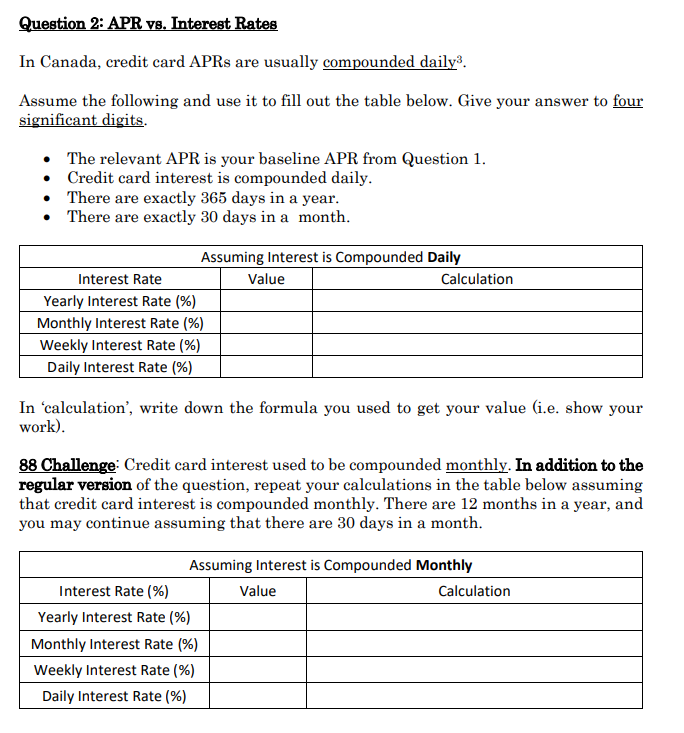

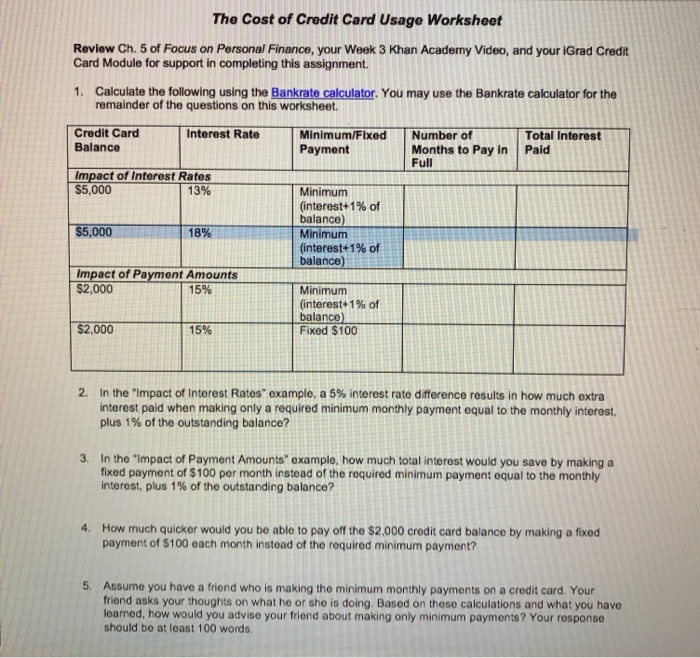

How To Calculate Credit Card Interest Per Month

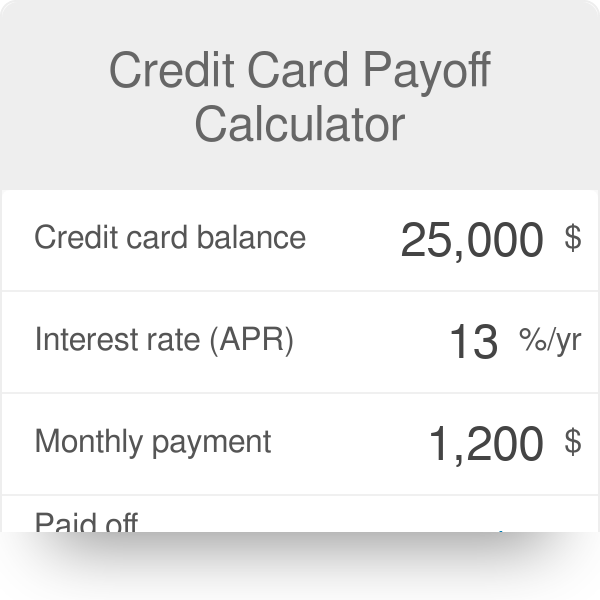

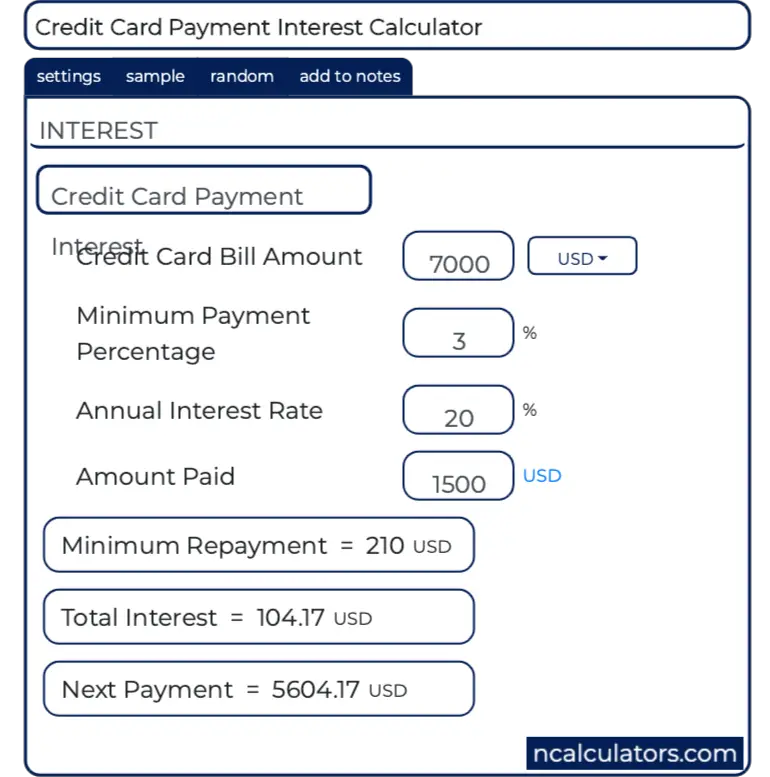

