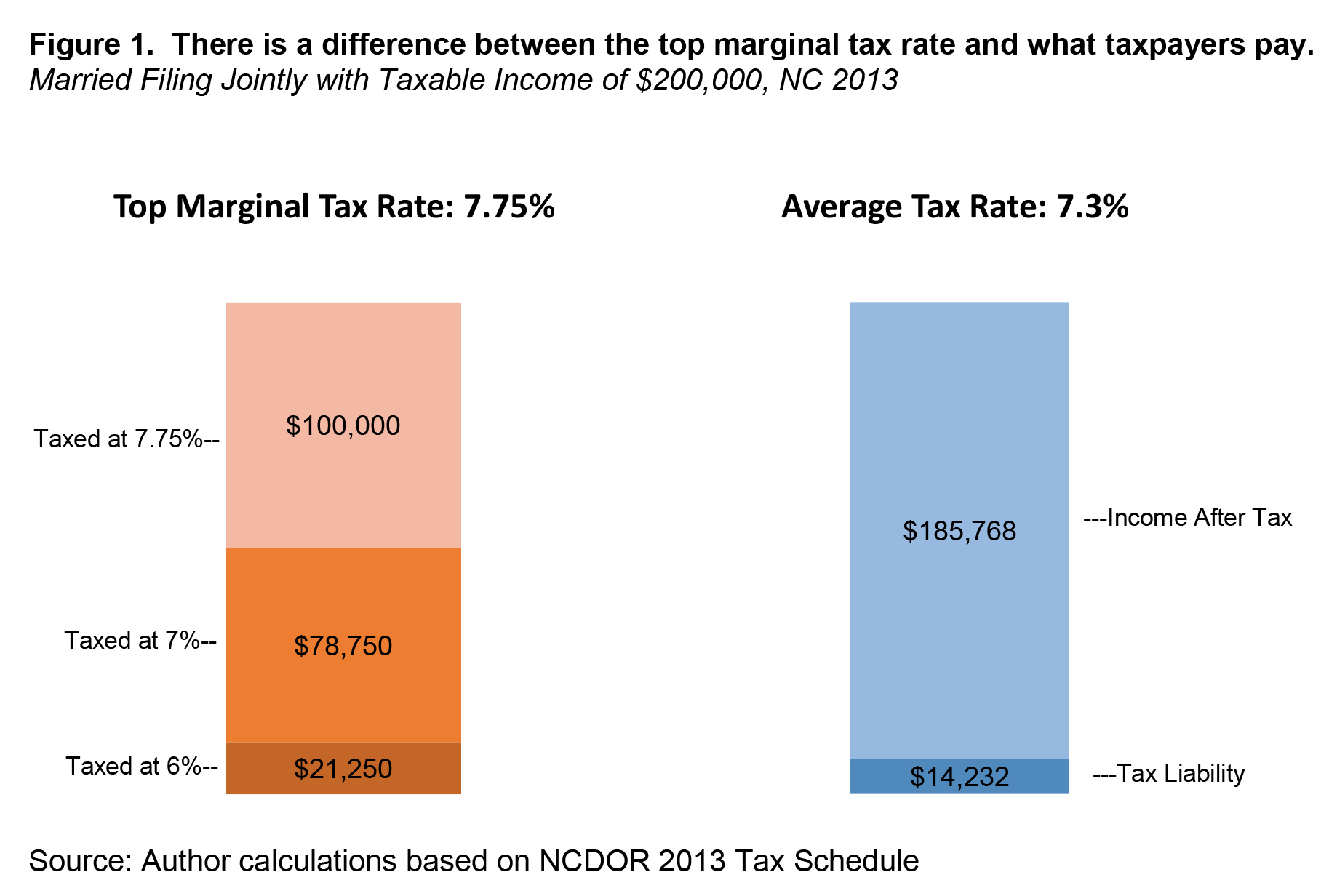

How to calculate marginal tax rate 2018. At higher incomes many deductions and many credits are phased out. With these phase outs adding 1000 to your income would result in a 0 marginal tax rate. Marginal tax rate calculator tax year 2018 knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. I commonly use changes in income of 1000 to make the calculation easy.