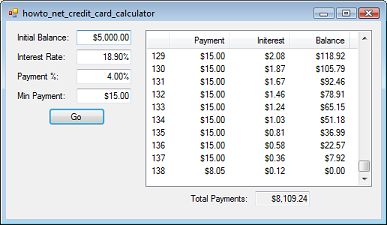

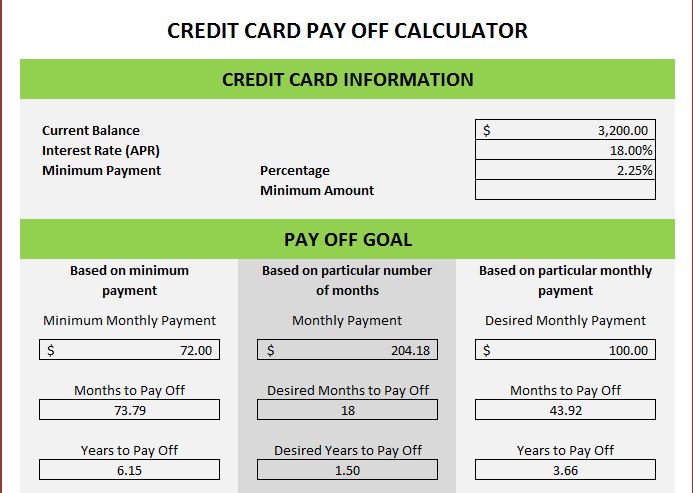

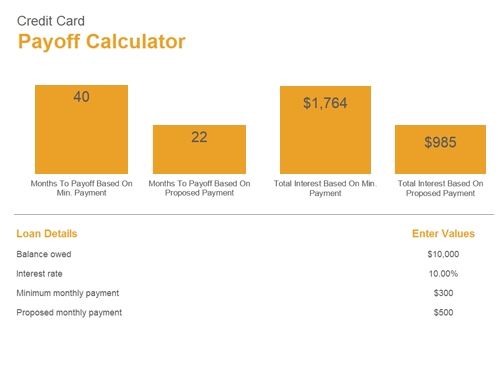

The number of years until your balance reaches zero.