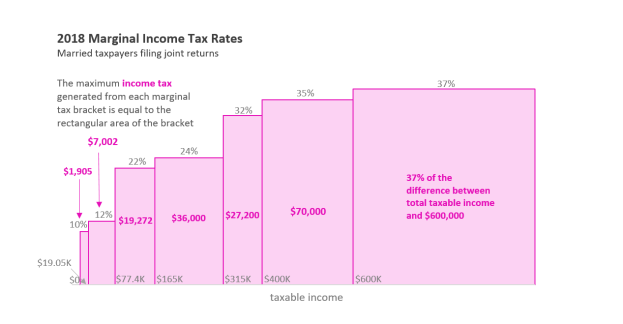

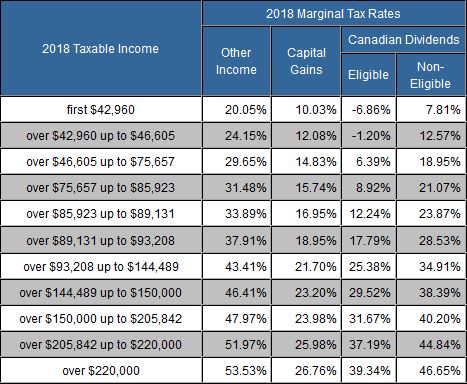

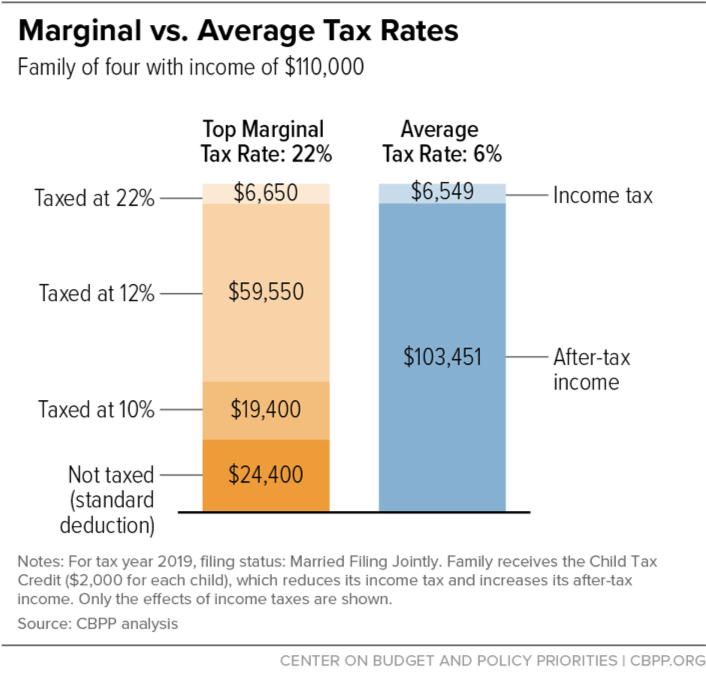

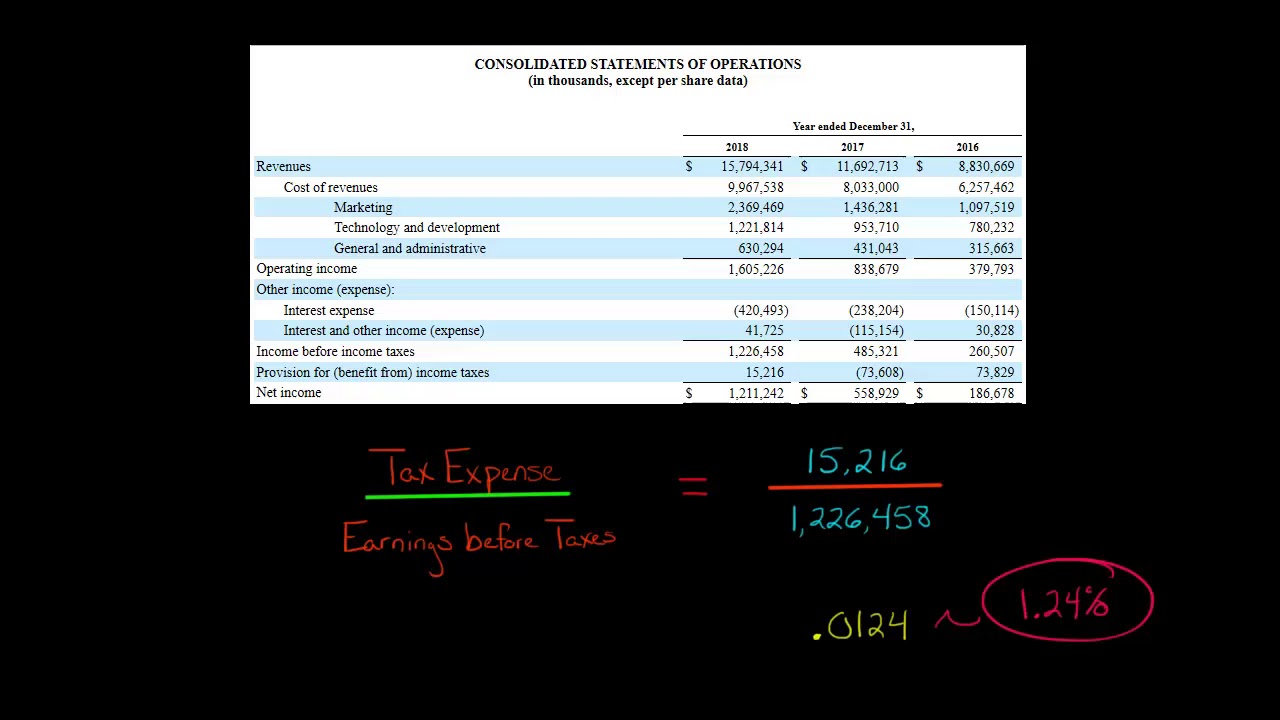

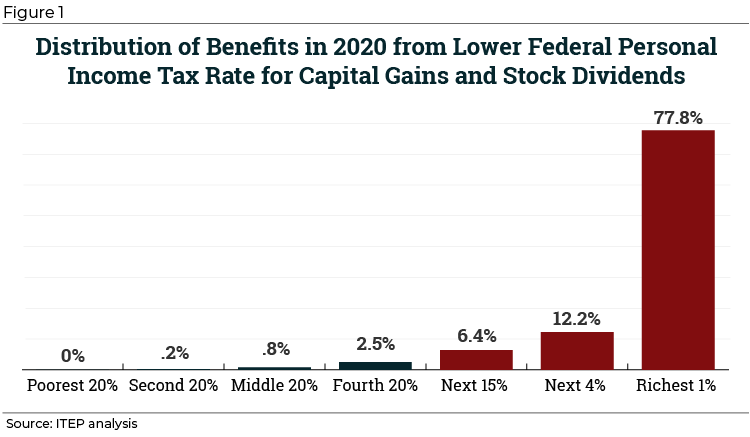

This calculator helps you estimate your average tax rate your tax bracket and your marginal tax rate for the current tax year. Press spacebar to hide graph. Capital gains tax rates by income for singles. The short term capital gains tax rate is equivalent to your federal marginal income tax rate.

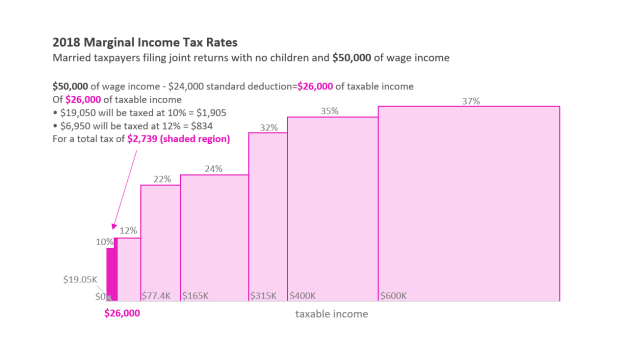

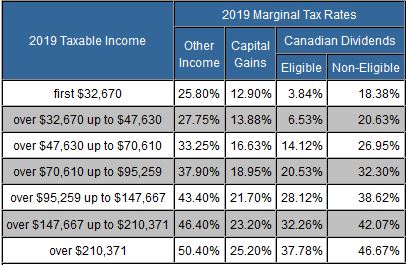

If your income falls within this range your tax is. If john were to receive a bonus of say 15000 by the end of the tax year his marginal tax would be 24. Once you hold your investments for longer than a year the long term capital gains tax rate kicks in and goes way down. Select your federal tax filing status most married couples benefit by filing jointly enter your total gross income taxact will automatically estimate the taxable portion of your income add any 401k and ira pre tax contributions employer sponsored retirement plan.

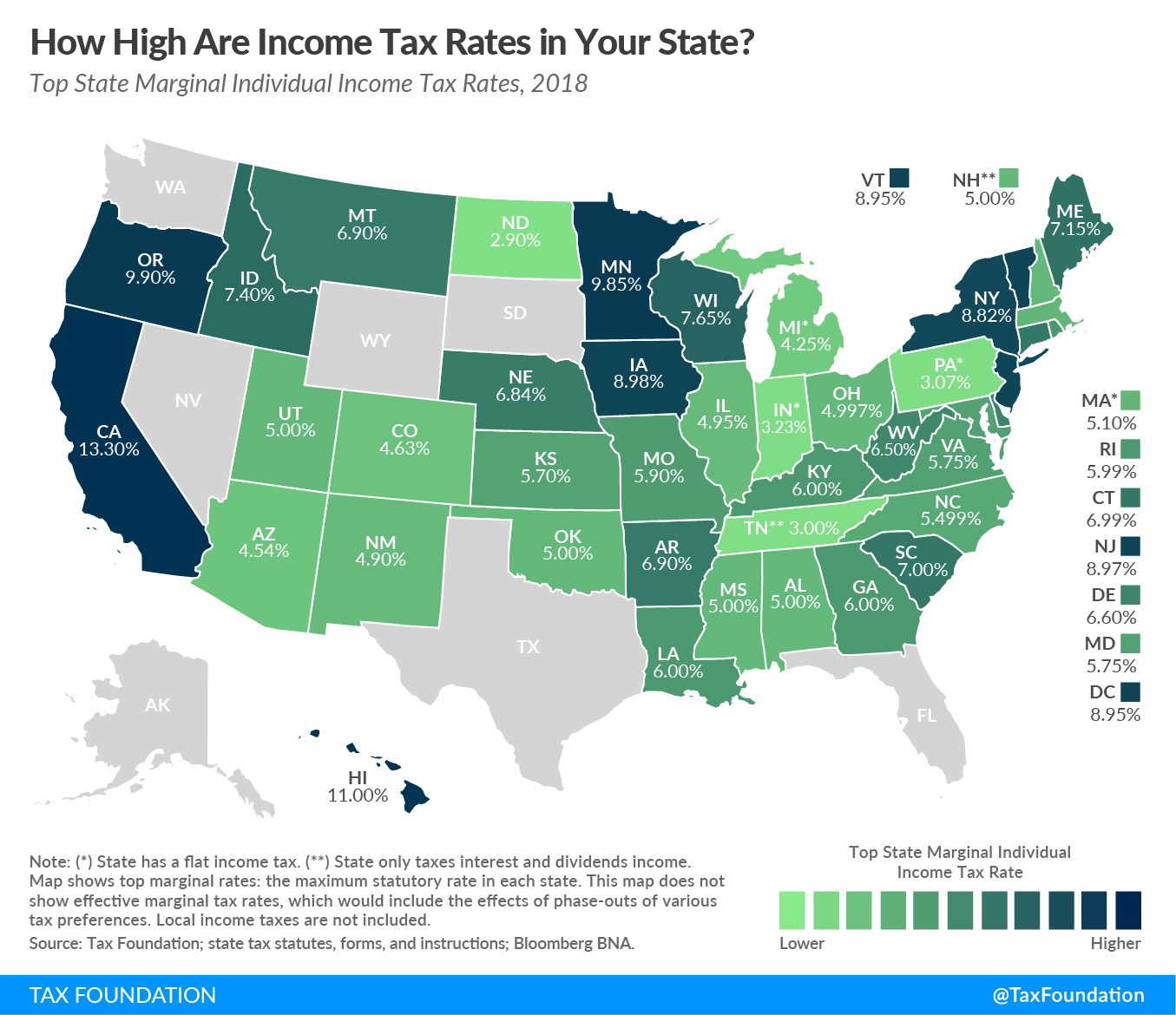

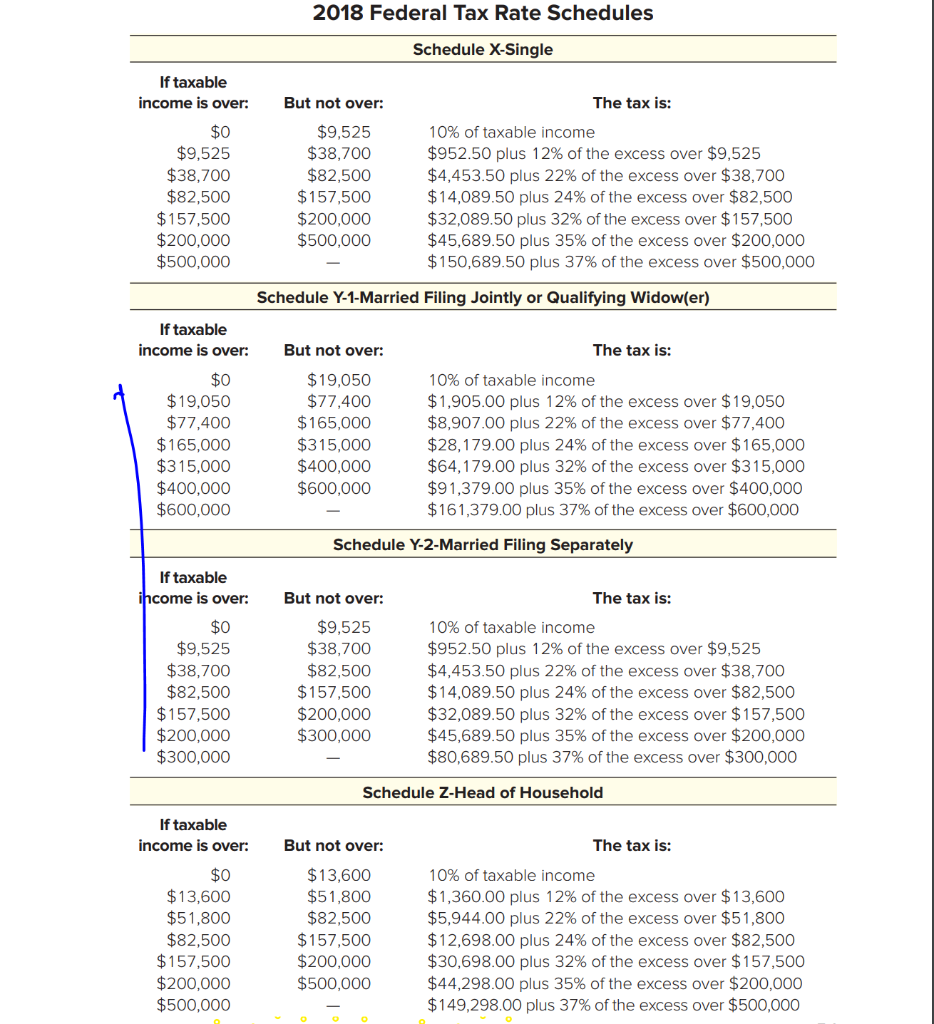

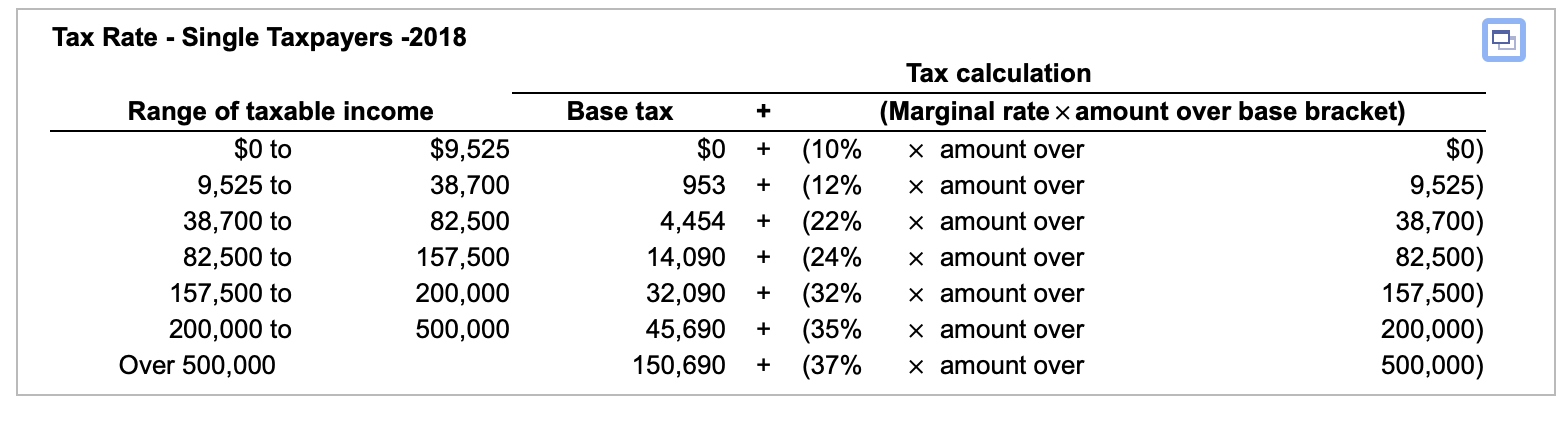

In this case he would need to make arrangements for deduction so that his taxable income is reduced and the pre tax contributions are increased. Individual tax rate schedules for 2018 you can compare yields by using the following formula. Non resident individual tax rates. Your income puts you in the 0 tax bracket.