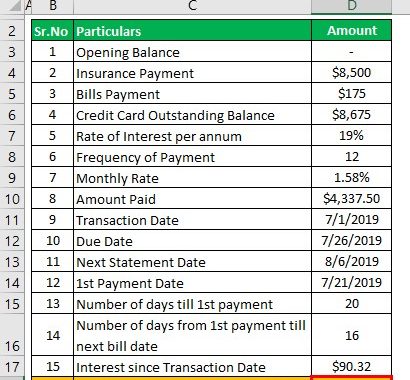

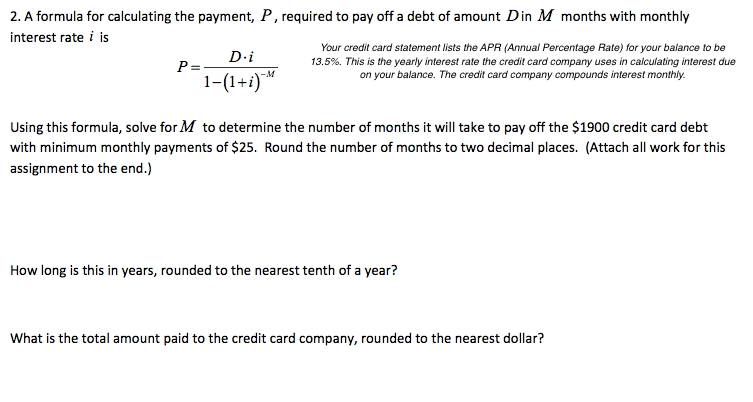

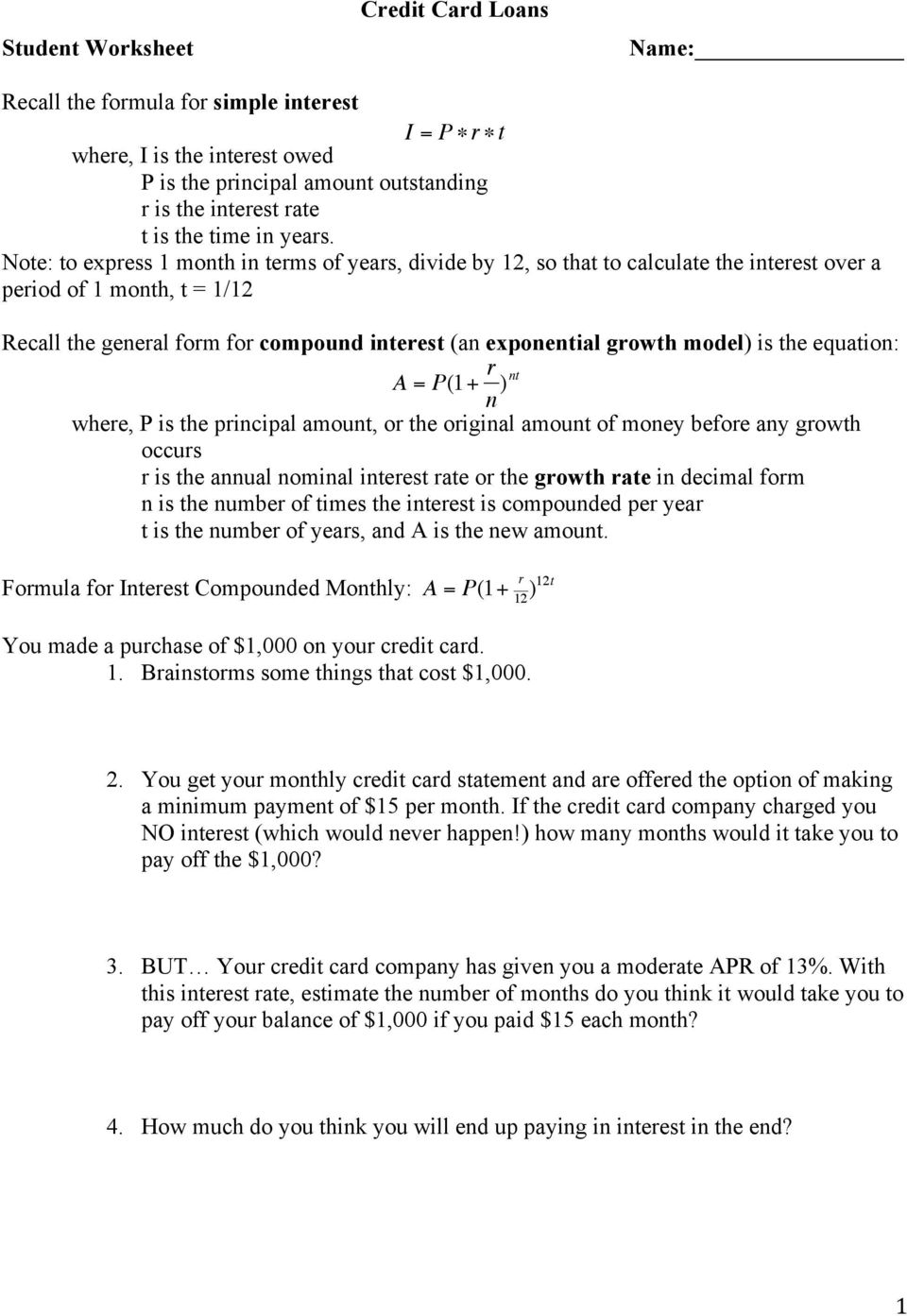

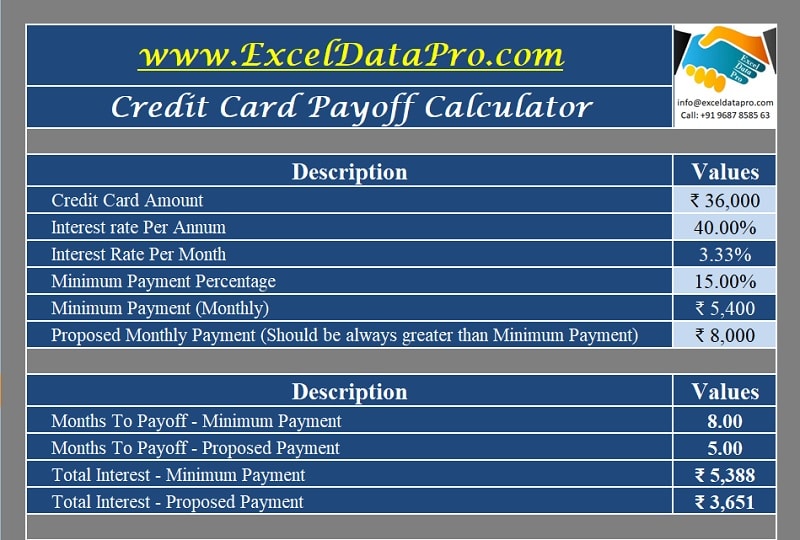

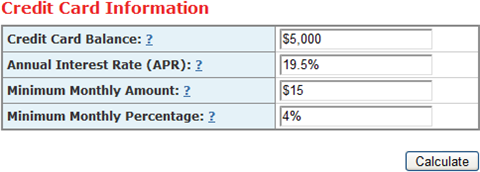

How to calculate credit card interest per month. So i found the formula to calculate credit card interest per month and decided to offer this tool to the rest of you who are in my situation. The amount of your next payment that will be applied to interest. Enter your current balance on your credit card. How much interest will you pay.

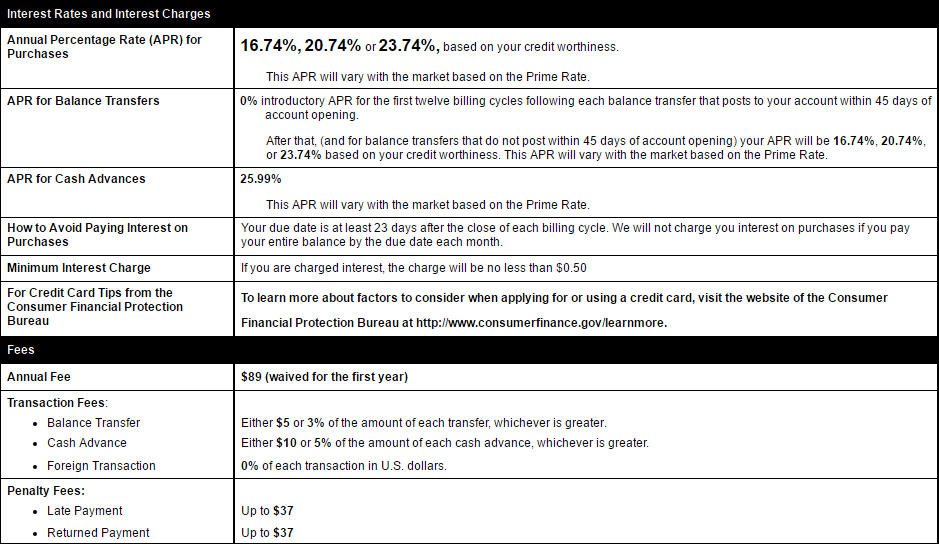

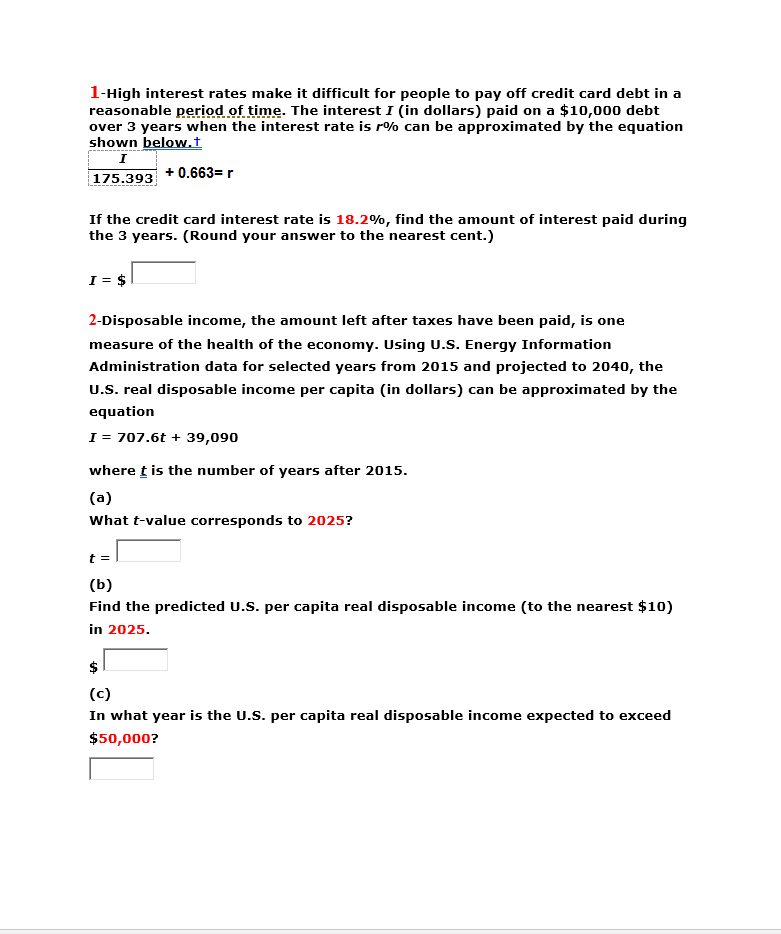

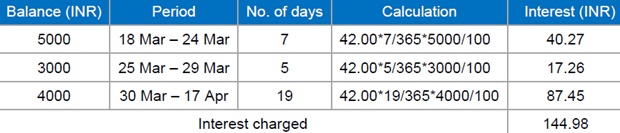

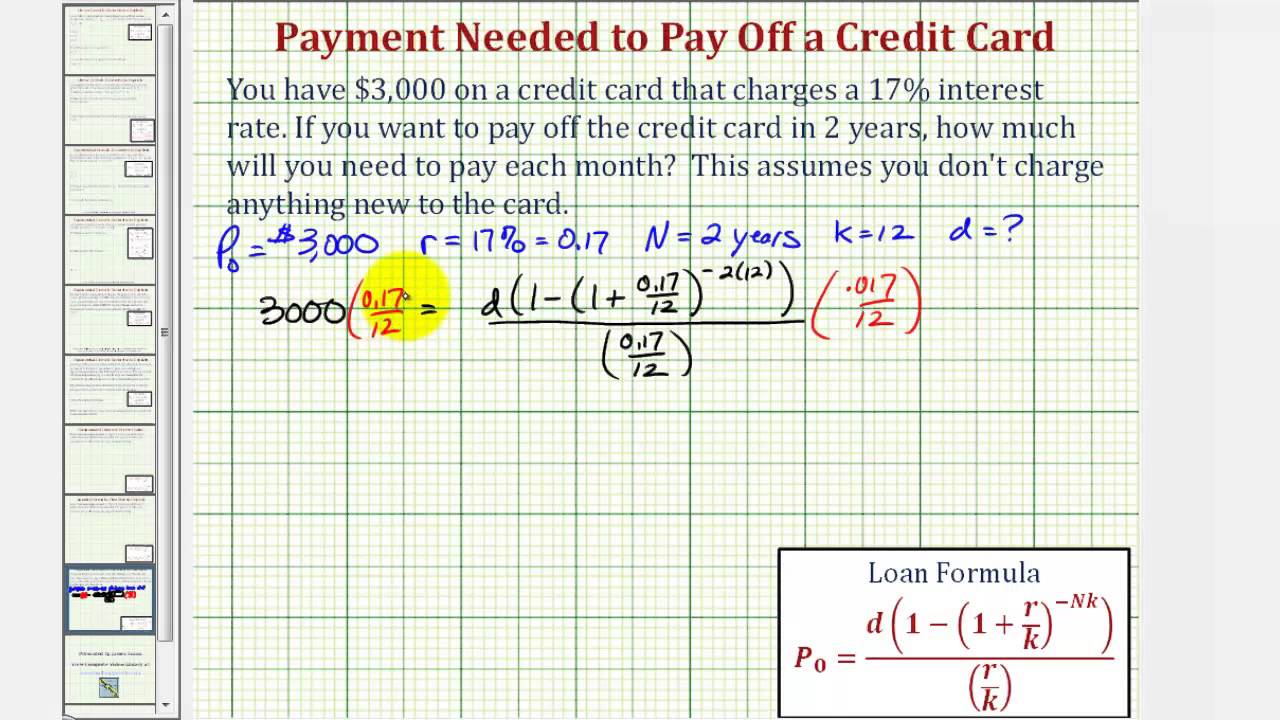

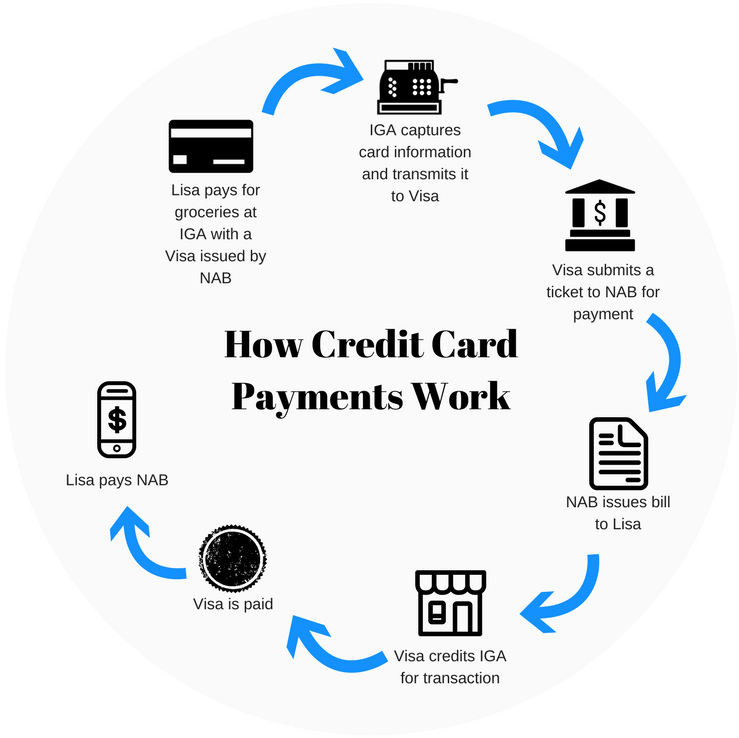

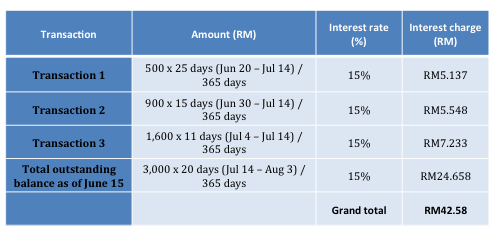

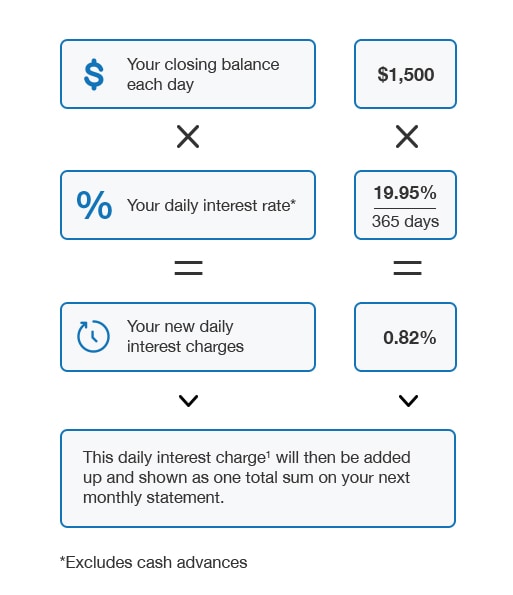

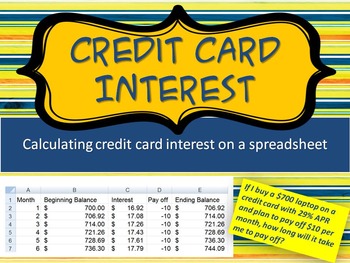

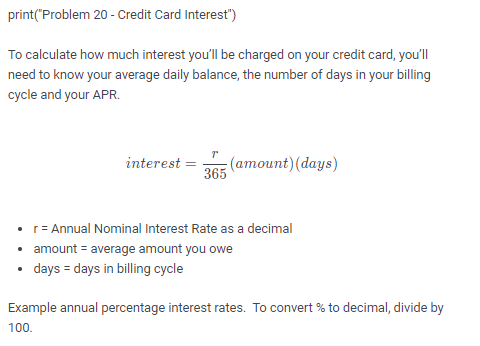

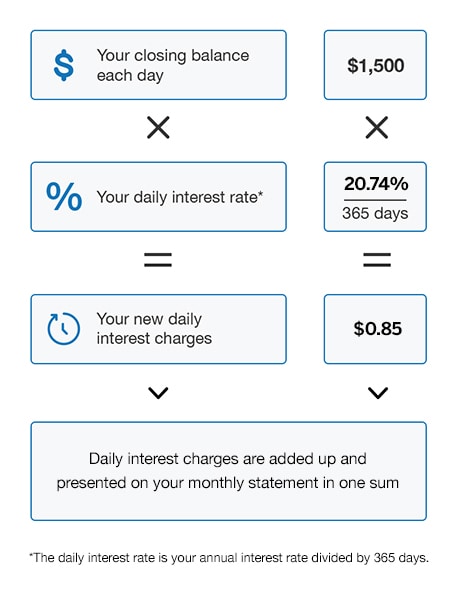

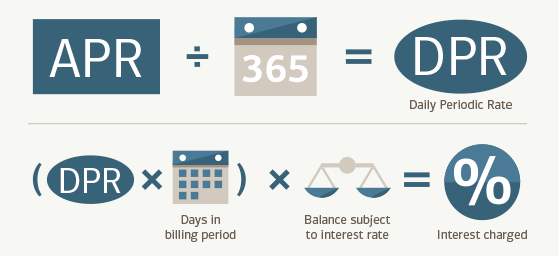

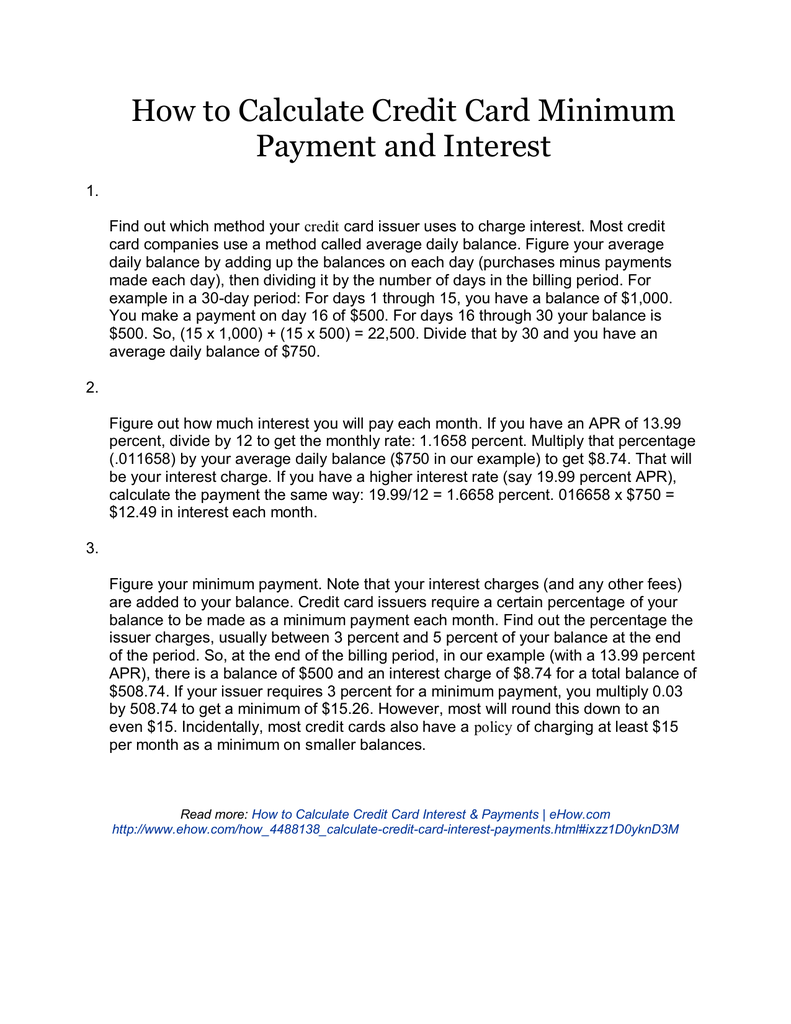