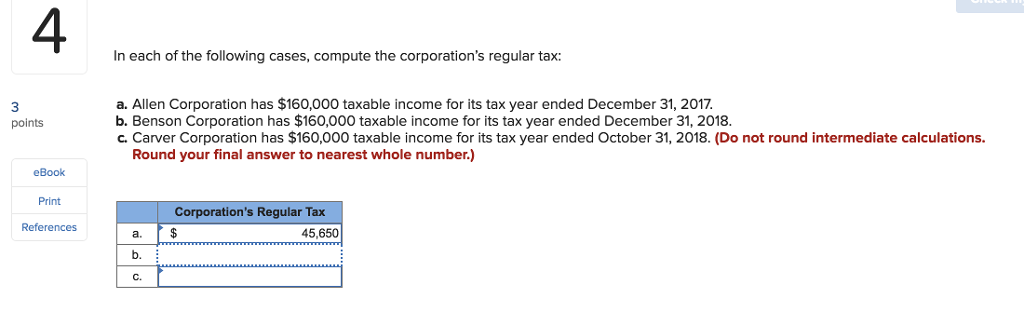

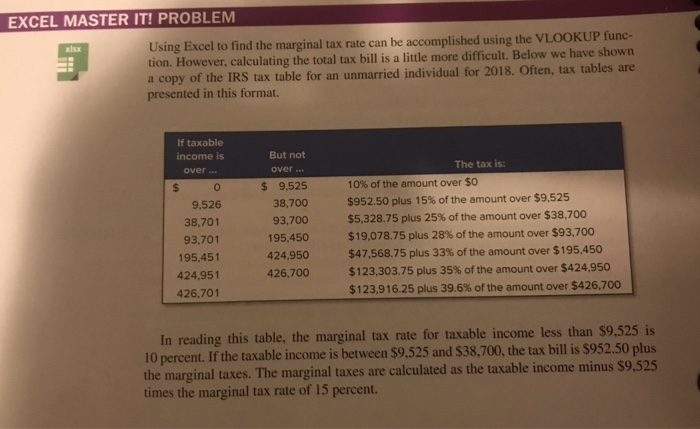

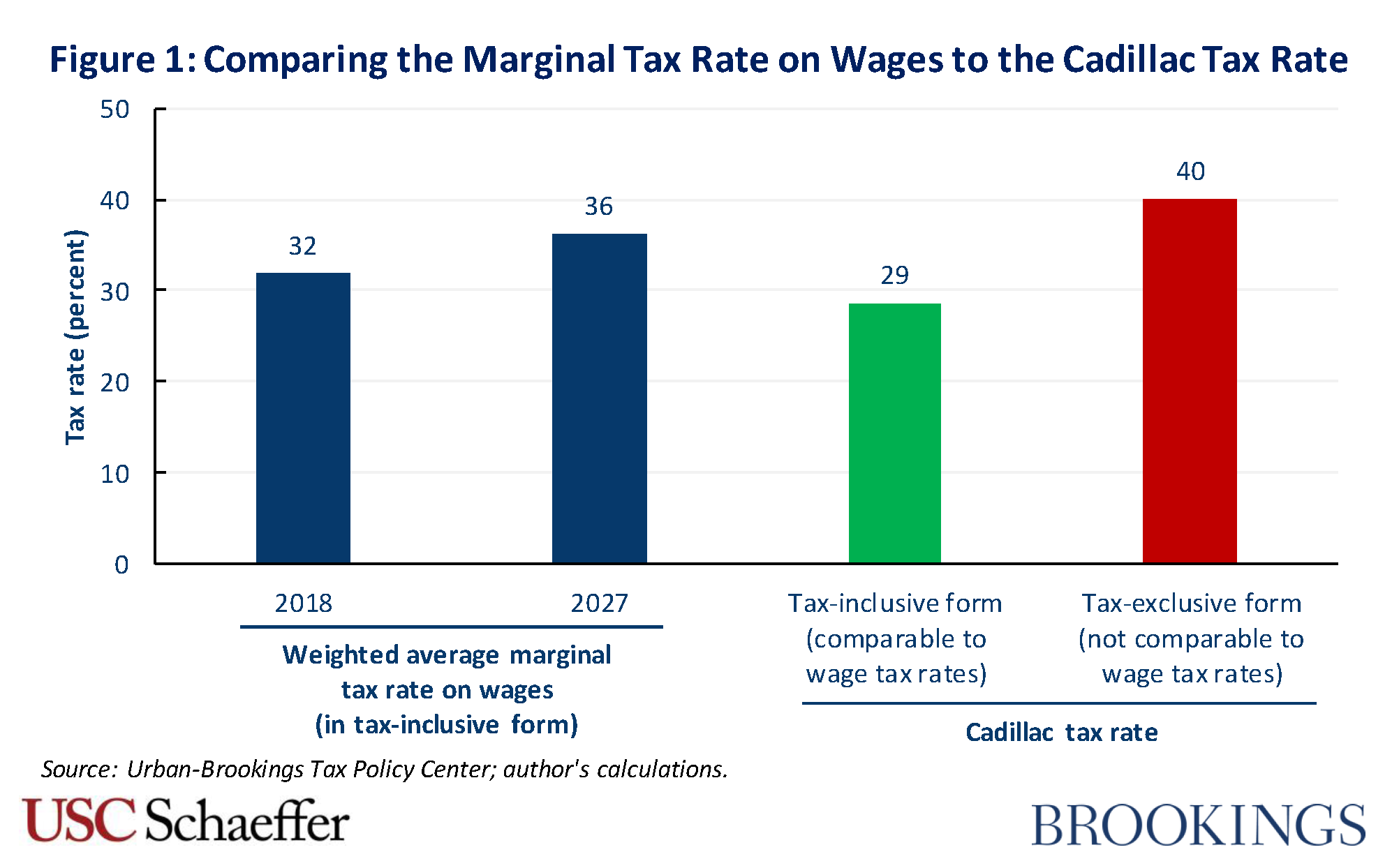

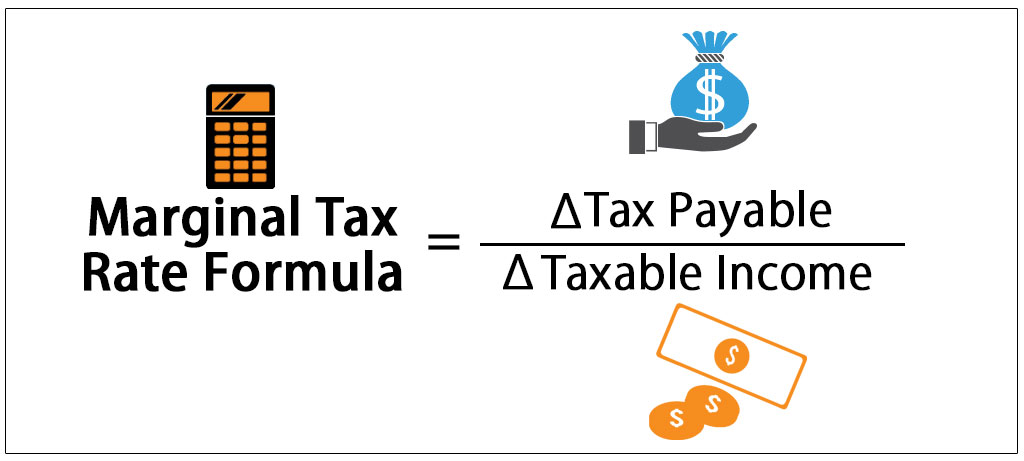

This increases your tax bill and your marginal tax rate. Total tax 95250 3501 18040. To determine the marginal tax rate for a particular type of income you must add or subtract that type of income see the resulting change in tax liability then divide the change in tax liability by the change you made in income. 1360 12 of the amount over.

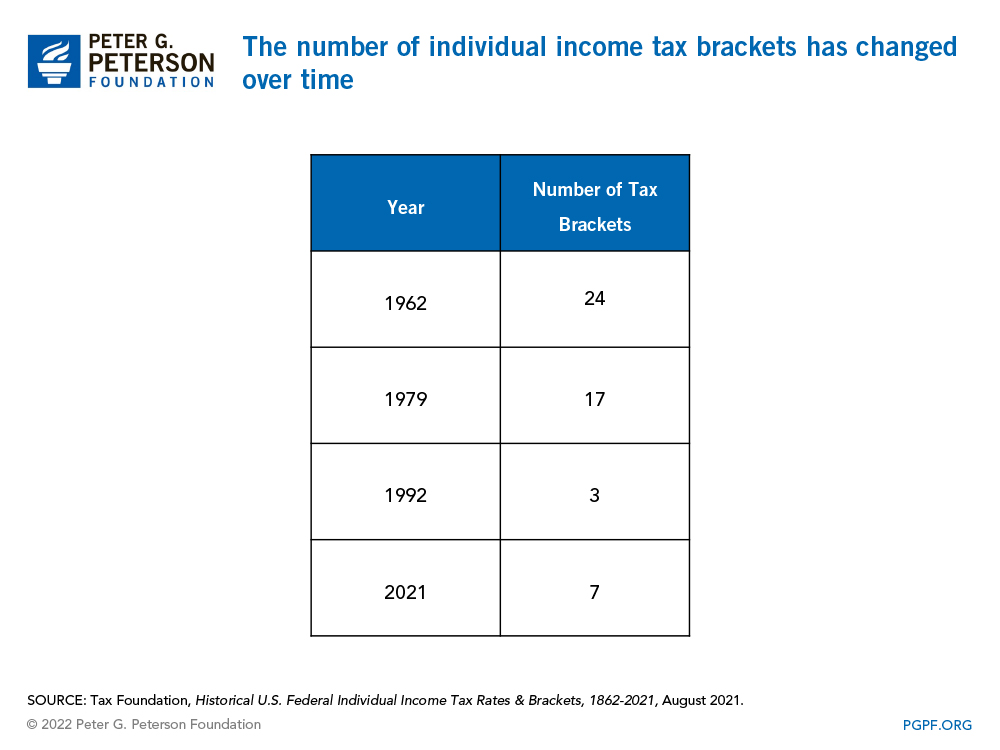

For more information about your how your 2018 2019 tax rates differ from the new 2019 2020 irs tax brackets and federal income tax rates or how different rates apply to different portions of your income check out the articles below.

/GettyImages-121266354-5731d77b5f9b58c34c7510d9.jpg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13673574/3.png)

:max_bytes(150000):strip_icc()/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)