Daily rate x average daily balance x number of days in month the first thing to understand about credit card interest is the terminology. This rate of interest determines how much it costs for you to borrow on the credit card. During a credit cards grace period the credit card issuer waives the interest charges between the statement closing date and the payment due dateyou must have a zero balance at the start of each month to use the grace period during the following month. If your annual interest rate is 16 then the monthly rate is 16 divided by 12 or 133.

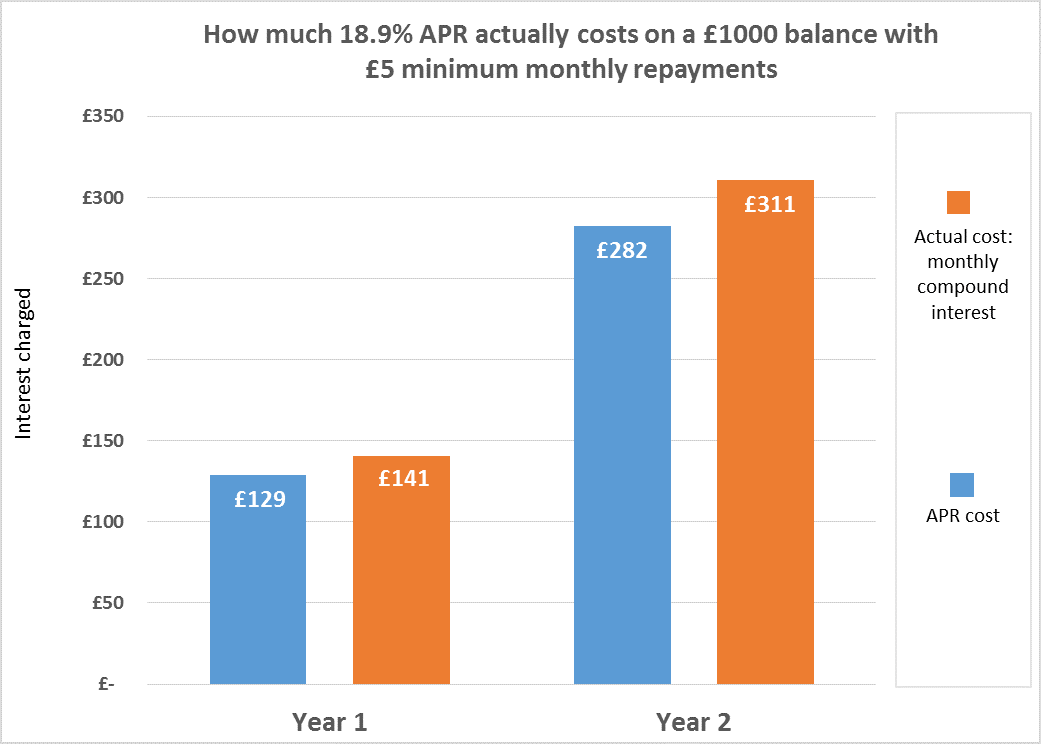

There are only three bits of information that are necessary to see how much interest youd pay based on your monthly payment or in a specific period of time. So if you carry a balance from one month into the next you wont be able to avoid interest charges by paying this months statement. The amount of your next payment that will be applied to principal. Unless you have changed cards recently its likely to be between about 149 and 299.

In normal laymans terms the interest is calculated on a daily basis using the apr rate multiplied against the amount outstanding on the card. Since i was at it i figured i would calculate the credit card interest cost i pay per day month and year. 2 annual credit card percentage rates vary from one company to another but they average about 16. This is summed up each month and added as a charge.

You should be able to find it on your statement usually in a summary box on the back. The number of monthly payments until your balance reaches zero.

:max_bytes(150000):strip_icc()/CalculateCardPayments3-71e54f8a7aaf487fac3795df9708ec42.jpg)